KEYTAKEAWAYS

- Bitcoin reached a new 2026 high around $96,000 as large-scale short liquidations amplified upside following steady U.S. inflation data.

- Market sentiment improved but remained closer to neutral than euphoric, suggesting the rally was structurally driven rather than purely FOMO-led.

- The path to $100,000 depends on sustained spot buying after liquidation pressure fades, with options positioning likely to shape volatility near the psychological level.

- KEY TAKEAWAYS

- WHAT HAPPENED: BTC PUSHED INTO A FRESH 2026 HIGH ZONE AS MACRO EASED AND SHORTS GOT SQUEEZED

- THE MACRO BACKDROP: CPI WAS STEADY ENOUGH TO KEEP “RATES STAYING PUT” THE BASE CASE

- SENTIMENT DIDN’T LOOK LIKE PEAK EUPHORIA YET, WHICH IS WHY THE MOVE CAN LAST LONGER THAN A ONE-CANDLE PUMP

- WHY $100,000 IS A MAGNET: IT’S NOT JUST PSYCHOLOGY—IT’S HOW POSITIONING AND HEDGING CLUSTER AROUND ROUND NUMBERS

- THE ROTATION SIGNAL: WHY BITCOIN IS LEADING WHILE ALTCOIN LEVERAGE SHRANK

- WHAT TO WATCH NEXT: THREE DATA-DRIVEN CHECKS FOR WHETHER $100,000 IS A “WHEN” OR A “FADE”

- BOTTOM LINE: THIS NEW 2026 HIGH LOOKS STRUCTURALLY DIFFERENT FROM A PURE FOMO SPIKE—BUT $100,000 STILL NEEDS SPOT FOLLOW-THROUGH

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Bitcoin’s push to a fresh 2026 high near $96,000 was driven by a short-squeeze and a supportive macro backdrop, raising the question of whether spot demand can carry BTC toward the $100,000 level.

WHAT HAPPENED: BTC PUSHED INTO A FRESH 2026 HIGH ZONE AS MACRO EASED AND SHORTS GOT SQUEEZED

On January 14, 2026, Bitcoin traded up into the mid-$95,000s to around $96,000 area across major venues, printing what multiple market reports described as its highest level of the year so far, while broader crypto followed risk-on price action after U.S. inflation data landed broadly in line with expectations.

The move was not simply “spot demand = up,” because leverage positioning mattered: CoinDesk reported that Bitcoin’s push above $96,000 coincided with over $500 million in liquidations, a classic setup where forced short covering can amplify upside once a key level breaks.

Bloomberg also noted that roughly $270 million of Bitcoin short positions had been liquidated over the prior 24 hours (CoinGlass data), reinforcing the interpretation that this rally’s acceleration was heavily shaped by a squeeze dynamic rather than a slow, purely discretionary bid.

THE MACRO BACKDROP: CPI WAS STEADY ENOUGH TO KEEP “RATES STAYING PUT” THE BASE CASE

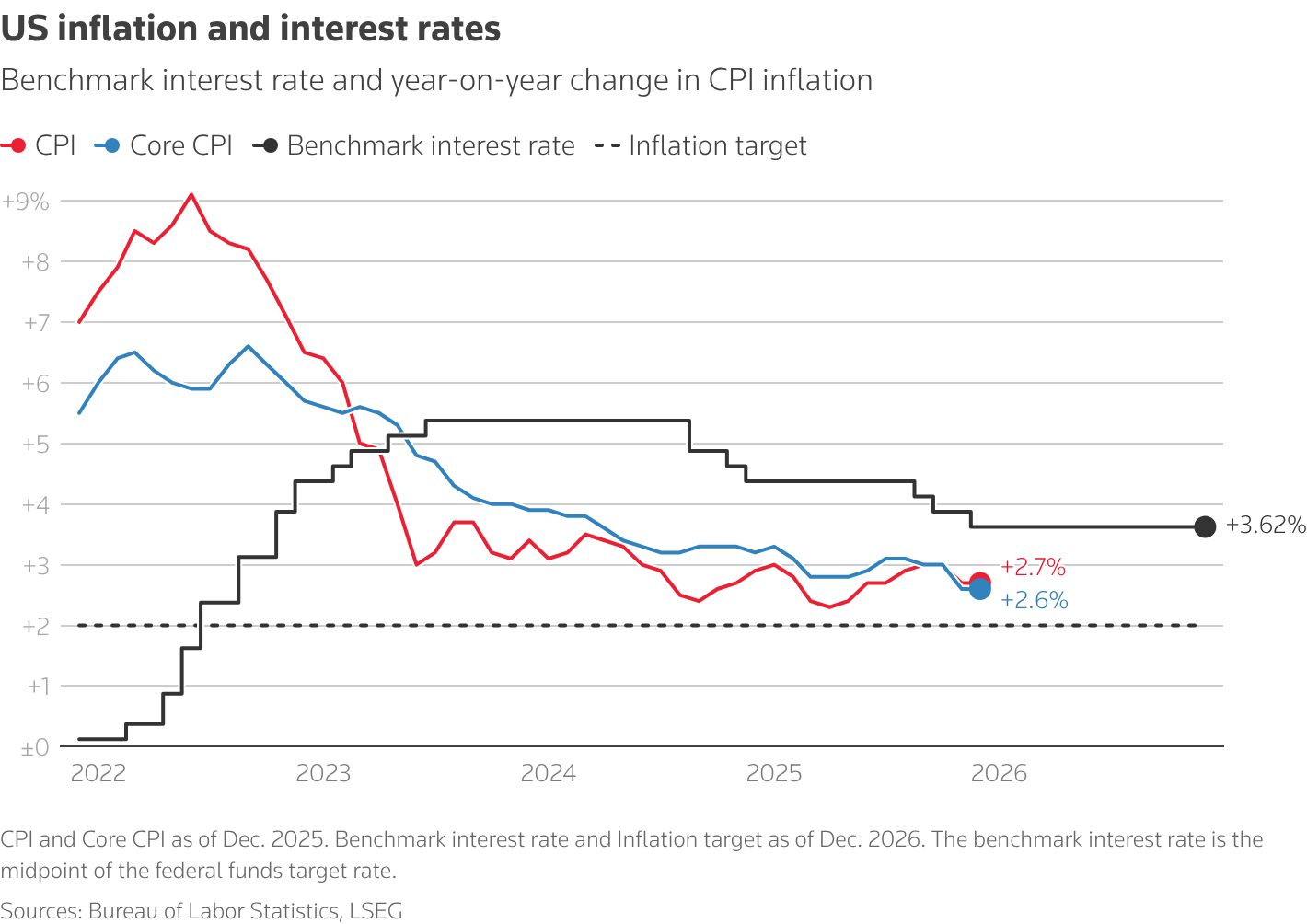

The macro catalyst was not a single headline, but the market’s read that inflation is not re-accelerating in a way that forces immediate tightening: Reuters reported December CPI +0.3% m/m and +2.7% y/y, with core CPI +0.2% m/m and +2.6% y/y, a combination that supported the view that the Federal Reserve is likely to hold rates unchanged in the near term.

That matters for Bitcoin because the path to $100,000 is less about narrative and more about whether global risk appetite can persist in a regime where real yields and the dollar are not violently repricing against risk assets—something the market did not see in this CPI print.

SENTIMENT DIDN’T LOOK LIKE PEAK EUPHORIA YET, WHICH IS WHY THE MOVE CAN LAST LONGER THAN A ONE-CANDLE PUMP

Even with the breakout-like behavior, “everyone is all-in” was not the clean takeaway from sentiment gauges: Alternative.me’s Crypto Fear & Greed Index showed “Now: 48 (Neutral)” around the time of the move, which is meaningfully different from the kind of 70–90 readings that typically characterize late-stage euphoria.

This matters because rallies that start from neutral-to-cautious sentiment often have more room to extend if spot demand remains steady, since incremental buyers are not already max-positioned.

WHY $100,000 IS A MAGNET: IT’S NOT JUST PSYCHOLOGY—IT’S HOW POSITIONING AND HEDGING CLUSTER AROUND ROUND NUMBERS

The $100,000 level functions like a magnet because large strikes, structured products, and systematic hedging often cluster around round numbers, which can compress volatility below the level and then expand it sharply once the level is cleanly taken or rejected; CoinDesk has also highlighted a related structural feature of this cycle—bitcoin options open interest staying larger than futures open interest, which tends to shift “how volatility expresses” from linear leverage into convex hedging flows.

In other words, if BTC grinds upward, dealers and hedgers can end up buying on the way up (and selling on the way down) in ways that make breakouts feel “inevitable” right until they aren’t—so the level matters, but the path matters more.

THE ROTATION SIGNAL: WHY BITCOIN IS LEADING WHILE ALTCOIN LEVERAGE SHRANK

One of the most important context clues is that speculative leverage has not been building across the whole board the way it does in full-risk-on phases: Bloomberg reported that open interest in altcoin futures has collapsed 55% since October, wiping out more than $40 billion in exposure, reflecting a market that has been de-risking the “long tail” while keeping more capital concentrated in the most liquid majors.

That backdrop helps explain why Bitcoin can lead a market rebound even when parts of the alt complex lag—because the marginal dollar is choosing liquidity, depth, and perceived durability rather than chasing beta.

WHAT TO WATCH NEXT: THREE DATA-DRIVEN CHECKS FOR WHETHER $100,000 IS A “WHEN” OR A “FADE”

- LIQUIDATIONS VS. FOLLOW-THROUGH: if the rally was mostly forced buying, you want to see price hold up after the liquidation impulse fades, otherwise the market can mean-revert once shorts are cleared.

- MACRO STAYS “NON-DISRUPTIVE”: CPI that keeps the Fed in “hold” mode is supportive, but any surprise that forces a sharp repricing of rate expectations can cap risk assets quickly.

- OPTIONS-LED STRUCTURE PERSISTS: as long as options positioning remains dominant relative to futures, the market can see sharper “pinning” and sudden bursts of volatility around key levels, including $100,000.

BOTTOM LINE: THIS NEW 2026 HIGH LOOKS STRUCTURALLY DIFFERENT FROM A PURE FOMO SPIKE—BUT $100,000 STILL NEEDS SPOT FOLLOW-THROUGH

Bitcoin’s move into a fresh 2026 high zone around $96,000 was supported by a macro tape that didn’t force a hawkish repricing and by a liquidation-driven squeeze that accelerated upside once resistance gave way, while sentiment measures stayed closer to neutral than euphoric and leverage appeared more concentrated in majors than in the altcoin tail.

Whether $100,000 breaks cleanly now depends less on the story and more on whether spot demand can keep absorbing supply after the squeeze impulse cools—because round numbers don’t just attract headlines, they attract hedging flows, and that can turn the final stretch into the most mechanically volatile part of the move.

Read More:

MicroStrategy’s Bitcoin Leverage: A Macro Bet on Fiat Decay

Is the Bitcoin Crash Just Beginning? Three Macro Risks Threatening BTC