KEYTAKEAWAYS

- Bitcoin and Ether experience a downturn amidst worries over U.S. stagflation, reflecting broader market concerns.

- Bitcoin experiences a decline as Hong Kong's newly listed ETFs fail to meet trading volume expectations.

- Despite facing federal prison for financial crimes, ex-Binance CEO's philanthropy and cooperation lead to a lenient sentence.

- MicroStrategy aims to create decentralized identities using Bitcoin's Ordinals Protocol, enhancing trust and security.

- JPMorgan maintains a cautious stance on crypto markets due to retail investors' sell-off dominance and lack of positive catalysts.

- KEY TAKEAWAYS

- TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

- TOP 5 CRYPTO BY MARKET CAP

- BITCOIN AND ETHER DECLINE AMID U.S. STAGFLATION CONCERNS

- BITCOIN FALLS AMID WEAK UPTAKE FOR HONG KONG ETFS

- LIGHT SENTENCE FOR EX-BINANCE CEO AMIDST GLOWING REPUTATION TESTIMONIALS

- MICROSTRATEGY DEVELOPING DECENTRALIZED IDENTITY SERVICE

- JPMORGAN CAUTIOUS ON CRYPTO MARKETS AMID RETAIL SELL-OFF

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In the Crypto Weekly Snapshot, we present to you 5 carefully selected stories from the crypto market and the latest crypto market data so you won’t miss anything important!

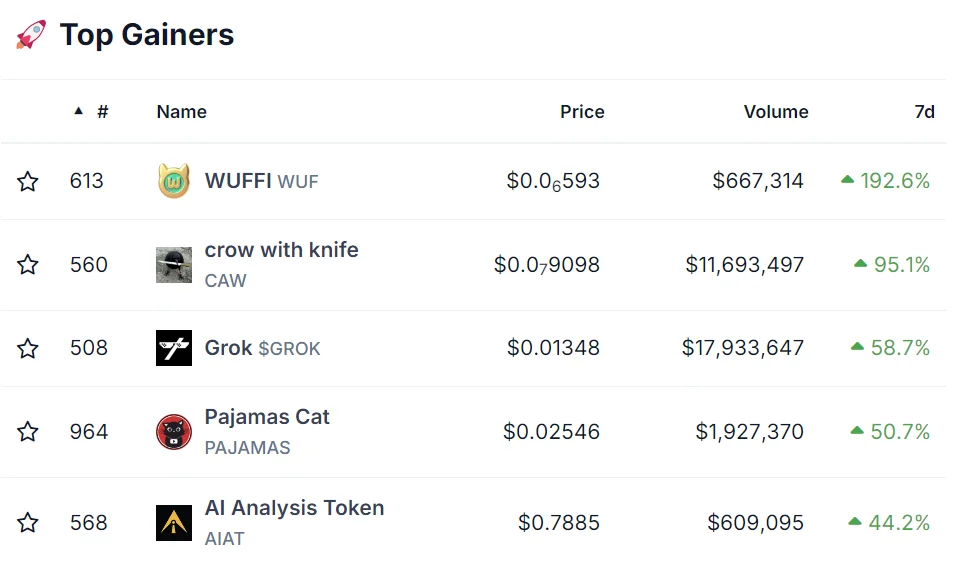

TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

(Source: CoinGecko)

- WUF +192.6%

- CAW +95.1%

- GROK +58.7%

- PAJAMAS +50.7%

- AIAT +44.2%

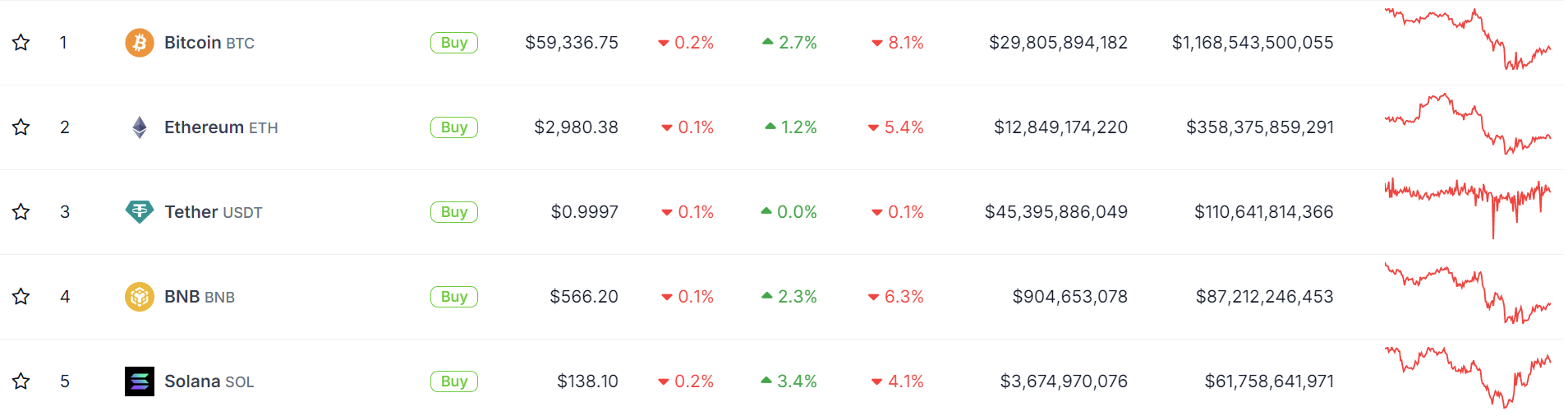

TOP 5 CRYPTO BY MARKET CAP

(Source: CoinGecko)

- BTC $1,168,543,500,055

- ETH $358,375,859,291

- USDT $110,641,814,366

- BNB $87,212,246,453

- SOL $61,758,641,971

Apr 29, 2024

BITCOIN AND ETHER DECLINE AMID U.S. STAGFLATION CONCERNS

Market Reaction to U.S. Economic Indicators

Bitcoin and ether faced downward pressure during the Asian trading session on Monday as concerns over U.S. stagflation resurfaced. At the time of reporting, Bitcoin registered a 2% decline, resting at $62,345, while Ether saw a 4% drop, trading at $3,170. The CoinDesk 20 (CD20), tracking the most liquid digital assets, mirrored the decline with a 4% decrease. Analysts attribute this trend to weaker-than-expected GDP data from the U.S., signaling a sluggish economy, coupled with persistent inflationary pressures highlighted by higher Core PCE figures. These factors have dampened expectations for potential Federal Reserve rate cuts.

Potential for Bitcoin ETF Approval in Australia

Amidst growing global interest in Bitcoin ETFs, Australia emerges as a potential frontier for their approval. Bloomberg reported that the first spot Bitcoin ETFs could receive regulatory approval in Australia by the year’s end. Entities such as DigitalX and VanEck have already submitted applications to list such funds with the Australian Securities Exchange, with another entity reportedly in the process. The Australian Securities Exchange, dominating 90% of the local market, holds significant influence over such regulatory decisions. Meanwhile, Cboe Australia received an application earlier this month from Monochrome Asset Management to list a spot BTC ETF, indicating increasing momentum in the region. This development follows Hong Kong’s recent approval of the first batch of Bitcoin ETFs, marking a significant step forward in the adoption of digital assets in the Asia-Pacific region.

Apr 30, 2024

BITCOIN FALLS AMID WEAK UPTAKE FOR HONG KONG ETFS

Market Reaction to Poor ETF Uptake

Bitcoin (BTC) encountered selling pressure during European trading hours following disappointing uptake for exchange-traded funds (ETFs) linked to bitcoin and ether in Hong Kong. The primary cryptocurrency by market value experienced a nearly 2% decline, dropping from $63,300 to under $61,000 within a span of 60 minutes, according to CoinDesk data. Ether (ETH), the second-largest cryptocurrency, also saw a 2.8% slip, reaching $3,066.

Underwhelming Performance of Hong Kong ETFs

Six ETFs recently launched for trading in Hong Kong on Tuesday fell considerably short of expectations, collectively amassing a mere $11 million in trading volume. This figure pales in comparison to the anticipated $100 million. Bitcoin ETFs comprised $8.5 million of the total volume, with ether ETFs contributing the remaining portion.

Comparison with U.S.-Based ETFs

The lackluster performance of Hong Kong’s ETFs is highlighted by the substantial contrast with U.S.-based spot BTC ETFs. On their first day of trading, U.S. spot BTC ETFs recorded a cumulative volume of $655 million. Since January 11, nearly a dozen spot BTC ETFs in the U.S. have attracted close to $12 billion in investor funds. However, recent inflows have decelerated, interrupting bitcoin’s upward trajectory.

Spot ETFs vs. Futures-Based ETFs

Spot ETFs offer investors exposure to cryptocurrency markets without requiring direct ownership. They are generally regarded as a preferable option compared to futures-based ETFs due to the absence of rollover costs associated with futures contracts.

This news article underscores the impact of underwhelming uptake for Hong Kong’s newly listed ETFs on Bitcoin’s market performance, shedding light on the contrasting dynamics between global ETF markets and their implications for cryptocurrency investors.

May 1, 2024

LIGHT SENTENCE FOR EX-BINANCE CEO AMIDST GLOWING REPUTATION TESTIMONIALS

Exceptional Reputation in Court

Former Binance CEO Changpeng Zhao, commonly known as CZ, found himself in a Seattle courtroom facing the consequences of financial crimes that resulted in a $4.3 billion fine for the cryptocurrency exchange. However, during the sentencing hearing, CZ’s reputation received widespread acclaim from Judge Richard Jones, defense lawyers, and even prosecutors. Despite the severity of the charges, CZ was portrayed as a philanthropist, a family man, and a first-time offender who voluntarily accepted responsibility for his actions.

Mitigating Factors Lead to Lenient Sentence

Judge Jones, in particular, was moved by the overwhelming support for CZ, evident in the numerous letters submitted by friends and family. Despite the gravity of the situation, Judge Jones expressed that CZ’s history and characteristics leaned towards mitigation rather than aggravation, ultimately resulting in a surprisingly light sentence of four months. This decision deviated significantly from the three years sought by prosecutors for violating the Bank Secrecy Act.

Mixed Outcome for CZ

While CZ’s reputation helped him secure a reduced sentence, he still faces four months in prison for failing to implement effective money-laundering controls during his tenure as CEO of Binance. Notably, CZ becomes the first CEO to be imprisoned under the Bank Secrecy Act, marking a significant development in cryptocurrency regulation.

— CZ 🔶 BNB (@cz_binance) March 3, 2023

Balance of Hubris and Cooperation

Throughout the court proceedings, CZ displayed a mixture of acknowledgement of his wrongdoings and anticipation of the lenient sentence. Despite his cooperation with the government and clean past, Judge Jones emphasized that wealth and power do not exempt individuals from following the law. While CZ’s hubris may have contributed to his downfall, his cooperation and efforts to rectify his mistakes were acknowledged in the sentencing decision. Despite the impending prison sentence, CZ’s philanthropic initiatives and global education projects suggest that his time behind bars may serve as a mere setback rather than the end of his journey.

May 2, 2024

MICROSTRATEGY DEVELOPING DECENTRALIZED IDENTITY SERVICE

MicroStrategy’s Venture into Decentralized Identity Services

MicroStrategy (MSTR), renowned as the largest corporate holder of bitcoin, has announced its foray into the development of a decentralized identity service leveraging Bitcoin’s technology. This move marks a significant expansion of MicroStrategy’s involvement in the cryptocurrency space beyond its substantial bitcoin holdings. Earlier this year, MicroStrategy rebranded itself as a “bitcoin development company,” signaling its intention to contribute to the advancement of the Bitcoin network through various means, including financial market activities, advocacy efforts, and innovative projects. The unveiling of “MicroStrategy Orange” underscores the company’s commitment to realizing this strategic shift.

MicroStrategy Orange: Trustless and Tamper-Proof Identities

MicroStrategy Orange, as described by founder Michael Saylor during the company’s Bitcoin For Corporations conference, aims to offer decentralized identities characterized by trustlessness, tamper-proof attributes, and longevity. This initiative signifies MicroStrategy’s endeavor to harness blockchain technology to enhance security and privacy in digital interactions. The decentralized identity service provided by MicroStrategy Orange enables users to issue decentralized identifiers (DIDs), ensuring pseudonymity similar to the anonymity inherent in bitcoin transactions. Leveraging Bitcoin’s Ordinals Protocol, MicroStrategy Orange empowers users to store and communicate information securely on individual satoshis, the smallest unit of bitcoin.

Practical Implementation: “Orange For Outlook”

MicroStrategy has already demonstrated the practicality of its decentralized identity service through the development of “Orange For Outlook.” This application integrates digital signatures into emails, enabling recipients to verify the identity of the sender securely. Such applications showcase the real-world utility of MicroStrategy’s innovative solutions. With holdings of 214,400 BTC, valued at approximately $10 billion, MicroStrategy reaffirms its position as a major player in the cryptocurrency space. This significant investment underscores the company’s confidence in the long-term potential of bitcoin and its commitment to driving innovation within the digital asset ecosystem.

Apr 19, 2024

JPMORGAN CAUTIOUS ON CRYPTO MARKETS AMID RETAIL SELL-OFF

JPMorgan’s Cautious Outlook

Wall Street giant JPMorgan (JPM) remains cautious about cryptocurrency markets in the near term, citing a dearth of positive catalysts and the diminishing retail impulse. The bank observes that retail investors have been selling off both crypto and equity assets throughout April, contributing to the decline in spot bitcoin exchange-traded funds (ETFs).

Retail Dominance in Sell-Off

Cryptocurrency markets have witnessed significant profit-taking in recent weeks, with retail investors playing a prominent role in the sell-off compared to institutional investors. Bitcoin experienced a 16% decline in April, marking the largest monthly drop since June 2022. Additionally, U.S.-based spot bitcoin ETFs saw their fastest pace of outflows on record, with a cumulative net outflow of $563.7 million, the largest since their inception.

Institutional Trading Dynamics

While retail investors have been driving the recent sell-off, JPMorgan notes that institutional investors, particularly momentum traders such as commodity trading advisors (CTAs) and quantitative funds, have been capitalizing on previous extreme long positions in both bitcoin and gold. However, the reduction in positions by other institutional investors outside quantitative funds and CTAs has been more limited, as indicated by analysis of the futures market.

Persistent Headwinds in the Market

Despite the sell-off driven by retail investors, JPMorgan identifies several persistent headwinds in the cryptocurrency market. These include elevated positioning, high bitcoin prices compared to gold and estimated bitcoin production costs, and subdued crypto venture capital (VC) funding. These factors contribute to the cautious outlook maintained by the bank on crypto markets in the near term.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!