KEYTAKEAWAYS

- Jia Yueting launches the first C10 Crypto Treasury, a $300M diversified crypto reserve model redefining corporate digital asset management.

- Ethereum shows Tesla-style breakout potential as analysts predict a three-phase recovery leading to a major bull rally.

- Nikkei 225 hits 50,000 for the first time, signaling renewed Asian risk appetite that could spill into crypto markets.

CONTENT

Jia Yueting Completes First Batch of C10 Crypto Treasury Allocation

On October 27, Jia Yueting announced on social media that “BlackRock has increased its holdings in FFAI by 26% to 6.8 million shares. In the crypto flywheel business, QLGN has partnered with BitGo and completed the first batch of C10 Crypto Treasury allocation, with transaction volume rising to around $300 million, showing strong early momentum.”

The “C10 Treasury” is a crypto treasury management product launched by a listed company. Its core investment strategy is to allocate assets based on the top 10 cryptocurrencies by market capitalization (the C10 Index). This approach builds upon the trend of companies holding Bitcoin as a reserve asset but expands it into a diversified basket to reduce volatility risk while capturing the broader growth of the crypto market. If successful, this model could mark a new paradigm for corporate engagement with digital assets — shifting treasury management from single-asset holdings to diversified crypto allocations.

Ethereum Poised for Tesla- or Gold-Style Rally

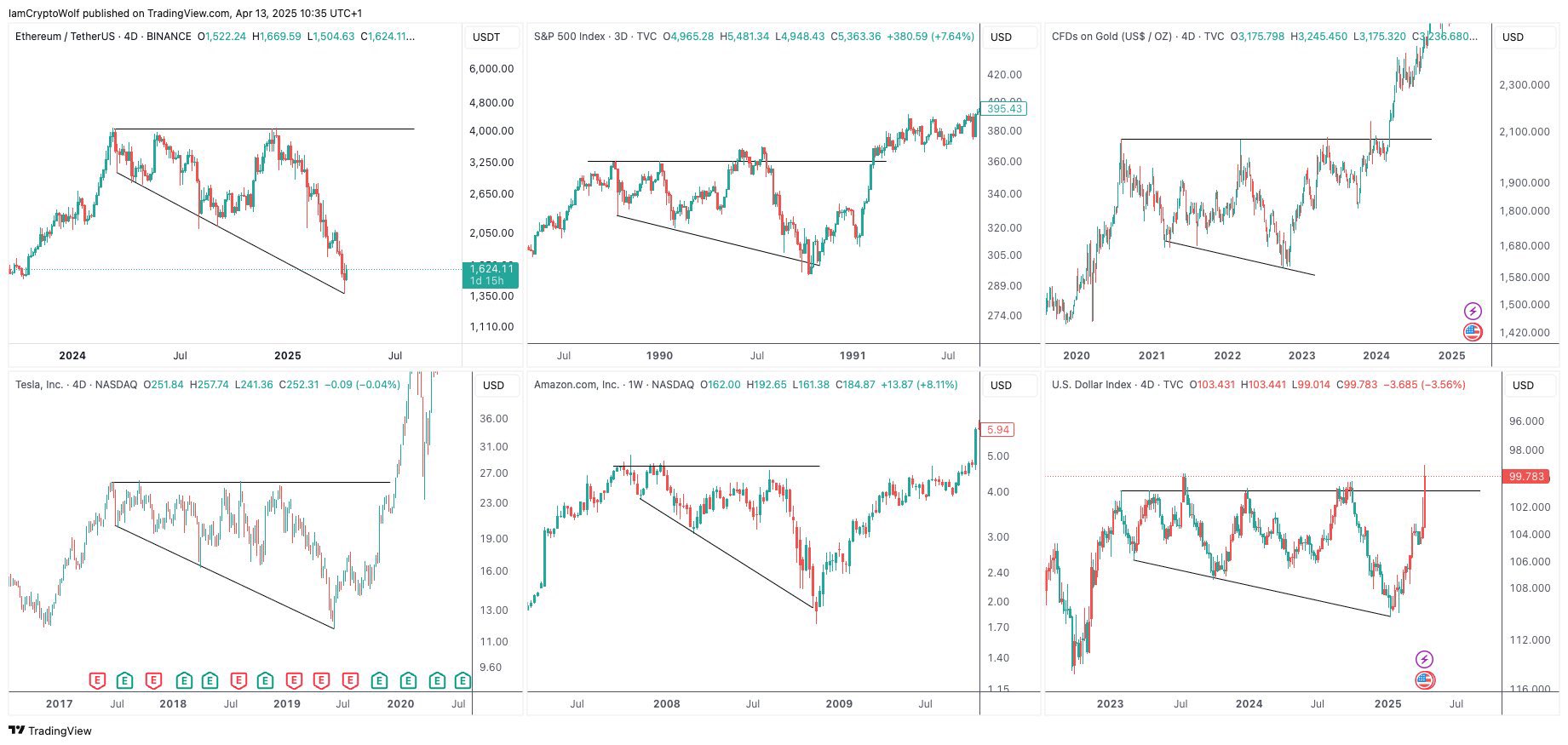

On October 27, crypto analyst @IamCryptoWolf posted on X, stating that since ETH bottomed at $1,500, its movement has followed three stages: a V-shaped recovery, a consolidation phase (current stage), and an upcoming rally phase. He compared this pattern to the historic bullish trajectories of Tesla (TSLA), gold (GOLD), and the uranium ETF (URA).

This reflects a classic “three-phase market bottom” structure — sentiment recovery, accumulation, and trend acceleration. Technically, ETH’s price action shows steady accumulation, while macro narratives such as upcoming Ethereum upgrades and institutional adoption could act as catalysts. If these factors align, ETH may enter a breakout phase similar to previous parabolic runs seen in other assets.

Nikkei 225 Breaks 50,000 for the First Time, Signaling Rising Risk Appetite in Asia

On October 27, the Nikkei 225 index surpassed the 50,000 mark for the first time, while South Korea’s KOSPI index also broke above 4,000. This historic milestone highlights a strong recovery in Asia-Pacific equity markets. For the crypto sector, it may signal a return of risk appetite and potentially fuel inflows into digital assets.

From a macro perspective, strong equity markets typically coincide with increased risk-taking behavior. Meanwhile, Japan’s yen depreciation and Korean won volatility could drive capital into hedge-oriented assets like Bitcoin. Historically, Asian equity markets and Bitcoin have shown cyclical correlations — when regional liquidity expands, BTC often becomes a new outlet for capital seeking higher returns.