KEYTAKEAWAYS

- Ondo Finance uses U.S. Treasury bonds and money market funds, leveraging Reg D/Reg S compliance, to provide secure, low-risk, yield-bearing tokenized assets with global accessibility.

- Its multi-phase strategy spans OUSG, USDY, OMMF launches to Ondo Chain, embedding KYC/AML and whitelist controls directly at the blockchain protocol layer for compliance scalability.

- By deeply integrating with public chains and DeFi protocols, Ondo ensures tokenized assets are composable, liquid, and usable, bridging traditional finance and decentralized ecosystems worldwide.

- KEY TAKEAWAYS

- 7. Ondo Finance Investment Risk Assessment: Comprehensive Analysis of Regulatory, Technical, Market and Competitive Risks

- 8. Comparison of RWA Development in China and the United States: Analysis of the Differences between Ondo Finance and Chinese Local Projects

- 9. Analysis of the global RWA market landscape: Comparison of the three major development models of the United States, China, and the developing world

- 10. Ondo Finance Investment Value Summary: Institutional Investor Allocation Recommendations and Market Outlook Forecast

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Ondo Finance leads U.S. RWA tokenization with compliant U.S. Treasury-backed assets, deep DeFi integration, and Ondo Chain infrastructure—offering a model for global on-chain finance and China’s RWA evolution.

7. Ondo Finance Investment Risk Assessment: Comprehensive Analysis of Regulatory, Technical, Market and Competitive Risks

Although Ondo has taken the lead in establishing brand and market advantages in the field of compliant asset tokenization, its future development still faces multiple uncertainties, which may affect its business at different stages.

Overall, risks can be divided into four main dimensions: regulation, market, technology and competition.

7.1 Regulatory Risk: Cross- jurisdictional Uncertainty

Ondo’s core advantage lies in its strict compliance with securities and financial regulations in the United States and some offshore markets, which is both a moat and a potential limitation.

On the one hand, the policies of the U.S. Securities and Exchange Commission (SEC) and other regulatory agencies regarding tokenized securities and money market funds are still evolving, and future rule adjustments may lead to increased compliance costs or product restrictions.

On the other hand, Ondo’s cross-border business needs to comply with the compliance requirements of multiple jurisdictions . Any tightening of regulations in any major market will directly affect its asset liquidity.

For example, some regions may restrict the cross-border transfer of on-chain assets or require additional local custody and approval processes.

7.2 Liquidity Risk: Imbalance between Market Depth and User Structure

While products like OUSG and OMMF are attractive to institutional investors, their trading activity is still limited by the investor base. Institutional investors hold positions for a long period of time, which can lead to insufficient immediate liquidity in the secondary market. When the market experiences significant volatility or redemptions, Ondo needs to ensure that the liquidation efficiency of the underlying off-chain assets is synchronized with the recovery of on-chain tokens. Otherwise, the price may deviate from the net asset value (NAV).

In addition, the DeFi protocol’s reliance on collateral liquidity also means that once the liquidity of Ondo assets dries up, it will affect the stability of the entire ecosystem.

7.3 Technical and Security Risks: Smart Contracts and Cross-Chain Infrastructure

Ondo’s ecosystem relies on smart contracts to execute asset transfers, whitelist management, and profit distribution. Once a contract has a loophole or is attacked, it may directly lead to financial losses.

Especially in the process of cross-chain asset transfer, cross-chain bridges are known to be high-risk security points. Many cross-chain hacking incidents in history have caused hundreds of millions of dollars in losses.

Although Ondo plans to launch its own Ondo Chain in the future and embed compliance controls into the chain layer , this also means that the technology will face the dual pressure of performance verification and security audits in the early stages of launch.

7.4 Competitive Risk: Track Concentration and Differentiation Barriers

The RWA (real-world asset) tokenization track is heating up rapidly, with existing traditional financial institutions (such as BlackRock’s BUIDL) and emerging on-chain financial projects (such as Matrixdock and Backed Finance) all competing for the compliant asset market.

As more competitors enter the market, Ondo’s leading position in product pricing, profit distribution and compliance advantages may be weakened.

In addition, if the industry as a whole shifts towards a decentralized, permissionless asset issuance model, Ondo’s existing high compliance threshold strategy may lose its appeal in some markets.

Overall, Ondo’s risks do not come from a single factor, but rather are dynamic challenges posed by compliance , market, technology and strategic execution.

In the future, Ondo needs to maintain its compliance moat while continuously optimizing liquidity management, strengthening technical security, and maintaining product and strategic flexibility amidst a changing competitive landscape in order to consolidate its core position in the global RWA ecosystem.

8. Comparison of RWA Development in China and the United States: Analysis of the Differences between Ondo Finance and Chinese Local Projects

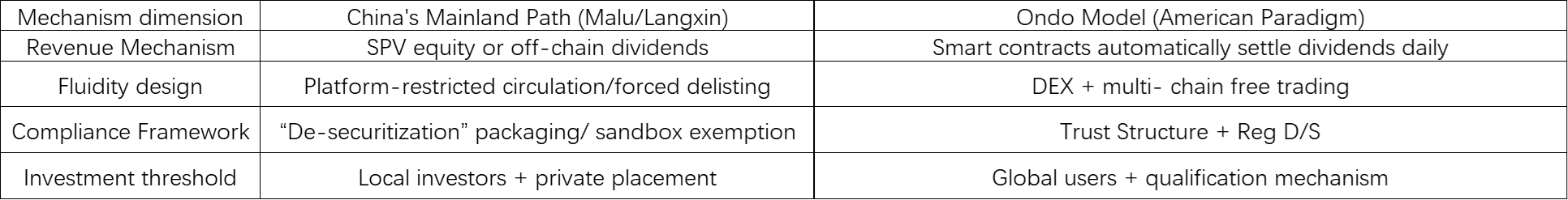

8.1 Difference Analysis

8.1.1 Differences in asset types and starting points

China’s path : Focus on existing real economy assets, especially non-standard or semi-standardized assets in agriculture, industry, and infrastructure.

For example, the Malu Grape Project realizes digital rights mapping through agricultural asset rights confirmation and NFT; Langxin Technology puts industrial assets such as charging piles on the chain using an SPV structure.

The Ondo approach : Directly select highly standardized and liquid assets in the international financial market (such as U.S. Treasury bonds and money market funds) as your entry point. These assets have mature off-chain legal definitions, pricing mechanisms, and liquidity channels, making the trust cost of on-chain low.

8.1.2 Compliance Framework and Regulatory Approach

China’s approach : Relying on the local regulatory system, when the compliance framework is not yet fully defined, it often adopts a “gray compliance” or “industry pilot” model. For example, it leverages the policy flexibility of local financial supervision or industrial parks to promote pilot projects. The core principle is “first implementation, then adjustment,” and strictly controls the circulation radius of the chain.

Ondo’s approach : Reg D/Reg S clearly targets investor types and circulation scope, ensuring full compliance from the initial offering . Ondo also maintains compliance in cross-chain and DeFi integration through AML/KYC whitelisting and on-chain address controls .

8.1.3 Integration of blockchain technology and ecosystem

China’s approach : Consortium or permissioned blockchains are often used. Assets on-chain are primarily used for traceability, ownership confirmation, and intra-industry settlement, lacking deep integration with open DeFi protocols. Cross-chain circulation and global transactions are rare.

Ondo Path : Issue tokenized assets directly on public chains (Ethereum, Polygon, Solana) and deeply integrate with mainstream DeFi protocols to enable high-frequency use cases such as on-chain lending, liquidity mining, and cross-chain bridge transfers . Future plans include seamlessly integrating circulation and regulation through built-in compliance controls within the Ondo Chain .

8.1.4 Ecological Expansion and Capital Logic

China’s path : Rely more on resource binding between upstream and downstream industrial chains and local governments, and promote asset digitalization through industrial finance and supply chain finance , but there is limited room for capitalization and liquidity improvement.

Ondo Path : Relying on the network effects of the global capital market and DeFi network, distribute assets to multiple public chains through standardized interfaces and cross-chain infrastructure , expanding the potential user base and capital acceptance.

8.2 Summary of Differences

After analyzing Ondo’s on-chain path and comparing it with China’s RWA on-chain case, we can clearly see the differences between different markets in regulatory frameworks, technical implementation paths, and ecological collaboration models.

China’s RWA projects – especially the agricultural and industrial asset chain represented by Malu Grape and Langxin Technology – are more localized explorations under strict regulatory constraints. Their technology and business logic must be deeply coupled with the existing industrial chain, local financial environment and policy orientation.

In contrast, Ondo relies on the compliance path of the US and offshore financial systems, and has greater freedom and global characteristics in product design, investor coverage and liquidity acquisition methods.

The distinctive feature of China’s path is the dual-track model of “off-chain governance + on-chain property rights confirmation”.

The asset side often relies on offline title confirmation and endorsement from traditional financial institutions, while the on-chain part serves more as a supplementary tool for title confirmation and information disclosure.

This model is particularly common in non-standard asset areas such as agriculture. It can solve data authenticity and regulatory compliance issues , but it has natural limitations in terms of liquidity, cross-border transactions and secondary market scalability.

Ondo’s environment allows assets to complete the entire process from ownership confirmation, issuance to circulation directly on the chain, and efficiently distributes liquidity to the global market through DeFi protocols, cross-chain bridges and stablecoin settlement systems.

Chinese projects are significantly less integrated with DeFi than Ondo.

Even for an industrial asset issuer like Langxin Technology, which already has strong digital capabilities, its tokenized products are still mainly targeted at closed and targeted investor groups. It lacks an open liquidity pool design and has not introduced tools such as on-chain lending, derivatives or structured returns.

This is because under China’s regulatory system, the introduction of open DeFi modules often touches policy red lines, especially those involving leverage, anonymous capital flows and cross-border transfers.

Ondo, by integrating with decentralized lending protocols such as Flux, directly incorporates its tokenized assets into the underlying asset pool of the on-chain financial market, greatly expanding capital efficiency.

In addition, China’s RWA projects tend to follow the path of “local pilot – industry replication – national promotion” in terms of compliance and market expansion .

This approach involves first validating feasibility within a limited policy sandbox and then gradually expanding to larger scale. This robust but time-consuming model is subject to local resource disparities and poses significant challenges in asset standardization.

Ondo chose to initially launch its offering globally, tiering its coverage to investors in different regions using regulatory frameworks like Reg D and Reg S to ensure access and liquidity in major global capital markets. This top-down globalization strategy enabled it to rapidly build asset size and brand influence in a short period of time.

Overall, the differences between Ondo and China’s RWA paths are mainly reflected in four aspects: regulatory openness, depth of integration with DeFi, asset standardization capabilities, and market coverage rhythm .

has formed a highly scalable product strategy matrix through open finance and cross-chain interoperability , while the latter has steadily promoted the implementation of digital assets while prioritizing compliance and managing risks . This difference stems from differences in policy and market environments, and also reflects the fundamental divergence in the two approaches’ approaches to ecosystem development.

9. Analysis of the global RWA market landscape: Comparison of the three major development models of the United States, China, and the developing world

In RWA’s global narrative, the reality is more divided than imagined: on one side is the institutional home turf led by the on-chainization of U.S. debt, on the other side is the dilemma of property rights under Chinese-style exploration, and in the middle is the stablecoin experiment, weak fiat currency and on-chain financial enlightenment that the third world is experiencing.

This is not a global unified market evolving in parallel, but rather three institutional logics colliding at the boundary.

9.1 World 1 : “Institutional Export-Oriented On-Chain Assets” centered on the United States

The Ondo case is undoubtedly a typical example of “institutional export-oriented RWA”.

In this world, the underlying assets are clearly legal (such as T-Bills), clearing institutions are regulated (such as Ankura Trust), the token issuance path is the product of compliance exemptions (Reg S), and on-chain protocols and governance structures are “free to evolve” within this institutional framework.

This means: America’s on-chain finance is not a decentralized utopia, but an on-chain extension of institutional forces .

ONDO, USDY and Flux are merely re-expressions of financial structures in on-chain scenarios, and their essence is still an organic part of the old system.

This is why Ondo has received support from institutions such as BlackRock – it has never really “derailed”, it has just changed its operating track.

9.2 World II: China’s On-chain Restricted Finance Experiment

In contrast, China is conducting a “compliance – led structural mapping experiment.”

Whether it is Malu’s property rights mapping of non-standard agricultural products or Langxin’s on-chain debt restructuring of industrial equipment, the essence is to conduct local tests of technical and structural possibilities under the premise of not giving up financial sovereignty.

The dilemma here is obvious: there is a lack of “autonomy” on the chain, a governance structure is absent, asset valuation lacks liquidity support, and product design often remains at the token level .

Most projects run in a centralized logic, and the chain is just a mirror channel for distributing tools or asset information.

But this does not mean failure.

This path still has institutional resilience, especially under specific industrial policies, municipal bond reform or agricultural product storage and purchase mechanisms, it has the “micro-scenario effectiveness” to be implemented.

The key lies in whether these structures can be further productized, governance-structured, and connected to external capital liquidity on the chain.

9.3 World III: Stablecoin Financial Enlightenment in the Third World

A world that is more easily overlooked is the Latin American, Central Asian, and Southeast Asian markets where USDY, USDT, and USDC are “subtly changing.”

There, RWA is not some grand technological concept, but a response to users’ rigid demand for stable income, secure payment and financial identity.

For example, Ondo’s USDY has been connected to the fiat-onramp in Mexico, becoming a substitute for the US dollar for some users; USDT/USDC is a means of wage payment and corporate liquidation in Argentina and Lebanon.

These scenarios may be low-frequency and atypical, but they constitute the simplest reality of RWA: the real owners of “real-world assets” may not be the liquidity players on the chain, but those who pursue stable value under systemic poverty.

9.4 A Convergence Point: The Chinese Proposition of Mechanism Transplantation

So, can China find its place among the three tensions?

The answer may be a question of institutional choice rather than technology or product.

We see that if Malu-style non-standard mapping wants to break through liquidity constraints, it needs stronger on-chain governance and property rights clarity; if Langxin-style structured financing wants to enter the public DeFi ecosystem, it needs limited openness and trust intermediary settings at the institutional level; and USDY-style income-generating stablecoins reveal a path that China has not yet fully developed – using the pricing power of standard assets to provide on-chain stable income financial instruments , which is the “mechanism” that can truly be learned from

In this sense, ONDO is not an “American story” but a mirror of institutional experimentation.

Its governance, issuance, liquidation, and incentive mechanisms may all be “partially sampled” by the Chinese RWA path, and even through institutional iteration, scenario adaptation, and incentive reconstruction, an “endogenous RWA architecture” may be developed.

10. Ondo Finance Investment Value Summary: Institutional Investor Allocation Recommendations and Market Outlook Forecast

As one of the most representative compliant asset tokenization platforms in the current global RWA track, Ondo has a clear path selection and precise rhythm, reflecting the typical “financial native” genes – first entering with highly standardized off-chain assets, locking in institutions and high-net-worth users through a strict compliance framework , and then gradually extending to the open DeFi ecosystem. The ultimate plan is to deeply bind compliance with on-chain applications with its own chain (Ondo Chain) to build a sustainable strategic moat.

Against the backdrop of accelerating global asset digitization, Ondo’s model has three core competitive advantages worth noting:

- Compliance first : Through Reg D/Reg S and KYC/AML whitelist systems, the entire process from issuance to circulation is compliant , building a foundation of trust for institutional investors.

- Ecological embedding : Deep integration with mainstream public chains and DeFi protocols ensures that tokenized assets are not just “static mappings” on the chain, but truly composable modules with liquidity and financial attributes.

- Product matrix : Starting from basic products such as OUSG and OMMF, it gradually extends to more categories of on-chain financial products, cooperating with Ondo Chain to create a complete ecological closed loop.

For investors, Ondo is not only the “traffic entrance” of the global RWA track, but also an important indicator for observing the speed of integration between traditional finance and crypto finance.

In the short term, its development will be subject to the regulatory environment in the United States and major markets, as well as the security of cross-chain liquidity infrastructure; in the medium and long term, once Ondo Chain is successfully launched and adopted by mainstream financial institutions, its position in the global compliant on -chain financial market is expected to be further consolidated.

Investment thinking :

Institutional investors can consider Ondo as the preferred platform for allocating on-chain US dollar assets and short-term debt products , and use its low-risk and high liquidity characteristics for asset management.

DeFi users can obtain stable returns through Ondo assets in scenarios such as lending and liquidity pools, and capture token appreciation opportunities in ecological expansion.

Strategic investors should pay attention to Ondo’s progress in implementing cross-chain, compliant public chains , and global cooperation networks, which will directly determine its ecological boundaries and valuation space.

compliant asset tokenization model represented by Ondo will become an important reference model for the development of global RWA in the next few years.

For emerging markets like China, Ondo’s experience not only provides a reference for technology and product design, but also highlights the importance of coordinated advancement in compliance , liquidity, and ecosystem expansion.