KEYTAKEAWAYS

-

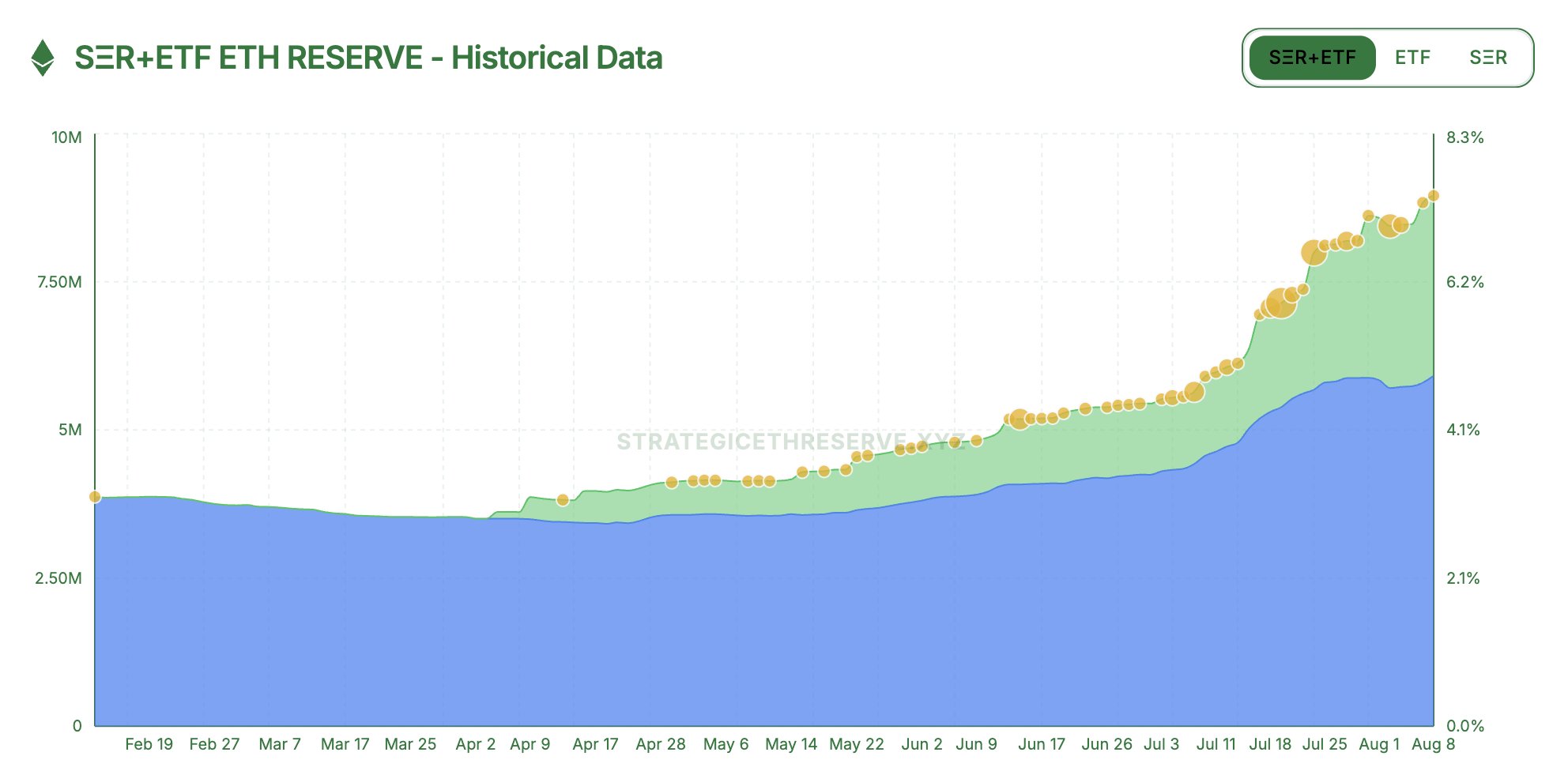

Ethereum treasury firms and ETFs now hold 7.4% of supply, signaling accelerating institutional adoption and reduced circulating ETH.

-

Treasury holdings up 4x in 2025; ETFs see $9.3B inflows despite recent outflows.

-

Staking rewards and DeFi yields boost institutional interest, echoing Bitcoin’s early adoption wave.

CONTENT

On August 11, according to strategicethreserve data, Ethereum treasury strategy companies now hold 3.04 million ETH, equal to 2.51% of supply. Ethereum ETFs hold 5.91 million ETH, or 4.89% of supply.

This shows Ethereum’s progress as an institutional-grade asset is accelerating. According to the latest report from Strategic ETH Reserve, Ethereum treasury strategy companies (including major corporate holders such as BitMine, SharpLink Gaming, and Bit Digital) have accumulated about 3.04 million ETH.

Source:x

This equals 2.51% of the total Ethereum supply of about 120.9 million ETH. At the same time, spot Ethereum ETFs (including products from BlackRock, Grayscale, Fidelity) hold a total of 5.91 million ETH, or 4.89% of supply.

The growth of these holdings shows strong institutional demand for Ethereum. Since the start of 2025, treasury company holdings have grown more than four times, while ETFs have seen total net inflows above $9.3 billion.

RISE OF THE INSTITUTIONAL ADOPTION WAVE

Ethereum treasury strategy companies are those that hold ETH as part of their corporate reserves, similar to Bitcoin’s institutional adoption wave in the early 2020s. Ethereum’s difference is its staking rewards and DeFi ecosystem use. These companies not only hold ETH but also earn passive income through staking or restaking protocols (for example, SharpLink has earned 322 ETH in rewards since June) with average annual yields of 3–5%.

According to CoinTelegraph, billions of dollars’ worth of ETH will flow into DeFi to chase yields of up to 14%, which could start a “DeFi Summer 2.0.” Currently, over 85 entities are involved in ETH treasury strategies, a big jump from the start of the year. This growth has been helped by clear regulations such as the U.S. GENIUS Act.

Ethereum ETFs are also performing strongly. Since launching in July 2024, these ETFs have reached nearly $23.5 billion in assets under management (AUM). Although recent days saw outflows (such as 155,700 ETH on August 11), total net inflows still exceed $9.3 billion. BlackRock’s iShares Ethereum Trust ETF saw over $4 billion inflows in July alone, setting a record.

This shows institutional investors see ETH as a diversification asset, alongside Bitcoin, as both “digital gold” and “digital oil.”

Together, treasury companies and ETFs control 7.4% of Ethereum’s supply (about 8.95 million ETH), worth more than $50 billion. This reduces circulating supply and creates upward pressure on ETH prices.

MARKET IMPACT AND OUTLOOK

This accumulation wave has pushed ETH prices up 50% in the past month, breaking above $4,000 over the weekend. Analysts at Standard Chartered predict treasury holdings could grow 10x by year-end to 10% of supply (worth more than $45 billion), pushing ETH above $4,500.

However, Ethereum co-founder Vitalik Buterin has warned against heavy reliance on borrowed funds for treasury accumulation to avoid volatility risk.

In a broader view, this trend shows Ethereum’s shift from a speculative asset to a strategic reserve. Companies like Cosmos Health and The Ether Machine recently announced ETH purchases worth hundreds of millions of dollars, strengthening this story. But investors should watch macro factors, such as interest rate changes and regulation updates, which may affect momentum.

In conclusion, Ethereum’s institutional adoption is accelerating. Growth in treasury and ETF holdings not only locks supply but also brings energy to the ecosystem. As more companies join, this “Ethereum reserve” era could reshape the crypto market landscape.