KEYTAKEAWAYS

- Bitcoin's $1.83 trillion market cap ranks eighth globally, with ETFs holding $106 billion, indicating institutional recognition of its emerging safe-haven properties amid economic uncertainty.

- Supply-demand dynamics strongly favor price appreciation: daily new Bitcoin production has fallen to 450 coins while ETFs absorb approximately 1,000 coins daily.

- Historical patterns show Bitcoin typically follows gold's all-time highs within 100-150 days, suggesting a potential Q3-Q4 2025 price breakthrough targeting $150,000-$180,000.

CONTENT

Bitcoin navigates economic winter: Analysis of how safe-haven demand could drive a new bull cycle while interest rates remain high. Key factors include institutional ETF adoption, halving mechanics, and gold correlation patterns.

As mentioned in previous articles, the current crypto market is primarily influenced by the broader economic environment. Especially in the last two months, keywords like Trump’s tariff war, US economic recession, and Federal Reserve monetary policy have frequently made headlines, with each headline causing noticeable fluctuations in the crypto market.

Looking at the larger economic cycle, Bitcoin‘s birth in 2008 coincided with the beginning of the recession phase of this long-term economic cycle (starting with the 2008 subprime financial crisis). Its design purpose was precisely a response to the centralized risks in the traditional financial system.

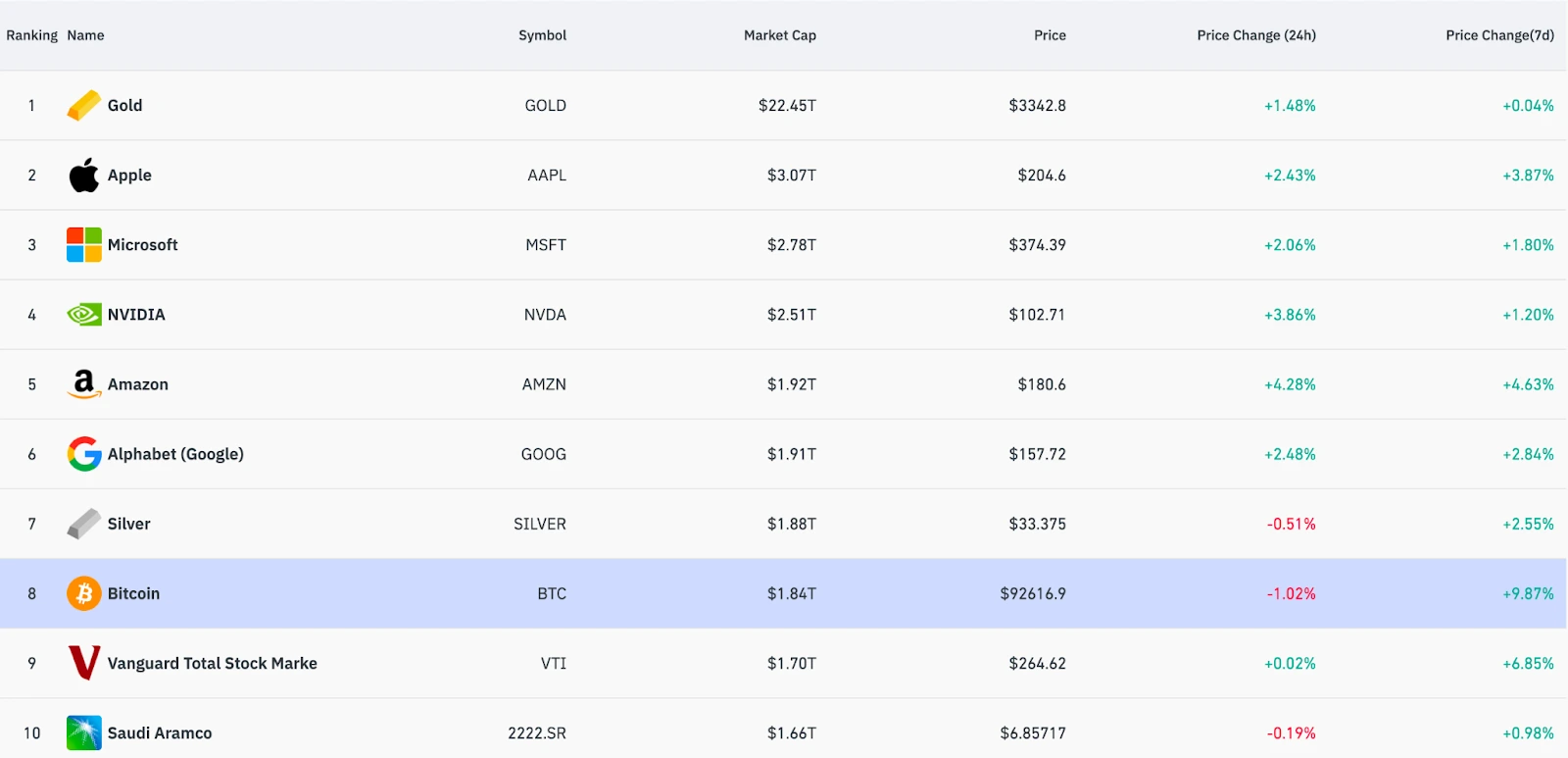

Over the past decade, Bitcoin has soared with its attributes of “decentralization,” “censorship resistance,” and “scarcity,” once breaking into the top five global assets by market capitalization. Currently, with a market cap of $1.83 trillion, it ranks eighth, just behind silver.

Bitcoin Global Market Cap Ranking

(Source: CoinGlass)

Now as the world economy enters the tail end of the winter phase of the long-term economic cycle, economic uncertainties are intensifying (such as sovereign debt crises, currency devaluation, economic recession, etc.). Bitcoin’s safe-haven properties are increasingly recognized by the market. As its market value rises and consensus strengthens, comparisons between digital gold and physical gold become more frequent. So in this macro environment, can Bitcoin rely on its safe-haven thesis against real-world risks to continue advancing strongly and enter an extended bull market with sustainable growth?

BITCOIN’S ORIGIN: BORN IN ECONOMIC RECESSION

Before formally beginning, let me briefly explain the long-term economic cycle theory. This is a theory proposed by Russian economist Nikolai Kondratieff in the 1920s, suggesting that capitalist economies experience cyclical waves lasting approximately 50 to 60 years, with each cycle including four phases: spring (recovery), summer (prosperity), autumn (recession), and winter (depression).

The core concept of the Kondratieff cycle is that technological innovation and productivity improvements are the main drivers of long-term economic growth. In the early stages of each cycle, new technological revolutions (such as steam engines, electricity, information technology, etc.) trigger transformations in production methods, driving economic growth. As technology becomes widespread and markets saturate, economic growth slows, entering recession and depression phases until new technological revolutions emerge, initiating the next cycle.

The mainstream classification divides global economics into 5 distinct Kondratieff cycles since the First Industrial Revolution in the 18th century. The current Kondratieff cycle is the fifth round, beginning around 1980, and we are now in the late depression phase of this cycle. This phase is characterized by slowing economic growth, rising debt levels, increasing deflationary pressure, low returns on traditional assets, and technological innovations disrupting old systems.

However, new technological revolutions (such as artificial intelligence, quantum computing, green energy, etc.) are emerging, potentially laying the foundation for the “spring” phase of the next cycle.

Bitcoin’s birth in 2008 coincided with the beginning of the recession phase of this Kondratieff cycle, specifically against the backdrop of the 2008 global financial crisis, when the fragility of the traditional financial system was fully exposed. One of Bitcoin’s design principles was decentralization and limited supply, to address the risks of excessive money printing and inflation in the fiat currency system.

In Bitcoin’s early stages, price volatility was extreme, with 10-fold or 100-fold increases during each halving cycle, followed by 80-90% drops when the bull market ended. For example, the first halving cycle saw a nearly 500-fold increase, then a drop of over 90% after the bull market ended. During this phase, Bitcoin was primarily viewed as a high-risk speculative asset.

Bitcoin Price Trend

(from: TradingView)

However, over time, Bitcoin has gradually been accepted by more institutions and investors. Especially against the backdrop of increasing economic uncertainty, its safe-haven properties as “digital gold” have gradually emerged. The market’s gradual expansion, institutional investors’ increasing participation, and growing global consensus have all made Bitcoin’s “digital gold” attributes increasingly well-deserved.

Historically, during recession phases, technological dividends diminish while commodity prices fluctuate dramatically, and capital turns to the virtual economy seeking higher returns. During this recession phase (2008-2015), not only did US stocks experience a long bull market, but Bitcoin also rose to prominence, beginning to attract worldwide attention.

As we enter the winter phase of the long-term economic cycle, stagflation risks become significant, the correlation between traditional safe-haven assets (such as gold, treasury bonds) and risk assets (stocks, real estate) weakens, and the global monetary system faces credit restructuring. The recent sharp decline in US stocks and gold repeatedly breaking new highs confirm this situation.

The previous four winter phases of long-term economic cycles (such as the Great Depression of 1929, the stagflation of the 1970s) were all accompanied by excessive money printing and reevaluation of physical assets’ value. This round of winter phase overlaps with the rise of the digital economy, providing fertile ground for new assets like Bitcoin.

FROM SPECULATION TO SAFE HAVEN: BITCOIN’S EVOLUTION

Bitcoin’s asset characteristics have evolved from a marginal speculative tool to an institutional allocation target. The strengthening safe-haven narrative is closely related to the economic environment under the long-term economic cycle.

From 2008 to 2015, during the recession phase of this economic cycle, technological innovation stagnated amid a crisis of trust. After the global financial crisis, the credit of traditional financial systems collapsed, with excessive money printing and debt problems becoming prominent.

Satoshi Nakamoto published the Bitcoin whitepaper in 2008, aiming to build a decentralized monetary system through blockchain technology, directly responding to the questioning of centralized finance during the recession. However, Bitcoin’s early stage was dominated by high-risk speculative properties, mainly used for experimental transactions among tech enthusiasts. Market volatility was extreme—for example, the 2011 Mt. Gox exchange theft incident caused a 94% price crash, and Bitcoin was viewed as a typical “risk appetite asset.”

At this time, due to limited market awareness, lack of institutional participation, regulatory uncertainty, and insufficient technological maturity, the development of its safe-haven narrative was restricted. During this period, Bitcoin reacted strongly to external policy and economic changes, characterized by low base and high volatility. Prices were dominated by technological events (such as exchange hacker attacks, regulatory uncertainty). A positive example was the 2013 Cyprus crisis pushing Bitcoin above $100, while a negative example was the 2017 ICO bubble driving the peak to $20,000, followed by China’s regulatory ban causing its price to halve.

The recession phase of the long-term economic cycle, with its transitional characteristics of technological revolution, resonated with the embryonic stage of Bitcoin’s underlying technology (blockchain), but had not yet formed a scale effect.

From 2015 to the present, as this economic cycle entered the winter phase, stagflation risks and safe-haven demands strengthened. Institutionalization and macro hedging needs brought Bitcoin into the mainstream market’s view.

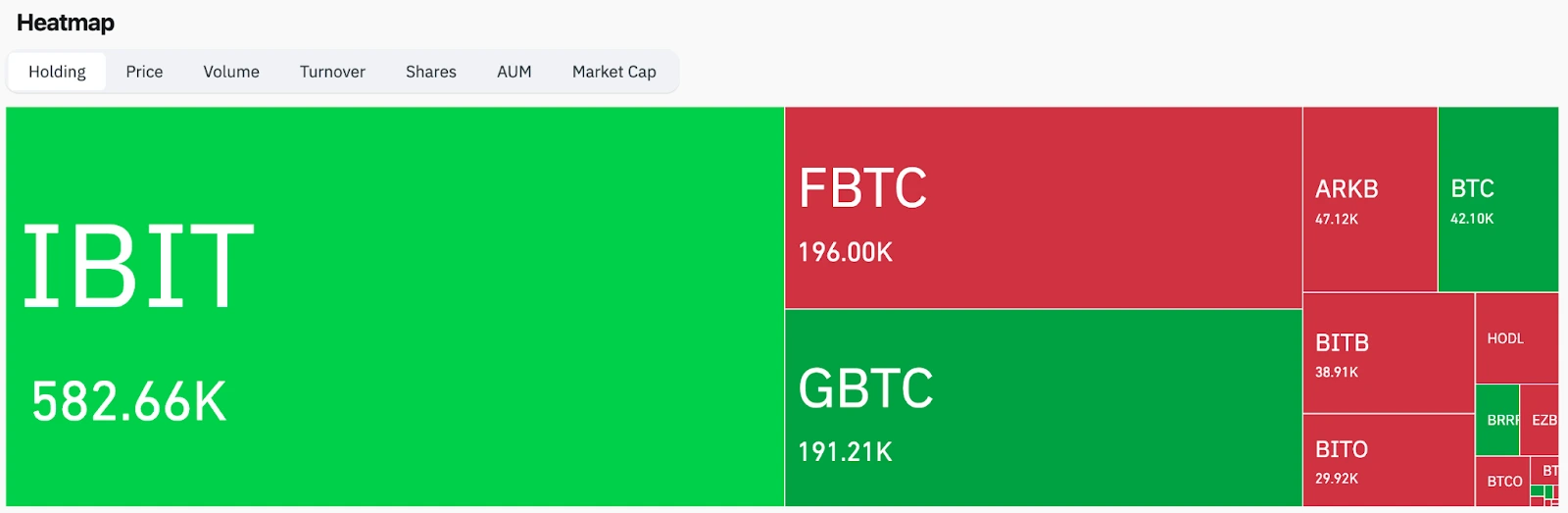

A landmark event was the entry of ETFs and institutions. The approval of US Bitcoin spot ETFs in 2024 marked its integration into the mainstream financial system, with capital inflow shifting from retail investors to long-term allocation capital.

Bitcoin ETF Holdings Heatmap

(Source: CoinGlass)

Safe-haven properties have gradually been verified. For example, during the 2023 SVB banking crisis and the simultaneous collapse across bond, stock, and currency markets triggered by the 2024 global trade war, Bitcoin demonstrated anti-risk capabilities differentiated from gold, with some capital viewing it as a “digital gold” alternative.

Additionally, Bitcoin’s halving mechanism (block rewards reduced to 3.125 BTC after the fourth halving in 2024) further compressed supply, strengthening scarcity and forming a hedge against inflationary pressures during the winter phase of the long-term economic cycle.

As Bitcoin has “evolved” to its current state, its safe-haven thesis has gradually gained support and recognition. Its absolute scarcity, with a 21 million coin limit design, contrasts with fiat currency excess and meets the demand for “hard currency” during winter periods of the economic cycle.

Decentralized risk resistance, independent of sovereign credit systems, avoids interference from geopolitics and monetary policy. Liquidity upgrades, mature derivative markets (such as futures and options), and global payment network expansion enhance its feasibility as a reserve asset.

In terms of policy catalysts, the Trump administration’s crypto-friendly policy expectations (such as supporting Bitcoin ETFs, relaxing regulations) have become core variables for the 2025 market. Global debt monetization, such as governments leveraging to support economies, has made Bitcoin and gold simultaneous hedging tools. The technological revolution transition that began in recent years, such as the integration of AI and blockchain (like decentralized computing networks), is seen as a core driver of the next Kondratieff prosperity, with Bitcoin benefiting from technological innovation expectations as an underlying asset.

Against today’s economic backdrop of global debt expansion, declining labor productivity, and intensifying geopolitical conflicts, Bitcoin’s positioning has upgraded from an “experimental asset” to “digital gold,” becoming a tool against inflation and sovereign currency abuse.

CAN BITCOIN’S SAFE-HAVEN STATUS FUEL THE NEXT BULL RUN?

As mentioned above, according to long-term economic cycle theory, the current global economy is in the winter phase of the fifth cycle. Although there is still debate about the division of these economic cycles, the current global economic performance indeed matches the characteristics of the winter phase, such as:

High debt and liquidity traps: Global debt has exceeded $350 trillion, corporate debt service pressure has intensified, and the Federal Reserve’s high interest rate policy has suppressed risk asset valuations.

Prominent stagflation risks: US tariff policies on China have pushed up prices (Bloomberg estimates that US household annual expenditures have increased by $4,000), while economic growth is weak, forming a typical stagflation environment of “high inflation + low growth.”

Technological revolution bottlenecks: The fifth round of technological revolution, dominated by artificial intelligence and new energy, has not yet formed industry-wide efficiency improvements. The marginal diminishing returns on capital have exacerbated market pessimism.

Historically, during winter phases of long-term economic cycles, the need for safe-haven assets becomes inevitable. This need essentially reflects capital’s distrust of traditional credit systems (fiat currencies, treasury bonds). The “decentralized anti-inflation” properties of gold and Bitcoin become core hedging tools.

Now gold has already broken historical highs. Looking at the lagged correlation between Bitcoin and gold, after gold creates historical highs, Bitcoin typically breaks through previous highs within 100-150 days. For example, after gold rose 30% in 2017, BTC reached $19,000; after gold broke $2,075 in 2020, BTC rose to $69,000. With gold breaking $3,500 in April 2025, if the pattern continues, Bitcoin will challenge historical highs in Q3-Q4 2025, with a current target range of $150,000-$180,000.

Bitcoin and Spot Gold Candlestick Patterns

(Source: Investing)

Looking at Bitcoin itself, institutional capital allocation has shifted, with ETF fund inflow effects evident. To date, total BTC ETF net asset value has reached $106 billion, accounting for over 5% of circulation, with institutional holding cost lines ($25,000) forming strong support. From the perspective of long-term holders (LTH) locking positions, current LTH selling pressure has decreased to 1.1%, controlling 77.5% of circulation, with ownership concentration reaching historical peaks, weakening short-term selling risks.

After this halving, daily new coin production has dropped to 450 coins, coupled with ETF daily average absorption (about 1,000 coins), creating a structural supply-demand imbalance. The expanding supply-demand gap drives prices higher long-term.

Overall, in the late winter phase of this Kondratieff cycle, an extended Bitcoin bull market can be expected, but a sustainable growth phase needs to overcome three major bottlenecks.

The Kondratieff winter phase is expected to last until 2029, with safe-haven demands and monetary excess (Federal Reserve may restart QE) forming long-term positives. The halving cycle and gold’s lagged resonance may make Q3 2025 a key breakthrough window.

The subsequent long-term steady bull market will require practical technological applications and broader ecosystem development. For example, the Ordinals protocol activates the Bitcoin network; if DeFi and NFT applications explode, they can attract incremental capital. Additionally, regulatory frameworks need clarification, with countries clearly defining Bitcoin’s legal status as “digital gold” to reduce policy black swan risks. Finally, retail investor confidence needs rebuilding, such as attracting conservative capital through reduced volatility (like stablecoin-linked derivatives).

During the Kondratieff winter phase, relying solely on safe-haven properties is insufficient to drive Bitcoin into an “ultra-fast bull market.” However, strategic reserves + ETFs + technological waves are establishing a foundation for sustained growth followed by an extended bull market.

The safe-haven narrative of the Kondratieff winter phase provides a historic opportunity for Bitcoin’s extended bull market. Whether it can transform into a sustainable growth phase depends on whether the technological revolution can break through the single narrative of “digital gold” to become the underlying infrastructure of a new economic paradigm.

As renowned economic cycle expert Zhou Jintao said: “Timing the Kondratieff cycle is the key to building wealth.” At the intersection of depression and recovery, Bitcoin stands at the crossroads of “Digital Gold 2.0” and “high-risk bubble.” Bitcoin and blockchain may become core drivers of the next Kondratieff recovery period. Only by embracing cycles and respecting risks can one capture the gifts of the era amid turbulence.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!