KEYTAKEAWAYS

- BNB Chain dominates DeFi with CAKE, XVS, and LISTA leading trading, lending, and LSDfi adoption, supported by billions in total value locked.

- RWA tokenization and decentralized storage through SOLV Protocol and BNB Greenfield highlight the ecosystem’s expansion into real-world finance and infrastructure.

- Emerging trends like AI, restaking, and gasless transactions aim to enhance user experience, but BNB faces decentralization, regulation, and competition challenges.

CONTENT

BNB Chain powers DeFi, RWA, DAO, and AI innovation with projects like PancakeSwap, Venus, and Lista driving growth. Explore its core tokens and future outlook.

INTRODUCTION TO BNB CHAIN

BNB Chain, formerly known as Binance Smart Chain, has developed into one of the largest blockchain ecosystems in the world. Designed for high throughput, low transaction fees, and full EVM compatibility, it offers an attractive environment for developers and users alike. Beyond its technical efficiency, BNB Chain benefits from the powerful network effects of Binance, which remains one of the largest exchanges globally.

Last week, BNB broke through the historical mark of $1,000, and this week it even touched $1,080, attracting great attention from the market.

As of late 2025, the BNB ecosystem covers a broad range of sectors: decentralized finance (DeFi), real-world asset (RWA) tokenization, decentralized autonomous organizations (DAO), infrastructure services, and emerging innovations such as AI integrations and restaking mechanisms. This article provides a structured analysis of these segments and introduces the core projects and tokens that define the BNB landscape.

DEFI CORE PROTOCOLS

DeFi remains the backbone of the BNB ecosystem, driving liquidity, user activity, and total value locked (TVL). Several flagship projects have established themselves as leaders within their respective niches.

PancakeSwap (CAKE)

PancakeSwap is the largest decentralized exchange (DEX) on BNB Chain. With more than $2.2 billion in TVL, it dominates token swaps, liquidity pools, and yield farming on the network. PancakeSwap also extends beyond BNB Chain, offering multi-chain support and features like Launchpad sales and an integrated NFT marketplace. Its native token, CAKE, is used for governance, trading fee discounts, and liquidity incentives. Over time, CAKE has shifted from inflationary emissions to a more deflationary model through buybacks and token burns.

Venus Protocol (XVS)

Venus Protocol is the primary lending and borrowing platform on BNB Chain. Holding over $2 billion in TVL, Venus enables users to supply assets and earn interest, or borrow against collateral. It also issues its own decentralized stablecoin, VAI. The governance token, XVS, empowers the community to vote on risk parameters, collateral types, and protocol upgrades. Venus has positioned itself as the central credit layer of the ecosystem.

Lista DAO (LISTA)

Lista DAO is one of the fastest-growing projects in the BNB ecosystem, operating at the intersection of liquid staking derivatives and stablecoins. By staking assets such as BNB or ETH, users can mint lisUSD, a decentralized stablecoin backed by liquid staking tokens. With nearly $2 billion locked, Lista is emerging as a key driver of LSDfi adoption. Its token, LISTA, governs protocol decisions and incentivizes liquidity providers.

SOLV Protocol (SOLV)

SOLV Protocol specializes in financial NFTs and RWA-linked products. By packaging assets into tokenized vouchers, SOLV creates flexible instruments for yield, fundraising, and structured products. Its token, SOLV, serves governance, staking, and participation incentives. As RWA adoption accelerates, SOLV stands out as a bridge between traditional finance and DeFi on BNB Chain.

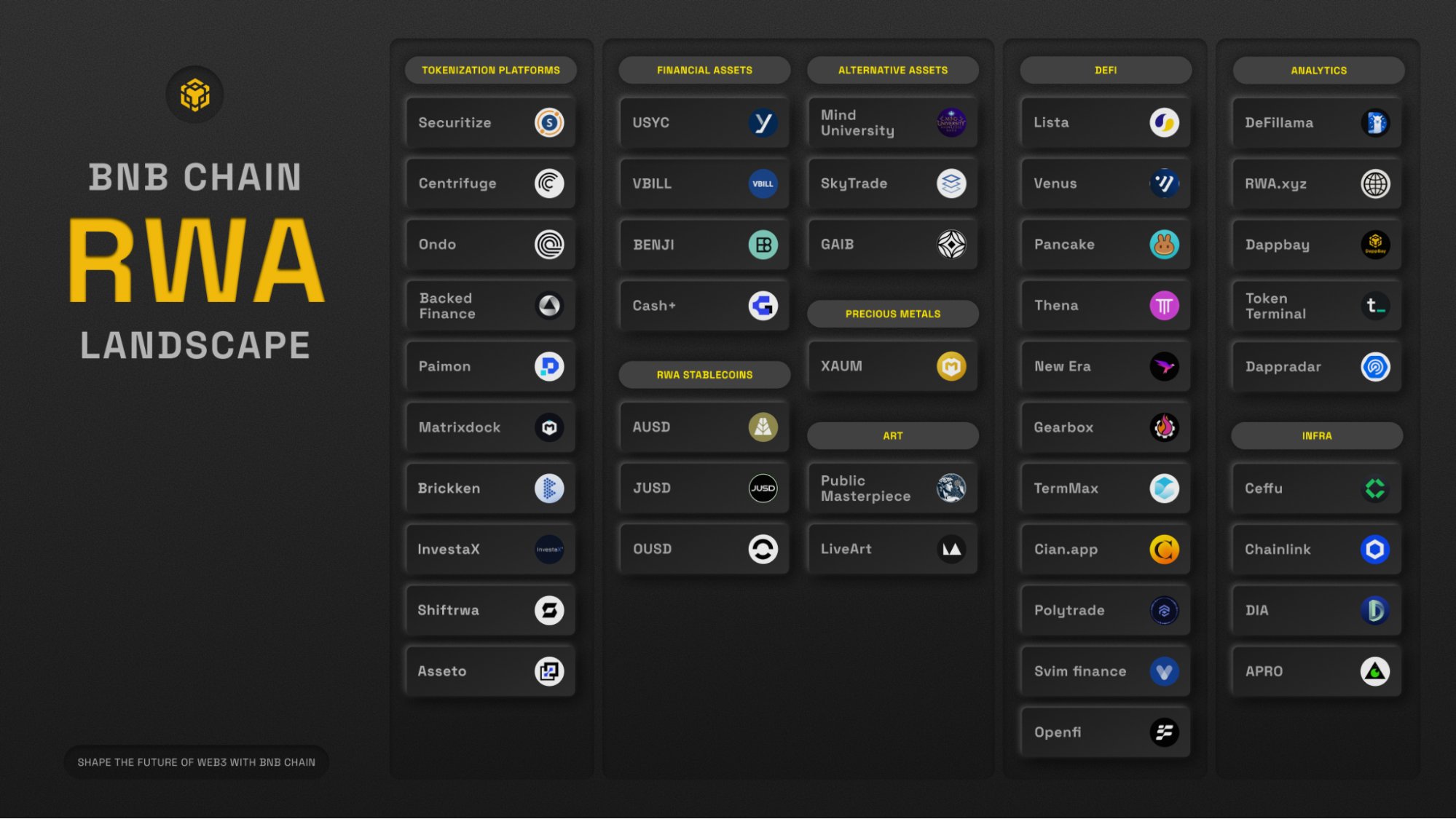

RWA DEVELOPMENT

Real-world assets (RWA) represent one of the most strategic areas of growth for BNB Chain. Projects are exploring tokenization of bonds, real estate, and commodities, allowing traditional assets to be represented on-chain.

Tokenized bonds enable investors to gain blockchain-based access to stable yield instruments. Real estate projects tokenize property ownership or fund shares, unlocking liquidity for traditionally illiquid assets. Commodities such as gold or oil are also being mapped to tokens, enabling on-chain collateralization and global accessibility.

While most RWA projects issue their own asset-specific tokens rather than universal governance coins, they are closely integrated with BNB DeFi protocols. This integration allows tokenized RWAs to be used as collateral in lending markets or paired in liquidity pools, expanding the practical utility of the ecosystem.

The core representative projects include Tokenized Bonds, Real Estate, and Commodities.

DAO AND GOVERNANCE

Community governance remains a defining feature of the BNB ecosystem. Several DAOs drive decision-making and resource allocation:

- PancakeSwap DAO uses CAKE holders to vote on fee structures and incentive programs.

- BNB Grant DAO funds early-stage developers and innovative projects building on BNB Chain. Rather than issuing a dedicated token, it often uses BNB directly as the medium of funding and governance.

- KernelDAO, represented by the KERNEL token, focuses on education and developer community initiatives, reinforcing the long-term sustainability of Web3 talent within the BNB ecosystem.

Together, these DAOs demonstrate a gradual shift toward decentralized decision-making, even as Binance maintains significant influence over the broader ecosystem.

INFRASTRUCTURE AND TOOLS

Beyond applications, BNB Chain has invested in core infrastructure to support scalable adoption.

BNB Greenfield

Greenfield is BNB’s decentralized storage network, designed to complement its smart contract layer. It offers a blockchain-verified alternative to cloud storage, enabling applications to manage large datasets in a decentralized and cost-effective manner.

Cross-chain Bridges

BNB Chain is tightly integrated with cross-chain bridges that connect it to Ethereum, other EVM chains, and non-EVM ecosystems. This interoperability ensures that liquidity can flow freely and that developers can build composable applications across chains.

RPC Providers and Node Services

To guarantee smooth operations for both developers and end-users, RPC providers and validator services form an essential part of the BNB stack. By offering reliable endpoints, they reduce latency and improve the overall experience of interacting with decentralized applications.

EMERGING DIRECTIONS

The BNB ecosystem is not static; it actively pursues innovation to remain competitive against Ethereum Layer-2 solutions, Solana, and other high-performance chains.

- AI + Blockchain: Integrations of artificial intelligence with decentralized applications are a major 2025 initiative. From AI-powered agents to decentralized data marketplaces, BNB is positioning itself at the frontier of AI-Web3 convergence.

- Restaking: Inspired by models such as EigenLayer, BNB is exploring restaking solutions that allow BNB or liquid staking derivatives (like snBNB) to secure multiple protocols simultaneously. This enhances capital efficiency and strengthens network security.

- Gasless Transactions and Sub-second Finality: By reducing or eliminating gas fees and accelerating finality, BNB aims to improve user experience and attract mainstream adoption.

RISKS AND CHALLENGES

Despite its progress, the BNB ecosystem faces several challenges:

- Centralization: Binance’s strong control over validators and token supply distribution raises questions about decentralization.

- Regulatory Pressure: Governments are tightening oversight on exchanges and stablecoins, which may directly impact the ecosystem’s ability to scale RWAs or DeFi products.

- Competition: Ethereum rollups, Solana, and other Layer-1 chains compete aggressively for developers and liquidity.

- Security Risks: Cross-chain bridges and DeFi protocols remain attractive targets for exploits, necessitating stronger security audits and risk frameworks.

CONCLUSION

The BNB ecosystem has evolved into a multi-faceted Web3 hub, anchored by DeFi leaders like PancakeSwap (CAKE), Venus Protocol (XVS), Lista DAO (LISTA), and SOLV Protocol (SOLV). Its expansion into RWAs, DAO governance, and decentralized infrastructure demonstrates a clear ambition to serve not just retail traders but also institutions and mainstream applications.

Looking ahead, the integration of AI, restaking, and gasless user experiences may position BNB Chain as one of the most accessible and innovative platforms in the global blockchain industry. However, overcoming regulatory uncertainty, decentralization concerns, and competitive pressure will be essential for its continued dominance.

For investors, developers, and users, the BNB ecosystem offers both opportunities and challenges. Its ability to adapt and innovate will determine whether it remains a top-tier blockchain network in the next wave of Web3 adoption.