KEYTAKEAWAYS

- Unichain Daily Active Addresses Surge 515%, Transactions Exceed 345,000

- Polkadot Spends $133M in 2024, Balance Sheet Shows $211M

- Goldman Sachs Q4 Bitcoin ETF Holdings Increase to $1.5 Billion

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

UNICHAIN DAILY ACTIVE ADDRESSES SURGE 515%, TRANSACTIONS EXCEED 345,000

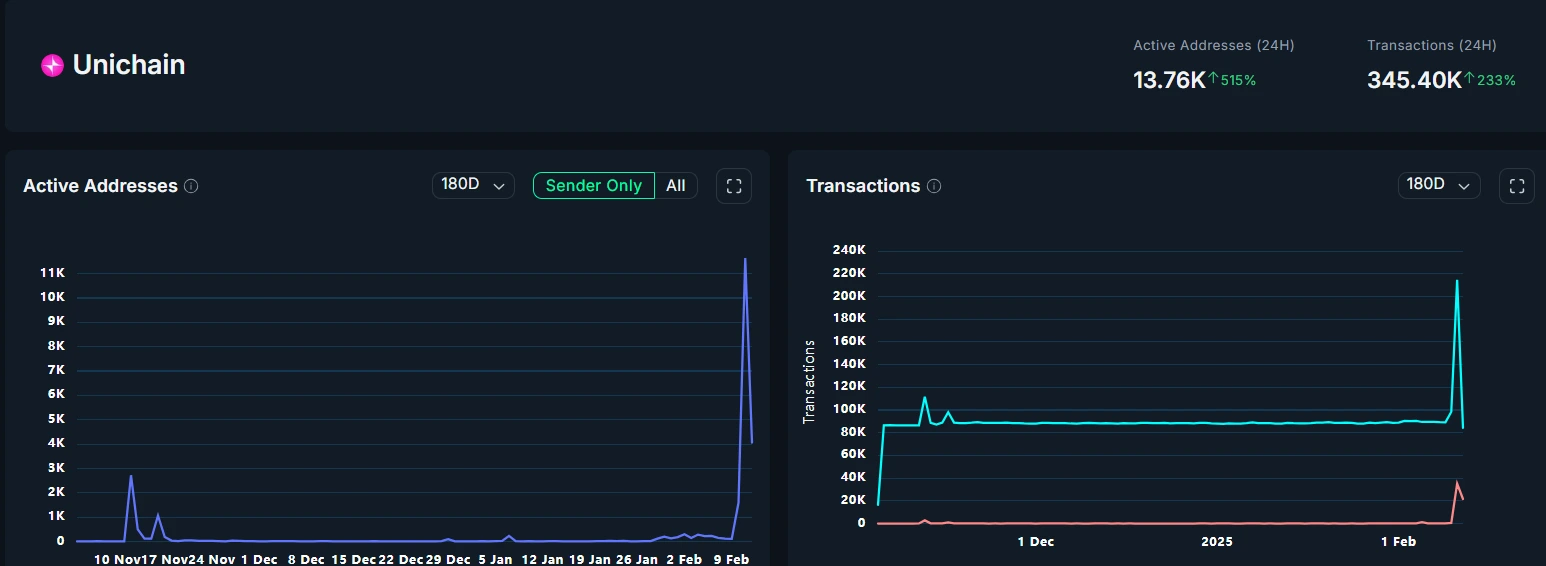

According to Nansen data, chain activity on Unichain surged hours after mainnet launch, with active addresses reaching 13,760 in the past 24 hours, up 515%; transaction count reached 345,400, up 233%.

Source: Nansen

Analysis:

The surge in on-chain activity following Unichain’s mainnet launch reflects strong market confidence and enthusiasm for its ecosystem. The explosive growth in active addresses and transaction counts is closely tied to Uniswap Labs’ backing and the participation of nearly 100 prominent crypto projects and protocols (such as Uniswap, Circle, Coinbase, etc.). The involvement of these heavyweight participants not only provides strong initial ecosystem support for Unichain but also lays the foundation for its future as a significant competitor in the Layer 2 space.

In the short term, the surge in chain activity may be related to initial airdrops, incentive programs, and users exploring the new ecosystem. In the long term, Unichain’s success will depend on its ability to attract more developers to build innovative applications and achieve efficient synergy with other Layer 2 networks and the Ethereum mainnet. If Unichain can continuously expand its ecosystem and optimize user experience, its market share in the DeFi space is likely to further increase.

POLKADOT SPENDS $133M IN 2024, BALANCE SHEET SHOWS $211M

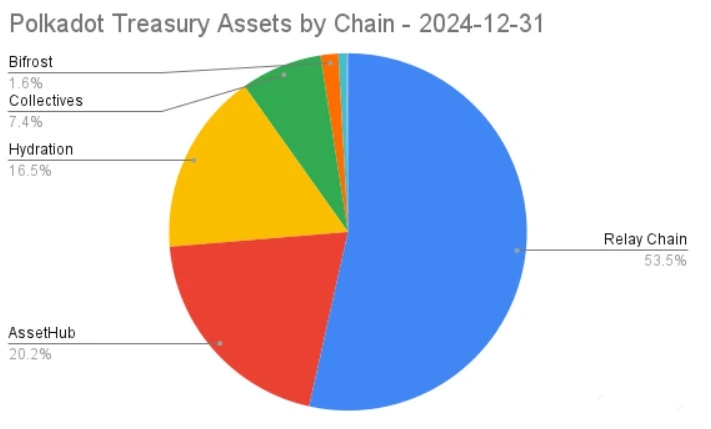

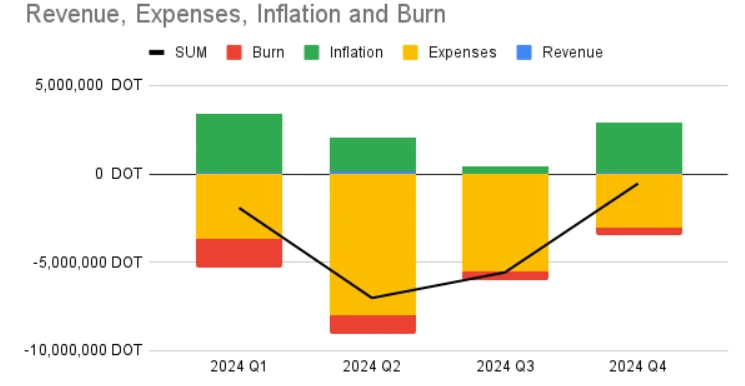

According to Polkadot’s 2024 Treasury Report, Polkadot spent a total of $133 million over the past year. Expenditures covered seven categories, including ecosystem expansion, research and development, business development, etc., with ecosystem expansion having the highest spending at $48 million.

Source: PolkaWorld

The report also shows that Polkadot DAO began incorporating stablecoins into its asset portfolio from the second half of the year, acquiring $32 million in stablecoins and spending $17 million. Additionally, the balance sheet shows Polkadot Treasury currently holds $211 million in assets, with $157 million freely disposable, $41.6 million for strategic initiatives, and $12 million invested in DeFi market operations.

Source: PolkaWorld

Analysis:

Polkadot’s $133 million expenditure in 2024 reflects its continued investment in ecosystem expansion and technological development. The large amount allocated to ecosystem expansion indicates Polkadot’s strategic focus on attracting developers and implementing projects. The increase in stablecoin allocation to $32 million demonstrates consideration for financial stability amid market volatility.

Overall, Polkadot’s financial condition remains robust, with future success depending on the actual effectiveness of ecosystem expansion and whether it can maintain market recognition in cross-chain interoperability and application implementation. Furthermore, the $12 million investment in DeFi markets may be aimed at enhancing capital utilization and improving liquidity management capabilities.

GOLDMAN SACHS Q4 BITCOIN ETF HOLDINGS INCREASE TO $1.5 BILLION

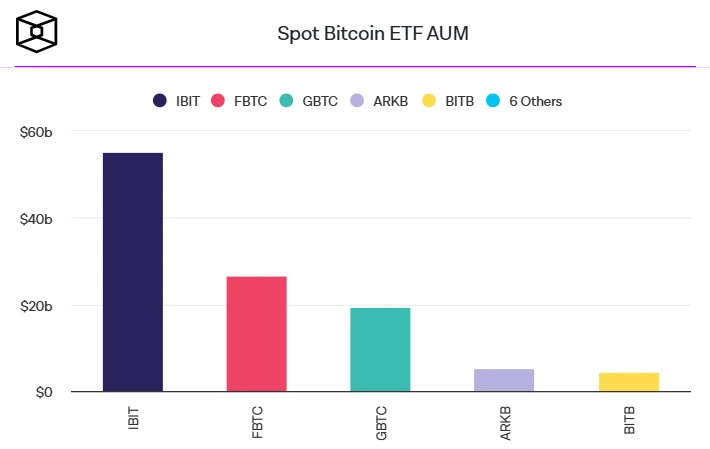

According to Goldman Sachs’ latest 13F filing, as of December 31, 2024, its Bitcoin ETF holdings increased to $1.5 billion. This includes $1.27 billion (24.07 million shares) in BlackRock’s iShares Bitcoin Trust ETF (IBIT), an 88% quarter-over-quarter increase; and $288 million (3.5 million shares) in Fidelity Wise Origin Bitcoin Fund (FBTC), a 105% increase.

Source: TheBlock

Analysis:

Goldman Sachs’ significant increase in Bitcoin ETF holdings in Q4 2024 demonstrates growing confidence from traditional financial institutions in Bitcoin spot ETFs. This trend is closely related to market developments following the SEC’s approval of Bitcoin spot ETFs in early 2024. Notably, Goldman Sachs’ increased positions in BlackRock’s IBIT and Fidelity’s FBTC indicate a preference for industry leaders when selecting ETF products with robust management and liquidity advantages.

Furthermore, IBIT and FBTC, as the most influential Bitcoin ETFs in the current market, have attracted significant institutional capital inflow, which may be one factor in BTC’s price increase. Goldman Sachs’ increased holdings reflect institutional investors viewing Bitcoin as part of long-term asset allocation, and more Wall Street institutions may follow this trend, further driving Bitcoin’s mainstream adoption.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!