KEYTAKEAWAYS

-

The launch of ultra short term prediction markets transformed Polymarket from a narrative driven platform into a microstructure trading arena.

-

The trader’s edge came from exploiting short term pricing lag between spot markets and probability contracts, not from long term forecasting.

-

Strict position sizing and systematic profit taking, rather than pure win rate, enabled consistent gains within compressed time windows.

CONTENT

A FIVE MINUTE MARKET TURNS PREDICTION INTO A SPEED GAME

When Polymarket launched its 5 minute and 15 minute ultra short term markets in February 2026, it quietly shifted the nature of prediction trading. Traditional prediction markets revolve around macro events such as elections, policy outcomes, or long term asset direction. They function as consensus machines, where price reflects collective belief about a distant future. But once the time frame shrinks to five or fifteen minutes, the structure changes completely. Participants are no longer debating narratives. They are reacting to live volatility. The product stops being a marketplace of opinions and starts resembling a lightweight derivatives venue.

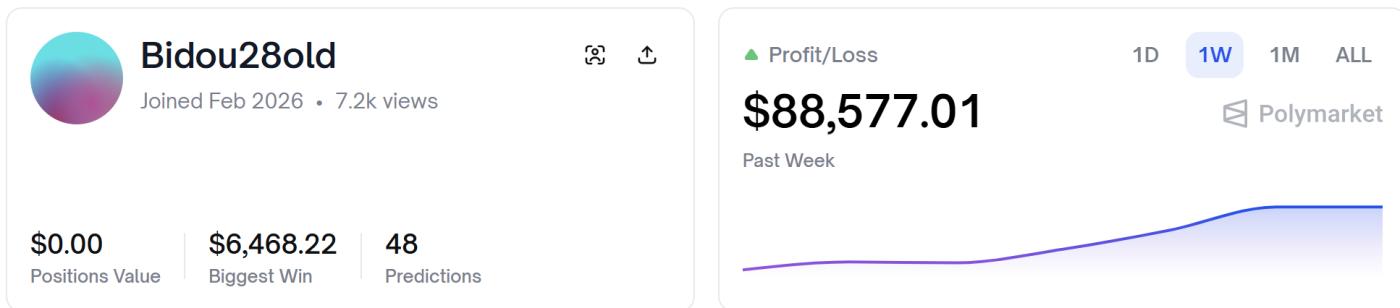

In that environment, a wallet named Bidou28old emerged almost immediately. Within less than twenty four hours of activity, the address completed 48 trades and walked away with a net profit of 80,000 dollars. The speed of accumulation drew attention, but the more important detail was consistency. This was not a single lucky strike. It was repeated execution within narrowly defined time windows. The launch of minute level markets created a new arena, and this trader clearly understood the rules faster than most participants.

HE WAS NOT PREDICTING THE FUTURE. HE WAS EXPLOITING PRICING LAG

On the surface, the trades appeared simple. He was betting on whether BTC or ETH would rise within five minutes. But the mechanics reveal something deeper. In prediction markets, price represents probability. Three cents implies a 3 percent chance. Eight cents implies 8 percent. However, during moments of sharp volatility, these contracts do not update as quickly as the underlying spot market. Liquidity is thinner. Order flow reacts slower. That gap between real time price movement and probability adjustment creates temporary inefficiency.

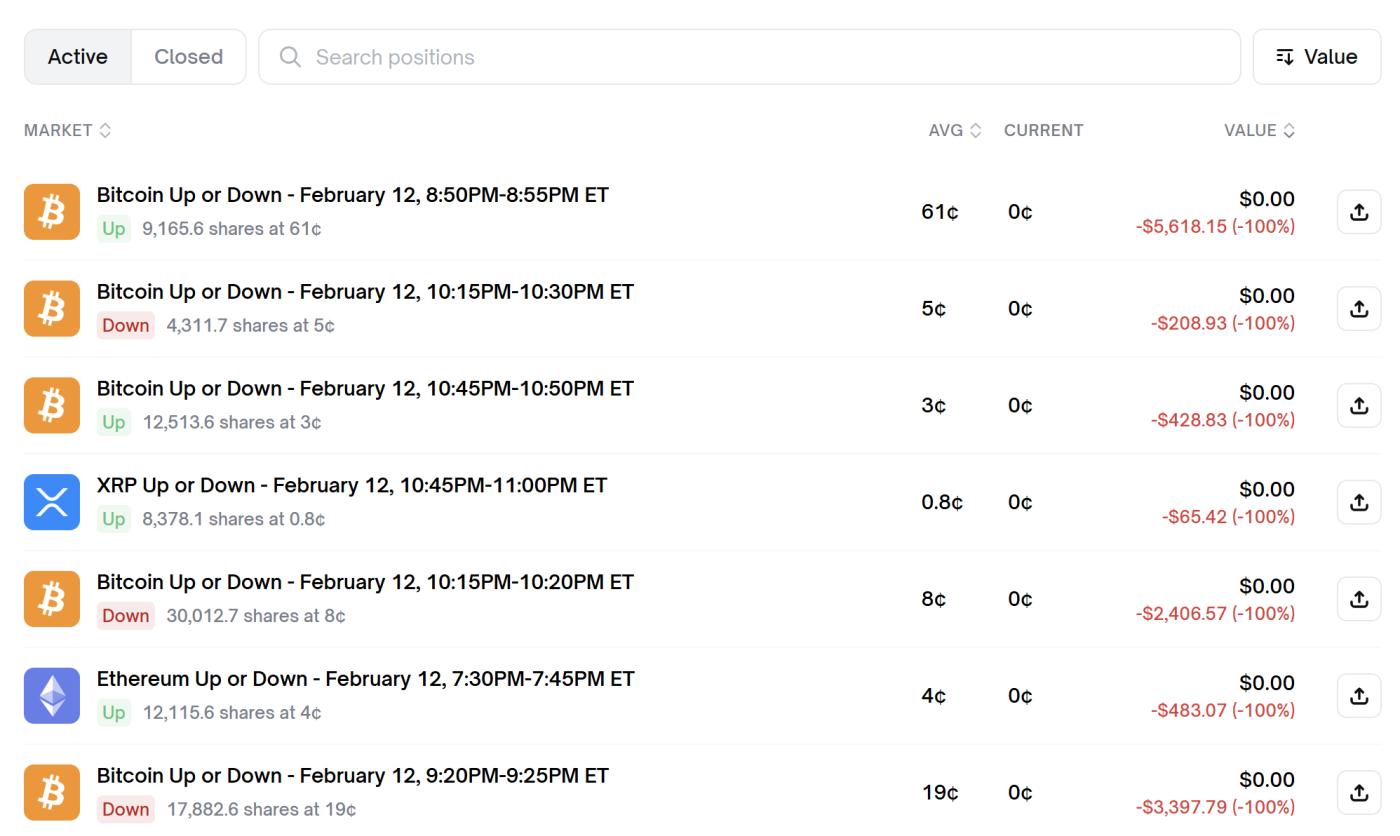

Bidou28old repeatedly entered positions priced between 3 cents and 8 cents when short term reversals were statistically mispriced. For example, during a rapid BTC drop, the market would compress the probability of a five minute rebound to extreme lows. If spot order books showed absorption or aggressive buying, the probability was no longer truly 3 percent. By entering at those depressed prices and exiting once contracts repriced toward equilibrium, he captured multiple fold returns without needing extreme directional conviction. Even a move from 3 cents to 40 cents generates more than ten times return. In probability terms, he was buying fear at a discount and selling normalization.

This approach transforms prediction markets into microstructure arbitrage. The edge does not come from knowing the future. It comes from recognizing when the market temporarily underestimates the immediate present.

POSITION SIZING AND RISK CONTROL WERE THE REAL WEAPONS

What truly separates this account from impulsive speculation is position structure. Many observers focus on the small price entries, but the larger insight lies in capital allocation. His losing trades were controlled and limited. Several small losses accumulated to more than 10,000 dollars, yet they did not disrupt overall profitability. That indicates predefined risk tolerance per attempt. Losses were part of the statistical model, not emotional errors.

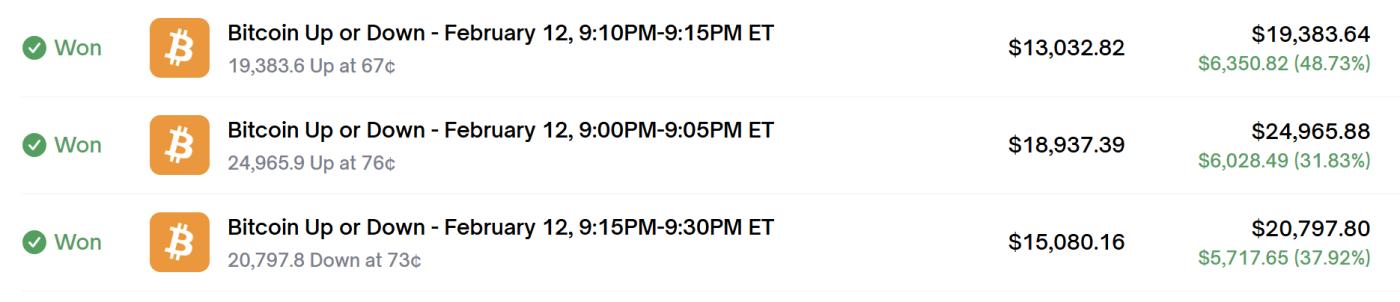

More revealing are the winning trades. In high conviction moments, position sizes ranged between 7,000 and 19,000 dollars. Profit per trade consistently fell between roughly 4,800 and 6,400 dollars. This narrow band of realized profit suggests predefined exit logic. He was not chasing maximum payout. He was extracting repeatable percentage moves and recycling capital rapidly. In three consecutive fifteen minute intervals, he generated over 18,000 dollars in under half an hour. That level of turnover implies structured decision making, not reactive betting.

The pattern shows layered strategy. Small size for asymmetric long shot opportunities. Large size for high probability continuation or reversal signals. Controlled exit once price reached statistical expectation. The success was not built on extreme win rate. It was built on disciplined scaling.

SPEED, STRUCTURE, AND THE FUTURE OF ULTRA SHORT TERM PREDICTION MARKETS

His trading activity concentrated between 7:30 PM and 11:00 PM Eastern Time, a window that overlaps with post equity market volatility and active global crypto liquidity. This timing suggests alignment with peak order flow rather than random engagement. Traders operating at this level often rely on low latency data feeds, order book analytics, or automated execution assistance. Even without full automation, the decision cycle must be rapid and structured.

The broader implication is structural. Prediction markets were originally designed for event based probability discovery. With the introduction of minute level contracts, they enter competition with high frequency trading environments. If professional participants systematically exploit pricing lag, retail users may find it harder to compete on speed. Platforms may need to deepen liquidity, refine pricing mechanics, or adjust participation rules to maintain balance.

The 80,000 dollar day was more than an isolated story. It highlighted a transition phase in prediction market evolution. When time frames compress, probability becomes micro volatility. In that compressed space, advantage belongs to those who combine statistical reasoning, disciplined capital management, and execution speed. As ultra short term markets expand, the battlefield will no longer be narrative forecasting. It will be structural efficiency.