KEYTAKEAWAYS

- Ethereum Gains Institutional Traction: The race for Ethereum spot ETFs demonstrates growing institutional confidence in Ethereum as a mainstream asset class, following Bitcoin's path.

- Diverse Applicant Pool: Major financial players like BlackRock, Fidelity, and Invesco, along with crypto-focused firms like Grayscale and Bitwise, are competing for approval, highlighting the diverse interest in the space.

- Potential Market Catalyst: Approval of these ETFs could significantly increase Ethereum's accessibility for mainstream investors, potentially driving up demand and further legitimizing the cryptocurrency market.

CONTENT

Nine institutions race to launch Ethereum spot ETFs, following Bitcoin’s lead. This article dives into their proposals and the potential impact on the crypto market.

In the early hours of May 21, the price of Ethereum experienced a remarkable rebound, surging over 25% from $3,000 to $3,800 USD. This surge, further fueled by Bloomberg analysts James Seyffart and Eric Balchunas raising the approval odds of Ethereum spot ETFs to 75% based on recent developments, is part of a broader bullish trend in the cryptocurrency market, initially sparked by the application for a Bitcoin spot ETF.

Now, as we shift our focus to Ethereum spot ETFs, CoinRank will delve into the profiles of the key investment institutions, exploring the distinctive features of their ETF proposals and the anticipated approval schedules.

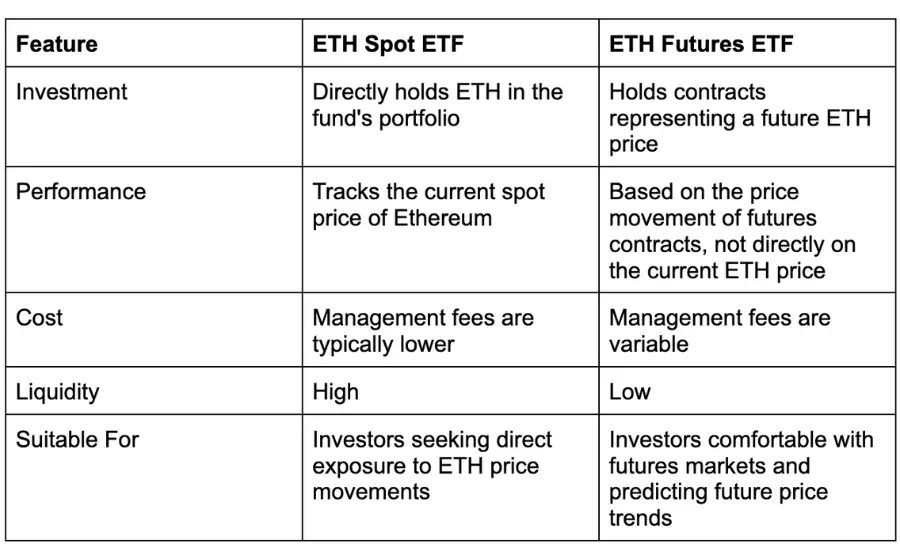

ETHEREUM SPOT ETF VS ETHEREUM FUTURES ETF

ETHEREUM ETF APPLICATION PROCESS

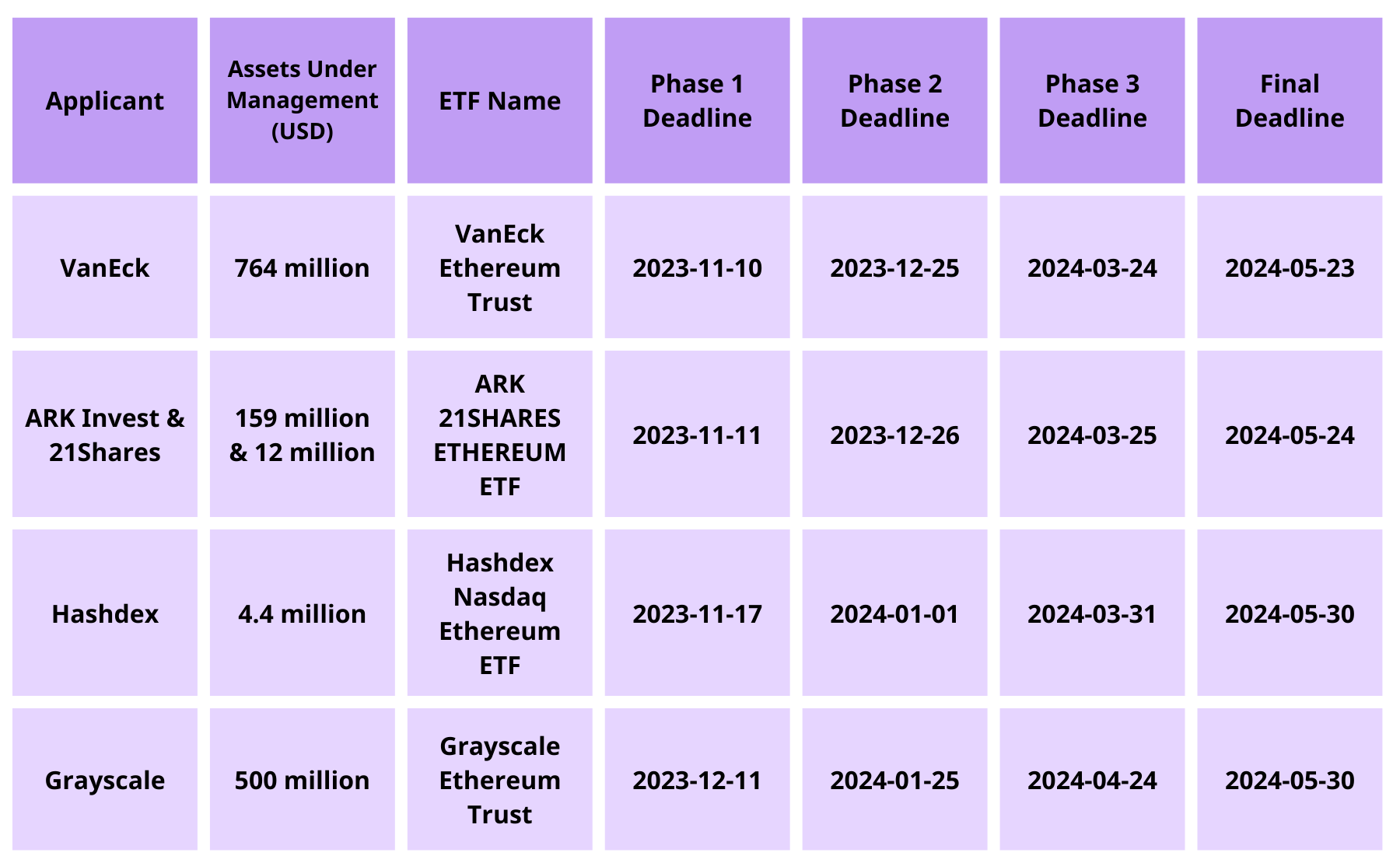

The Ethereum ETF application process mirrors that of Bitcoin spot ETFs. Upon submission, the SEC registers the application in the Federal Register, initiating a 240-day countdown.

This countdown consists of four stages: 45 days, 45 days, 90 days, and 60 days. At each stage, the SEC must decide to approve, deny, or request more time to review. A final decision is mandatory within 240 days of registration.

VanEck and Kryptoin Investment Advisors have been pursuing Ethereum spot ETFs since 2021. They are now joined by notable players like BlackRock, ARK Invest, Invesco, Hashdex (proposing a mixed spot and future contracts ETF), and Grayscale (aiming to convert a futures trust into a spot ETF).

INVESTMENT INSTITUTIONS APPLYING FOR ETHEREUM SPOT ETFS

1. VanEck: VanEck Ethereum Trust

VanEck is known for its investment performance across different asset classes. The company’s expertise in specific industries and regions has helped investors achieve substantial returns, especially in metals and mineral resources, emerging markets, fixed income, and alternative investments.

Over the decades, VanEck’s investment strategy has focused on providing low-risk, steady returns while emphasizing diversification, committed to offering investment options that cater to different risk preferences and investment goals.

VanEck was one of the earliest institutions to apply for an Ethereum spot ETF, which focuses on holding Ethereum tokens.

2. ARK Invest & 21Shares: ARK 21SHARES ETHEREUM ETF

Founded in 2014, ARK Invest is committed to discovering and investing in companies and technologies with disruptive potential, playing a significant role in emerging industry investments.

Over the past few years, ARK Invest has gained favor with investors for its precise positioning in emerging tech and innovation sectors. Its funds, such as the ARK Innovation ETF (ARKK) and the ARK Genomic Revolution ETF (ARKG), hold stocks of emerging companies like Tesla, Square, Teladoc, and CRISPR Therapeutics, yielding impressive returns for ARK Invest.

3. Hashdex: Hashdex Nasdaq Ethereum ETF

Unlike other experienced investment institutions, Hashdex is a cryptocurrency asset management company headquartered in Brazil. It is one of the pioneers in investing in cryptocurrencies in Latin America.

Over the past few years, Hashdex has developed a series of cryptocurrency index funds based on various types of cryptocurrencies or tracking specific cryptocurrency indices.

The Ethereum Nasdaq ETF proposed by Hashdex is not a pure spot ETF but a new type of product that combines Ethereum futures contracts, Ethereum spot, and cash. Analysts believe that such non-pure spot products have a chance to achieve breakthroughs for spot ETFs, potentially increasing their likelihood of approval.

4. Grayscale: Grayscale Ethereum Trust

Grayscale Investments was founded in 2013, renowned for its cryptocurrency investment products. Over the past few years, it has created a series of cryptocurrency trusts, such as the Bitcoin Trust and Ethereum Trust. These funds allow investors to participate in mainstream cryptocurrency investments, such as Bitcoin and Ethereum, through traditional securities markets, providing a relatively safe and convenient way to invest in the cryptocurrency market.

The Grayscale Ethereum Trust, which Grayscale intends to convert to an ETF, is currently the world’s second largest physical ETH entity, holding approximately $5 billion in ETH. Previously, Grayscale won the first stage of a lawsuit against the United States Securities and Exchange Commission concerning the conversion of the Bitcoin Trust (GBTC) to a spot ETF, which has made some investors quite optimistic about the conversion of the Ethereum spot ETF.

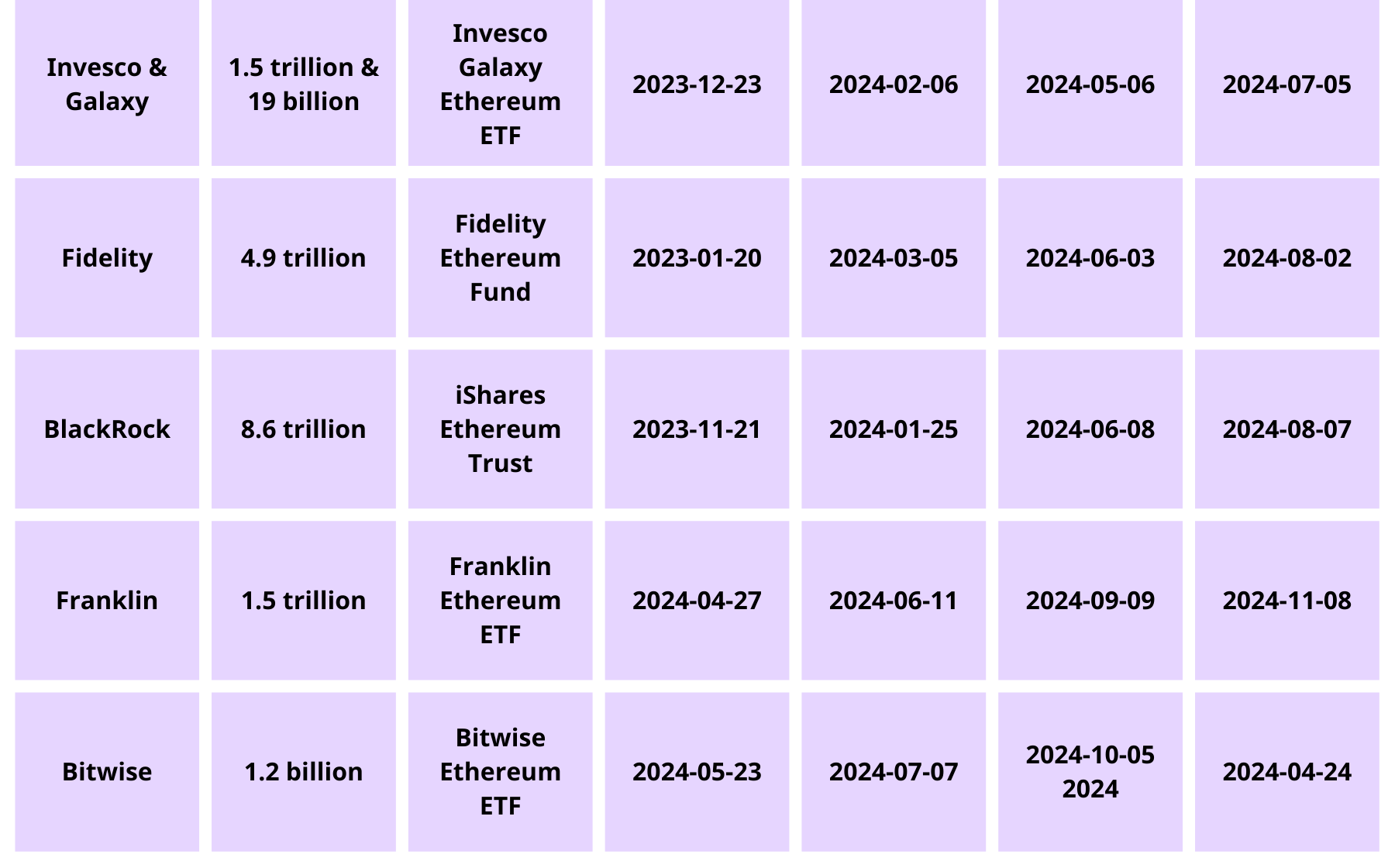

5. Invesco & Galaxy: Invesco Galaxy Ethereum ETF

Invesco is a globally renowned asset management company with a long history, founded in 1935, known for its extensive investment portfolio and global investment perspective. Their investment fields are diverse, including stocks, bonds, alternative investments, and asset allocation.

Invesco’s diversified investment strategy aims to provide investors with various risk and return options, continually integrating innovative investment strategies with robust risk management. In the past few years, Invesco has achieved considerable success in some of its investment products, such as the PowerShares series of ETFs and actively managed funds in different asset classes, which have secured significant investment returns for investors.

6. Fidelity: Fidelity Ethereum ETF

Fidelity was founded in 1946 and is headquartered in Boston, Massachusetts. Managing over $4.2 trillion, Fidelity operates across various sectors, including asset brokerage, fund custody, investment management, retirement services, securities execution, asset management, and life insurance. It is the world’s fourth largest multinational financial company.

Fidelity has been researching Bitcoin and blockchain technology since 2014, eventually establishing a subsidiary, Fidelity Digital Assets, to provide services related to cryptocurrency assets. Currently, it has the second largest Bitcoin spot ETF in terms of market value, valued at $1.2 billion.

7. BlackRock: iShares Ethereum Trust

Founded in 1988, BlackRock is one of the largest asset management companies in the world. Known for its professional asset management and diversified investment portfolio, BlackRock’s investments cover various assets, including stocks, bonds, money, real estate, and alternative investments. Besides offering various investment products and solutions, BlackRock provides risk management, investment advisory, and technology platforms for institutional investors, corporations, and individual investors.

BlackRock is widely recognized for its massive asset management scale, managing over $8.6 trillion across various assets and financial derivatives worldwide, making their moves and investment intentions particularly noteworthy. The Bitcoin spot ETF application they filed earlier this year has been a recent catalyst for the cryptocurrency market’s rise, significantly heightening external investors’ interest in the cryptocurrency market.

8. Franklin: Franklin Ethereum ETF

Founded in 1947, Franklin is committed to creating long-term stable investment returns for clients through in-depth market analysis and precise investment strategies. It is known for its diversified investment products and rigorous risk management system.

In recent years, Franklin has actively positioned itself in the blockchain market. Besides owning the second largest tokenized fund in the RWA track and a Bitcoin spot ETF currently valued at $470 million, it launched a digital asset dynamic BTC/ETH separately managed account (SMA) at the beginning of the year, further assisting clients in asset allocation in the cryptocurrency field.

9. Bitwise: Bitwise Ethereum ETF

Founded in 2017 and headquartered in San Francisco, Bitwise is one of the largest and fastest-growing cryptocurrency investment companies. It offers a range of investment tools through index and active strategies, including creating the world’s largest cryptocurrency index fund (OTCQX: BITW) and a series of ETFs focused on cryptocurrencies, stocks, and futures, as well as investment products covering Bitcoin, Ethereum, DeFi, NFT, and Metaverse. It is rumored to currently manage over $1.2 billion and is the last institution to submit an application review this time.

CONCLUSION

Looking at the list of applications submitted, these institutions attempting to launch Ethereum spot ETFs have all previously applied for Bitcoin spot ETFs or tried to convert existing trust or futures products to spot products. This series of actions indicates that the traditional financial industry’s optimism about the cryptocurrency market extends beyond Bitcoin to include Ethereum, the second largest cryptocurrency.

If the Bitcoin spot ETF is successfully approved, there seems to be no reason not to approve the Ethereum spot ETFs. The intent of the institutions to secure a first-mover advantage is quite evident.