KEYTAKEAWAYS

- Bitcoin’s recent rebound has improved sentiment, but price strength alone is insufficient to confirm a full recovery without supporting liquidity and macro data.

- Stablecoin supply, ETF holdings, and derivatives positioning show limited improvement, suggesting that capital commitment to Bitcoin remains cautious rather than conviction-driven.

- Until real rates fall, liquidity expands, and sustained ETF inflows appear, waiting for clearer confirmation may offer better risk control than chasing short-term rallies.

- KEY TAKEAWAYS

- BITCOIN (BTC) RECENT REBOUND AND MARKET REACTION

- WHY SOME BELIEVE BITCOIN (BTC) IS RECOVERING

- MACRO DATA SHOWS BITCOIN (BTC) LIQUIDITY REMAINS CONSTRAINED

- MID-TERM ON-CHAIN AND ETF DATA SIGNAL CAUTION FOR BITCOIN (BTC)

- SENTIMENT VS DERIVATIVES DATA IN BITCOIN (BTC) MARKETS

- CONCLUSION: WHY WAITING ON BITCOIN (BTC) STILL MAKES SENSE

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Bitcoin (BTC) has rebounded recently, but macro conditions, ETF flows, stablecoin data, and derivatives positioning suggest the recovery is not yet confirmed.

Over the past few days, Bitcoin (BTC) has shown clear signs of short-term recovery. Prices have moved higher, market discussions have heated up, and overall sentiment has improved rapidly. For many participants, this rebound feels like the long-awaited signal that the market is finally turning bullish again.

However, history repeatedly shows that price action alone is rarely sufficient to confirm a true trend reversal. While the recent move in Bitcoin (BTC) is undeniable, a closer look at macro indicators, liquidity conditions, on-chain data, and derivatives positioning suggests that the market may still be in a transitional phase rather than a confirmed recovery.

This article first outlines the recent rebound in Bitcoin (BTC) and the reasons commonly cited to support a bullish narrative. It then presents a data-driven counterpoint, explaining why caution remains justified at this stage.

BITCOIN (BTC) RECENT REBOUND AND MARKET REACTION

The most obvious signal of recovery is price behavior. After a prolonged period of weakness, Bitcoin (BTC) has climbed steadily over several sessions, breaking the monotony of downward or sideways movement. This rebound has been fast enough to reignite speculative interest and short-term optimism.

At the same time, market sentiment indicators have reacted sharply. The crypto Fear & Greed Index jumped from deeply pessimistic levels to near-neutral territory within a single day. Such rapid shifts tend to amplify confidence, as traders interpret them as evidence that downside risk has already been absorbed.

Spot market activity has also picked up modestly. Volumes are higher than during the recent lows, reinforcing the perception that capital is returning. On the surface, these developments paint a convincing picture of recovery. Yet surface-level strength often hides unresolved structural constraints.

WHY SOME BELIEVE BITCOIN (BTC) IS RECOVERING

One widely cited argument is the macro environment. Nominal interest rates in the United States are declining, which theoretically benefits risk assets like Bitcoin (BTC). Lower nominal yields reduce the opportunity cost of holding assets that do not generate cash flow.

Another frequently mentioned factor is ETF activity. Spot Bitcoin ETFs have become a key transmission channel between traditional finance and crypto markets. Even modest changes in ETF flows can influence short-term price action, leading many to attribute the recent rebound in Bitcoin (BTC) to institutional positioning.

Finally, sentiment-based indicators reinforce the bullish narrative. As fear levels rise from extreme pessimism toward neutrality, traders often interpret this as confirmation that the worst phase is over. In previous cycles, similar sentiment shifts sometimes preceded broader trend reversals.

Despite these arguments, none of them are sufficient on their own to confirm that Bitcoin (BTC) has entered a sustainable recovery phase.

MACRO DATA SHOWS BITCOIN (BTC) LIQUIDITY REMAINS CONSTRAINED

From a macro perspective, the issue is not whether nominal rates are falling. That development has been well understood for some time. The more critical question is whether liquidity is actually flowing into the financial system.

At present, the so-called intermediate layer of liquidity remains blocked. While the U.S. is lowering interest rates, it is simultaneously issuing large amounts of debt, effectively absorbing liquidity. This dynamic limits how much capital can reach risk assets, including Bitcoin (BTC).

Conditions in the real economy reinforce this constraint. Bank lending standards remain tight, and corporations are hesitant to borrow. Without credit expansion, monetary easing struggles to translate into broader market liquidity.

This situation is reflected in real interest rates. Over the past two weeks, real rates have increased slightly, from around 1.92 to approximately 1.94. Even small increases matter, as rising real rates are inconsistent with the liquidity expansion typically required for a sustained bull market.

The U.S. dollar index supports this interpretation. During the same period, DXY has remained largely unchanged, moving only marginally from about 98.4 to 98.2. A stable dollar suggests that global liquidity conditions remain restrictive, offering limited macro support for Bitcoin (BTC).

MID-TERM ON-CHAIN AND ETF DATA SIGNAL CAUTION FOR BITCOIN (BTC)

Mid-term crypto-native indicators also point to caution. On-chain stablecoin supply, a key proxy for native liquidity, has shown minimal change. Over the past two weeks, total stablecoin market capitalization declined slightly from around 270 to approximately 268.8, indicating that fresh capital inflows remain limited.

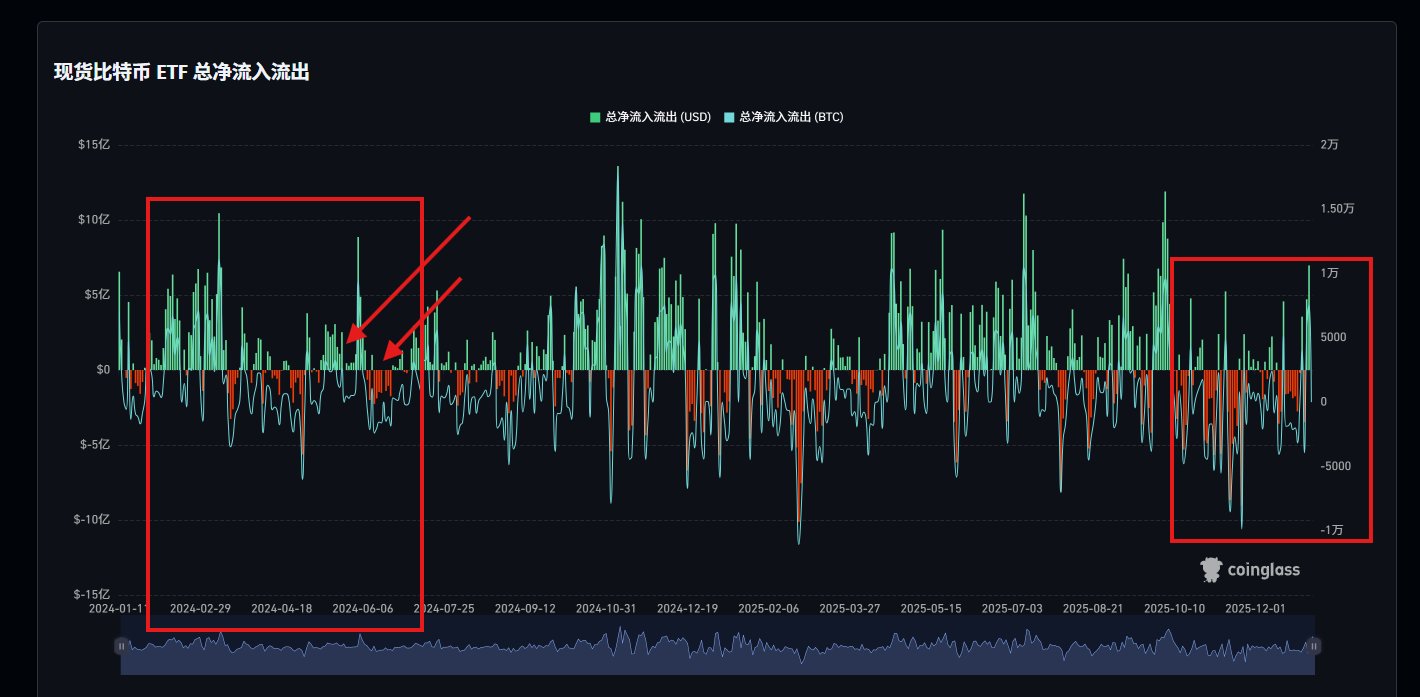

ETF data tells a similar story. Total spot Bitcoin ETF holdings are effectively unchanged at roughly $118 billion, consistent with levels seen two weeks ago. While short-term fluctuations exist, the overall picture suggests that institutional exposure to Bitcoin (BTC) has not meaningfully increased.

Recent price strength appears to be driven primarily by short-term ETF flow dynamics rather than sustained accumulation. Over the past five trading days, Bitcoin ETFs recorded four days of net outflows, including a large single-day outflow of approximately $1.15 billion.

Importantly, historical context matters. In early March 2024, the market experienced a structurally similar phase. Despite prolonged net inflows at the time, prices eventually declined and entered a deeper correction lasting more than two weeks. This episode highlights why ETF flows alone cannot confirm a durable recovery in Bitcoin (BTC).

SENTIMENT VS DERIVATIVES DATA IN BITCOIN (BTC) MARKETS

Sentiment indicators have rebounded sharply, but derivatives data remains subdued. The Fear & Greed Index jumped from the mid-20s to around 44 within a day, compared with a two-week average near 23.

Such rapid sentiment shifts often reflect emotional relief rather than structural improvement. When sentiment recovers faster than liquidity and positioning, the risk of false signals increases.

Derivatives positioning supports this cautious view. Open interest has remained relatively stable around 56, showing no meaningful expansion in leveraged exposure. A genuine trend reversal typically coincides with growing participation, which has yet to materialize in Bitcoin (BTC) markets.

In essence, traders feel more optimistic, but they are not yet committing capital aggressively.

CONCLUSION: WHY WAITING ON BITCOIN (BTC) STILL MAKES SENSE

The recent rebound in Bitcoin (BTC) is real, but the data suggests it is incomplete. Price and sentiment have moved first, while liquidity, macro confirmation, and positioning remain weak.

This does not imply an imminent collapse. It does imply that confidence is running ahead of confirmation. Without clear improvements in real rates, dollar weakness, stablecoin expansion, and sustained ETF inflows, the probability of a false recovery remains high.

In uncertain conditions, patience is not a missed opportunity but a form of risk management. Markets rarely move in a straight line, and clearer entry points often appear once trends are genuinely established.

When prices rise without strong structural support, caution is not pessimism—it is discipline.

Read More: