KEYTAKEAWAYS

-

Meme coins unexpectedly kicked off the first major rally of 2026, driven by capital rotation, recovering risk appetite, and broad-based participation rather than isolated speculation.

-

Technical indicators and derivatives data confirm real capital inflows, but rapidly expanding leverage also increases the risk of sharp volatility and forced deleveraging.

-

While meme coins may act as an early signal for broader altcoin and Solana-led upside, their historically fragile structure makes this rally as much a warning as it is an opportunity.

- KEY TAKEAWAYS

- IS THE CAPITAL ROTATION CYCLE REPEATING?

- TECHNICAL CONFIRMATION: THE MEME COIN REBOUND IS NOT WITHOUT BASIS

- LEVERAGE AND SENTIMENT: LONG POSITIONS ARE ENTERING, BUT LEVERAGE RISK IS ALSO ACCUMULATING

- ALTCOIN RALLIES MAY FOLLOW MEME COINS, POTENTIALLY BENEFITING SOL

- A PRELUDE TO RECOVERY, OR A CLASSIC BULL TRAP?

- DISCLAIMER

- WRITER’S INTRO

CONTENT

The first crypto rally of 2026 is led not by Bitcoin or Ethereum, but by meme coins—raising a critical question: is this a genuine signal of market recovery, or another leverage-driven bull trap fueled by sentiment and speculation?

After what could only be described as an “excruciating” fourth quarter of 2025, the crypto market has finally begun to show early signs of recovery at the start of 2026.

Unexpectedly, the spark that ignited the new year’s market momentum was not Bitcoin or Ethereum, but meme coins. Following a quiet holiday period and subdued market activity, meme coins are making a strong comeback.

IS THE CAPITAL ROTATION CYCLE REPEATING?

Frankly speaking, this round of the meme coin rally is not abrupt. Toward the end of 2025, market liquidity dried up, FUD sentiment spread, and retail investors’ risk tolerance fell to its lowest level of the year. The total market capitalization of meme coins dropped by more than 65%, hitting a yearly low of USD 35 billion on December 19, as traders’ risk appetite weakened.

After Christmas, Bitcoin remained range-bound and major assets lacked clear direction. Capital naturally rotated toward higher-beta assets with greater elasticity, and meme coins happened to fill this gap.

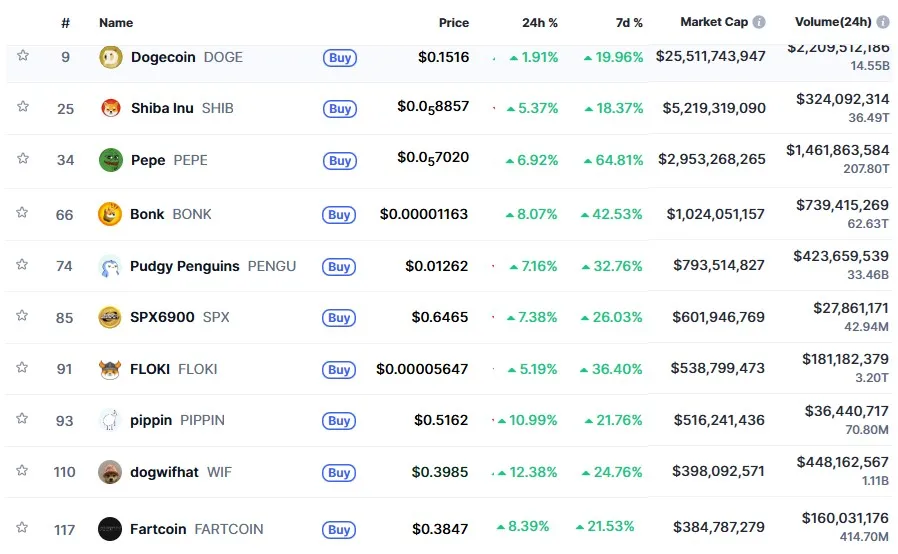

According to CoinMarketCap data, the total market capitalization of the meme coin sector has surpassed USD 47.7 billion, up nearly USD 10 billion from USD 38 billion on December 29, 2025. Among the top three meme coins by market cap, DOGE rose nearly 20% over the past week, SHIB gained 18.37%, and PEPE surged 64.81%.

At the same time, trading volume in meme coins climbed sharply alongside market capitalization, jumping from USD 2.17 billion on December 29, 2025 to USD 8.7 billion as of Monday this week—an increase of nearly 300%.

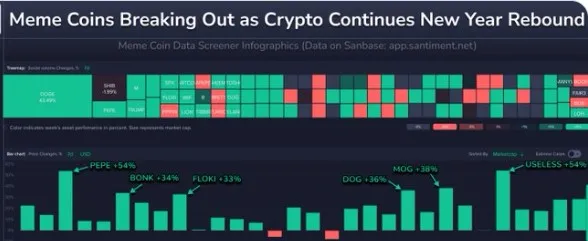

From a data perspective, this meme coin rally is not a “mania” driven by a single token, but rather a broad-based sectoral recovery. Meanwhile, social media discussion intensity and on-chain transaction volumes have expanded in tandem, indicating that attention and liquidity are flowing back into the sector, rather than a simple price-driven pump.

TECHNICAL CONFIRMATION: THE MEME COIN REBOUND IS NOT WITHOUT BASIS

Meme coins are among the highest-risk assets in crypto. When they rebound, it often signals that investors are once again willing to take on higher risk. From a macro technical structure perspective, the TOTAL3 indicator (total crypto market capitalization excluding BTC) shown in the chart suggests that the crypto market has transitioned from a downtrend into a repair phase, indicating a shift in market behavior from “sell every bounce” to “accumulate on dips.”

Currently, TOTAL3 is testing a key resistance level around USD 848 billion, which coincides with the 200-day moving average and a medium-term trendline. If this level is broken with sufficient volume and holds, the technical target could extend toward USD 900 billion, providing room for continued rebounds in altcoins and meme coins.

From an internal sector structure perspective, meme coins are showing clear signs of systemic strength. Recent gains are not concentrated in a single asset but span multiple tokens such as PEPE, BONK, DOGE, FLOKI, and MOG, across both the Ethereum and Solana ecosystems. This kind of broad participation typically suggests sector-level capital allocation rather than short-term speculation in isolated assets. Historical cycles also show that during Bitcoin consolidation phases, high-beta assets often rebound first to test overall market risk tolerance.

LEVERAGE AND SENTIMENT: LONG POSITIONS ARE ENTERING, BUT LEVERAGE RISK IS ALSO ACCUMULATING

The meme coin derivatives market has also heated up rapidly. According to Coinglass data, DOGE open interest rose 45.41% over the past 24 hours, reaching USD 1.941 billion. PEPE increased 33.32% to USD 514 million, SHIB rose 93.66%, WIF climbed 123.39%, and PENGU increased 69.04%.

Open interest is commonly used as a core indicator to determine whether “real capital” is entering the market, as it reflects the total amount of unsettled derivatives contracts, with every short position matched by a long position. This round of meme coin price rebounds has been confirmed by simultaneous increases in both open interest and trading volume.

Taking PEPE and DOGE as examples, multiple meme coins have seen significant expansions in derivatives trading volume alongside rising prices. This synchronization typically indicates strong bullish momentum, as leveraged traders open more positions in anticipation of higher prices, suggesting genuine long positioning rather than mere short covering.

However, the rapid expansion of open interest also means that leverage exposure is accumulating at the same time. Given that meme coins generally lack strong fundamental support and are highly sentiment-driven, increased activity on high-leverage platforms can significantly amplify short-term volatility. Historically, meme coins often act as the “canary in the coal mine” for market cycles: they are the first to reflect shifts in risk appetite, but also the first to collapse when sentiment reverses.

If market sentiment turns or external shocks emerge, overly concentrated long positions could trigger rapid deleveraging and cascading liquidations. Therefore, while derivatives data provides positive confirmation for the current rebound, its structure also signals that short-term pullback risks should not be ignored.

ALTCOIN RALLIES MAY FOLLOW MEME COINS, POTENTIALLY BENEFITING SOL

On-chain analytics platform Santiment previously posted an analysis on X, noting that this meme coin rebound began a few days after Christmas, when FUD among retail traders reached its peak. Historically, the assets that rebound first in the crypto market are often those most disliked by retail investors at the time.

As market capital begins to disperse into “other” areas such as meme coins, altcoins may also soon experience upward momentum. Historical data suggests that among altcoins, SOL has benefited the most from meme coin cycles.

Meme coins have long been one of Solana’s primary growth engines, driving user activity and cultural influence over the past few years. This activity has helped attract developers and traders to the network and has played a significant role in the revival of Solana’s decentralized finance ecosystem. At the same time, the dominance of meme coin trading has shaped how investors and institutions perceive the network, often linking Solana’s growth to speculative cycles.

Igor Stadnyk, co-founder and Head of AI at True Trading, stated that meme coins have become part of Solana’s cultural identity and a liquidity engine for attracting users. However, Solana’s next phase of growth may come from applications that rely less on viral speculation and more on sustained execution, such as on-chain perpetual futures and AI-native trading agents.

A PRELUDE TO RECOVERY, OR A CLASSIC BULL TRAP?

Given that the broader crypto market has not fully emerged from its downturn, this meme coin surge has also sparked skepticism within the community: is it a prelude to a full recovery, or merely a short-lived, sentiment-driven rebound?

Optimists argue that the strong rebound in meme coins signals a return of risk appetite in the crypto market, potentially paving the way for gains in altcoins and even major assets. On the other hand, features such as social media-driven momentum, amplified leverage, and prices still far below historical highs closely resemble past “bull trap” patterns.

For traders, this is not a signal to blindly chase prices higher, but rather a phase that demands high discipline, rapid response, and strict risk management.

What can be stated with certainty is this: meme coins have kicked off the first wave of the 2026 crypto market. Whether this wave will illuminate a new bull market or burn too hot and backfire on the market remains to be seen—and the answer may arrive sooner than expected.