KEYTAKEAWAYS

- Ethereum’s validator exit queue surged past 2 million ETH after staking provider Kiln began withdrawing all of its validators in response to a Solana-related security incident.

- The move was a precautionary reset, not a mass sell-off, with most of Kiln’s stake expected to be restaked once security concerns are addressed.

- The episode highlights the operational risks of staking providers and the ripple effects infrastructure issues can have on Ethereum’s network and liquid staking markets.

CONTENT

SECURITY BREACH SPARKS PRECAUTIONARY MOVE

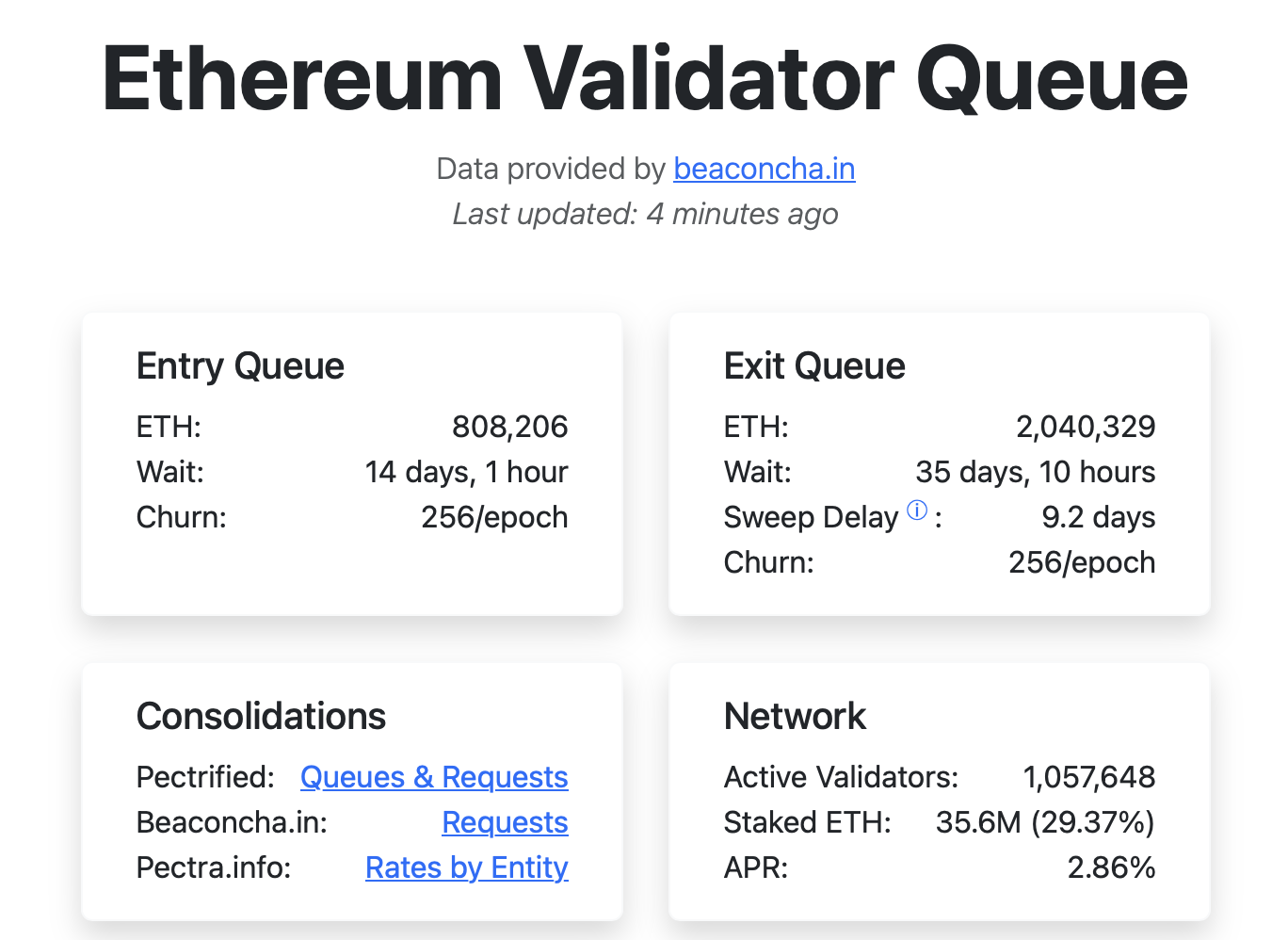

Ethereum’s validator exit queue ballooned this week, with more than two million ETH now waiting to leave the network. The surge pushed withdrawal times beyond a month and briefly sparked fears of a major sell-off. But the spike traces back to one provider’s precautionary move rather than an exodus of whales.

The pressure started on Sept. 8, when SwissBorg disclosed a theft of roughly 192,600 SOL worth about $41 million. The attack was linked to Kiln, the staking infrastructure firm that powers SwissBorg’s Solana staking service. Kiln said an API vulnerability allowed hackers to access a wallet, prompting the company to pause Solana operations and launch a security review with external partners.

EXIT QUEUE SWELLS TO RECORD LEVELS

Although the breach was limited to Solana, Kiln said on Sept. 10 it would “orderly exit” all of its Ethereum validators as an added safeguard. The firm controls around 1.6 million ETH, and under Ethereum’s consensus rules, mass exits must be staggered over days or weeks. As a result, the queue to withdraw ETH quickly swelled, with exit times stretching beyond 35 days. Validators continue to earn rewards during the process, and Kiln stressed that no ETH was lost.

The optics were striking: more ETH queued to leave than ever before, nearly double the previous record from late August. Yet inflows have not stopped; more than 800,000 ETH remain lined up to enter staking. Developers and analysts were quick to point out that the majority of Kiln’s stake is likely to return once security concerns are resolved, either under new validator keys or through other providers. “This isn’t two million ETH heading to exchanges,” Ethereum educator Anthony Sassano said, noting the exits were a reset rather than a withdrawal of confidence.

WHAT IT MEANS FOR ETHEREUM

Still, the episode underscores how quickly staking infrastructure issues can ripple across Ethereum. Extended exit times may frustrate some users, and liquid staking tokens that rely on predictable redemptions could see pressure if delays persist. The temporary removal of a large validator set also trims the network’s active decentralization, though not enough to compromise security.

For Ethereum, the protocol has so far done exactly what it was designed to do, handling a sudden wave of exits without disruption. The challenge lies with service providers. Kiln now faces the task of restoring trust and resuming normal operations, while the market is reminded that staking security depends as much on operational resilience as it does on code.