KEYTAKEAWAYS

- Funding rate arbitrage creates balanced long-short positions across spot and perpetual markets, generating profits from funding rate differentials while minimizing exposure to price volatility.

- This strategy requires minimal market prediction skills, making it accessible to beginners while offering stable returns and accommodating large capital investments.

- Traders should carefully select exchanges and cryptocurrencies with significant funding rate imbalances to maximize arbitrage opportunities and potential returns.

CONTENT

Discover how funding rate arbitrage offers a stable approach to crypto trading without predicting market movements. Learn the step-by-step process to build a delta-neutral portfolio and generate consistent returns.

BACKGROUND

With a series of positive developments, such as the election of the first crypto-friendly president, Trump, who even launched his first memecoin $TRUMP, the crypto market has become exceptionally heated, albeit with extremely high risks. For newcomers entering the crypto market looking for stable returns, how should they participate in the market? The answer is Delta-neutral arbitrage trading. Today, we will explain one of its strategies: Funding rate arbitrage.

First of all, we have to understand some basic concepts.

1. TRADING FEE

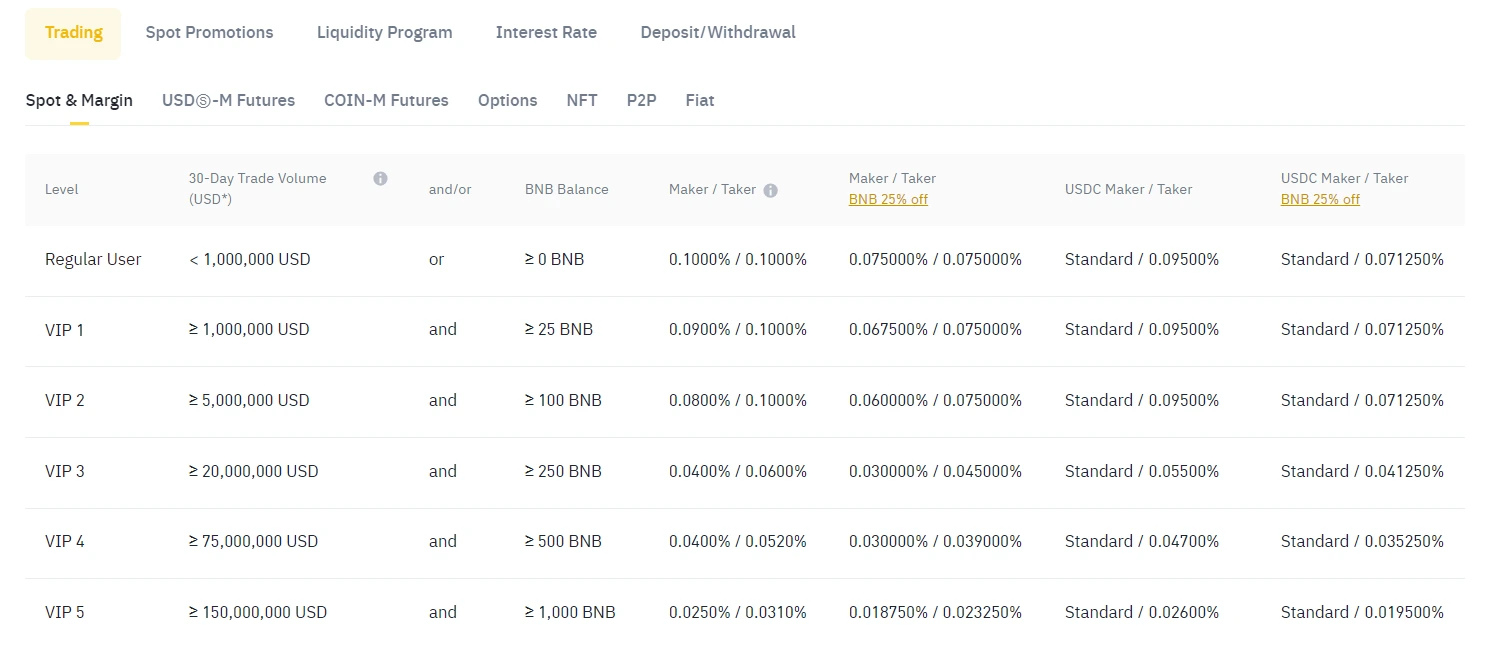

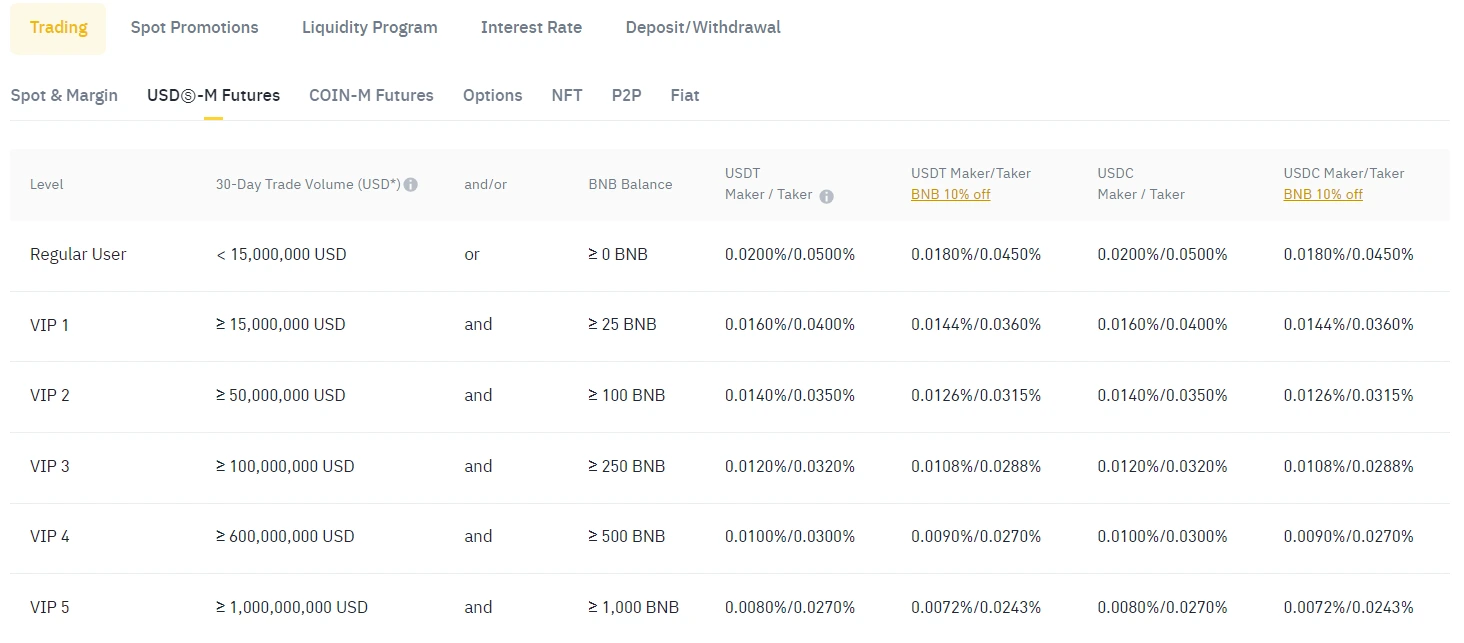

Trading fees are the costs that users incur when executing trades such as spot and futures. These fees vary depending on the exchange, trading volume, and trading pairs involved. They are typically divided into two main categories:

- Maker Fee: This is the fee paid when a user places a limit order on the order book, waiting for other users to match it. Makers provide liquidity to the market, so they typically enjoy lower fees.

- Taker Fee: This fee is charged when a user places a market order that immediately matches an existing order on the order book. Takers consume liquidity from the market, which is why their fees are usually higher than those of makers.

( Source: Binance’s Fee rate-Spot)

(Source: Binance’s Fee Rate-Futures)

2. PERPETUAL CONTRACTS

Perpetual Contract is a popular financial derivative product in the cryptocurrency market, allowing traders to speculate on cryptocurrencies’ price movements without holding the underlying assets. They are similar to traditional futures contracts, but unlike futures, perpetual contracts do not have an expiration date and can be held indefinitely. Key features of Perpetual Contracts include:

- No Expiry Date: Perpetual contracts have no fixed expiration, offering high flexibility. Combined with the 24/7 operation of the crypto market, traders can open and close positions at any time and adjust their positions based on their strategies.

- Leverage: Perpetual contracts allow users to leverage their positions, bet small & win big. This means they can gain greater exposure with a relatively smaller initial investment. For example, 5x leverage means a trader can control a $5,000 perpetual contract with just a $1,000 deposit. Leverage on centralized exchanges typically ranges from 1x to 200x, allowing traders to choose leverage according to their strategies. It is important to note that while leverage can amplify profits, it also increases risks. In a highly volatile market, high leverage can accelerate losses and potentially lead to liquidation. Therefore, traders need to carefully manage their leverage levels to avoid excessive risk.

3. FUNDING RATE

The funding rate is a unique mechanism in the crypto market used to adjust the price of perpetual contracts. Unlike traditional futures, perpetual contracts utilize funding rates to maintain stability and align the futures market price with the spot market price of the underlying asset. The purpose is to balance the market supply and demand between long and short positions. Typically, the funding rate is settled at regular intervals (e.g., every 8 hours on Binance), with fees charged to either long or short positions based on market conditions.

- Funding rate > 0: Long position holders make the funding payments to the short position holders.

- Funding rate < 0: Short position holders pay the funding payments to the long position holders.

4. FUNDING RATE ARBITRAGE

Funding rate arbitrage involves taking advantage of the positive and negative fluctuations in funding rates to generate profits. When the funding rate significantly deviates from zero, traders can create hedged positions to lock in profits. The advantages of this strategy include:

- Low Risk: The strategy doesn’t depend on predicting market price movements. Instead, it profits from the funding rates. By holding both long and short positions simultaneously, traders can effectively hedge against most market risks.

- Large Capital Capacity: This strategy can accommodate substantial capital without the risk of strategy failure or a significant reduction in profits due to capital inflows.

- Simplicity: This strategy doesn’t require complex trading models or high-frequency trading techniques, making it accessible to all traders, even beginners. It focuses solely on the fluctuations in funding rates, eliminating the need to predict market direction.

- Stable Returns: Net profits are the result of funding rate income minus trading fees. Due to its neutral market approach, traders can achieve relatively stable returns regardless of market price fluctuations.

HOW TO ARBITRAGE?

Step 1: Select an Exchange and Portfolio

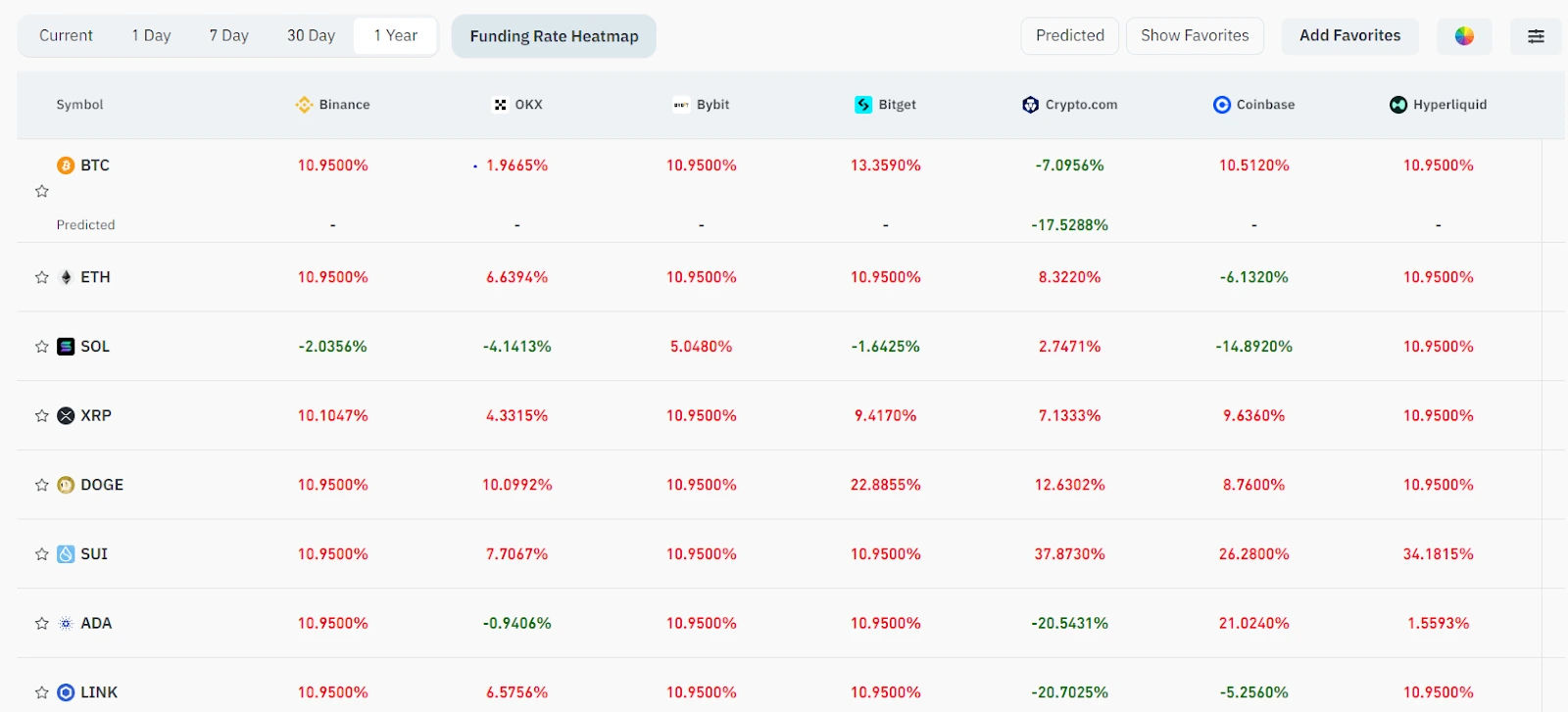

Funding rates are constantly fluctuating, and different exchanges may offer varying funding rates for the same portfolio. As shown in the screenshot below, over the past year, the APR for $DOGE on Binance was 10.95%, while on Bitget it reached 22.88%. Traders can select their preferred exchange to execute their trades.

(Source: CoinGlass)

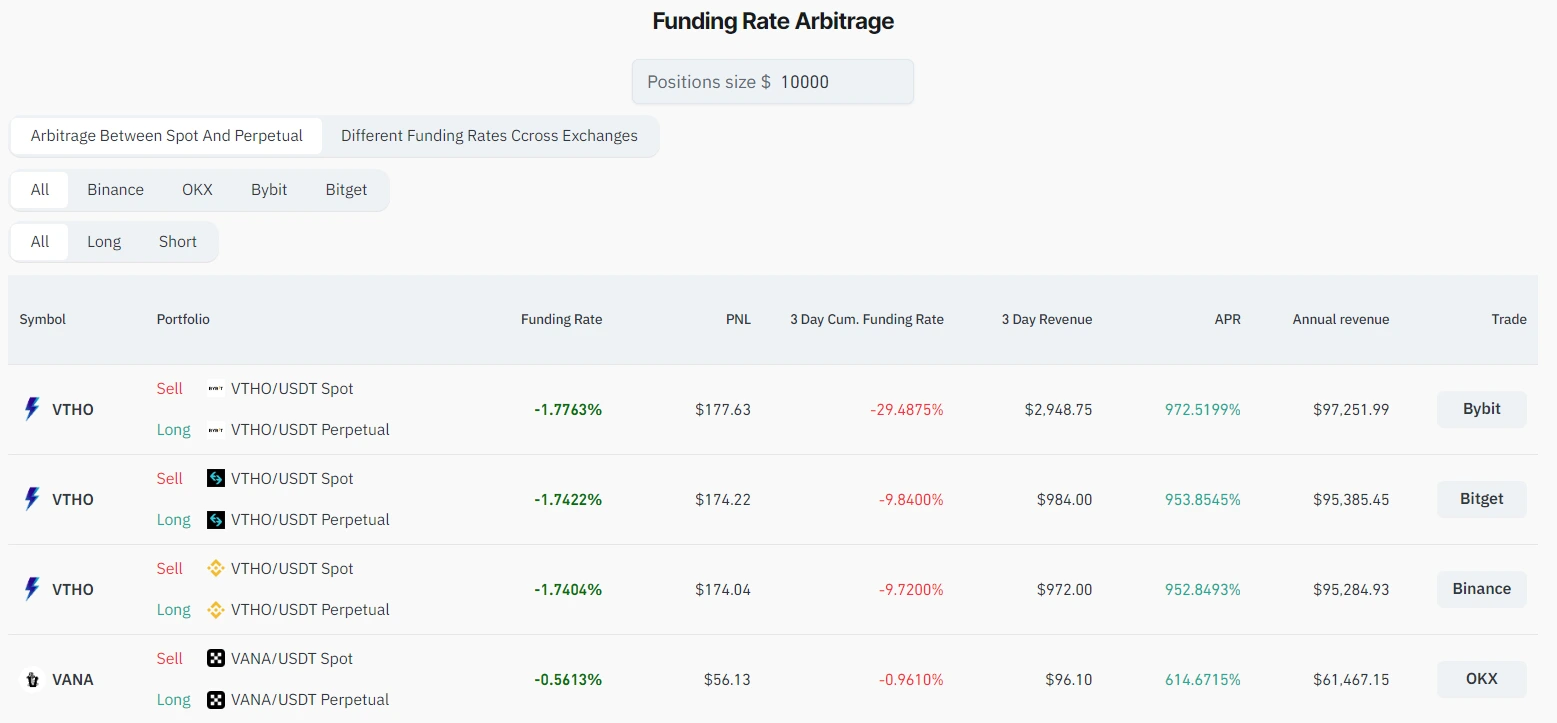

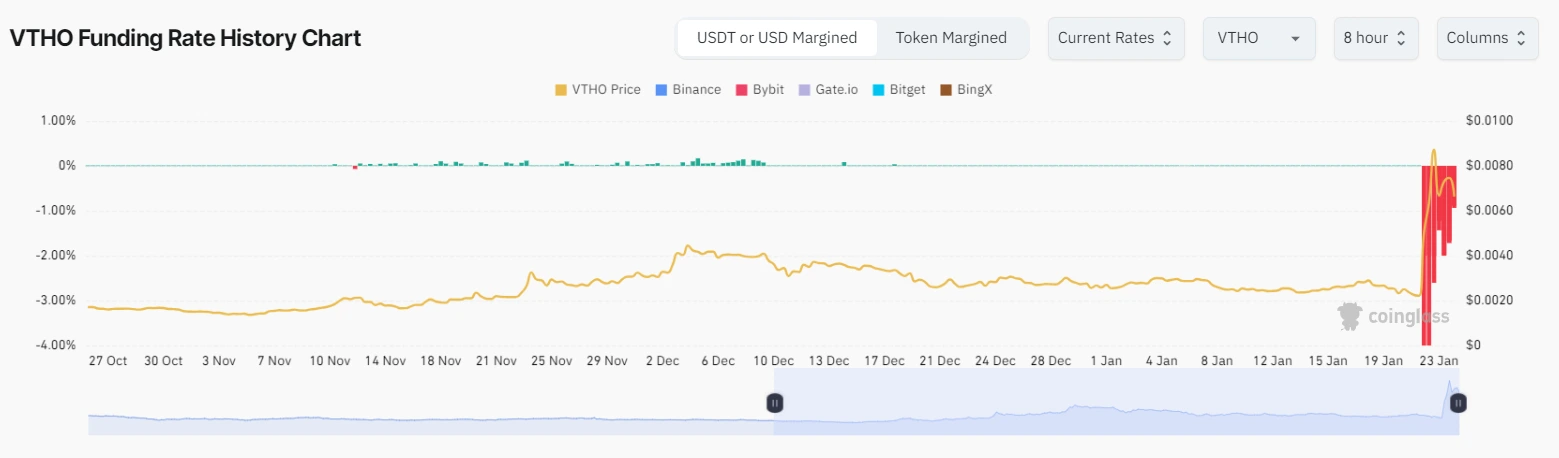

Funding rates also vary between different cryptocurrencies. For example, the highest yield currently comes from Bybit’s $VTHO, with a funding rate of -1.77%. This means that if you invest $10,000 on Bybit, short $VTHO on the spot market, and simultaneously take a long position in the $VTHO perpetual contract, you could earn $177 every 8 hours, with an APR of a staggering 972%.

(Source: CoinGlass)

It’s important to note that the funding rate for $VTHO only became negative after January 22, while in the prior month, the funding rate was 0. This indicates that the price of the $VTHO perpetual contract was almost identical to the spot price, with the market in a balanced state. In such cases, no funding fees need to be paid or collected between long and short positions, meaning no arbitrage opportunities. Therefore, users should carefully select tokens based on their preferences.

(Source: CoinGlass)

Step 2: Build Arbitrage Portfolio

Once you have selected the token, you can proceed to build an arbitrage portfolio:

- If the funding rate is positive, buy a certain amount of cryptocurrency on the spot market and simultaneously short the same amount on the perpetual contract market.

- If the funding rate is negative, short a certain amount of cryptocurrency on the spot market and simultaneously take a long position on the perpetual contract market.

Step 3: Collect Funding Fee

Once your arbitrage portfolio is set up, you can wait to collect the funding fees. Traders can also adjust their positions based on changes in the funding rate to optimize returns.

CONCLUSION

Funding rate arbitrage offers a stable and straightforward approach for crypto investors to participate in the market. Don’t wait—start exploring and trying this strategy now to take advantage of market opportunities.

Read more: What is Crypto Arbitrage & How to Make a Profit?

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!