KEYTAKEAWAYS

- ASTER enables yield-bearing collateral, hidden orders, and multi-chain support, combining efficiency with privacy and drawing attention from traders seeking new perpetuals platforms.

- Launch day delivered $371M in volume and 330K new users, with ASTER’s price surging over 1,600% as TVL approached $1 billion in its first phase.

- Challenges include token unlock sell pressure, fierce competition from Hyperliquid, and regulatory risks, which will test ASTER’s ability to sustain early momentum.

CONTENT

ASTER’s launch electrified DeFi with explosive growth, $371M day-one volume, and nearly 330K users. Can its fundamentals, tokenomics, and backing sustain long-term dominance in perpetual trading?

PROJECT FUNDAMENTALS

ASTER has quickly emerged as one of the most talked-about projects in decentralized finance. Positioned as a decentralized exchange specializing in perpetual futures, it is designed to challenge long-standing leaders like Hyperliquid. Unlike projects that simply replicate existing models, ASTER has introduced innovative features such as capital efficiency, multi-chain support, and enhanced user privacy.

At the core of its design lies the ability to use yield-bearing assets as collateral. Traders can employ liquid-staking derivatives or yield-generating stablecoins to both secure positions and earn ongoing returns, significantly increasing capital efficiency. ASTER also integrates hidden orders to minimize the impact of front-running and MEV, making the trading experience smoother.

In terms of tokenomics, ASTER has a capped supply of 8 billion tokens. Its distribution strategy prioritizes community engagement, with more than half allocated to airdrops and rewards. Around 30% supports ecosystem growth, while the treasury, team, and liquidity allocations are smaller. Importantly, team tokens are locked and vested, reducing immediate sell pressure and aligning incentives for the long term.

EARLY MARKET PERFORMANCE

ASTER’s breakout moment came with its token generation event (TGE). On day one, trading volume soared to $371 million on its native DEX, while nearly 330,000 new users joined. This demonstrated both market anticipation and ASTER’s strong onboarding capacity.

Price action underscored this excitement. Starting at approximately $0.03015, ASTER surged to about $0.528 within hours, a gain of more than 1,600%. Such rapid growth is not uncommon in crypto, but the scale of ASTER’s rise distinguished it from many other launches.

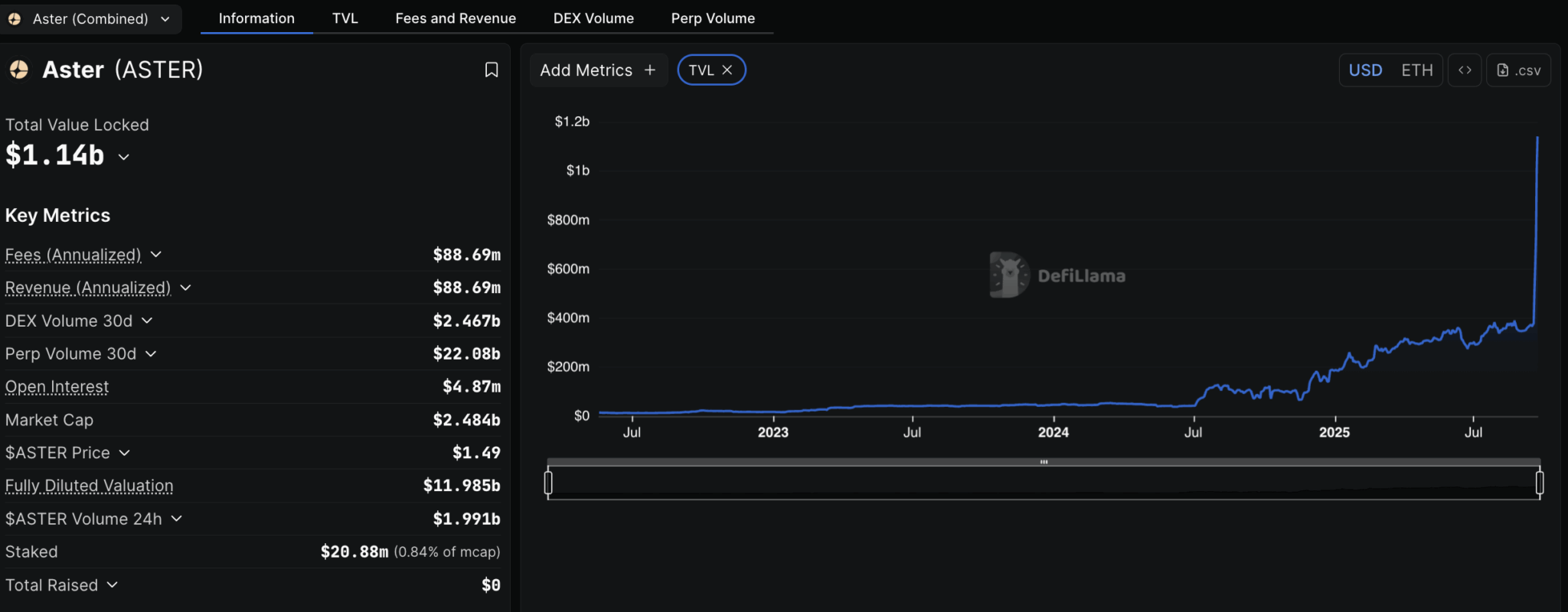

Momentum extended beyond price. The project’s TVL quickly approached $1 billion, supported by large inflows of ETH and other collateral. At one stage, more than 330,000 ETH had been locked in the protocol, reflecting significant real capital commitment rather than speculative trading alone.

COMPETITIVE LANDSCAPE

Although the decentralized perpetuals market is increasingly crowded, ASTER has already proven capable of challenging established leaders. Hyperliquid has long dominated the space, yet ASTER’s trading volume and TVL growth signaled users’ willingness to migrate to newer platforms. For a brief period, ASTER even overtook Hyperliquid in daily volume, marking a symbolic shift in the competitive balance.

ASTER’s multi-chain deployment has further strengthened its position. The launch on BNB Chain, in particular, led to a sharp rise in network activity. BNB Chain’s transaction fees surged and, at times, surpassed Solana’s daily fee revenue. This highlighted ASTER’s ability to generate demand for block space and create positive spillover effects for its underlying infrastructure.

COMMUNITY AND BACKING

ASTER also benefits from strong institutional and community support. Backed by YZi Labs and publicly endorsed by Binance founder Changpeng Zhao, the project has credibility that attracts investors. In crypto, such endorsements often serve as powerful signals that shape sentiment.

Equally important is ASTER’s grassroots engagement strategy. By reserving over half of its supply for airdrops and community incentives, it has fostered active participation across social platforms. This broad distribution encourages ownership, loyalty, and ongoing conversation, helping ASTER maintain a constant presence in the crypto narrative.

CHALLENGES AND RISKS

Despite its strong debut, ASTER faces notable challenges. One of the most pressing concerns is its token unlock schedule. With only a fraction of the supply currently in circulation, future unlocks could trigger sell pressure, particularly if large holders seek to realize gains.

Competition remains another risk. Projects such as Hyperliquid and Avantis continue to innovate, and their established user bases provide resilience. ASTER must sustain liquidity and user engagement to remain competitive over the long term.

Additionally, regulatory scrutiny of derivatives and leveraged products could affect ASTER’s growth. Perpetual futures remain a sensitive area for regulators, and policy shifts in key jurisdictions may limit expansion or introduce compliance hurdles.

OUTLOOK

In just weeks, ASTER has risen from a newcomer to one of the most closely followed projects in DeFi. With innovative collateral mechanics, multi-chain operations, and strong community rewards, it has demonstrated both traction and potential.

However, sustaining this trajectory will require careful navigation of competition, regulation, and token unlock dynamics. Many projects enjoy early hype but fade without consistent delivery. For ASTER, the coming months will determine whether it can transition from a breakout success into a lasting cornerstone of decentralized perpetuals.

For now, it has clearly captured the market’s imagination. Whether it can cement its place as a leading force in decentralized derivatives will depend on execution, adaptability, and community trust.