KEYTAKEAWAYS

- Binance’s decision to park the entire SAFU fund in USDC at a publicly trackable onchain address reflects a deliberate move away from volatile collateral toward insurance-style liquidity that performs when markets break, not when they rally.

- The SAFU fund’s evolution—from BTC- and BNB-linked assets during prior cycles to a fully stablecoin-denominated reserve—mirrors lessons learned during the 2022 bear market, when pro-cyclical protection mechanisms proved fragile.

- By pre-positioning nearly $1 billion in auditable USDC well before renewed public attention, Binance reframes SAFU from a marketing slogan into a credibility signal anchored in preparedness, transparency, and execution speed.

CONTENT

Binance’s $1 billion SAFU fund was not newly assembled but quietly pre-positioned a year in advance, signaling a shift toward stablecoin-backed, onchain-verifiable user protection designed to hold credibility under market stress.

SIGNAL, NOT HEADLINE

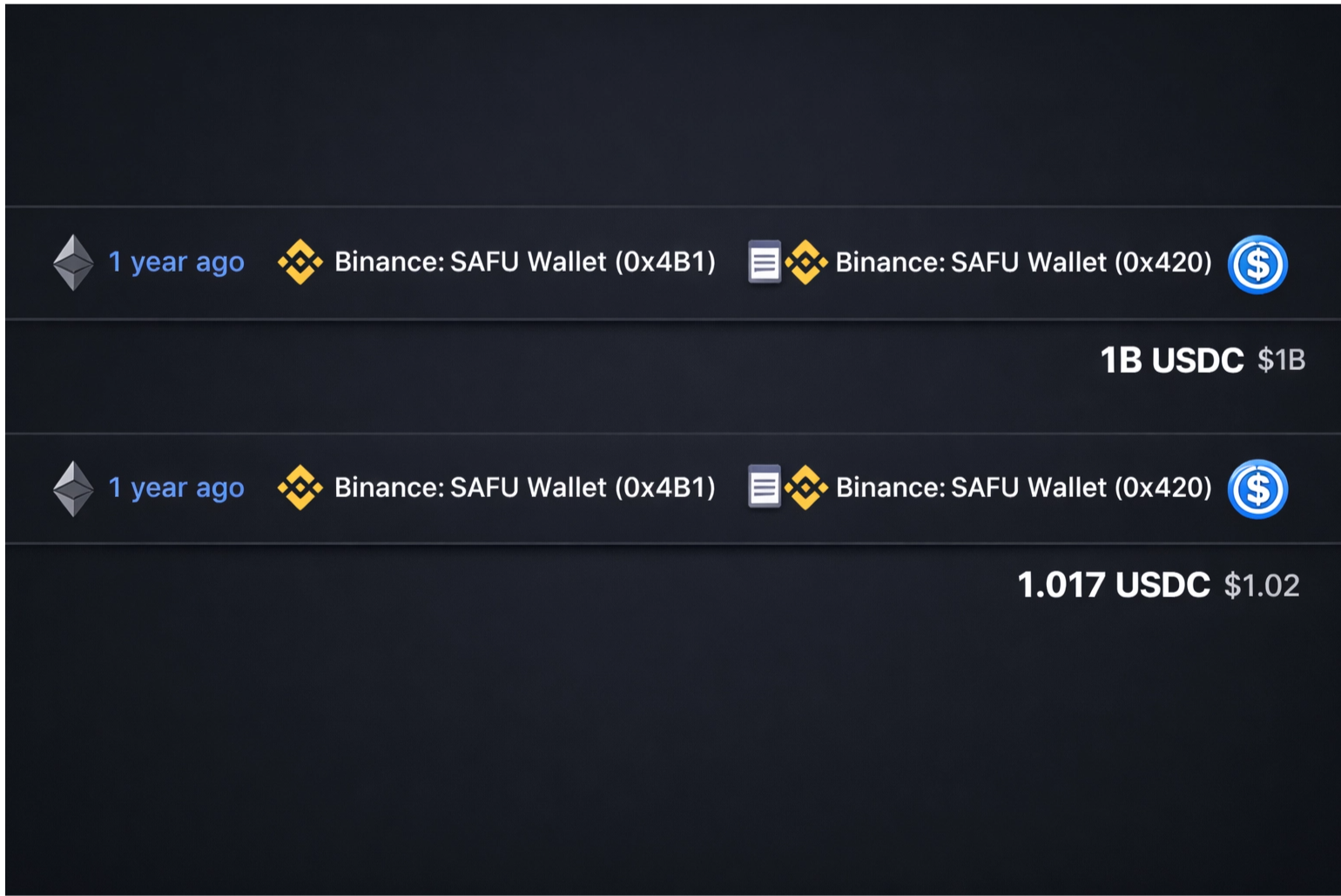

When a major exchange repeats the phrase “funds are SAFU,” the market reflex is to treat it like marketing, yet the more interesting part of today’s discussion is how boring the wallet looks: Binance’s April 2024 update disclosed that it had moved 100% of SAFU into USDC and that the fund would be visible at a new onchain address starting with 0x420. What onchain explorers show at that address now is not a constantly rebalanced trading book but a large, largely static pool of USDC—roughly 1,000,000,002 USDC and just under $1.0B in value at the time of capture—exactly the kind of inert “insurance capital” footprint you would expect if the point is credibility under stress rather than yield or optimization. The address itself was created in December 2024 (Etherscan shows a contract creation timestamp on 2024-12-10), which lines up with the idea that whatever “new wallet” Binance wanted the public watching had already been established and ready well before it became a renewed talking point. In other words, the news value here is not that an emergency fund exists—everyone already knew that—but that, after years of crypto learning the hard way that volatile collateral undermines “insurance” when you need it most, Binance appears to be leaning into a deliberately unexciting structure: a stablecoin-denominated backstop whose primary feature is that it doesn’t surprise you.

WHY USDC CHANGES THE MESSAGE

Binance’s own framing for the April 2024 conversion was blunt: SAFU can fluctuate, but Binance “typically” targets $1B, and moving fully into USDC was meant to “enhance reliability” and keep the fund “stable at $1B.” This matters because the core weakness of most crypto “protection funds” historically has not been the intent but the denominator: if your safety net is materially exposed to BTC or an exchange token, then a broad risk-off event can hit users and simultaneously shrink the cushion that is supposed to protect them, turning the fund into a pro-cyclical promise. Binance is implicitly arguing that the correct design for an exchange-level emergency reserve is closer to regulated financial plumbing—high liquidity, low volatility collateral—than to a treasury strategy, and it is hard to miss the secondary signaling embedded in the choice of USDC, a stablecoin that markets often associate with a more compliance-forward posture than some alternatives. External coverage at the time described the move as Binance converting its “billion-dollar” emergency fund into USDC, reinforcing that the company wanted the public to evaluate SAFU through a stability lens rather than through the upside optics of holding volatile assets.

A BRIEF HISTORY OF SAFU’S “STRESS TESTS”

SAFU was born in July 2018 as an explicit response to the exchange-risk problem: centralized venues can be the most efficient liquidity layer in crypto, but they are also single points of failure, and an emergency fund is a way to internalize part of that tail risk. Binance has repeatedly reiterated the fund’s purpose as protection in “extreme situations,” not as an operating pool, and later company materials summarize that it was established to protect users who lose assets due to security breaches. The narrative became real in May 2019, when Binance disclosed a “large scale security breach” and said it would use SAFU to cover the incident in full, crystallizing the fund’s function as a credibility mechanism rather than a theoretical commitment. That episode also shaped an important behavioral precedent for the industry: the exchange that can eat a large loss without socializing it onto users buys something rare in crypto—time—because trust doesn’t merely depend on not getting hacked, it depends on what happens immediately after you do.

THE BEAR-MARKET LESSON THAT LED HERE

The second formative chapter was the 2022 drawdown, because it exposed the uncomfortable arithmetic of a protection fund marked in volatile assets: Binance announced in January 2022 that SAFU was valued at $1B, but by November 2022 it acknowledged that market conditions had pushed the value down to about $735M, and it “topped” the fund back up to the $1B target. That sequence is more revealing than it looks, because it shows the fund behaving like a maintained threshold rather than a fixed endowment, and it also reveals why the later shift to USDC is strategically coherent: topping up in a crash is reputationally necessary but financially inefficient if your reserve assets are themselves correlated to the stress event. Converting to USDC is, in effect, Binance choosing to pay an opportunity cost in bull markets in order to reduce the probability that it must scramble for replenishment in a panic, and the onchain visibility of a near-$1B USDC balance at the published address functions as a live, continuously verifiable receipt. This is also why the “one year ago the wallet was funded” angle resonates: in crypto, preparedness is often claimed only after the fact, whereas a visibly parked reserve is a quieter—but stronger—form of commitment, because it is capital that cannot simultaneously be used for something else.

WHAT THE “PARKED” WALLET REALLY MEANS

The deeper takeaway is that SAFU is evolving from a crypto-native symbol into something closer to a primitive of institutional risk management: ring-fenced liquidity, transparent location, stable denominator, and a public policy of keeping it at a psychologically important round number. That does not make users “fully insured” in the way bank depositors are, and it does not remove governance questions about when and how compensation decisions are made, but it does show that the exchange is trying to separate two ideas that crypto has historically mixed together: a volatile corporate treasury that seeks upside and a user-protection pool that must perform under maximum stress. If the last cycle taught the market anything, it is that trust is rarely destroyed by a single exploit and more often destroyed by a liquidity gap and a slow, ambiguous response; by contrast, a fund that is both pre-positioned and publicly auditable changes the conversation from “will they pay” to “how fast can they execute,” and that shift—more than the marketing value of the word SAFU—is what makes the onchain footprint of the 0x420 wallet a meaningful macro-signal about how large exchanges now compete on credibility.

Read More: