KEYTAKEAWAYS

- Bitcoin halving refers to the reduction by half of Bitcoin production from the blockchain.

- As of 2023, there have been three Bitcoin halving events, with the next one expected in April 2024.

- Bitcoin halving impacts the market, Bitcoin price and production, and miners' income.

CONTENT

Explore the concept of the Bitcoin halving: its mechanics, historical context, and potential influence on Bitcoin’s price in 2024. Understand this key event in the cryptocurrency world.

Since its concept was introduced, Bitcoin has experienced three Bitcoin halvings and always faced price turbulence during them. The next Bitcoin halving is expected to occur in April 2024. Given that the crypto environment has changed a lot from that of the last halving, could the Bitcoin halving in 2024 mean any difference for the crypto players this mean? In this article, we will elaborate on all you need to know about Bitcoin halving 2024: the significance of a Bitcoin halving, the Bitcoin halving’s history and dates, and how the Bitcoin halving process works.

WHAT IS BITCOIN HALVING?

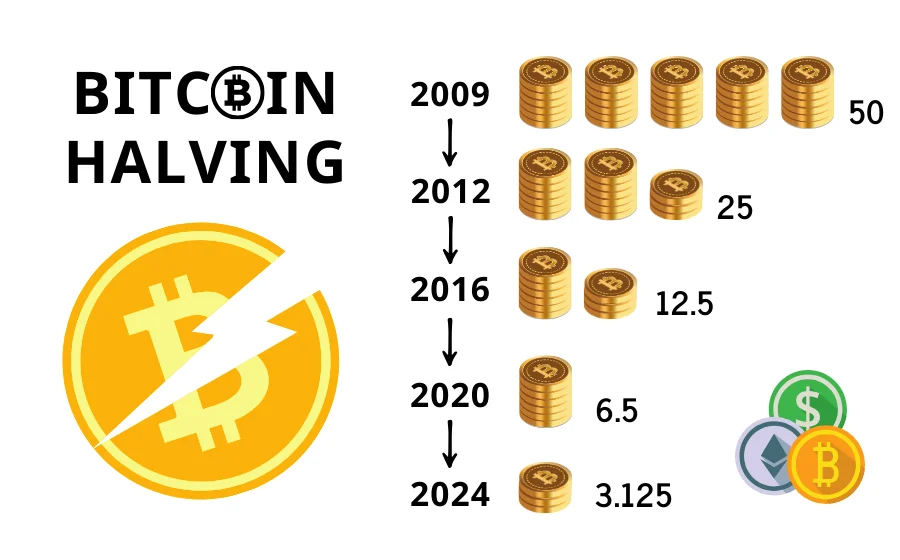

The Bitcoin halving is a scheduled event in the Bitcoin network that occurs approximately every four years. In the event of a Bitcoin halving, the reward for mining new blocks is halved. This is part of the Bitcoin protocol, designed to control the supply of Bitcoin and ultimately limit the total supply to 21 million coins.

The most recent bitcoin halving, anticipated in April 2024, will reduce the block reward for Bitcoin miners to 3.125 bitcoin per block mined, potentially leading to a decrease in the supply of new bitcoins and influencing the price.

When a Bitcoin halving occurs, miners expend the same effort but receive 50% fewer bitcoins. The purpose of the Bitcoin halving is to balance supply and demand: as supply decreases, demand tends to increase, thereby typically raising the value of each Bitcoin.

It seems like the Bitcoin halving has a negative impact on the crypto market; however, for traders and investors, it can lead to positive results in the end.

- Further reading: What is Bitcoin?

IMPACT OF BITCOIN HALVING

- Reduced Supply: After the Bitcoin halving, the number of new bitcoins generated decreases, slowing down the growth of Bitcoin’s supply.

- Reduced Mining Rewards: For miners, a Bitcoin halving means that their earnings for mining each block are cut in half, which could lead some less efficient miners to exit the market.

- Price Volatility: Historically, Bitcoin halvings have led to price volatility around the time of the halving, as market expectations of reduced supply can affect the price.

- Market Expectations: Bitcoin halvings often attract market attention and expectations, which can impact Bitcoin’s price before and after the event.

- Long-term Impact: Bitcoin halvings help ensure the scarcity of Bitcoin, which is considered an important factor for its long-term value.

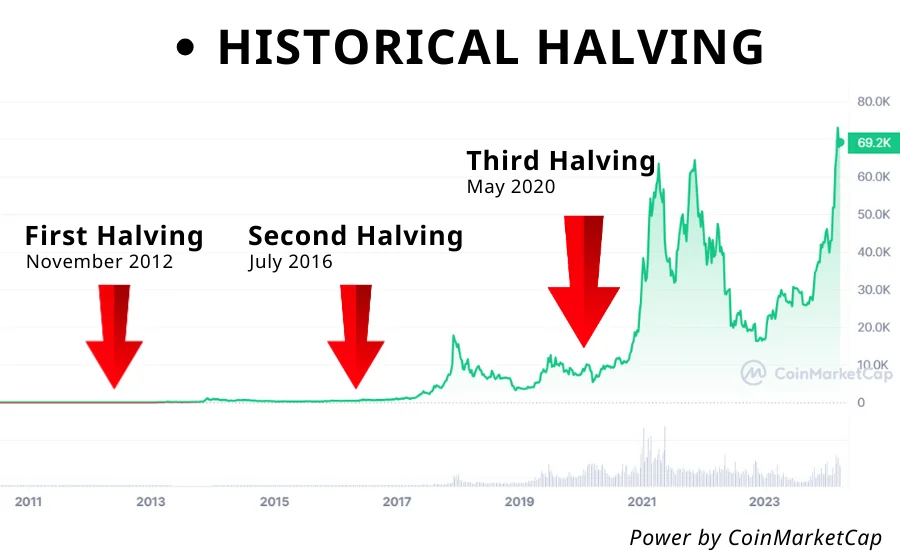

HISTORICAL BITCOIN HALVINGS

Since its inception in 2009, Bitcoin has faced several halvings

- First Bitcoin Halving: In November 2012, the reward was halved from 50 BTC to 25 BTC.

- Second Bitcoin Halving: In July 2016, the reward was halved from 25 BTC to 12.5 BTC.

- Third Bitcoin Halving: In May 2020, the reward was halved from 12.5 BTC to 6.25 BTC.

- Fourth Bitcoin Halving: The fourth halving is expected to occur in 2024, further halving the reward to 3.125 BTC.

In summary, the Bitcoin halving is a key component of Bitcoin’s economic model, with significant implications for Bitcoin’s supply, mining ecosystem, and market price.

BITCOIN HALVING MARKET IMPACT

Historically, Bitcoin halvings have typically been associated with price increases, as the reduced supply of new bitcoins after a halving can lead to significant upward pressure on the price if demand remains constant.

However, traders must also be aware of the potential negative effects of the Bitcoin halving. As mining costs suddenly double, miners may sell off their Bitcoin rewards, potentially exposing Bitcoin to a significant crash risk.

It is hard to make the prediction for each Bitcoin halving, but they often come with price volatility, which can be both positive and negative. Usually, price volatility increases both before and after a Bitcoin halving. Traders can take advantage of this volatility to make profits. However, sharp price fluctuations can also make pricing patterns elusive, thereby affecting the execution of trading strategies.

IS IT POSSIBLE TO BENEFIT FROM BITCOIN HALVING?

The volatility surrounding a Bitcoin halving presents both challenges and opportunities for traders. Those who understand these fluctuations can find significant opportunities amidst the uncertainty.

Traders can capitalize on this volatility by:

- Going long in a bullish trend or short in a bearish trend around the Bitcoin halving.

- Identifying key support and resistance levels for executing breakout trades.

Breakouts are significant as they can indicate potential trend reversals or the continuation of an existing trend. Support levels are prices at which Bitcoin might stop declining, while resistance levels are points where it may pause its ascent.

Using technical analysis tools like moving averages, horizontal support and resistance lines or trendlines, traders can identify these levels and wait for a decisive price break above a resistance level or below a support level. A confirmed breakout occurs when the price closes beyond the identified level, suggesting a shift in market sentiment.

For instance, in 2016, before the Bitcoin halving, Bitcoin was trading at around $665. Traders observing a resistance level at $700 might have used a breakout strategy, with a decisive break above $700 signaling a bullish breakout.

Upon breakout confirmation, traders may:

- Enter a long position if it’s a bullish breakout or a short position if it’s bearish.

- Set stop-loss orders and take-profit levels to manage risk and lock in profits.

- Continually monitor their trade and adjust their strategy as the market changes.

However, breakout trading involves risks, including the possibility of false breakouts. Traders must be cautious and conduct thorough research to distinguish potential false breakouts.

Additionally, traders can exploit price discrepancies across different crypto exchanges. Bitcoin’s volatility might cause temporary price imbalances, allowing traders to profit from arbitrage opportunities by buying on one exchange and selling on another.

-

Learn more about TradingStrategies

FAQ

1. When will the next Bitcoin halving occur?

The next Bitcoin halving is estimated to occur in April 2024, depending on the network’s block production rate.

2. How many bitcoins are left to be mined?

As of the third halving, 18.37 million of the total 21 million bitcoins have been mined, leaving 2.63 million remaining.

3. What will happen after all bitcoins are mined?

After all bitcoins are mined by 2140, no new bitcoins will be issued. Miners will only earn transaction fees, and Bitcoin may experience deflation.

4. Is Bitcoin still worth investing in?

Bitcoin is considered a deflationary asset due to decreasing mining output. However, it’s volatile and affected by market conditions, legal policies, and community narratives.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!