KEYTAKEAWAYS

-

Blockchain’s strongest use case is financial infrastructure, not general consumer applications.

-

Internet Capital Markets enable global, internet native capital formation beyond crypto projects.

-

Long term ecosystem survival depends on real revenue, economic sustainability, and open market liquidity.

CONTENT

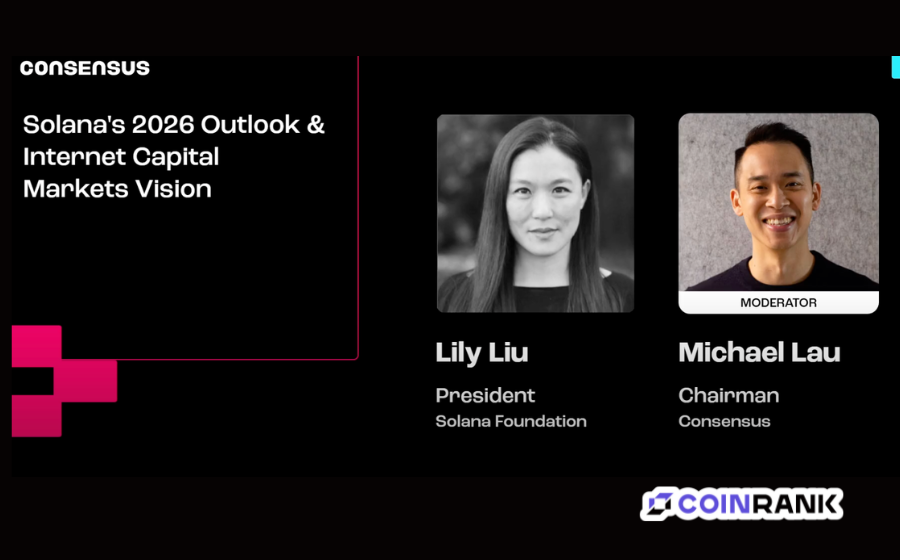

At Consensus 2026 in Hong Kong, Solana Foundation President Lily Liu returned to a theme she has repeated many times: Internet Capital Markets. Instead of speaking about token prices or ecosystem statistics, she focused on a deeper question. What is blockchain actually good for?

The conversation moved away from short term market cycles. It centered on structure, capital formation, and the long term role of blockchain as financial infrastructure for the internet.

BLOCKCHAIN IS NOT A UTOPIAN TECHNOLOGY

When asked to explain Internet Capital Markets, Lily began with a basic point. For more than fifteen years, the industry has been exploring what blockchain is truly useful for. Many people once believed that putting anything on chain would automatically improve it. She disagrees.

Blockchain is powerful, but it is not useful for everything.

In her view, most successful blockchain use cases will relate to finance and markets. This does not mean copying traditional finance. It means embedding capital markets directly into internet applications. If assets can be tokenized, if payments and trading happen on chain, and if financial tools exist natively on the internet, then capital markets become part of the internet itself.

She described one of crypto’s strongest value propositions in simple terms. Anyone can access finance. Anyone can access capital markets.

That is the foundation of what she calls Internet Capital Markets.

FROM ICOS TO INTERNET CAPITAL FORMATION

The discussion moved to the ICO era. Many remember 2017 and 2018 as a period of speculation and excess. Lily acknowledged that there were problems. There were few guardrails and too much scale too quickly. But she made an important distinction.

The mechanism itself was powerful.

For the first time, projects could raise money globally through the internet. Capital formation became native to the online world. Investors from different countries could participate within minutes.

She pointed to a recent example where a crypto project raised hundreds of millions of dollars in minutes. Her question was direct. If this is possible for a crypto native project, why should it not be possible for other innovative companies around the world?

In her view, ICOs were not a failure. They were an early experiment. The idea of internet native capital formation will continue to return in different forms because it is a strong financial primitive.

Internet Capital Markets means expanding that mechanism beyond crypto projects. It means allowing more types of assets and companies to access global liquidity through open networks.

ASIA IS A CORE MARKET, NOT A FRONTIER

When asked about Asia, Lily was clear. She has never seen Asia as a frontier market for crypto. She sees it as a core market.

She reminded the audience that early mining hardware production, large scale miner deployment, and some of the first major exchanges emerged from the Asia Pacific region. Infrastructure development in this industry has deep roots in Asia.

She also highlighted the global language structure. English and Chinese are two of the largest language groups in the world. Each has strong talent networks and capital networks. These systems often operate in parallel.

If blockchain aims to become neutral global financial infrastructure, it must operate across both of these systems. For that reason, Asia is not an expansion target. It is part of the foundation.

REVENUE AND ECONOMIC SUSTAINABILITY

One of the strongest parts of the interview focused on revenue. Lily argued that if a layer one blockchain wants to be a platform, it must demonstrate real revenue.

She questioned the long term logic of governance tokens. Voting rights alone do not create value. Community participation is important, but it does not automatically produce economic returns.

In a proof of stake network, the model is clearer. Users generate activity. Activity creates fees. Validators earn revenue. Stakers receive a portion of that revenue. This creates a logical value flow. But it only works if there is real usage.

She separated two levels of sustainability. The network must generate revenue. Applications built on top of the network must also be economically viable. If developers cannot earn money, they will not stay. If networks do not generate income, token value becomes difficult to justify.

She summarized the lesson from previous cycles in one short sentence. Vibes do not pay.

Community energy and culture are powerful, but without an economy they cannot last.

BLOCKCHAIN AS FINANCIAL TECHNOLOGY

The most debated part of the discussion was her claim that blockchain’s true product market fit lies in financial applications.

She did not step back from that claim. In her view, blockchain was designed as financial technology. Bitcoin introduced digital scarcity. Public blockchains extended that idea into a broader financial system.

She questioned the idea that putting social media or games on chain automatically makes them better. She asked a simple question. How does being on chain make a social network more engaging? How does it make a game more fun?

She clarified that digital ownership is valuable. However, ownership alone does not create price. She made a clear distinction between value and price. An asset may have value, but without market structure it has no price discovery. On the other hand, crypto markets often show price without clear value.

Tokenization does not create value by itself. Market liquidity, trading infrastructure, and financial tools create price formation.

She also reflected on the era of private and permissioned blockchains. Many institutions once believed private systems would dominate. Over time, they realized that assets inside closed systems lacked open liquidity and price discovery. As a result, more institutions began connecting to public blockchain infrastructure.

Liquidity on the open internet is what creates real market value.

DEFINING THE DIRECTION

In the final question, she was asked about a view others might consider contrarian. She responded by saying that the industry often mixes terms such as Web3, crypto, blockchain, and digital assets. These words come from different perspectives, yet they are used as if they mean the same thing.

For her, the goal has always been consistent. It is about building financial infrastructure that is accessible to everyone on the internet.

She compared today’s financial systems to traditional postal systems. Blockchain, in contrast, functions like an internet protocol. If the internet transformed how information moves, blockchain aims to transform how value moves.

Economic sovereignty and individual sovereignty depend on access to financial systems. Internet Capital Markets is not a marketing phrase. It is her way of describing the long term direction of blockchain.

The debate will continue. But in her framework, the path forward is economic, structural, and global.