KEYTAKEAWAYS

-

Sharps, Pantera, and Galaxy plan $2.65B Solana DATs, signaling rising institutional adoption and potential market impact.

-

Massive Solana treasury projects may tighten supply, boost prices, and highlight risks of volatility and regulatory uncertainty.

-

DATs position Solana as a corporate asset, combining staking yields, institutional backing, and growing ecosystem strength.

CONTENT

In the wave of cryptocurrency moving from a fringe asset to a mainstream financial tool, Solana (SOL), with its high-performance blockchain and fast-growing ecosystem, is quickly becoming a focus for institutional investors. In August 2025, Sharps Technology (STSS), Pantera Capital, and the joint group of Galaxy Digital, Multicoin Capital, and Jump Crypto announced Solana digital asset treasury (DAT) plans totaling $2.65 billion.

This record-setting move not only marks the rise of Solana as a corporate treasury asset but also shows a new stage of deep integration between traditional finance and blockchain. These plans, with large investments, strategic cooperation, and institutional support, highlight Solana’s potential as global financial infrastructure.

$2.65 BILLION SOLANA DAT PLAN

Sharps Technology (STSS), a Nasdaq-listed company originally focused on medical device manufacturing, took a bold step into digital assets. It announced a $400 million raise through a private investment in public equity (PIPE) to create the largest Solana digital asset treasury to date.

This plan has strong support from top crypto investors including Pantera Capital, ParaFi, FalconX, and CoinFund, showing the strong appeal of the Solana ecosystem. Sharps reached a strategic deal with the Solana Foundation to buy $50 million worth of SOL (about 265,957 SOL at $188 each) at a 15% discount to the 30-day average price. This discount lowers the initial cost and leaves space for future upside.

In leadership, Alice Zhang, co-founder of Jambo Web3 Phone, became Chief Investment Officer, while James Zhang became Strategic Advisor. Their experience in Web3 gives strong support for execution.

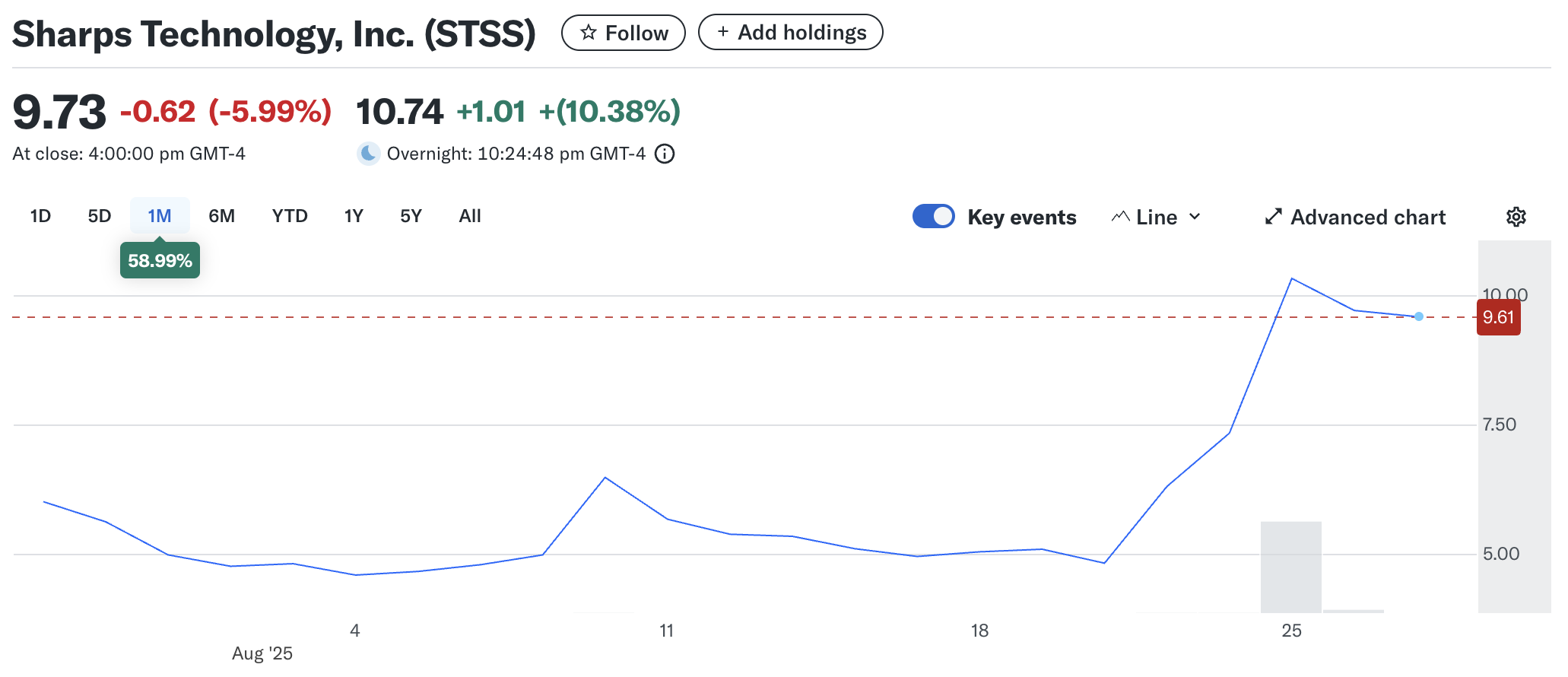

Source:Yahoo

After the announcement, Sharps stock jumped 60% in one day to $96, showing strong market reaction to this new strategy. This not only marks a traditional company entering digital assets but also recalls the success of MicroStrategy’s Bitcoin treasury. By holding SOL and staking, Sharps expects an annual yield of about 7%, much higher than traditional treasury assets.

At the same time, Pantera Capital proposed a larger plan to raise $1.25 billion and transform a Nasdaq-listed company into “Solana Co.” focused on SOL accumulation. The plan uses $500 million in equity financing and $750 million in warrants, balancing early dilution with later commitments.

Pantera, a pioneer in crypto investment, has already deployed more than $300 million into DATs across eight tokens including BTC, ETH, SOL, BNB, TON, HYPE, SUI, and ENA. It also joined the Sharps $400 million raise. Pantera has called Solana the “Mac OS of blockchains,” praising its high throughput, low fees, and user-friendly design. Pantera sees it as core infrastructure for global finance. With its financing structure, the plan not only offers investors exposure to Solana’s growth but could also increase SOL liquidity and price through large purchases.

Galaxy Digital, Multicoin Capital, and Jump Crypto also announced a joint $1 billion plan to buy and convert a public company into a Solana DAT, with Cantor Fitzgerald as lead underwriter. This plan has support from the Solana Foundation and is expected to complete in early September 2025. Solana’s strong ecosystem gives a solid base: in the first half of 2025, Solana apps brought $1.3 billion in revenue, with daily trading volume of $6 billion and more than 7,500 new developers.

These numbers show Solana’s leadership in DeFi, NFTs, and Web3 apps. Cantor Fitzgerald’s role adds traditional finance credibility. This plan strengthens Solana as a core institutional asset and may speed up its adoption in DeFi and stablecoins.

TOTAL SCALE AND MARKET IMPACT

Together, the three plans total $2.65 billion, about 14,095,744 SOL at $188 each. This is 4.1 times larger than the disclosed holdings of current Solana DATs (about 3,431,861 SOL worth $650 million). It equals 0.69% of SOL’s total circulating supply. Such a large amount may have big effects.

First, buying large volumes of SOL will tighten supply, possibly raise prices, and increase volatility. Treasuries holding and staking SOL will lock coins away and reduce liquidity, further tightening supply. This effect could attract more speculative funds and push prices higher.

The plans will also increase institutional share of SOL. Currently, disclosed DATs hold only about 0.17% of supply. After these new plans, the ratio could rise close to 1%, reinforcing Solana’s role as a corporate asset. The rise of Sharps stock shows strong interest, but past examples also warn of risks.

Some companies saw share prices fall after announcing crypto treasury plans, as investors worried about risk. Overall, these moves put Solana at the front of institutional adoption, and its market and ecosystem performance will be key in the coming months.

TRENDS AND LESSONS OF DIGITAL ASSET TREASURIES

The rise of digital asset treasuries (DATs) is reshaping corporate asset allocation. MicroStrategy, with more than $70 billion in Bitcoin, proved the potential of crypto as a treasury asset, inspiring others. Solana, with high performance and staking yield, is now a popular choice.

Solana blockchain can process up to 65,000 transactions per second at costs of fractions of a cent, giving it advantages in DeFi, NFTs, and stablecoins. Its ecosystem growth—$1.3 billion revenue, $6 billion daily volume, and more than 7,500 new developers—supports the treasury strategy.

But the DAT model also carries risks. Market volatility can hurt asset value and share price, especially for non-crypto companies like Sharps. Global regulation is also uncertain, with possible changes in tax or securities laws. Some investors may doubt traditional firms entering crypto, causing mixed sentiment. Still, Solana’s performance and strong backing make it an ideal DAT choice, and its growing ecosystem offers long-term potential.

FUTURE OUTLOOK

The $2.65 billion Solana DAT plans mark the shift of crypto from speculative asset to institutional treasury asset. Solana, with its technology and ecosystem, is stepping to the center of global finance. Actions by Sharps Technology, Pantera Capital, and Galaxy Digital not only bring huge funds into Solana but also add credibility through cooperation and finance partners. These plans may raise SOL’s price, tighten supply, and accelerate adoption in DeFi, stablecoins, and Web3. Large investment and attention will also attract more developers and grow the ecosystem further.

For traditional companies, Sharps gives a model: through DATs, they can join the crypto market, get high yield, and diversify assets. Success, however, depends on good execution, market acceptance, and risk control. For investors, the plans mean both opportunities and risks. They give exposure to Solana growth but require close watch on volatility and regulation. In the months ahead, Sharps’ progress, Pantera’s raise, and Galaxy’s moves will be key signals for Solana’s future potential.