KEYTAKEAWAYS

- Crypto savings accounts offer significantly higher APYs than traditional banks, providing an attractive option for earning interest on digital assets.

- Understanding the balance between high returns and potential risks, including market volatility and platform stability, is crucial for crypto savings success.

- Diversifying your crypto investments across different assets and savings platforms can mitigate risks and enhance the growth of your digital asset portfolio.

CONTENT

Exploring cryptocurrency savings has become a favored approach for investors eager to secure passive income. This guide aims to equip crypto beginners with the knowledge to navigate the crypto savings sphere intelligently, focusing on effective strategies and understanding interest calculations.

CRYPTO SAVINGS: UNDERSTANDING THE BASICS

Crypto savings accounts allow you to earn interest on your digital assets by depositing them into a platform. Unlike traditional savings accounts, these can offer Annual Percentage Yields (APY) significantly higher, sometimes ranging from 10% to 15% or more.

CRYPTO SAVINGS: NAVIGATING THE PROS AND CONS

Pros

- High APY: The potential to earn high interest rates is a significant advantage over traditional savings accounts.

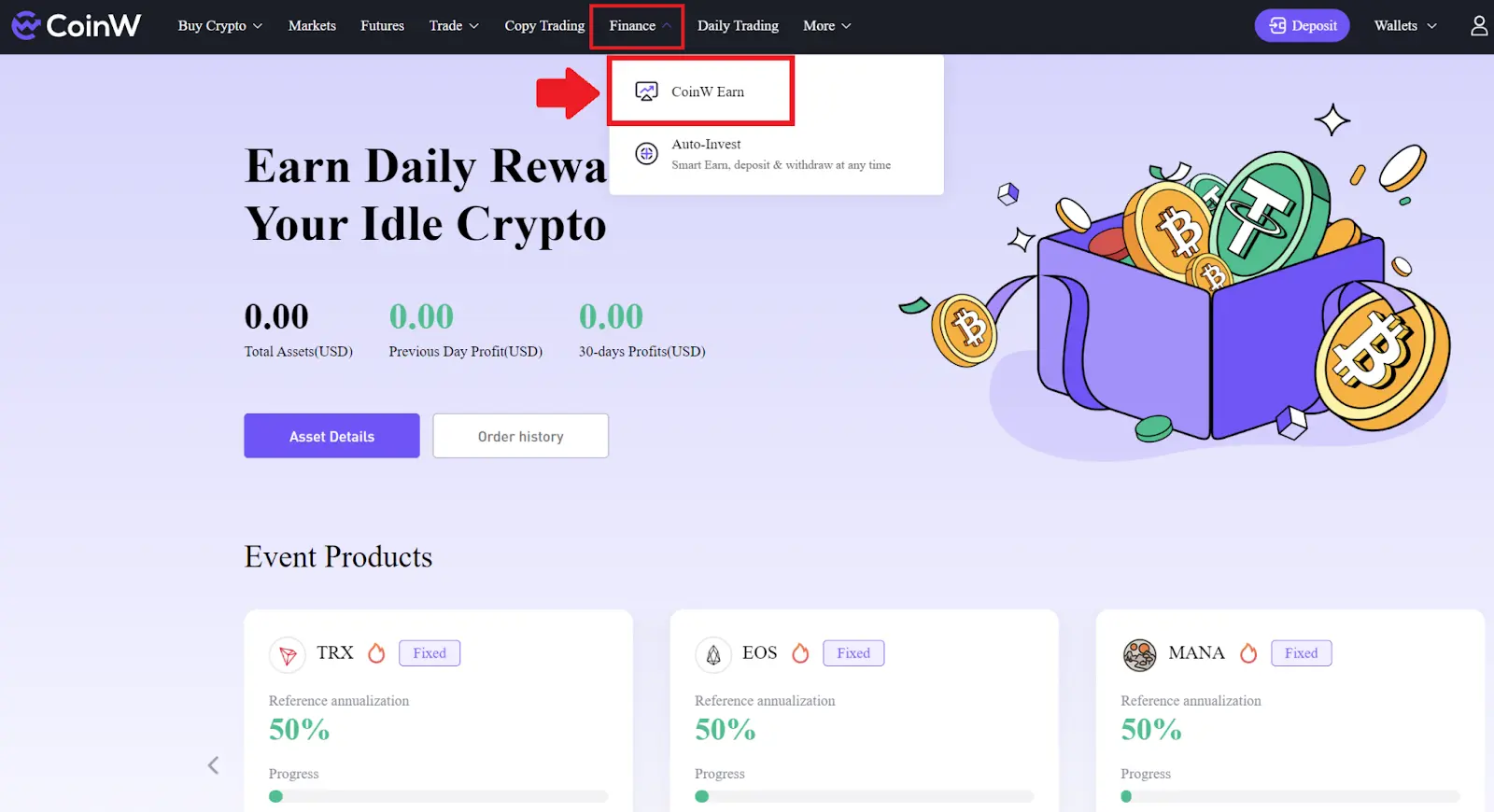

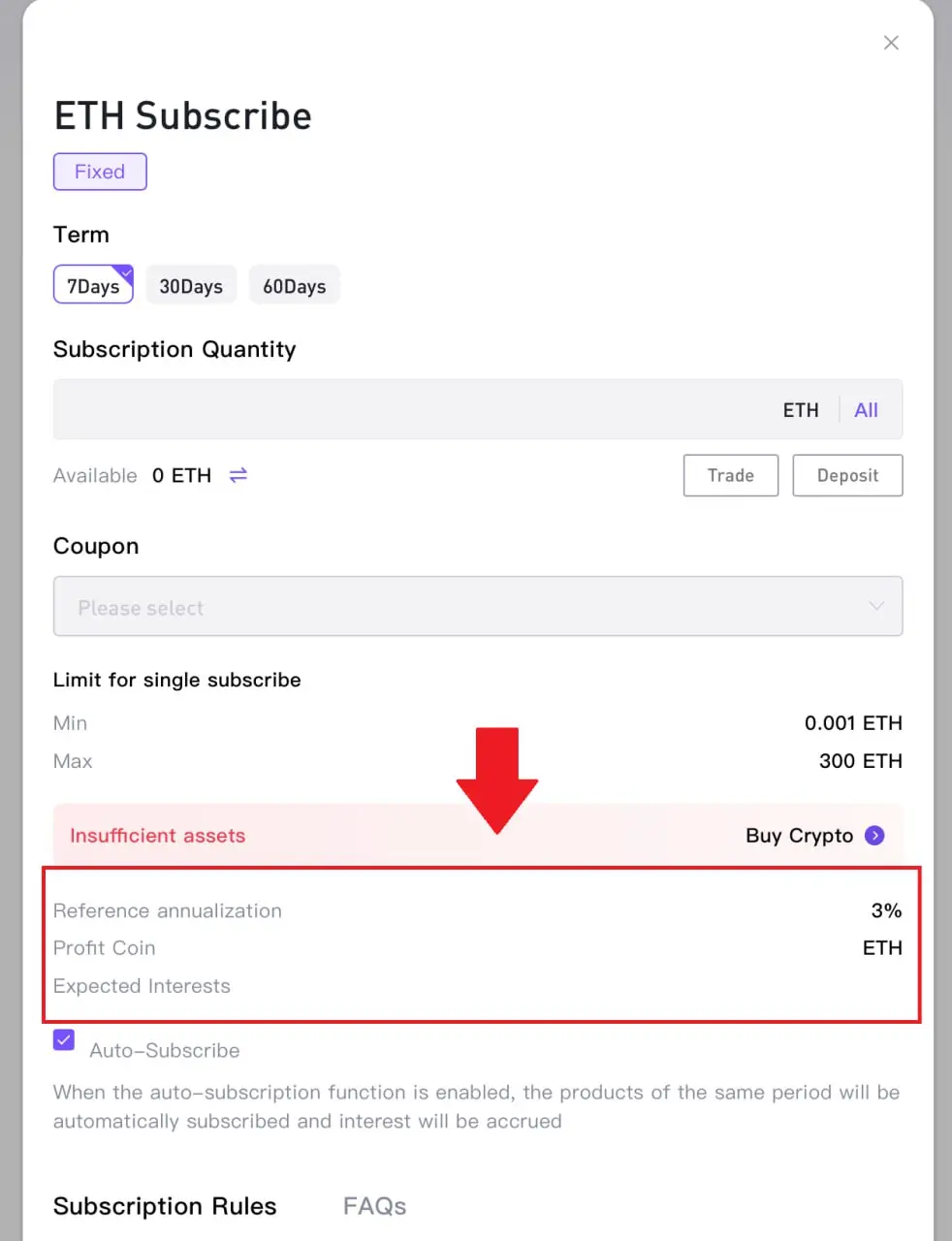

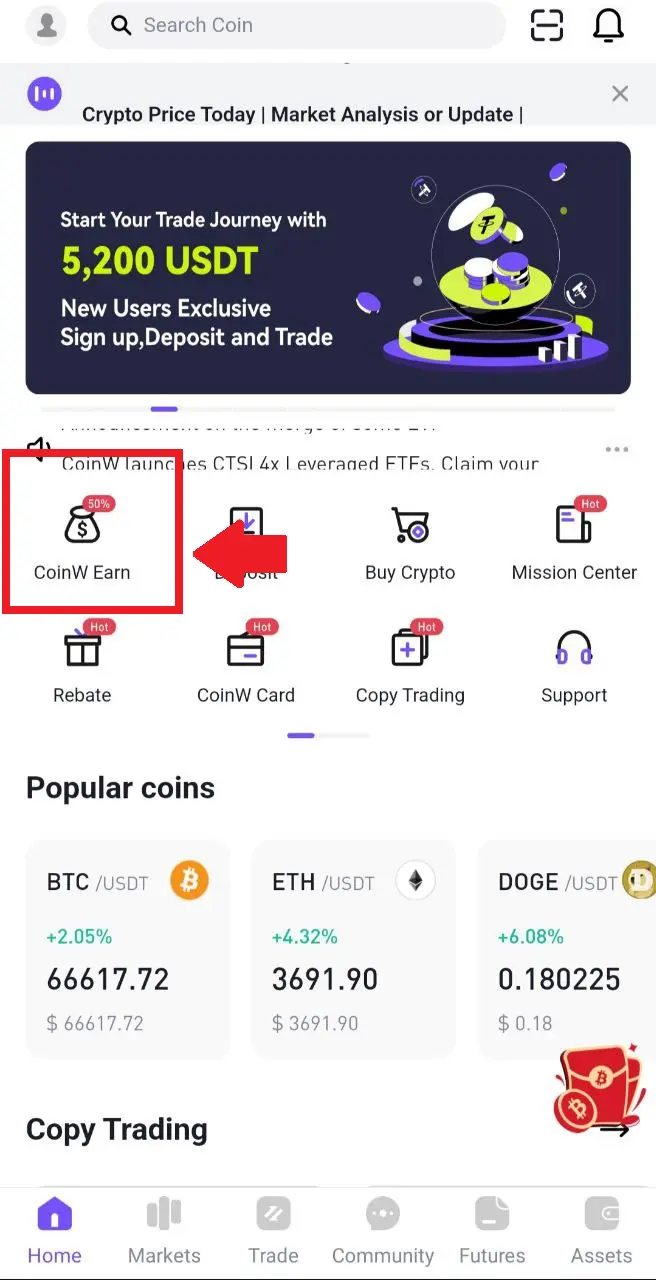

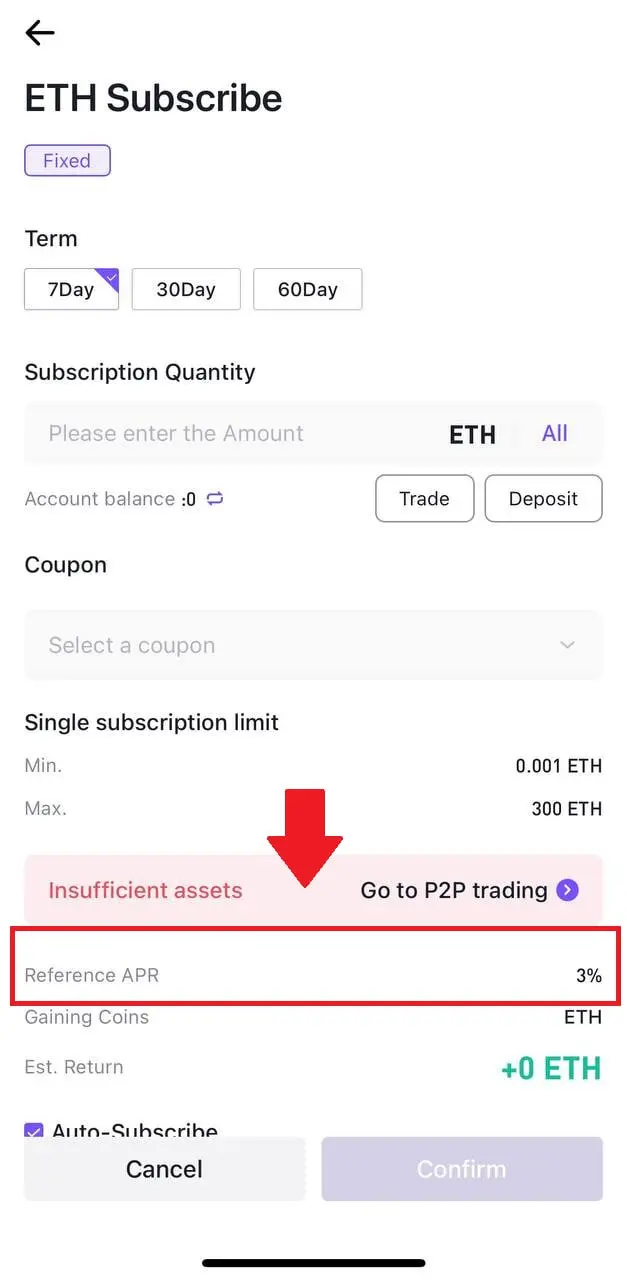

- Flexibility: Platforms like CoinW (as shown below) provide options for daily interest payouts, giving you greater control over your investment.

Cons

- Market Risk: The value of cryptocurrencies can be highly volatile, impacting the real value of your savings.

- Platform Stability: Historical instances such as Celsius and Voyager’s challenges underline the importance of choosing reputable platforms.

CRYPTO SAVINGS EXPANSION: STRATEGIES FOR GROWTH

- Interest Calculations: Understanding how your earnings are calculated is crucial. Most crypto savings accounts use a simple interest formula: Interest = Principal × Rate × Time, where the rate is the annual interest rate, and time is the period your crypto is saved.

For example:

Principal: 1 BTC

Interest rate: 5%

Term: 30 days

Interest = 1 * 0.05 * 30 = 1.5 BTC

Some platforms compound interest, which means your interest earnings also earn interest over time, potentially increasing your returns significantly.

Crypto Selection: Choose cryptocurrencies that align with your risk tolerance and investment goals. While stablecoins might offer lower volatility, altcoins could provide higher returns (with increased risk).

Diversification: Don’t put all your eggs in one basket. Consider spreading your investment across different cryptocurrencies and savings platforms to mitigate risk.

BEYOND CRYPTO SAVINGS ACCOUNTS: OTHER WAYS TO EARN PROFIT

While crypto savings accounts are popular, other methods also exist for earning from your digital assets:

- Staking: Lock up your crypto to support the operation of a blockchain network and earn rewards. Staking is particularly common with cryptocurrencies that use a Proof of Stake (PoS) consensus mechanism.

- Lending: For those seeking passive income, lending your crypto via DeFi platforms earns interest. This method generates interest from borrowers, leveraging smart contracts for secure and automated transactions without the need for traditional intermediaries.

CRYPTO SAVINGS: CHOOSING THE RIGHT PLATFORM

Factors to consider include:

- Interest Rates (APY): Look for competitive rates but also weigh other factors such as platform security and flexibility.

- Supported Cryptocurrencies: More options give you greater flexibility to diversify.

- Security Measures: Opt for platforms with robust security features and possibly insurance to protect your assets.

- Payout and Lock-in Terms: Consider how often interest is paid out and whether you can access your crypto easily if needed.

Note: The images showcase the interface of the CoinW platform. Although specific steps and terms can differ based on the platform utilized, the general process is similar.

PC

Mobile

CONCLUSION

Earning through crypto savings requires a balanced approach, combining knowledge of how interest is calculated with strategies for risk management. While the allure of high APYs is strong, understanding the risks and diversifying your investment can help secure and grow your digital asset portfolio responsibly.