KEYTAKEAWAYS

- The collapse of early-stage crypto funding signals a structural break, leaving the secondary market short of new narratives and assets.

- Memecoins are not altcoin replacements but short-lived attention instruments, unsuitable for long-term, sustainable trading.

- Asset tokenization and prediction markets are emerging as viable paths, turning real-world assets and events into the next core trading primitives.

CONTENT

As altcoins fade and primary markets collapse, crypto is redefining what’s tradable—shifting from tokens to tokenized assets and prediction markets driven by real-world uncertainty.

This weekend, amid mounting internal stress and external shocks, the crypto market was once again brutally washed out. Bitcoin is now hovering around $76,000, roughly aligned with Strategy’s average cost basis, while altcoins are in far worse shape—prices across the board are simply painful to look at.

Yet beneath this bleak short-term picture lies a deeper question:

🔍 What, exactly, will the crypto market be trading a year from now?

And behind that, an even more fundamental issue emerges:

If the primary market is no longer producing “the future” for the secondary market, then what will the secondary market be trading a year from now?

What happens to exchanges in that scenario?

The idea that “altcoins are dead” has been repeated for years, but over the past year, the market has hardly lacked new projects. Every day, projects are still lining up for TGE, and from a media perspective, we are still engaging at high frequency with teams seeking market exposure and promotion.

What this increasingly resembles is an industry-wide inventory clearance—or, more bluntly, a procession toward the end of the lifecycle. Tokens are issued, teams and investors get a formal conclusion, and what follows is either quiet stagnation or the passive hope that a miracle might arrive, funded by whatever remains on the balance sheet.

THE PRIMARY MARKET IS DEAD

For those of us who entered the industry during the ICO era—or even earlier, who have lived through multiple bull and bear cycles and witnessed how crypto once empowered countless individuals through industry-wide tailwinds, there is a deeply ingrained belief:

given enough time, a new cycle will emerge—along with new projects, new narratives, and new TGEs.

The reality, however, is that we are now far outside that comfort zone.

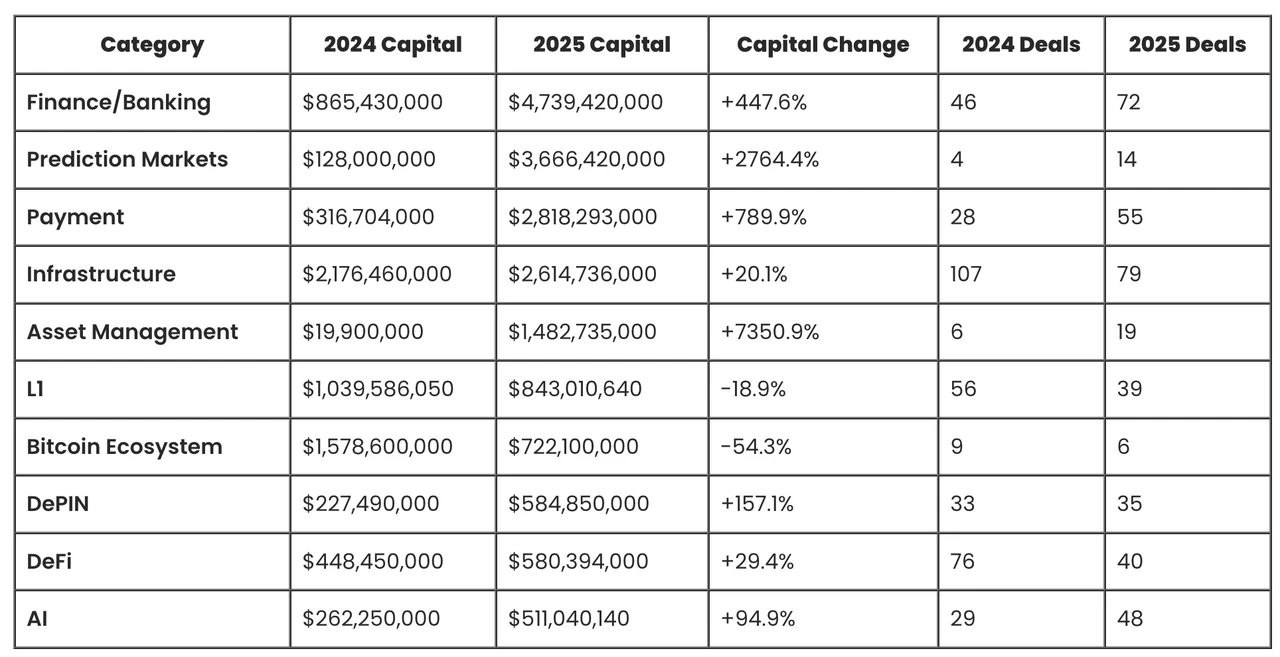

Let’s go straight to the data. Over the most recent four-year cycle (2022–2025), excluding special primary-market activities such as M&A, IPOs, and public fundraising, the number of crypto financing rounds shows a clear and sustained decline:

❗ 1,639 → 1,071 → 1,050 → 829

(source: Crypto Fundraising)

But the reality is worse than the headline numbers suggest. The shift in the primary market is not merely a contraction in total capital—it represents a structural collapse.

Over the past four years, early-stage funding rounds, which traditionally represent the industry’s fresh blood—including angel, pre-seed, and seed rounds—have fallen from 825 to 298, a 63.9% decline.

This drop is significantly steeper than the overall market decline (49.4%), indicating that the primary market’s ability to supply new life to the industry has been steadily eroding.

The few sectors where financing activity has increased are financial services, exchanges, asset management, payments, and AI-powered crypto applications. But in practical terms, these areas have limited relevance to the broader market—most of them, quite frankly, will never issue tokens.

By contrast, native crypto sectors such as L1s, L2s, DeFi, and social protocols have experienced far more pronounced declines in financing, underscoring just how severely the original engine of crypto innovation has stalled.

One data point that is often misread is the sharp decline in the number of funding rounds, alongside a rise in average deal size. The primary driver behind this divergence is precisely what was noted earlier: “large projects” have been capturing substantial capital from the traditional finance side, significantly inflating the average ticket size.

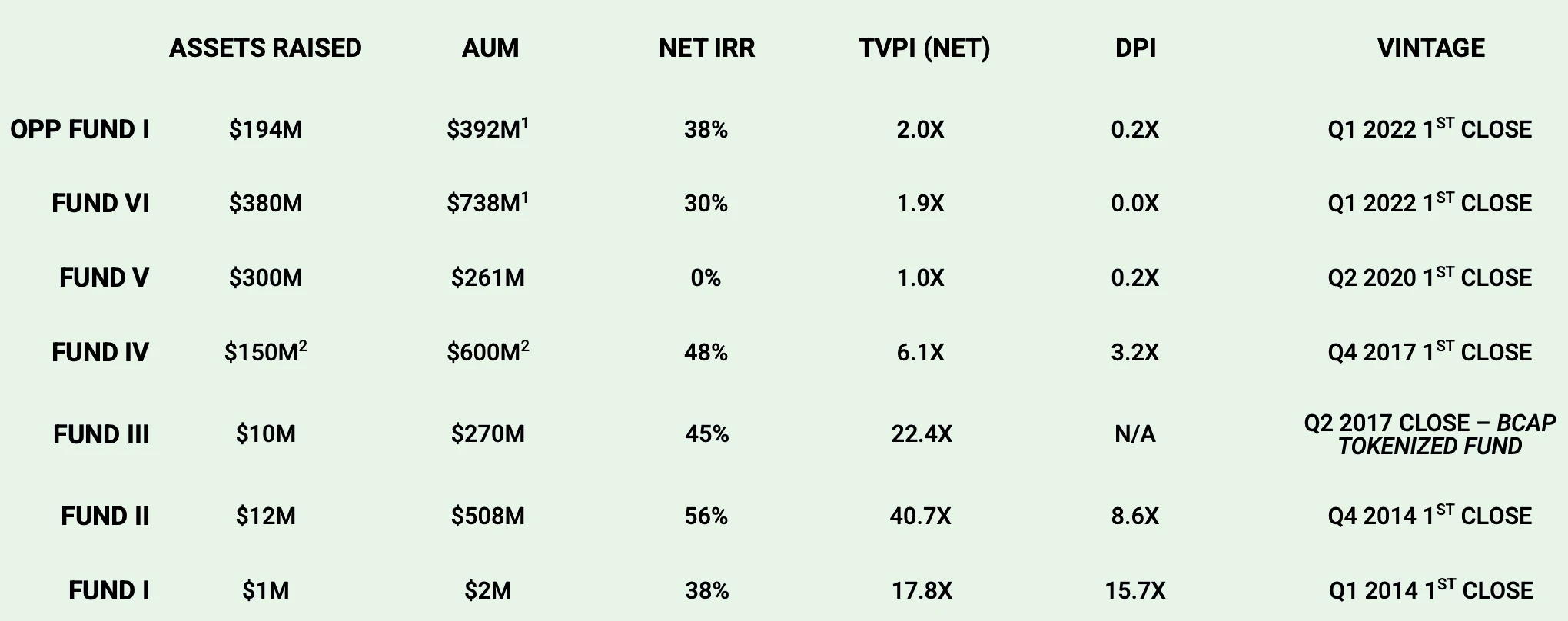

At the same time, leading VCs have increasingly concentrated their bets on a small number of “super projects”, committing ever larger checks to fewer names—Polymarket’s multiple nine-figure funding rounds being a prime example.

From the perspective of crypto-native capital, this top-heavy and self-reinforcing negative cycle is even more pronounced.

MEMES WERE NEVER A SUBSTITUTE FOR ALTCOINS

When we talk about the depletion of crypto-native projects, one commonly cited counterexample is the explosion of meme tokens.

Over the past two years, a recurring narrative has taken hold in the industry:

memes are the replacement for altcoins.

Looking back now, that conclusion has proven to be fundamentally wrong.

In the early days of the meme wave, we approached memes the same way we once approached mainstream altcoins—screening dozens of projects for so-called fundamentals, community quality, and narrative coherence, hoping to identify the one that could survive long term, continuously reinvent itself, and eventually grow into Doge—or even “the next Bitcoin.”

Today, if anyone still tells you to “hold memes for the long run,” you would probably assume something is seriously wrong with their judgment.

🔍 Modern memes function as an instant monetization mechanism for attention.

They are a game of attention versus liquidity, products of mass production by developers and AI tools, and an asset class defined by extremely short lifecycles but continuous supply.

Memes no longer aim to survive.

They aim to be seen, traded, and exploited.

Within our own team, we have several traders who have achieved consistent, long-term profitability in meme markets. Unsurprisingly, what they focus on is not a project’s future, but timing, propagation speed, emotional structure, and liquidity pathways.

Some argue that memes are no longer tradable. In my view, however, Trump’s “final harvest” moment ironically marked the point at which memes, as an asset class, truly matured.

Memes were never meant to replace long-term assets. Instead, they represent a return to pure attention finance and liquidity warfare—more refined, more ruthless, and far less suitable for most retail traders.

>>> More to read: What is Memecoin And Why Are They Popular?

LOOKING OUTSIDE FOR SOLUTIONS

📌 Asset Tokenization

As memes become professionalized, Bitcoin becomes institutionalized, altcoins stagnate, and new projects face an impending supply gap, a practical question emerges for people like us—ordinary participants who enjoy value research, comparative analysis, and judgment-based speculation, but who are not pure high-frequency probability gamblers and want something sustainable:

🔍 What is left to trade?

This question is not exclusive to retail traders.

It confronts exchanges, market makers, and platforms just as directly—after all, a market cannot rely indefinitely on higher leverage and increasingly aggressive derivatives to maintain activity.

In fact, as the industry’s internal logic begins to unravel, it has already started looking outward for answers.

The most widely discussed direction is clear:

repackaging traditional financial assets into on-chain, tradable instruments.

Tokenized equities and precious metals are rapidly becoming strategic priorities across exchanges. From major centralized venues to decentralized platforms like Hyperliquid, this path is increasingly viewed as a critical breakthrough—and the market response has been positive.

During last week’s most extreme days in the precious metals rally, daily silver trading volume on Hyperliquid briefly exceeded $1 billion. At one point, tokenized stocks, indices, and precious metals occupied nearly half of the top 10 trading pairs, helping push HYPE up over 50% in the short term, driven by the narrative of “full-asset trading.”

>>> More to read: Real-world Assets (RWA): Bridging Traditional And Defi Markets

📌 Prediction Markets

Beyond bringing external assets on-chain, there is another path:

bringing external uncertainty on-chain—prediction markets.

According to Dune data, despite last weekend’s sharp crypto selloff, prediction market activity not only held up but increased. Weekly transaction counts hit a new all-time high of 26.39 million.

Among them, Polymarket led with 13.34 million trades, followed closely by Kalshi at 11.88 million.

From a crypto-native user’s perspective, a fair question arises:

Why do we trade prediction markets? Are we just gamblers?

Of course we are.

But in truth, altcoin traders were never really betting on technology either—they were betting on events:

Will it get listed?

Will a partnership be announced?

Will a token launch?

Will a new feature go live?

Will there be regulatory tailwinds?

Will it catch the next narrative?

Price was always the outcome. Events were the starting point.

What prediction markets do—for the first time—is extract this logic from being an implicit variable hidden inside price charts, and turn it into a directly tradable object.

You no longer need to buy a token to indirectly bet on whether something happens.

You can bet directly on whether it will happen at all.

More importantly, prediction markets fit perfectly into the current environment of project scarcity and narrative exhaustion.

As new tradable assets become fewer, market attention naturally shifts toward macro conditions, regulation, politics, influential individuals’ actions, and major industry milestones.

In other words, while tradable assets are shrinking, tradable events are not—they may even be increasing.

This is why nearly all meaningful liquidity growth in prediction markets over the past two years has come from non-crypto-native events.

At its core, prediction markets import uncertainty from the real world into the crypto trading system. From a user experience standpoint, they are also more intuitive for traditional crypto traders:

The core question is reduced to just one thing:

Will this outcome happen—and is the current probability priced too high or too low?

Unlike memes, the barrier here is not execution speed, but information judgment and structural understanding.

Put this way—

doesn’t it suddenly feel like something you could actually try?

>>> More to read: What is Crypto Prediction Market? A Complete Beginner’s Guide