KEYTAKEAWAYS

- The rising probability of Kevin Warsh as Fed chair has repriced expectations for tighter monetary conditions, pressuring both Bitcoin and other liquidity-sensitive assets.

- Cross-asset reactions—from gold’s sharp pullback to record Bitcoin ETF outflows—show that markets are de-risking in anticipation of a more disciplined policy regime.

- The episode reinforces a recurring pattern in crypto history: shifts in perceived Federal Reserve reaction functions matter more to Bitcoin than headline-friendly narratives about long-term adoption.

CONTENT

Trump’s imminent Fed chair nomination has become a liquidity shock for markets, exposing how Bitcoin still trades less like digital gold and more like a barometer of monetary credibility and risk appetite.

WHY THIS NOMINATION MATTERS

When markets fixate on who will run the Federal Reserve, they are not really trading a person; they are trading an implied path for rates, the balance sheet, and the tolerance for financial conditions to loosen, which is why Donald Trump’s expected announcement of a new Fed chair nominee has started to behave like a macro catalyst that bleeds into every “liquidity asset,” including bitcoin, long-duration tech, and high-beta credit. On January 30, 2026, multiple reports indicated Trump is preparing to nominate former Fed governor Kevin Warsh, a name widely framed as more hawkish on inflation and more supportive of shrinking the Fed’s balance sheet, and that perception alone has been enough to reprice risk even before any formal decision is confirmed.

THE WARSH SIGNAL

Warsh is not “anti-crypto” in the simplistic way markets sometimes assume hawkishness implies, but his worldview is still fundamentally a “discipline and credibility” worldview that tends to translate into tighter financial conditions when inflation credibility is questioned, and that is the channel bitcoin ultimately trades. In public remarks at the Hoover Institution, Warsh has described bitcoin as something that “doesn’t make me nervous,” while also framing it as an asset whose existence can help remind policymakers that monetary credibility matters—supportive language in tone, yet still nested inside a framework that prioritizes constraining inflation and avoiding policy complacency.

THE CROSS-ASSET TELL

The cleanest way to understand what markets fear is to watch what moves first when the rumor mill turns into consensus, and on January 30, 2026, Reuters reported that gold fell sharply—over 4% on the day—as investors digested the possibility of a more hawkish Fed chair appointment, even though gold was still on pace for its strongest monthly run since 1980 after gaining more than 20% in January, a combination that screams “positioning was crowded, and the marginal buyer suddenly hesitated.” In the same risk-off impulse, Reuters also reported bitcoin slid to a two-month low around $82,300, with the move explicitly linked to fears that a Warsh-led Fed would mean reduced liquidity support for speculative assets, reinforcing the uncomfortable truth of this cycle: bitcoin can wear the “digital gold” narrative, but it still trades like global liquidity most days when leverage is high and conviction is fragile.

WHAT FLOWS ARE SAYING

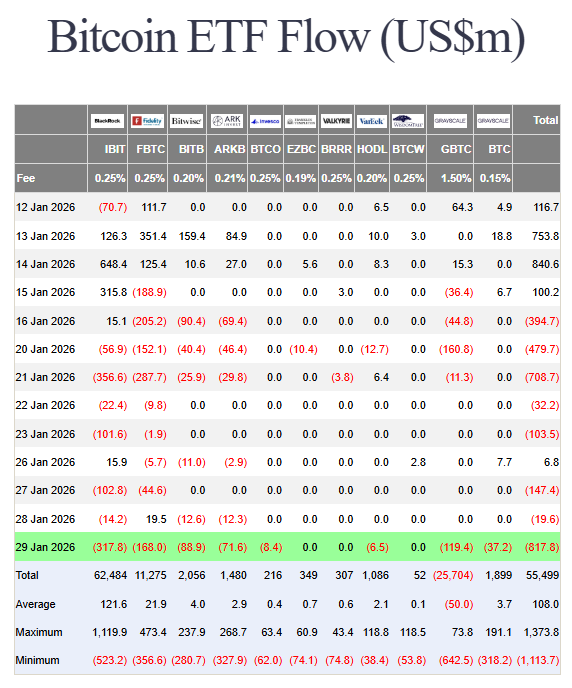

Even if price action looks like pure sentiment, the plumbing usually tells the real story, and this week’s ETF tape is hard to ignore because it shows institutions stepping back rather than leaning in. Farside Investors’ daily flow table shows that on 29 Jan 2026 the U.S. spot Bitcoin ETFs recorded a total net outflow of -$817.8 million, led by IBIT at -$317.8 million, in a setup where the market is effectively trying to find equilibrium while the largest regulated bid is temporarily moving from “buy dips” to “reduce exposure.” This matters because the ETF channel has become the dominant “macro bridge” into spot demand, so a multi-day outflow streak doesn’t just remove buying pressure; it also weakens the narrative feedback loop that normally pulls discretionary capital back in during drawdowns.

A HISTORY LESSON CRYPTO KEEPS RELEARNING

The deeper lesson—one crypto has historically been reluctant to price in until it is forced to—is that leadership changes and communication shifts at the Fed tend to matter less for the day of the announcement than for what they do to expectations about the reaction function. When the market believes the Fed will tolerate easier conditions, bitcoin’s reflex is to behave like a liquidity sponge; when the market believes the Fed will defend credibility more aggressively, bitcoin’s reflex is to de-risk alongside other levered expressions, even if the long-term narrative remains intact. That is why tonight’s nomination, if it indeed points to Warsh as widely reported, is best read as a volatility catalyst first and a “policy era” second, because the next move will come from how traders translate the pick into the probability of faster balance-sheet shrinkage, a higher-for-longer policy stance, and a lower ceiling for speculative excess across risk assets.

Read More:

Fed Chair Decision Imminent: Kevin Warsh at 95% — Why Markets Believe the Outcome Is Already Decided