KEYTAKEAWAYS

-

Bitcoin's $110,000 target gains traction with 64% prediction odds on Polymarket, fueled by institutional inflows and favorable macro conditions.

-

Key drivers include ETF demand, softening inflation, and technical momentum, though volatility and prediction market biases pose notable risks.

-

While bullish sentiment dominates, traders remain cautious of potential liquidations and exaggerated price movements in the short term.

CONTENT

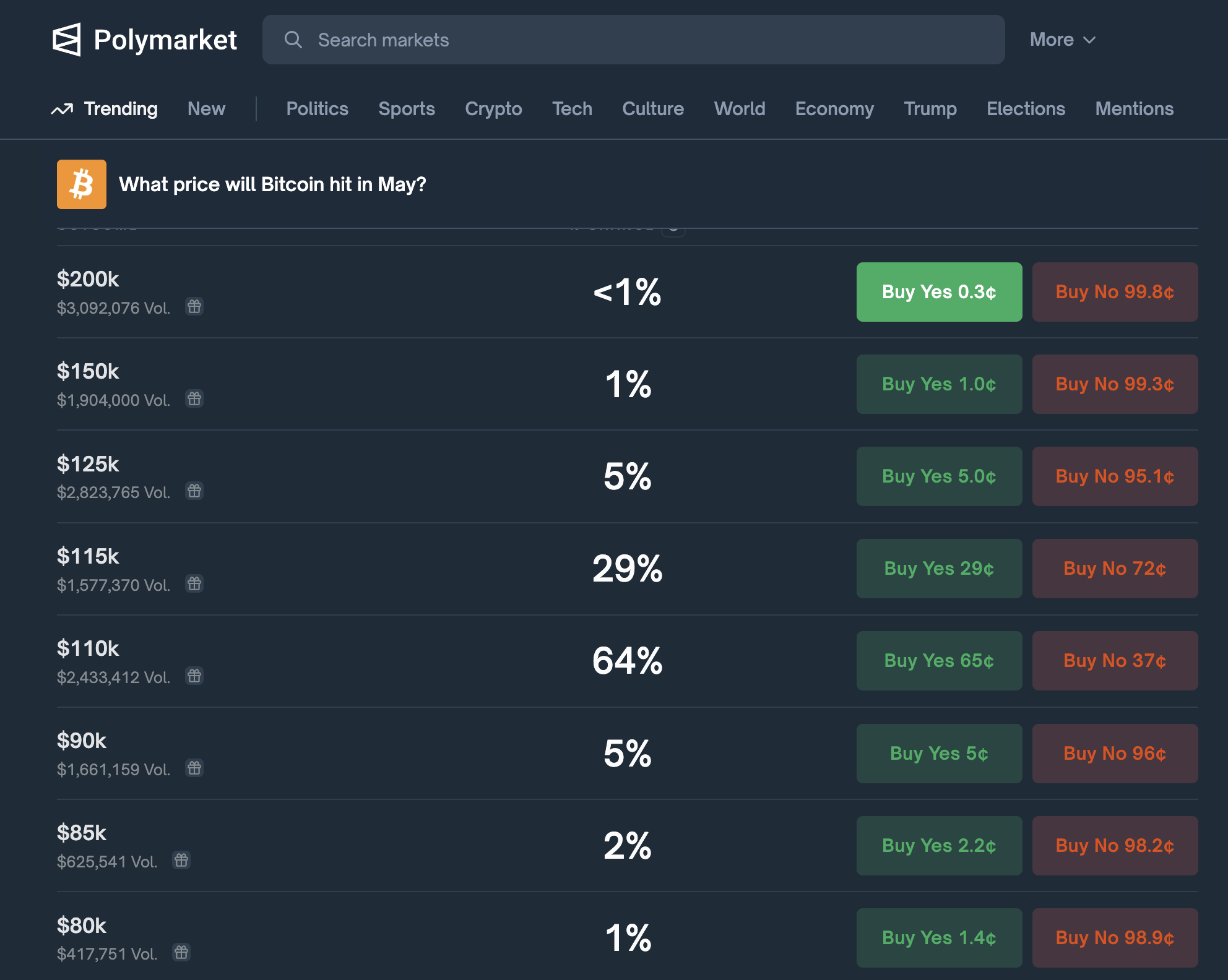

Bitcoin (BTC), the world’s leading cryptocurrency, continues to attract strong market attention. According to data from Polymarket, the chance of Bitcoin hitting $110,000 this month has risen to 64%, while the chance of reaching $115,000 is now 28%.

Over $17.76 million has been traded in these prediction markets, showing strong bullish sentiment from investors. However, despite the optimism, risks and uncertainty remain.

POLYMARKET PREDICTION FOCUSES ON $110,000 TARGET

Polymarket is a decentralized prediction platform where users place bets on future events. The latest data shows a sharp rise in predictions for Bitcoin reaching $110,000 this month.

The $17.76 million in total bets shows heavy interest and investor confidence in higher prices. Many traders believe Bitcoin could quickly break past $110,000 and even aim for $115,000.

Polymarket has grown rapidly in the crypto space. In October 2024, it reached a record $2.28 billion in trading volume.

Bitcoin remains one of the most followed assets on the platform, and $110,000 is seen not just as a price target but also as a symbolic step toward a new all-time high.

WHAT’S DRIVING THE BULLISH MOMENTUM?

Several key factors are pushing Bitcoin higher:

- Institutional Buying:

On-chain data from Glassnode and Santiment shows that large holders (10 to 10,000 BTC) have been adding to their positions. Institutional investors are also buying through spot Bitcoin ETFs, which brings more support to the market.

- Favorable Macro Environment:

U.S. inflation recently dropped to 2.3%, lower than expected. This eases fears of interest rate hikes and weakens the U.S. dollar, creating a better environment for assets like Bitcoin.

Global economic uncertainty is also pushing more investors toward Bitcoin as a “digital gold.”

- Technical Support:

Bitcoin recently broke through the $100,000 level. Technical analysts believe $110,000 is the next major resistance.

Current indicators, such as the RSI (Relative Strength Index), suggest Bitcoin is not yet overbought, meaning there could still be room to grow in the short term.

CHALLENGES ON THE ROAD TO $110,000

Even though market sentiment is strong, there are still risks:

- High Volatility:

Data from Coinglass shows that sudden moves below $100,000 or above $104,000 could trigger major liquidations, leading to sharp price swings. The presence of short-term speculative funds adds to this risk.

- Prediction Bias:

Polymarket predictions are based on user bets and can be influenced by large players. For example, in a previous election market, one user bet $46 million, causing odds to shift dramatically. Similar large bets could distort Bitcoin price predictions as well.

CONCLUSION

Bitcoin’s push toward $110,000 has sparked strong interest on Polymarket, with a 64% probability and $17.76 million in trades reflecting market confidence.

Institutional buying, macro trends, and technical strength are supporting this outlook. Still, investors should stay cautious—volatility, biased forecasts, and regulatory risks remain important factors.

Bitcoin’s future is full of potential, but careful risk management is essential in this fast-moving market.