KEYTAKEAWAYS

-

The cryptomarketcorrection in December 2025 was driven by macro liquidity shifts, not market panic.

Changes in global funding conditions, especially the weakening of carry trade dynamics, forced institutions to reduce risk exposure across crypto and other high beta assets.

-

Stablecoin regulation reshaped capital efficiency and accelerated the cryptomarketcorrection.

By defining stablecoins as payment tools rather than yield assets, new rules reduced on chain returns, lowered leverage appetite, and slowed DeFi activity.

-

The cryptomarketcorrection signals a structural transition rather than the end of the crypto cycle.

Crypto markets are becoming part of the global macro system, where interest rates, regulation, and capital structure matter more than short term narratives.

- KEY TAKEAWAYS

- HOW GLOBAL LIQUIDITY SET THE STAGE FOR A CRYPTOMARKETCORRECTION

- REGULATION AND CAPITAL EFFICIENCY DURING THE CRYPTOMARKETCORRECTION

- PRICE ACTION AND LEVERAGE UNWINDING IN THE CRYPTOMARKETCORRECTION

- ASSET DIVERGENCE REVEALS A CHANGING CYCLE

- THIS CRYPTOMARKETCORRECTION WAS A RESET, NOT AN ENDING

- DISCLAIMER

- WRITER’S INTRO

CONTENT

The crypto market entered a sharp cryptomarketcorrection in December 2025, but the reasons behind this move were widely misunderstood.

Many observers described the decline as fear driven or sentiment based. Prices fell across major assets, volatility increased, and liquidation headlines dominated social media. Yet this interpretation misses the deeper forces at work. What the market experienced was not a sudden loss of confidence. It was a systematic adjustment to changes in global liquidity, regulatory structure, and capital efficiency.

This cryptomarketcorrection followed Bitcoin’s all time high earlier in the year. Instead of continuation, the market slowed, then gradually reversed. Importantly, there was no single event that triggered mass selling. No exchange collapse. No protocol failure. No geopolitical shock tied directly to crypto.

That absence of a clear catalyst is precisely what makes this correction significant. It signals a market that is no longer driven purely by narrative cycles. Crypto has become deeply connected to global macro conditions. Funding currencies, interest rate expectations, and regulatory frameworks now shape price behavior in ways that were rare in earlier cycles.

Understanding this cryptomarketcorrection requires stepping away from charts and headlines. It requires looking at how capital actually moves, how risk is managed, and how crypto assets are increasingly treated as part of a broader financial system rather than an isolated ecosystem.

HOW GLOBAL LIQUIDITY SET THE STAGE FOR A CRYPTOMARKETCORRECTION

The Japanese Yen and Global Risk Funding

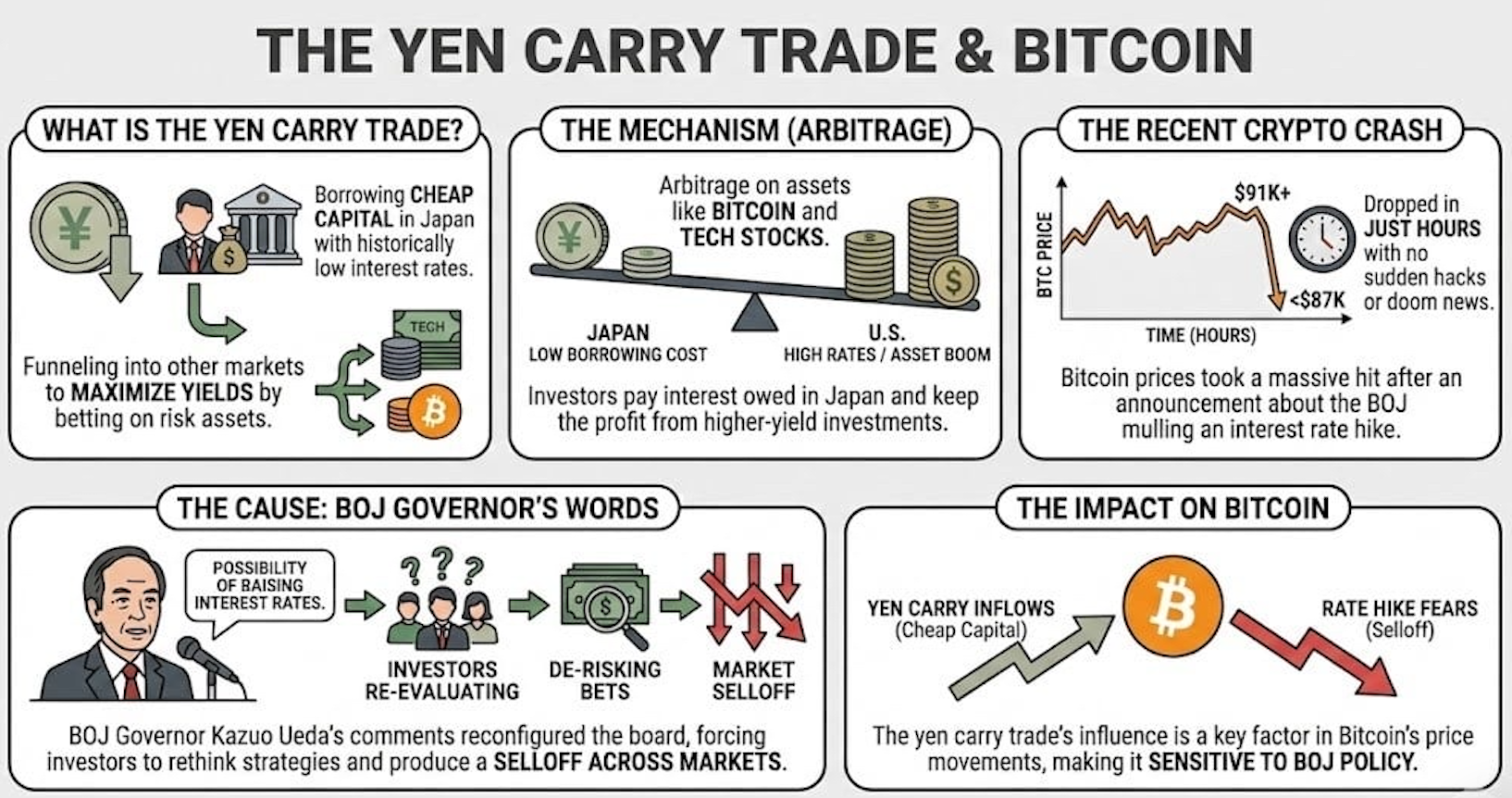

One of the least discussed drivers of the cryptomarketcorrection was the role of the Japanese yen.

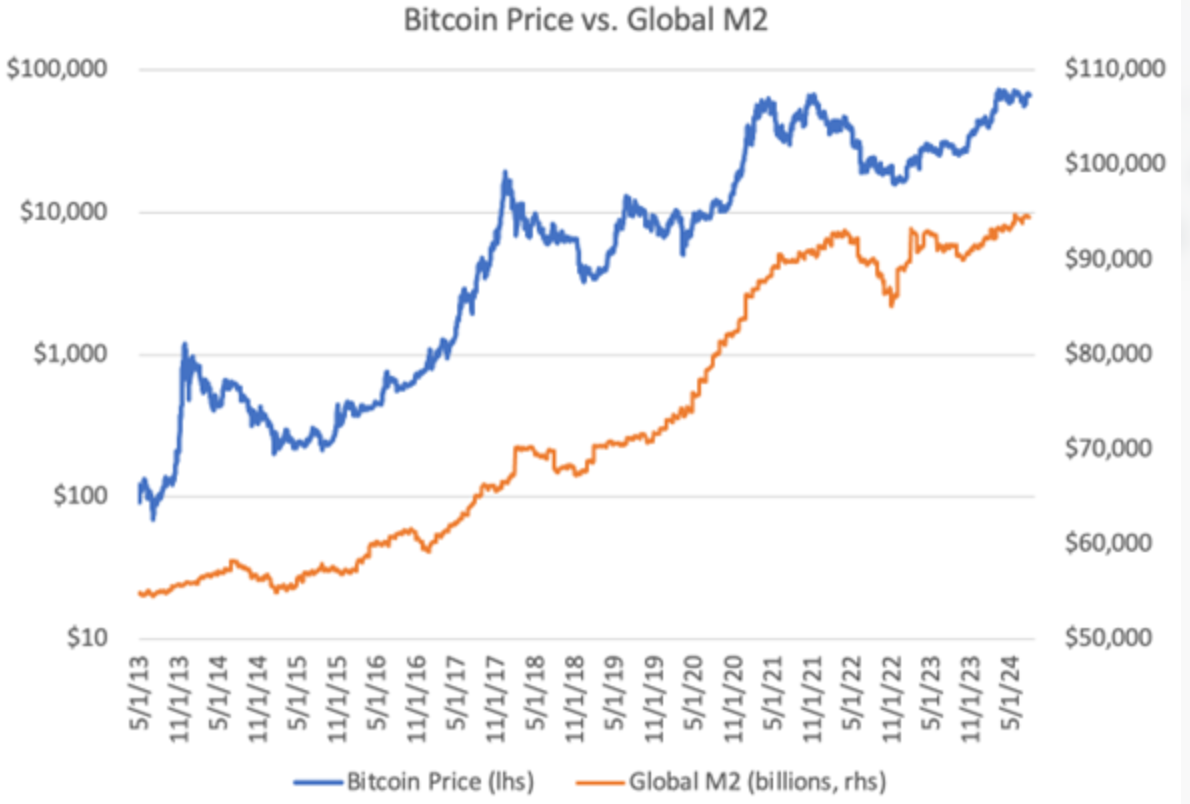

For years, the yen functioned as a primary funding currency for global risk assets. Institutions borrowed in yen at extremely low cost and deployed that capital into higher return assets. US equities, technology stocks, and crypto markets all absorbed this liquidity.

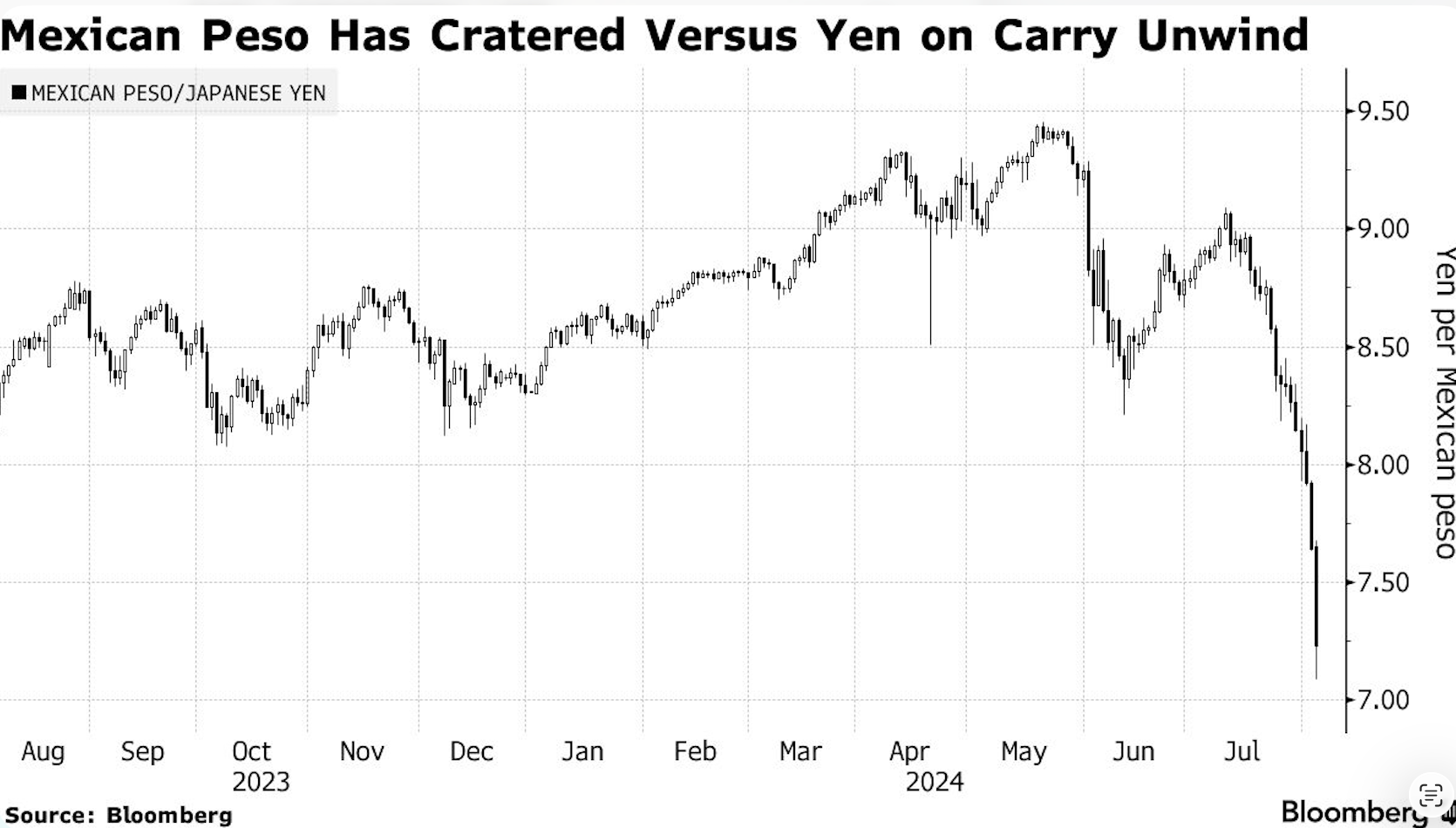

In 2025, that structure began to unwind. Inflation in Japan remained persistent. Wage growth strengthened. Expectations for tighter monetary policy became increasingly certain rather than speculative.

As the yen strengthened, carry trade economics deteriorated. Borrowing costs rose. Currency risk increased. Risk models reacted automatically. Positions were reduced across global portfolios.

Crypto assets did not sit outside this process. Bitcoin in particular was treated as a liquid risk asset rather than a hedge. Because it trades continuously and offers deep liquidity, it became one of the easiest assets to sell during rebalancing.

This liquidity driven adjustment explains why the cryptomarketcorrection unfolded gradually rather than violently. Capital moved out not because of fear, but because funding conditions changed.

Why This Was Not a Crypto Specific Event

Another key insight from this phase of the cryptomarketcorrection is that crypto was not uniquely targeted.

The same funding pressures affected other high risk assets. Technology stocks experienced similar drawdowns. Correlations between crypto and broader risk markets increased.

This alignment signals maturity. Crypto is no longer priced in isolation. It reacts to the same macro forces that shape global capital flows.

The correction was not a rejection of crypto. It was an acknowledgment that crypto now lives inside the global financial system.

REGULATION AND CAPITAL EFFICIENCY DURING THE CRYPTOMARKETCORRECTION

Stablecoin Rules Changed Market Assumptions

While global liquidity explained why capital needed to reduce risk, regulation explained why capital hesitated to return.

In 2025, new stablecoin regulations in the United States provided long awaited clarity. However, this clarity came with constraints that reshaped on chain finance.

Stablecoins were formally defined as payment instruments. Issuers faced stricter reserve requirements. Most importantly, stablecoins were no longer allowed to offer yield to end users.

This rule quietly dismantled a core assumption of DeFi. Stablecoins had functioned as productive capital. Yield was embedded across lending, liquidity provision, and structured strategies.

When yield disappeared, capital behavior shifted. Risk tolerance declined. Leverage contracted. Activity slowed.

This regulatory shift did not kill innovation. But it forced the market to reassess capital efficiency. During the cryptomarketcorrection, this reassessment amplified downside pressure.

Why Capital Became More Selective

The new regulatory environment introduced higher friction. Compliance costs increased. Growth became slower but more controlled.

As a result, investors became more selective. Capital concentrated in assets with simpler risk profiles and clearer regulatory positioning.

This is a natural phase in market evolution. The cryptomarketcorrection reflected capital learning how to operate under new rules rather than abandoning the space.

PRICE ACTION AND LEVERAGE UNWINDING IN THE CRYPTOMARKETCORRECTION

Derivatives and Forced Positioning

Price behavior during the cryptomarketcorrection revealed important structural signals.

Derivatives markets saw heavy liquidations in mid December. Long positions dominated the unwind. This indicates that optimism had been crowded rather than fear spreading suddenly.

When key support levels broke, risk systems forced deleveraging. This was not an aggressive short attack. It was mechanical position cleanup.

Such events often mark the transition from speculative excess to more sustainable positioning.

Sentiment Indicators Told a Delayed Story

Fear indicators dropped sharply. Search interest around crypto bear markets surged. Yet sentiment followed price rather than leading it.

Market structure remained intact. Trading continued. Liquidity thinned but did not disappear.

This distinction matters. The cryptomarketcorrection was controlled. It was not systemic failure.

ASSET DIVERGENCE REVEALS A CHANGING CYCLE

Why Bitcoin Behaved Differently

During the cryptomarketcorrection, Bitcoin showed relative resilience.

This was not due to upside narratives. It was due to structural simplicity. Bitcoin carries no protocol dependency. No yield expectations. No governance risk.

For institutions, it remains the cleanest crypto exposure. In a risk reduction phase, that clarity matters.

Ethereum and the Repricing of Financial Activity

Ethereum faced more pressure. This was not a judgment on its technology. It reflected reduced on chain activity and lower financial throughput.

As yields declined and DeFi slowed, Ethereum’s valuation adjusted accordingly.

This divergence highlights an important shift. Crypto cycles are no longer driven purely by internal events. Macro conditions and regulation now shape relative performance.

THIS CRYPTOMARKETCORRECTION WAS A RESET, NOT AN ENDING

The cryptomarketcorrection of December 2025 was not a collapse. It was a recalibration.

Markets adjusted to tighter liquidity, clearer rules, and lower capital efficiency. Leverage declined. Expectations reset. Noise faded.

Crypto did not fail. It adapted.

The next phase will favor assets that function well under these new conditions. Simpler risk structures. Regulatory alignment. Sustainable capital use.

This cryptomarketcorrection was not the end of a cycle. It was the beginning of a more mature one.

Read More:

Bank for International Settlements.

Federal Reserve Economic Data.