KEYTAKEAWAYS

- The attack exploited unchecked external calls and broad token approvals, a recurring DeFi vulnerability that has persisted since early router-based exploits.

- Multi-chain deployment amplified losses, showing how composability can magnify risk when core contract assumptions fail.

- Beyond technical fixes, the incident highlights a deeper trust challenge for DeFi, where sustainable growth depends on changing risk culture, not just patching code.

CONTENT

ApertureFinance’s $17.4 million exploit underscores how long-known router and approval risks continue to threaten DeFi as protocols expand across multiple chains without proportionate security discipline.

WHAT ACTUALLY HAPPENED

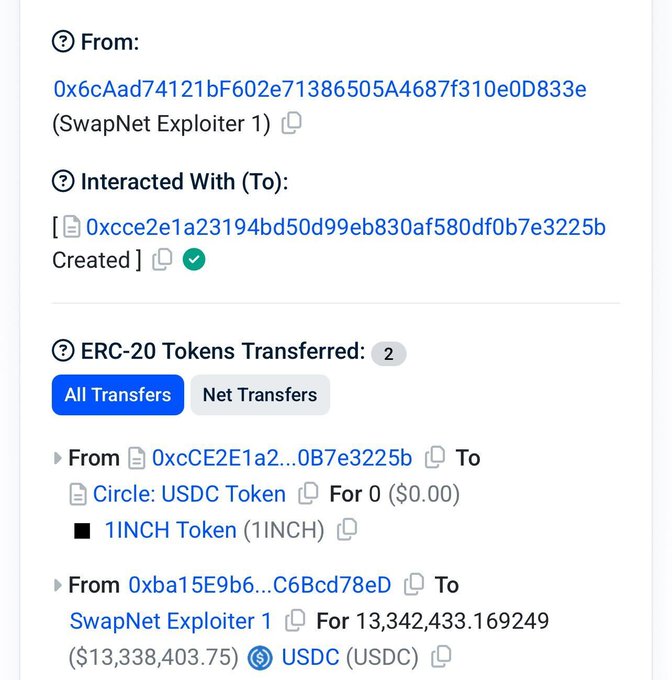

In the latest reminder that smart-contract risk remains the defining fragility of decentralized finance, Aperture Finance suffered a multi-chain exploit that resulted in losses exceeding $17.4 million, after attackers abused an arbitrary external call vulnerability embedded in un-audited, non-open-source contracts linked to its routing infrastructure, a flaw that allowed malicious calls to drain funds from user wallets that had previously granted token approvals to the protocol’s router.

According to on-chain alerts and post-incident disclosures by security firms including GoPlus Security and HashDit, the exploit impacted assets across Ethereum, BNB Chain, Arbitrum, and Base, underscoring how shared contract logic and cross-chain deployment can amplify losses once a single execution path is compromised, even when the exploit itself is conceptually simple rather than technically exotic.

THE RECURRING “ROUTER RISK” PROBLEM

While the scale of the loss has drawn attention, the mechanics of the attack place it squarely within a long-standing class of DeFi exploits centered on unchecked external calls and over-permissive token approvals, a pattern that has repeatedly surfaced since early incidents such as the 2021 BadgerDAO front-end compromise and later approval-drain attacks during the 2022–2023 DeFi downturn.

In this case, the affected contracts allowed arbitrary calls without sufficient validation, meaning that once users had approved the router to spend tokens, attackers could effectively hijack that trust relationship, turning a convenience feature into a liability, a structural weakness that continues to persist despite years of industry warnings and post-mortems.

WHY THIS STILL KEEPS HAPPENING

The uncomfortable reality exposed by the ApertureFinance incident is that the industry’s security failures are rarely the result of unknown vulnerabilities, but rather the repeated deployment of known-risk patterns under competitive pressure to ship products quickly across multiple chains.

Security researchers have long noted that un-audited or partially audited routing contracts, especially those handling delegated approvals, represent an asymmetric risk surface: they concentrate value, interact with many external protocols, and rely on users maintaining broad, long-lived permissions, creating ideal conditions for attackers once a single validation check is missed.

That this exploit occurred simultaneously on several major networks highlights how composability, often celebrated as DeFi’s greatest strength, also functions as a force multiplier for loss when defensive assumptions fail.

MARKET REACTION AND TRUST DYNAMICS

The immediate market response reflected this deeper trust shock rather than simple loss accounting, as alerts from GoPlus Security and HashDit spread rapidly across social platforms, triggering visible panic among users and a surge in discussion questioning not only ApertureFinance’s code quality but the broader safety of router-based abstractions.

Although the affected contracts have reportedly been patched and ApertureFinance has attempted on-chain communication with the attacker to negotiate potential recovery, the reputational impact is likely to outlast the technical fix, because in DeFi, confidence is not restored by remediation alone, but by the perception that risk culture itself has changed.

A HISTORICAL LESSON DEFI STILL HASN’T LEARNED

Viewed in historical context, the ApertureFinance exploit fits into a repeating cycle that has defined every DeFi expansion phase: rapid innovation, capital inflows, abstraction layers designed to simplify user experience, followed by exploits that expose how complexity without proportional security review transfers risk onto end users.

Despite billions of dollars lost across protocols since 2020, many projects continue to rely on implicit user trust rather than explicit, verifiable guarantees around permission scope, contract immutability, and audit coverage, a gap that becomes increasingly untenable as DeFi seeks institutional relevance.

If DeFi is to evolve from a high-velocity experimental arena into durable financial infrastructure, incidents like this will need to become exceptions rather than recurring milestones, not through reactive patching, but through a fundamental shift in how protocols treat user approvals, external calls, and the trade-off between speed and safety.

Read More:

Four.meme’s latest security scare shows why “airdrop season” is a hacker’s favorite market regime