KEYTAKEAWAYS

- Binance listed the Binance Life token on its spot market with multiple trading pairs, bringing a BNB Chain–native meme asset into centralized price discovery.

- The token’s fully circulating supply and large on-chain holder base provided a measurable foundation prior to centralized exchange exposure.

- The listing reflects a broader shift in BNB Chain’s meme economy toward liquidity-driven assessment and repeatable market structures.

- KEY TAKEAWAYS

- SPOT LISTING MARKS A NEW PHASE OF VISIBILITY FOR A BNB CHAIN MEME ASSET

- ON-CHAIN SUPPLY AND HOLDER STRUCTURE ARE FULLY OBSERVABLE

- DECENTRALIZED LIQUIDITY REMAINED ACTIVE AHEAD OF THE LISTING

- WHAT THE LISTING SIGNALS ABOUT BNB CHAIN’S MEME ECONOMY

- FROM EVENT TO STRUCTURE

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Binance’s spot listing of the Binance Life token highlights how BNB Chain meme assets are increasingly evaluated by on-chain liquidity, holder distribution, and market sustainability rather than narrative momentum alone.

SPOT LISTING MARKS A NEW PHASE OF VISIBILITY FOR A BNB CHAIN MEME ASSET

In early January 2026, Binance added the “Binance Life” token to its spot trading market, opening multiple trading pairs including Binance Life/USDT, Binance Life/USDC, and Binance Life/TRY, while assigning the asset a Seed Tag. The listing formally connected a previously on-chain–native meme token to Binance’s centralized price discovery and liquidity infrastructure, significantly expanding its visibility beyond decentralized venues.

According to Binance’s official listing notice, the token is issued on BNB Smart Chain, with a publicly disclosed contract address, allowing market participants to independently verify supply metrics, holder distribution, and transaction activity through on-chain explorers.

ON-CHAIN SUPPLY AND HOLDER STRUCTURE ARE FULLY OBSERVABLE

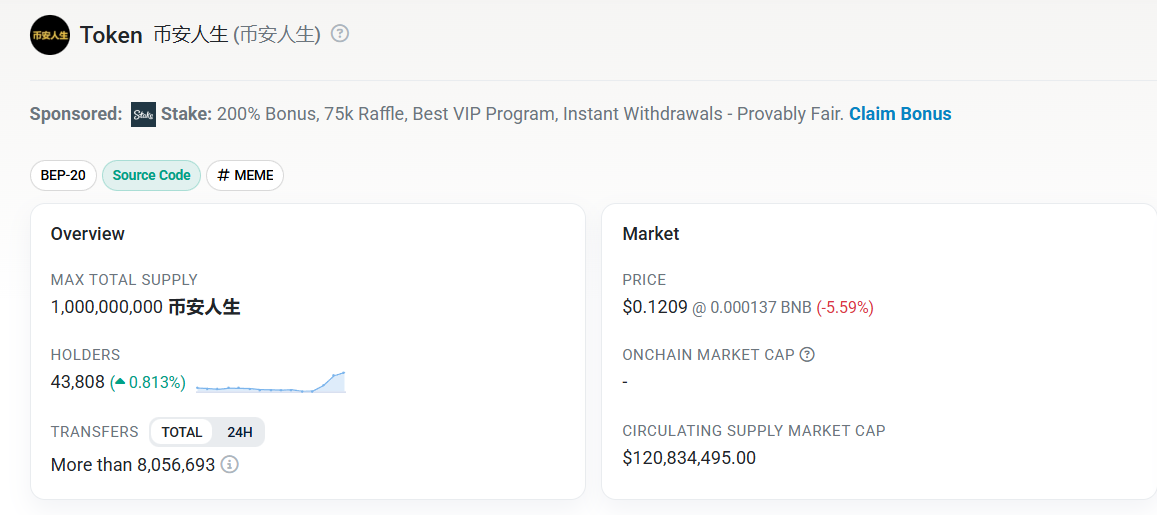

Blockchain data shows that Binance Life was launched with a maximum and circulating supply of 1 billion tokens, a structure that places the asset firmly in the “fully circulating” category rather than a phased emission or vesting-driven model. At the time of the spot listing, on-chain records indicated more than 40,000 holder addresses, reflecting a distribution that had already reached a meaningful breadth prior to centralized exchange support.

This matters from a market-structure perspective. For meme assets, a fully circulating supply combined with a large holder base reduces uncertainty around future unlock events and shifts attention toward liquidity behavior and turnover rather than token release schedules.

DECENTRALIZED LIQUIDITY REMAINED ACTIVE AHEAD OF THE LISTING

Before and during the spot listing, Binance Life maintained active liquidity on BNB Chain–based decentralized exchanges, particularly on PancakeSwap trading pairs. On-chain market data shows multi-million-dollar liquidity pools, tens of thousands of completed swaps, and sustained daily trading volume, indicating that the asset’s activity was not solely dependent on centralized exchange access.

This combination—active decentralized liquidity followed by a spot market listing—highlights a familiar pattern in the BNB Chain ecosystem, where meme tokens often establish baseline price discovery and holder distribution on-chain before being absorbed into centralized trading venues.

WHAT THE LISTING SIGNALS ABOUT BNB CHAIN’S MEME ECONOMY

Binance Life’s spot listing illustrates how BNB Chain meme assets increasingly function as liquidity instruments rather than purely narrative-driven tokens. The pathway from decentralized trading to centralized spot markets effectively merges two liquidity layers: permissionless on-chain activity and regulated exchange order books.

From a structural standpoint, this process benefits assets that already demonstrate measurable on-chain engagement—visible holder growth, stable liquidity pools, and consistent transaction flow—prior to centralized exposure. In that sense, the listing reflects not only exchange selection criteria, but also the maturation of BNB Chain’s meme segment into a repeatable liquidity pipeline.

FROM EVENT TO STRUCTURE

Viewed in isolation, a new spot listing may appear to be a short-term trading catalyst. Viewed in context, Binance Life’s transition from on-chain trading to Binance spot markets reinforces a broader trend: BNB Chain meme assets are increasingly evaluated through the lens of liquidity depth, holder distribution, and transactional sustainability, rather than narrative virality alone.

As centralized and decentralized liquidity continue to interlock, future meme listings on BNB Chain are likely to be judged less by momentary attention and more by whether on-chain metrics can support durable market participation beyond the initial listing window.

Read More:

What is Binance Life? | BNB Chain Meme Rise

The Binance Life Phenomenon: How a Joke Sparked a Billion-Dollar Meme Coin Frenzy