KEYTAKEAWAYS

- Bitcoin ETFs integrate Bitcoin into regulated financial frameworks, enabling institutions to gain Bitcoin price exposure without on-chain custody, private key management, or technical risk.

- The growth of spot Bitcoin ETFs is reshaping market capital structure by attracting long-term institutional investors such as pension funds, asset managers, and endowments.

- As ETF assets and disclosures expand, Bitcoin’s price discovery, volatility profile, and valuation logic are increasingly aligning with those of mainstream financial assets.

- KEY TAKEAWAYS

- Why Bitcoin ETFs Are Becoming a Core Gateway for Global Capital

- What Is a Bitcoin ETF? Understanding the Core Mechanism Through Financial Structure

- The Real Market Impact of Bitcoin ETFs: What Is Changing?

- Allocation Logic and Common Misconceptions Around Crypto Asset ETFs

- The Deeper Relationship Between Bitcoin ETFs and Global Regulatory Trends

- Bitcoin ETFs Are Driving Bitcoin Toward Global Mainstream Asset Allocation

- References

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Bitcoin ETFs are transforming Bitcoin into a regulated, institutionally accessible financial asset by providing compliant, scalable exposure for global capital through traditional securities markets.

Why Bitcoin ETFs Are Becoming a Core Gateway for Global Capital

Bitcoin ETFs are rapidly emerging as a key financial instrument bridging the traditional financial system and the crypto-asset world. Over the past decade, Bitcoin has steadily matured in market perception—its decentralization, scarcity, and inflation-hedging attributes have been repeatedly validated. Yet at the institutional level, it has long faced a structural dilemma: “understood by institutions, but difficult to participate in.” Ambiguous regulatory status, unclear custody responsibilities, and the absence of standardized valuation and accounting treatments have kept large pools of traditional capital on the sidelines.

The emergence of Bitcoin ETFs represents an institutional solution born out of this structural tension. By adopting the ETF—a mature and well-established financial product format—Bitcoin has, for the first time, been embedded within a regulated securities market framework, meeting the core requirements of traditional financial institutions in terms of compliance, custody, clearing, and disclosure. For investors, participating in a Bitcoin ETF means gaining Bitcoin price exposure through familiar brokerage accounts, without directly managing private keys, conducting on-chain operations, or bearing technical risks.

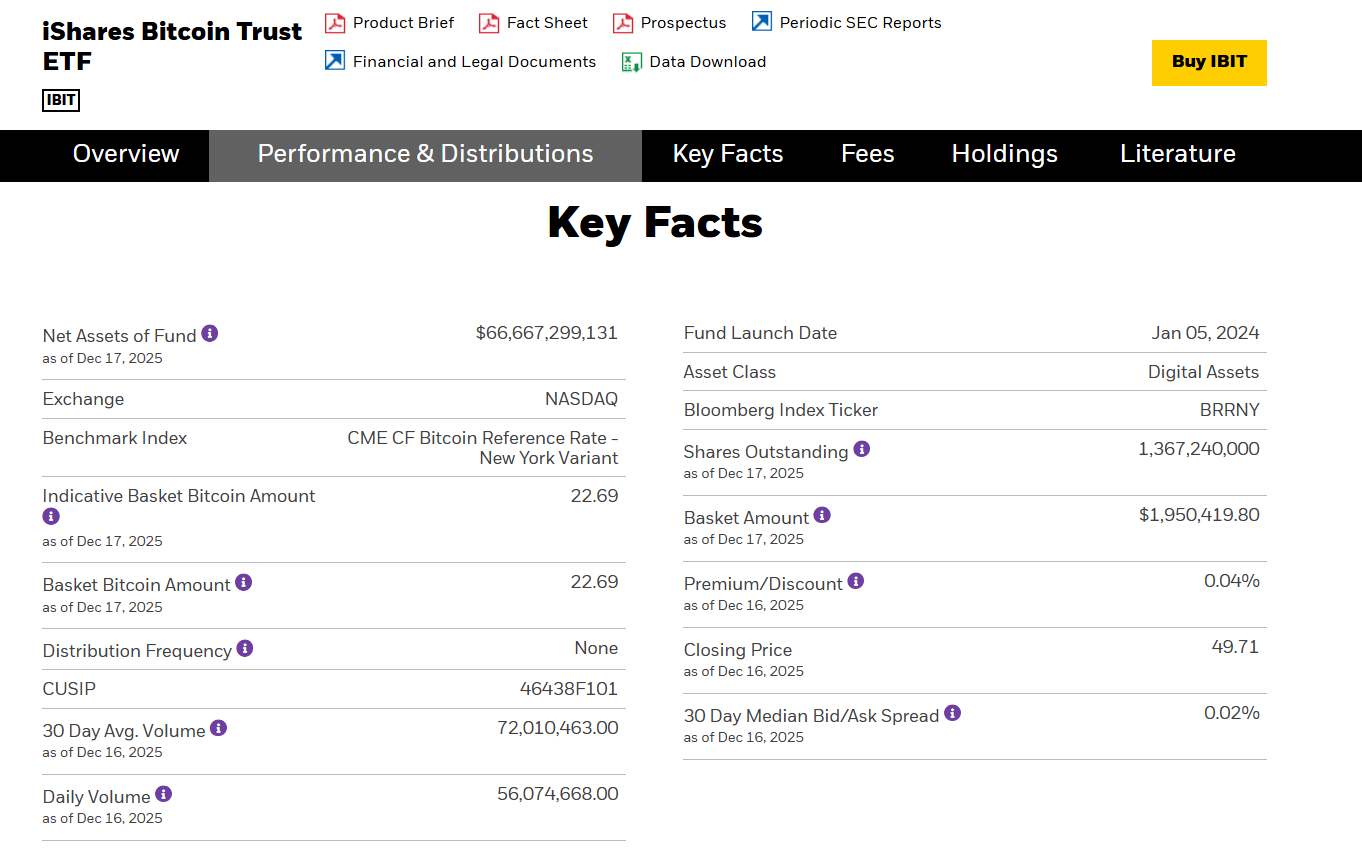

More importantly, the significance of Bitcoin ETFs goes far beyond improved investment convenience. According to BlackRock’s official product Key Facts, as of December 17, 2025, the iShares Bitcoin Trust (IBIT) had approximately USD 66.67 billion in net assets. This scale alone clearly demonstrates that institutional capital is continuously entering the market via Bitcoin ETFs. Bitcoin ETFs are accelerating Bitcoin’s transition from an “alternative speculative asset” to an “institutionally allocable financial asset,” fundamentally reshaping global capital’s long-term perception and allocation logic toward Bitcoin.

Image Source: iShares Bitcoin Trust ETF | IBIT

https://www.blackrock.com/us/individual/products/333011/ishares-bitcoin-trust-etf

What Is a Bitcoin ETF? Understanding the Core Mechanism Through Financial Structure

Basic Definition and Operating Model of Bitcoin ETFs

A Bitcoin ETF (Exchange-Traded Fund) is a fund product listed and traded on regulated securities exchanges, designed to track the price performance of Bitcoin. By buying and selling ETF shares, investors gain exposure to Bitcoin’s price movements without directly holding or managing Bitcoin itself.

In a spot Bitcoin ETF structure, the fund manager is responsible for product design, regulatory filings, and disclosures; a designated custodian ensures the secure storage of actual Bitcoin; and authorized participants and market makers maintain price stability between the ETF’s market price and its net asset value through the creation and redemption mechanism. This structure fully integrates Bitcoin into the traditional financial system’s clearing, custody, and regulatory framework, granting it—for the first time—the institutional attributes of a standardized financial asset.

Fundamental Differences Between Spot ETFs and Futures ETFs

Early Bitcoin ETFs were primarily futures-based, gaining exposure by rolling Bitcoin futures contracts. This model is inevitably affected by roll costs, term structure dynamics, and contract liquidity, resulting in noticeable long-term tracking errors.

By contrast, spot Bitcoin ETFs are directly backed by physical Bitcoin, offering significantly higher price fidelity and long-term holding efficiency. Bloomberg has noted in multiple Bitcoin ETF market research reports that the launch of spot Bitcoin ETFs enables institutional investors to allocate Bitcoin over the long term without bearing the structural inefficiencies of futures-based products—one of the key reasons behind the rapid concentration of capital in spot Bitcoin ETFs.

The Real Market Impact of Bitcoin ETFs: What Is Changing?

How Bitcoin ETFs Are Reshaping Capital Inflow Structures

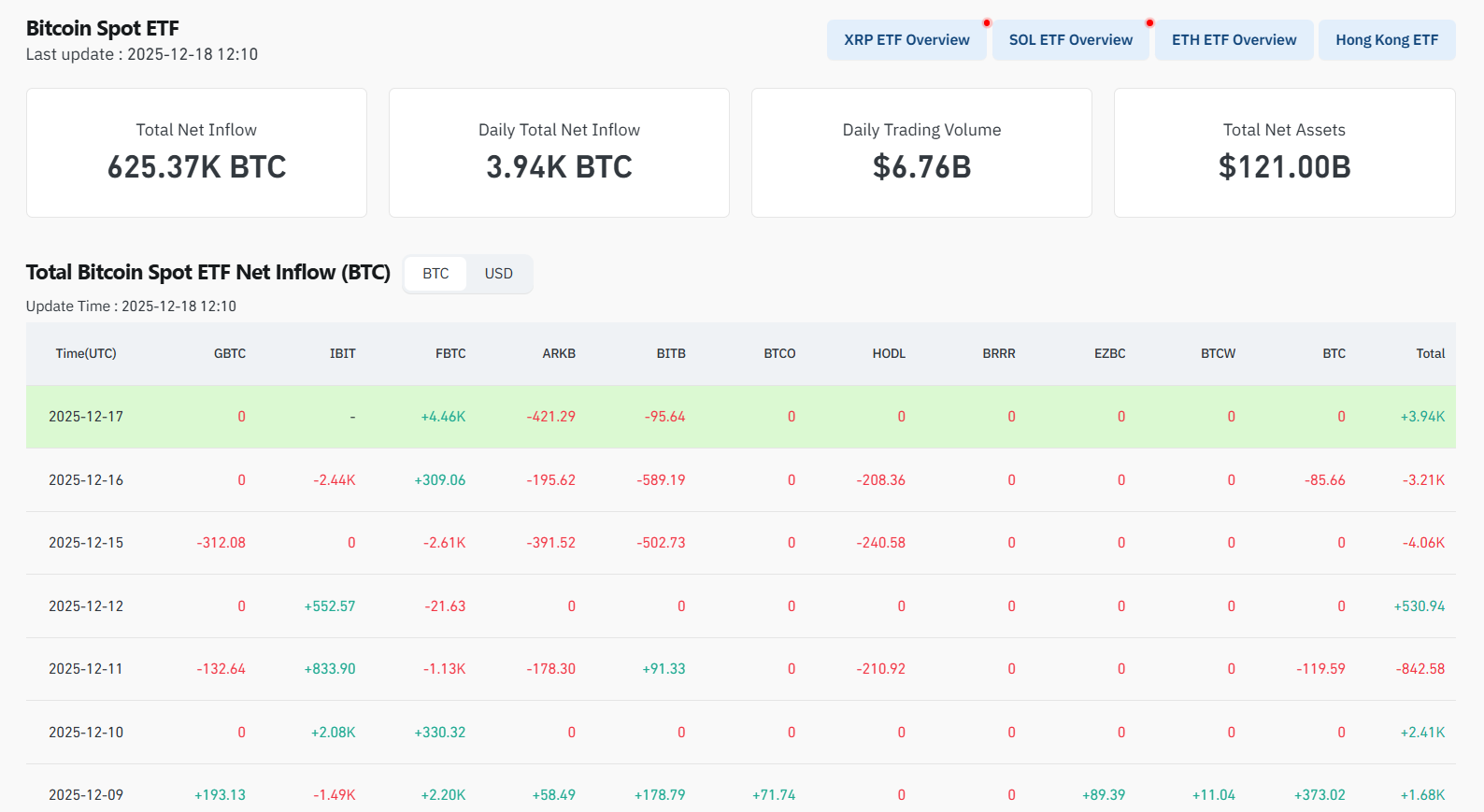

Since the launch of Bitcoin ETFs, one of the most visible changes has been the transformation of market capital structure. According to official CoinGlass data, as of December 18, 2025, total net assets of U.S. spot Bitcoin ETFs had reached approximately USD 121 billion. Meanwhile, ETF flows have shown net inflows across multiple recent trading days, indicating sustained demand for regulated Bitcoin investment vehicles.

Unlike earlier market structures dominated by retail investors and crypto-native capital, incremental ETF inflows largely originate from pension funds, asset managers, university endowments, and family offices. These investors typically operate on longer allocation cycles, trade less frequently, and adhere to stricter risk controls—gradually introducing more long-term and disciplined capital characteristics into the Bitcoin market.

As spot Bitcoin ETF assets continue to expand, ETF flow data itself has become an important reference for assessing medium- to long-term market trends. Some institutions now view ETF flows as a core indicator of Bitcoin’s institutionalization process.

In this context, Bitcoin ETFs are no longer merely passive price-tracking tools, but are increasingly participating in the reshaping of market structure and supply-demand dynamics.

Image Source: https://www.coinglass.com/bitcoin-etf

Impact on Price Discovery and Volatility

Bitcoin ETFs are also transforming Bitcoin’s price discovery mechanism. Because ETFs trade in traditional securities markets, their price behavior is becoming more closely correlated with macroeconomic data, equity market sentiment, and institutional trading rhythms. Bloomberg has observed that this cross-market pricing dynamic is gradually giving Bitcoin’s volatility structure more characteristics of a conventional financial asset.

In addition, the creation and redemption mechanism of Bitcoin ETFs requires physical Bitcoin backing. When ETF inflows persist, they directly drive spot market buying demand. This explains why current market analysis increasingly focuses on ETF fund flows alongside on-chain circulating supply dynamics.

Allocation Logic and Common Misconceptions Around Crypto Asset ETFs

Core Considerations Behind Bitcoin ETF Recommendations

In practical portfolio allocation, Bitcoin ETF recommendations typically focus on several key dimensions: fund size, management fees, liquidity depth, custody arrangements, and issuer background. Using IBIT as an example, it not only holds the largest asset scale in the market, but also meets institutional-grade standards in custody security, disclosure transparency, and trading liquidity.

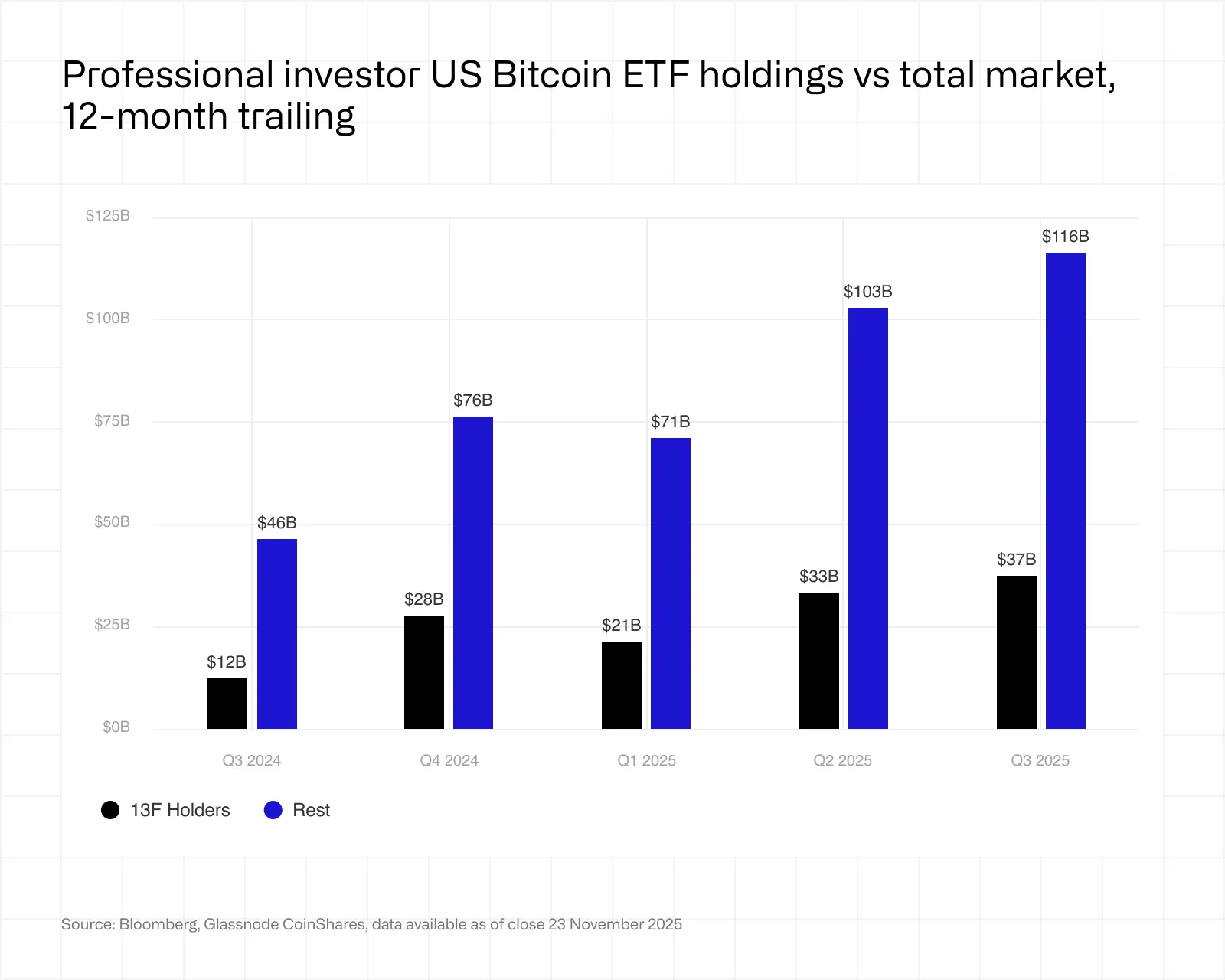

SEC-disclosed Q3 2025 Form 13F filings show that institutional holdings via Bitcoin ETFs grew by approximately 13% quarter-over-quarter, with net inflows of about USD 12.5 billion during the quarter. This suggests that Bitcoin ETFs are gradually shifting from exploratory allocations toward more definitive long-term asset positioning.

Image Source: Institutional Report – 13F Bitcoin ETF Data, Q3 2025

Common Misconceptions About Bitcoin ETFs

A common misconception is equating Bitcoin ETFs with “risk-free” Bitcoin exposure. In reality, ETFs merely lower participation barriers and operational complexity; they do not eliminate Bitcoin’s inherent price volatility. Moreover, ETF investors do not directly control private keys—asset ownership remains dependent on custodians and the broader financial intermediary system.

Therefore, Bitcoin ETFs are better suited for investors seeking Bitcoin price exposure without engaging in on-chain operations or ecosystem governance, rather than users who prioritize full asset sovereignty and self-custody.

The Deeper Relationship Between Bitcoin ETFs and Global Regulatory Trends

Why Regulators Accept Bitcoin ETFs

Regulators’ evolving stance toward Bitcoin ETFs does not stem from full ideological endorsement of crypto assets, but rather from practical considerations around risk controllability. Through the ETF structure, Bitcoin trading is brought under existing securities regulatory frameworks, with clearly defined rules governing trading behavior, custody arrangements, and disclosures.

SEC Form 13F disclosures show a growing number of traditional institutions gaining exposure via Bitcoin ETFs. For example, as of Q3 2025, Harvard University’s endowment disclosed holdings of approximately USD 443 million in IBIT shares. The participation of such long-term capital continues to reinforce the institutional legitimacy of Bitcoin ETFs.

Will Bitcoin ETFs Drive Broader Asset Securitization?

Bloomberg argues that the success path of Bitcoin ETFs is becoming a reference model for other digital assets. Whether more crypto assets can enter mainstream finance will largely depend on their ability to replicate Bitcoin ETFs’ maturity in compliance, custody mechanisms, and market acceptance.

Bitcoin ETFs Are Driving Bitcoin Toward Global Mainstream Asset Allocation

Bitcoin ETFs are integrating Bitcoin into the global mainstream financial system in an institutionalized, regulated, and scalable manner. This shift is reflected not only in the continued growth of assets under management and trading activity, but also in the deeper transformation of Bitcoin’s asset identity. Through Bitcoin ETFs, Bitcoin has, for the first time, been systematically allocated within pension accounts, asset managers, university endowments, and family offices under securities-compliant frameworks—gradually moving away from a market structure heavily reliant on retail sentiment and crypto-native capital. At the same time, as ETF assets expand, institutional holdings are increasingly disclosed, and inflow rhythms become more stable, Bitcoin’s price formation mechanisms, volatility profile, and long-term valuation logic are undergoing profound changes. Bitcoin is evolving from a highly volatile alternative speculative asset into a global financial asset that can be seriously evaluated and incorporated into long-term portfolio frameworks. This ETF-driven structural transformation remains in an ongoing process of deepening and expansion.

References

- BlackRock – iShares Bitcoin Trust ETF (IBIT), Key Facts,BlackRock Official Website

- CoinGlass – Bitcoin Spot ETF Overview,CoinGlass Official Data Platform

- CoinShares – A Data-Driven Look at Institutional Bitcoin Exposure in Q3 2025,CoinShares Research & Data, based on SEC Form 13F filings

Read More:

Bitcoin ETFs Look Less Powerful — Because the Market Is Changing

Crypto Still Bullish? VIX and ETF Flows Say It’s a Reset

Bitcoin Faces ETF Selling Pressure, But It’s Not a Bear Market