KEYTAKEAWAYS

-

The crypto industry is increasingly converging with regulatory authorities worldwide, focusing on defining and legitimizing cryptographic assets.

-

Countries like Singapore, Hong Kong, the United Arab Emirates, and the European Union are at the forefront of adopting and implementing comprehensive virtual asset regulations.

- KEY TAKEAWAYS

- 1. SINGAPORE — PIONEERING VIRTUAL ASSET REGULATION

- 2. HONG KONG — ACCELERATING VIRTUAL ASSET DEVELOPMENT

- 3. UNITED ARAB EMIRATES (UAE) — ESTABLISHING A TAILOR-MADE VIRTUAL ASSET FRAMEWORK

- 4. EUROPE — EU UNVEILS THE MOST COMPREHENSIVE UNIFIED VIRTUAL ASSET REGULATORY FRAMEWORK

- 5. UNITED KINGDOM

- 6. UNITED STATES — KEY PLAYER IN VIRTUAL ASSET WORLD DEVELOPMENT

- 7. JAPAN AND SOUTH KOREA — THE DYNAMIC LANDSCAPE OF VIRTUAL ASSETS

- 8. G20 — ADVOCATES FOR A UNIFIED GLOBAL VIRTUAL ASSET REGULATORY FRAMEWORK

- CONCLUSION

- DISCLAIMER

- WRITER’S INTRO

CONTENT

The ideal state of the crypto world is often envisioned as decentralized, permissionless systems operating under digital rules. While this may seem at odds with traditional regulation, the current trajectory of the crypto industry is witnessing a rapid convergence with regulatory bodies worldwide. Despite the reservations of many crypto purists, the constant influx of legislation has become a focal point for industry development.

Beliefs in sovereign freedom and mathematical order remain core to the industry’s future. However, for new innovations to seamlessly integrate into the existing global order and rapidly proliferate, a dance with regulation is an inevitable and essential part of the journey. This article will dissect the current landscape of the industry’s most significant trends in 2023 from the perspective of industry observers, focusing on broadly defined cryptographic assets (referred to as virtual assets for clarity).

1. SINGAPORE — PIONEERING VIRTUAL ASSET REGULATION

After the bankruptcy of Three Arrows Capital and FTX, Singapore’s regulatory environment has become more cautious and stringent, slowing down the pace of development. Nevertheless, due to its stable policies and open atmosphere, Singapore continues to be a preferred destination for global Web3 companies and entrepreneurs.

-

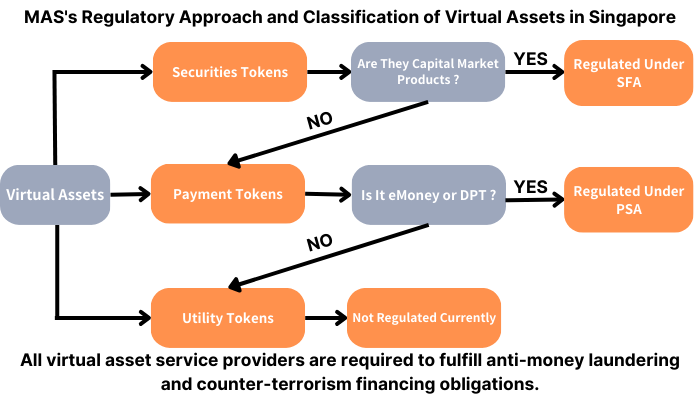

MAS’s Three-Tier Virtual Asset Regulatory Framework

The Monetary Authority of Singapore (MAS), the central bank and financial regulatory authority, employs a functional and classification-based approach to regulate virtual assets, aiming for legitimization. According to MAS’s May 2020 revised “Digital Token Offering Guidelines,” virtual assets are categorized into three types: Security Tokens, Payment Tokens, and Utility Tokens. Each category falls under specific regulations, such as the Securities and Futures Act (SFA) for Security Tokens and the Payment Services Act (PSA) for Payment Tokens.

Approval from MAS is required for assets falling under SFA and PSA regulations. Additionally, compliance with anti-money laundering and counter-terrorism financing regulations is mandatory for all virtual asset activities, similar to other financial activities.

-

Introduction of Stablecoin Final Regulatory Framework

On August 15, 2023, MAS announced the final version of the stablecoin regulatory framework, aiming to ensure stability in Singapore-regulated stablecoins. This initiative makes Singapore one of the first jurisdictions globally to include stablecoins within its local regulatory system.

The framework sets criteria for stablecoin issuers, focusing on stability, capital requirements, face value redemption, and information disclosure.

The regulatory framework provides users with a clear distinction between MAS-regulated stablecoins and others, allowing them to make informed decisions about the associated risks.

+

+

2. HONG KONG — ACCELERATING VIRTUAL ASSET DEVELOPMENT

After a period of silence, Hong Kong has reinvigorated its embrace of the virtual asset industry, with policies rolling out since the release of the “Hong Kong Virtual Asset Development Policy Declaration” on October 31, 2022. The 2022/23 annual report from the Hong Kong Financial Development Bureau positions the city as a global leader in developing virtual assets and complementary technology.

-

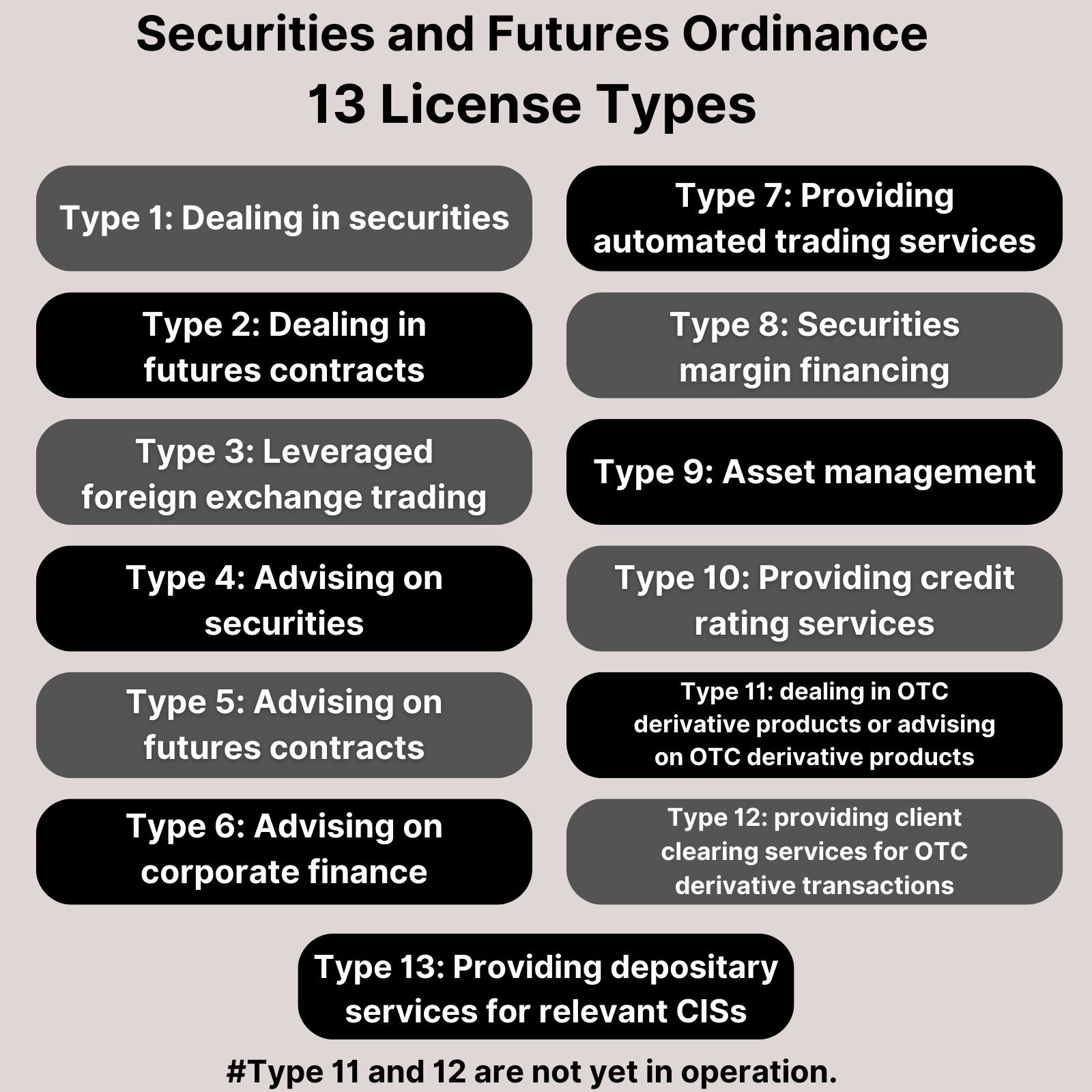

Hong Kong’s Unique Dual-Licensing System

Hong Kong employs a unique dual-license system for operators of virtual asset trading platforms. This system involves two types of licenses: one designated for “security tokens,” regulated under the Securities and Futures Ordinance, and another for “non-security tokens,” governed by the anti-money laundering regulations. The Securities and Futures Ordinance’s Type 12 license applies to virtual assets categorized as security tokens, necessitating application for relevant securities-related licenses. Presently, virtual asset businesses must apply for three licenses—Type 1, Type 7, and VASP licenses—and may, depending on operational requirements, also need to apply for Type 4 and Type 9 licenses.

Hong Kong has previously established a robust licensing framework. If virtual assets fall under the category of security tokens, operators must apply for access licenses related to securities. The three essential licenses for operating virtual asset businesses are the Type 1, Type 7, and VASP licenses, with the possibility of needing to apply for Type 4 and Type 9 licenses based on practical operational needs.

- VASP License

The issuance of Virtual Asset Service Provider (VASP) licenses is a result of amendments to the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance, which was passed by the Hong Kong Legislative Council in December 2022. This ordinance represents Hong Kong’s inaugural legislation specifically addressing the regulation of virtual assets.

As defined by the 2022 Amendment Ordinance, virtual assets refer to digitally encrypted values expressed in the form of units or stored economic value. They serve as a medium of exchange for payment of goods or services, clearing debts, investments, or management, operation, and voting on virtual asset-related matters. The ordinance covers a wide range of virtual currencies in the market, including BTC, ETH, stablecoins, utility tokens, and governance tokens.

Virtual asset trading platforms that already hold Type 1 and Type 7 licenses are required to apply for the VASP license under a simplified application process. Notably, platforms such as HashKey and OSL successfully upgraded their Type 1 and Type 7 licenses through a simplified process, gaining approval for retail services promptly and expanding their business scope from professional investors to retail users.

The 2022 Amendment Ordinance provides a transitional period until June 1, 2024, for existing virtual asset trading platforms that hold Type 1 and Type 7 licenses but have not obtained VASP licenses. Platforms that do not intend to apply for the license are advised to prepare for a systematic conclusion of their operations in Hong Kong, with the closure deadline set for May 31, 2024. In essence, from June 1, 2024, virtual asset exchanges without VASP licenses will be unable to operate in compliance with regulations.

- Accelerating Stablecoin Development

Regarding stablecoins, the Securities and Futures Commission (SFC) has made it clear in its “Consultation Summary” that the Hong Kong Monetary Authority released the “Consultation Conclusions on Crypto-assets and Stablecoins” in January 2023. It stated the intention to implement regulatory arrangements for stablecoins in 2023/24, establishing a licensing and permit system for activities related to stablecoins.

Before stablecoins come under regulation, the SFC believes they should not be included for retail trading. On May 18, the Hong Kong Monetary Authority announced the launch of the “Digital Hong Kong Dollar” pilot program, with 16 companies from the financial, payment, and technology sectors selected to participate in the first round of trials in 2023. The pilot project delves into six potential use cases, including comprehensive payments, programmable payments, offline payments, token deposits, Web3 transaction settlements, and token asset settlements.

At the Wanxiang Blockchain Week on September 19, Hong Kong legislator Dennis Kwok mentioned that regulations for Hong Kong Dollar stablecoins might be introduced in June of the following year.

(Sourse:HK SFC)

3. UNITED ARAB EMIRATES (UAE) — ESTABLISHING A TAILOR-MADE VIRTUAL ASSET FRAMEWORK

Established in March 2022, the Dubai Virtual Assets Regulatory Authority (VARA) is the world’s first government entity dedicated to overseeing the virtual asset industry. VARA manages and supervises activities related to virtual assets in Dubai (excluding international financial centers).

The UAE government has taken a bold and proactive stance toward virtual asset development, creating an impact as a global player.

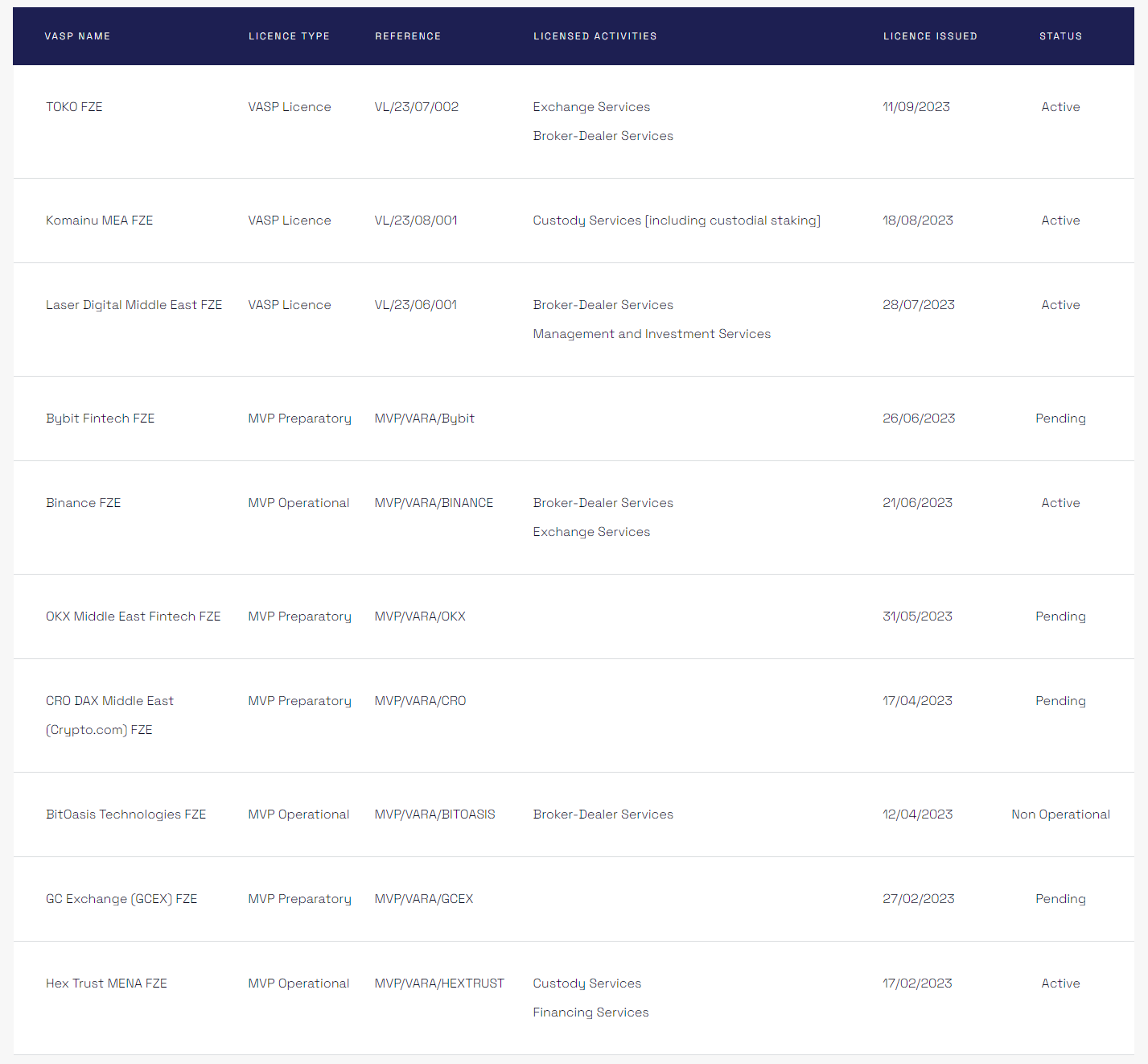

On February 7, 2023, VARA released the 2023 Virtual Assets and Regulatory Activities Regulation, requiring all market participants offering virtual asset services in the UAE to obtain approval and licenses from the Securities and Commodities Authority (SCA) or VARA. VARA defines seven virtual asset activities, encompassing advisory, brokerage, custody, exchange, lending, management and investment, and transfer settlement services.

The licensing process involves temporary licenses, preparation and operation of the minimum viable product (MVP), and the so-called full-market product (FMP) license. MVP license holders cannot provide services to retail consumers until obtaining the phased FMP license approval. Currently, three companies have officially obtained VASP licenses for relevant activities, including Binance, OKEx, and Bybit, at different stages of the MVP.

Dubai’s government, with its proactive attitude, not only established an independent regulatory authority and policies but also vigorously developed artificial intelligence and the metaverse, quickly becoming an influential international participant in the virtual asset field.

(Sourse:VARA Public Register)

4. EUROPE — EU UNVEILS THE MOST COMPREHENSIVE UNIFIED VIRTUAL ASSET REGULATORY FRAMEWORK

- European Union (EU)

On May 31, 2023, the European Union officially signed the milestone legislation — the Markets in Crypto-Assets Regulation (MiCA). Published in the Official Journal of the European Union on June 9, 2023, MiCA marks the world’s first comprehensive and clear unified virtual asset regulatory framework. This regulation provides a common virtual asset regulatory system for all 27 EU member states, creating a unified market covering a population of 4.5 billion people.

MiCA, totaling 150 pages, offers a comprehensive regulatory framework for companies and individuals to review specific regulations in corresponding chapters. It covers the scope and definitions of regulation, classification and related regulations for crypto-assets, regulations for crypto-asset service providers, and supervisory authorities. According to the law, any company offering crypto-assets to the public must release a fair, clear white paper, cautioning against risks without misleading potential buyers. Additionally, such companies must register with supervisory authorities and reserve appropriate bank-style reserves for stablecoins.

MiCA defines crypto assets as digital representations of value or rights transferred and stored electronically using distributed ledger technology or similar techniques. It classifies assets into electronic currency tokens, asset reference tokens, and other crypto assets. Electronic currency tokens maintain stable value by referencing an official currency, while asset reference tokens aim to maintain stable value by referencing another form of value, right, or combination, including one or more official currencies. Utility tokens are used solely to provide access to goods or services offered by the issuer.

Despite its comprehensive nature, MiCA lacks clear regulatory methods for security tokens and non-fungible tokens (NFTs), and further clarification is needed based on real-world use cases in the current crypto market.

MiCA undergoes an 18-month transition period and officially comes into effect on December 30, 2024. By mid-2025, the committee will report on whether further legislation is needed to meet the demands of NFTs and decentralized finance.

(Sourse:Mayer Brown)

5. UNITED KINGDOM

Following the introduction of the MiCA regulation in the EU, the United Kingdom accelerated its legislation on virtual assets. On June 19, 2023, the UK House of Lords approved the Financial Services and Markets Bill (FSMB), which received royal assent from King Charles on June 29. The FSMB brings cryptocurrencies under legal regulation and includes measures for supervising cryptocurrency promotions.

UK Financial Services Minister Andrew Griffith stated that, post-Brexit, the UK has the autonomy to control its financial service rulebook, supporting the secure adoption of cryptocurrency assets in the UK. On July 28, the UK and Singapore agreed to jointly develop and implement global regulatory standards for cryptocurrencies and digital assets.

6. UNITED STATES — KEY PLAYER IN VIRTUAL ASSET WORLD DEVELOPMENT

The United States, with the Securities and Exchange Commission (SEC) leading the way, has become the strictest global regulator in recent years. However, both traditional financial and crypto enterprises in the US are striving to advance industry development and regulatory integration.

Since 2022, US legislators have submitted over 50 digital asset bills to Congress. Regulatory challenges in the US pose both a key obstacle and a significant accelerator for future development, given the critical role of the US dollar in the current liquidity of the crypto world.

-

SEC and CFTC

The SEC, established under the Securities Exchange Act of 1934, is an independent agency responsible for securities oversight and management in the United States. It ensures public companies avoid financial fraud, provide non-misleading information, prevent insider trading, and comply with securities laws.

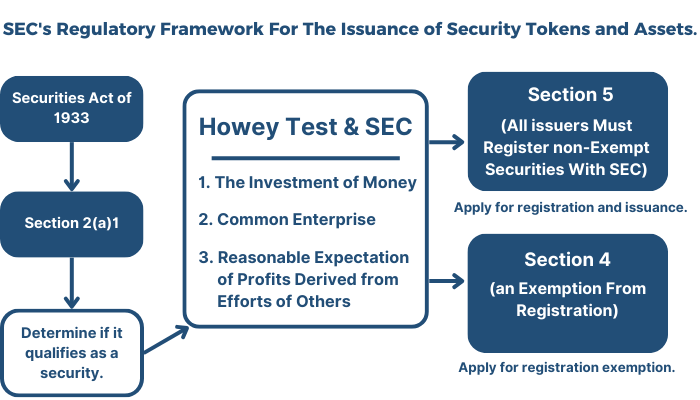

With the development of crypto assets with financial attributes, the SEC introduced the “Howey Test” framework on April 3, 2019, to determine whether a crypto asset qualifies as a security. SEC Chairman Gary Gensler emphasized that most crypto tokens, apart from truly decentralized ones like Bitcoin, fall under the category of securities. This subjects them to SEC registration requirements.

SEC’s regulatory approach has raised concerns about its impact on the crypto industry. Gary Gensler has repeatedly stated that, barring truly decentralized virtual currencies like Bitcoin, most crypto tokens meet the investment contract test and should be considered securities. This requires them to register their offering and sales with the SEC or meet exemption requirements. Token classification as securities implies high costs and regulatory scrutiny for issuers and trading platforms, potentially hindering industry operations and future innovation.

The Commodity Futures Trading Commission (CFTC) in the US, established in 1974, is an independent agency responsible for regulating commodity futures, options markets, and financial derivatives. The current CFTC chairman, Rostin Behnam, has expressed differences in crypto asset regulation compared to the SEC, stating that many crypto assets are commodities rather than securities.

Despite these statements, recent enforcement actions by the CFTC against three DeFi projects indicate a strict regulatory stance. This includes penalties for blockchain companies Opyn, Inc., ZeroEx, Inc., and Deridex, Inc., based in the US.

- Bitcoin Spot ETF

Bitcoin Spot Exchange-Traded Funds (ETFs) have garnered significant attention in the U.S. financial landscape. ETFs are investment funds traded on stock exchanges, allowing investors to gain exposure to various assets. A Bitcoin Spot ETF primarily invests in spot assets related to Bitcoin, enabling investors to speculate on Bitcoin’s price without owning the cryptocurrency directly.

The approval of a Bitcoin Spot ETF is considered crucial for several reasons: it simplifies the investment process, lowers barriers for investors, introduces a new legal investment product in traditional finance, and attracts substantial funds into the market. Several major U.S. fund giants, including BlackRock, Fidelity, ARK, Bitwise, WisdomTree, and Valkyrie, have submitted applications. The SEC is expected to make decisions on these applications at different deadlines.

(Sourse:Bloomberg)

- Stablecoins

The US House Financial Services Committee Republicans proposed a new stablecoin regulation bill earlier this year, seeking to transfer regulatory authority from the SEC to federal and state banking and credit union regulatory bodies. However, this proposal did not pass in the Democrat-majority Senate.

In August, global payment giant PayPal announced the launch of PYUSD, a stablecoin for transfers and payments, issued by Paxos Trust Co. On August 16, Dante Disparte, Chief Strategy Officer of Circle, urged the US to expedite stablecoin legislation.

- Real World Assets (RWA)

Real World Assets (RWA) have rapidly become a significant area in the US, with RWA associated with US Treasury bonds becoming crucial crypto assets. The US Federal Reserve, in a September 8 paper on tokenization, emphasized the increasing importance of asset tokenization in the crypto market.

- DeFi and NFTs

DeFi and NFTs have become focal points for US regulatory agencies. The SEC took enforcement actions against entertainment company Impact Theory, LLC, and Stoner Cats 2 LLC in August and September, respectively, for selling unregistered securities.

Despite having the most robust financial system and high regulatory standards, the US has faced criticism this year for incorporating virtual assets into existing frameworks without introducing new regulations conducive to industry development. Despite these challenges, the US remains home to innovative enterprises and large traditional interest groups entering Web3, which may drive regulatory changes.

7. JAPAN AND SOUTH KOREA — THE DYNAMIC LANDSCAPE OF VIRTUAL ASSETS

- Japan

In the intricate tapestry of the virtual asset realm, Japan stands as a seasoned participant, albeit not without enduring a severe setback in 2014. The colossal Mt. Gox, a global Bitcoin exchange, fell victim to a hacker onslaught, resulting in the loss of a staggering 850,000 bitcoins. The ensuing debt resolution saga has persisted for nine years, with the trustee responsible for the Mt. Gox bankruptcy recently deciding to defer creditor payments for an additional year. Originally slated for October 31, 2023, the new payment deadline has been extended to October 31, 2024.

Post the Mt. Gox incident, Japan adopted a stringent regulatory approach towards the cryptocurrency industry. In 2017, amendments to the Payment Services Act brought cryptocurrency exchanges under the oversight of the Financial Services Agency (FSA), ushering in a licensure regime. As the crypto industry burgeoned in recent years, Japan accelerated its policy initiatives. Prime Minister Fumio Kishida, on June 1, 2022, asserted that the advent of the Web3 era could propel Japan’s economic growth, prompting the establishment of the Web3 Policy Office under the Ministry of Economy, Trade, and Industry.

April 2023 witnessed the release of a whitepaper by Japan’s ruling party’s Web 3.0 project team, outlining recommendations to foster the development of the country’s crypto industry. In June 2023, the revised Fund Settlement Law, the world’s first legislation addressing stablecoins, was voted through the upper house. Notably, Ethereum’s developer conference, EDCON 2024, is slated to take place in Japan.

- South Korea

A fervent player in cryptocurrency trading, South Korea, with its population of over 50 million, commanded 20% of all Bitcoin transactions in 2017, emerging as the largest market for Ethereum. Subsequent years witnessed the South Korean government implementing measures to curb speculative activities in crypto trading, including trader admissions and regulatory registration for exchanges. Despite regulatory interventions, the enthusiasm for crypto trading persists, often leading to “Kimchi premiums” where token prices on Korean exchanges far exceed global counterparts.

The regulatory landscape in South Korea has evolved in tandem with its counterparts. In June of the current year, the South Korean National Assembly passed the “Virtual Assets User Protection Act,” introducing a regulatory framework aimed at safeguarding users and fostering a sound, transparent market order. The Financial Services Commission is gearing up for the second phase of legislation for virtual assets, with the law expected to come into effect one year after government programming, around July 2024.

Recent developments in South Korea’s blockchain industry include major securities firms forming the “Token Securities (ST) Token Alliance” to collaboratively establish infrastructure. Furthermore, on September 21, the city of Busan approved plans for the establishment and future schedule of the Busan Digital Asset Exchange, scheduled to commence operations in the first half of 2024. Busan envisions becoming a “blockchain city” centering around the exchange and has proposed a plan for a KRW 100 billion (approximately USD 75 million) Blockchain Innovation Fund.

8. G20 — ADVOCATES FOR A UNIFIED GLOBAL VIRTUAL ASSET REGULATORY FRAMEWORK

Against the backdrop of disparate global standards and regulations for virtual asset governance, the G20, representing 85% of the world’s GDP, 80% of trade, and two-thirds of the global population, is actively promoting a harmonized global regulatory framework.

On September 9, 2023, G20 leaders endorsed recommendations from the Financial Stability Board (FSB) and the International Monetary Fund (IMF) on crypto asset activities, stablecoin regulation, and supervision. Discussion on advancing the proposed roadmap from FSB and IMF is scheduled for the October meeting. During the New Delhi Summit on September 11, G20 leaders reached a consensus on the swift implementation of a cross-border framework for crypto assets. This framework aims to facilitate global exchange of crypto asset information starting in 2027, with countries automatically sharing transaction information across different jurisdictions, including transactions on unregulated crypto exchanges and wallet providers. (G20 comprises China, Argentina, Australia, Brazil, Canada, France, Germany, India, Indonesia, Italy, Japan, South Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom, the United States, and the European Union.)

While the G20 is actively pushing for progress in virtual asset regulation, the diverse political ideologies and complex interests within the group, combined with the current era of geopolitical rivalry, may slow down the implementation of substantive policies.

CONCLUSION

-

High Regulatory Compliance Costs:

Despite the introduction of laws globally, the current cost of regulatory compliance for crypto companies remains high. Varied definitions, classifications, and regulatory approaches across nations necessitate adaptation to diverse rules for both companies and individual investors.

-

Need for Innovative Regulations:

Virtual assets, with their innovative and distinctive nature, call for new regulations rather than being fit into existing frameworks. The complex life cycle and asset categories of virtual assets, spanning mining, staking, issuance, trading, transfer, payment, lending, derivatives, etc., require tailored regulatory methods based on the widely agreed-upon characteristics of virtual assets.

-

Evolutionary Regulatory Path:

As more virtual asset regulations come into effect in 2024, the process of adapting to these regulations is expected to be lengthy and challenging. Integrating regulatory changes while altering existing systems has become an inevitable path for the market’s infusion of new liquidity and widespread applications.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!