KEYTAKEAWAYS

-

Prediction markets moved decisively ahead of official confirmation, with traders treating Kevin Warsh’s nomination as effectively settled and repricing risk accordingly.

-

Warsh represents a break from post 2008 monetary orthodoxy, prioritizing policy credibility and balance sheet discipline over market backstops and liquidity reassurance.

-

For crypto and stablecoins, a Warsh led Fed may reduce short term liquidity tailwinds but increase long term regulatory clarity and institutional legitimacy.

CONTENT

In Washington, confirmation usually comes last. Markets move first.

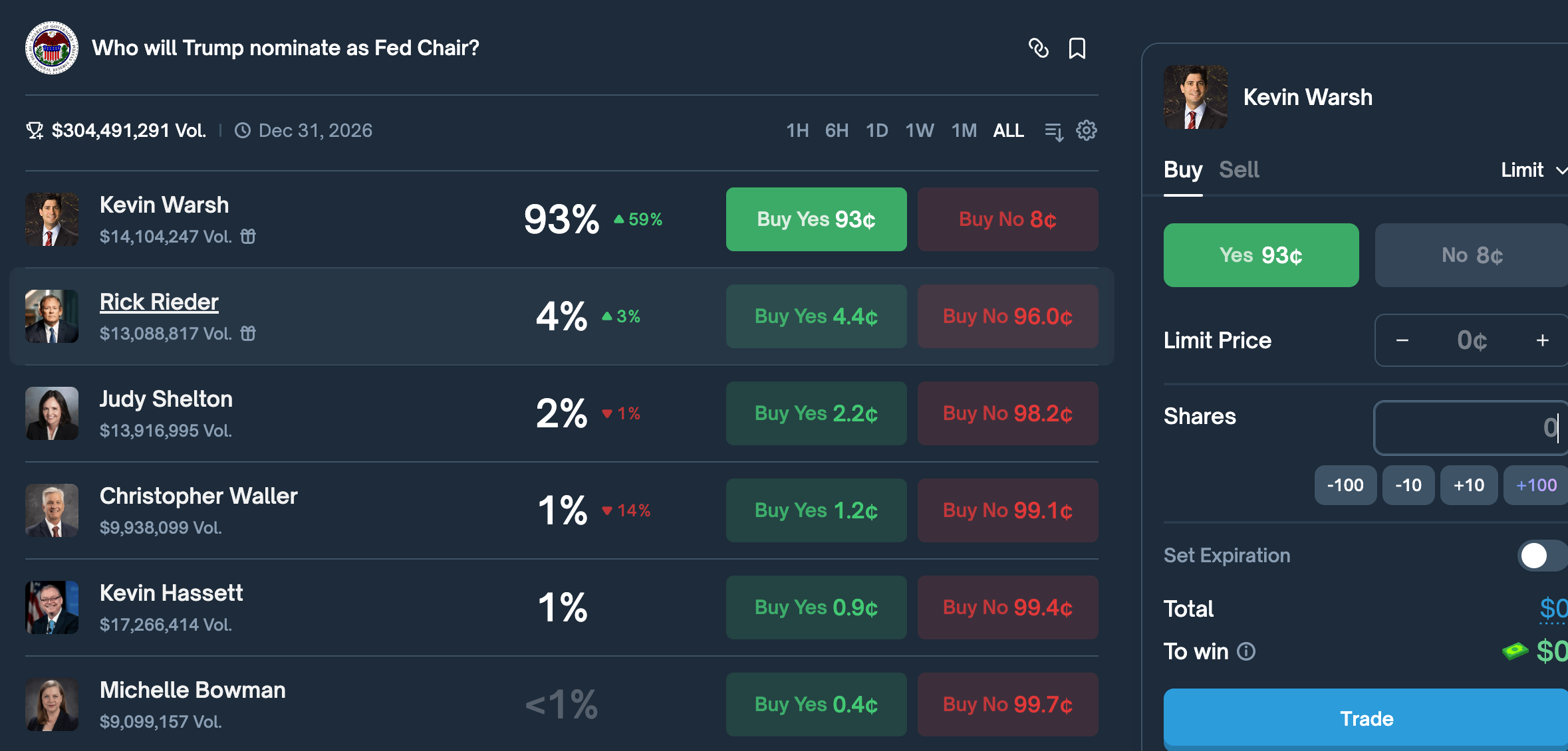

Hours before the official announcement of the next Chair of the Federal Reserve, traders on prediction markets have already made their call. On Polymarket, the probability that former Fed Governor Kevin Warsh will be nominated has surged to 95%, effectively ending months of speculation.

This was not a gradual shift. It was abrupt, decisive, and unusually confident.

In recent years, prediction markets have repeatedly proven faster than traditional media at capturing political outcomes. Their sudden convergence around Warsh suggests something more than speculation: a belief that the decision is already settled inside the political and financial establishment.

For global markets, the question is no longer who. It is what kind of Federal Reserve comes next.

WHEN PREDICTION MARKETS STOP BETTING AND START SIGNALING

Prediction markets usually reflect uncertainty. This time, they reflect conviction.

Only weeks ago, contracts were split among several candidates. Liquidity was thin, sentiment unstable. Then, following public remarks by U.S. President Donald Trump hinting that the nominee would be “well known” and “not surprising,” capital rotated aggressively into Warsh-linked outcomes.

Such a one-sided repricing is rare. Traders did not hedge. They piled in.

In market terms, this looks less like a bet and more like price discovery after new information enters the system. When probabilities move this fast, participants typically believe informal confirmation has already circulated among insiders.

That belief alone is enough to reshape expectations — even before the official name is read aloud.

FROM A FOUR WAY RACE TO A FOREGONE CONCLUSION

The Fed Chair selection initially resembled a political reality show. Four candidates, four narratives, each aligned with a different vision of monetary power.

Kevin Hassett, Director of the National Economic Council, was the loyalty candidate. Deeply trusted by Trump, closely involved in economic messaging. Yet over time, it became clear that Trump preferred to keep him inside the White House rather than send him to an institution designed to resist political pressure.

Christopher Waller, a sitting Fed Governor, represented continuity. Markets saw him as safe, predictable, and competent. But safety was precisely the problem. Continuity does not fit a moment defined by inflation backlash, institutional distrust, and political realignment.

Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock, briefly surged as a market favorite. His advocacy for lower rates aligned with Trump’s economic instincts. But BlackRock’s globalist image proved incompatible with the current political climate.

Which left Warsh.

Not the loudest candidate. Not the most obvious. But the one whose profile quietly aligned with every constraint in the system.

KEVIN WARSH AND THE ANTI FED FED CHAIR

Kevin Warsh is not an outsider. He is something more disruptive.

He served as a Fed Governor in his mid-30s, the youngest in modern history. He worked at Morgan Stanley. He partnered with Stanley Druckenmiller. He understands markets not as abstractions, but as power structures shaped by incentives and fear.

And yet, he has spent much of his post Fed career criticizing the institution from the inside out.

His defining belief is simple and unforgiving: inflation is not an accident. It is a policy choice.

That view puts him at odds with the post-2008 consensus that central banks should absorb volatility at all costs. Under Warsh, the so called Fed Put is not guaranteed. Liquidity is not unconditional. Market discomfort is not a policy failure.

For asset prices built on abundant liquidity, that is a warning.

For institutions concerned with long term credibility, it is a reset.

WHY CRYPTO IS WATCHING WARSH MORE CLOSELY THAN WALL STREET

Warsh’s relationship with crypto is often misunderstood.

He has criticized Bitcoin’s volatility and questioned its suitability as a unit of account. Yet unlike many central bankers, he has engaged directly with the industry. He invested early in the algorithmic stablecoin project Basis. He advised Bitwise, one of the first institutional crypto index providers.

More importantly, he draws a sharp distinction between speculation and infrastructure.

Warsh has strongly opposed retail facing central bank digital currencies, arguing that they risk enabling financial surveillance and political control. At the same time, he supports blockchain based upgrades to wholesale settlement systems, where efficiency gains do not come at the cost of civil liberties.

On stablecoins, his stance is clear but not hostile. He favors integrating them into a narrow banking framework, backed one to one by cash or short term Treasuries. For crypto natives, this sounds restrictive. For institutions, it sounds like legitimacy.

In other words, Warsh does not want to crush crypto. He wants to force it to grow up.

ALLY OR ULTIMATE BOSS

Warsh once summarized his own candidacy with a line that markets have not forgotten: “If the President wanted someone weak, I wouldn’t be here.”

That sentence explains why prediction markets moved so fast.

A Warsh led Fed would likely tighten financial conditions structurally, not tactically. Liquidity would become scarcer. Policy credibility would outweigh market comfort. Risk assets would need to stand on fundamentals rather than expectation of rescue.

Yet clarity would increase.

For crypto, that trade off is familiar. Less euphoria. More structure. Fewer gray zones.

As traders wait for formal confirmation, one thing is already clear. Markets are no longer asking who will lead the Federal Reserve.

They are preparing for a central bank that intends to lead markets, not follow them.