KEYTAKEAWAYS

-

Solana’s decline is closely linked to the fading Meme wave and shrinking on chain activity.

-

Competition has shifted from speed to ecosystem depth, with Ethereum strengthening its position in RWA and infrastructure.

-

Digital Asset Treasury buying provided support in 2025 but could not offset broader bearish pressure in 2026.

CONTENT

WHEN THE MEME TIDE FADES

When SOL briefly fell to 67 dollars in early February, market sentiment shifted from doubt to caution. Since the peak in October 2025, SOL has declined for several consecutive months, with a maximum drawdown of more than 70 percent. Even after a short rebound to around 80 dollars, trading volume and on chain activity have not shown strong recovery. The NFT project Mad Lads, once a symbol of Solana’s prosperity, saw its floor price drop from a peak equivalent of more than 40,000 dollars to below 2,000 dollars. The wealth effect faded quickly. A chain once seen as one of the biggest winners of the bull market is now facing a clear cycle test.

During the last uptrend, SOL climbed from below 10 dollars to nearly 300 dollars. It became one of the strongest performers among major public chains. High speed, low fees, and the explosive Meme wave formed a powerful growth loop. Pump.fun once launched more than ten thousand new tokens per day. Dogwifhat and Bonk reached multibillion dollar valuations. Celebrity tokens also chose Solana as their launch network. Daily trading volume once reached several billion dollars. At that moment, liquidity and speculation pushed SOL to its historical high.

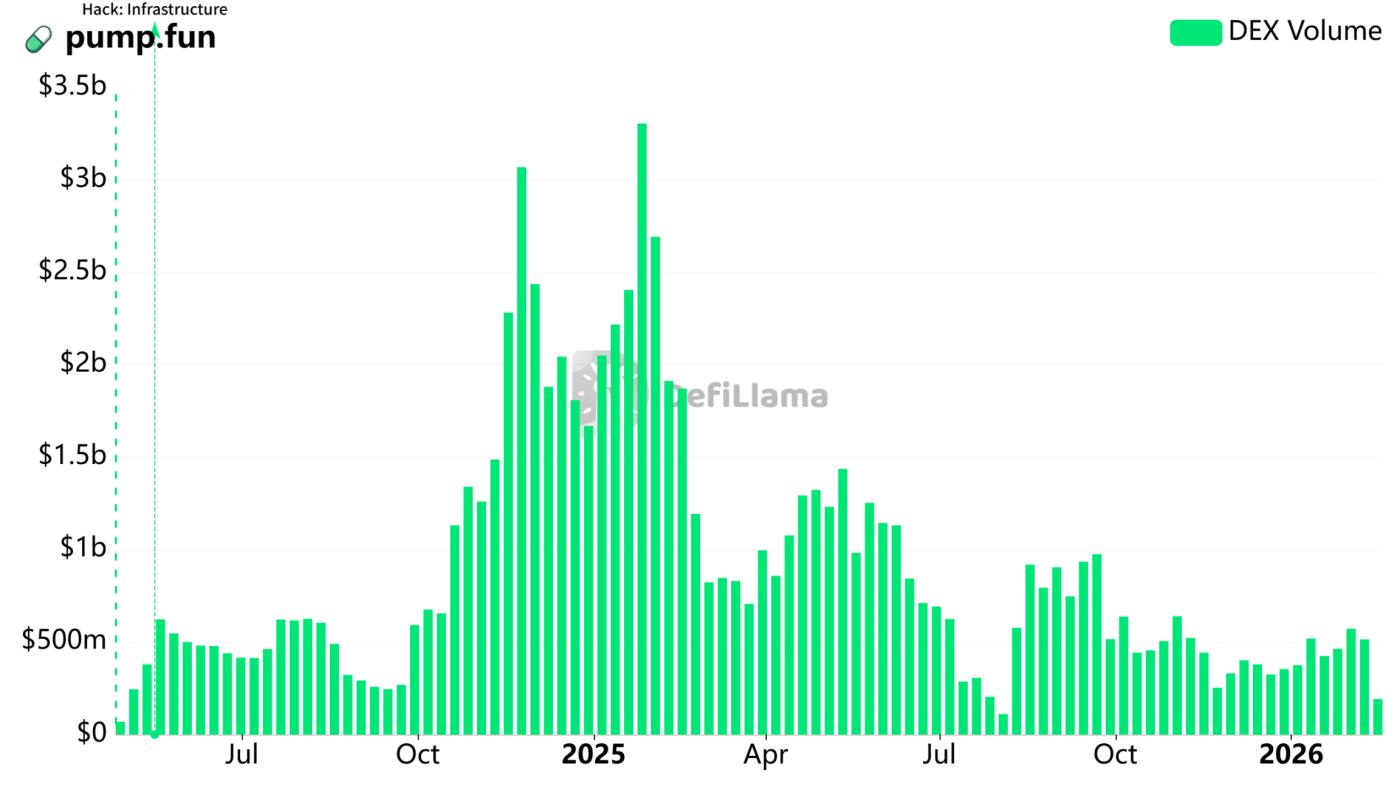

However, when the Meme wave cooled, the growth logic of Solana weakened. Since the second half of 2025, the graduation rate of Meme projects has dropped sharply. Fewer wealth stories appeared. Capital started to rotate. Data shows that Pump.fun weekly volume fell from tens of billions at its peak to only a few hundred million dollars in early 2026. That is roughly one sixth of its high point. At the same time, part of the traffic moved to BNB Chain. Through the Four.Meme platform and strong community influence, BNB Chain attracted a new round of speculative funds. Capital rotation between chains diluted Solana’s advantage. As Meme demand shrank, so did the need for SOL.

FROM TPS COMPETITION TO STRUCTURAL COMPETITION

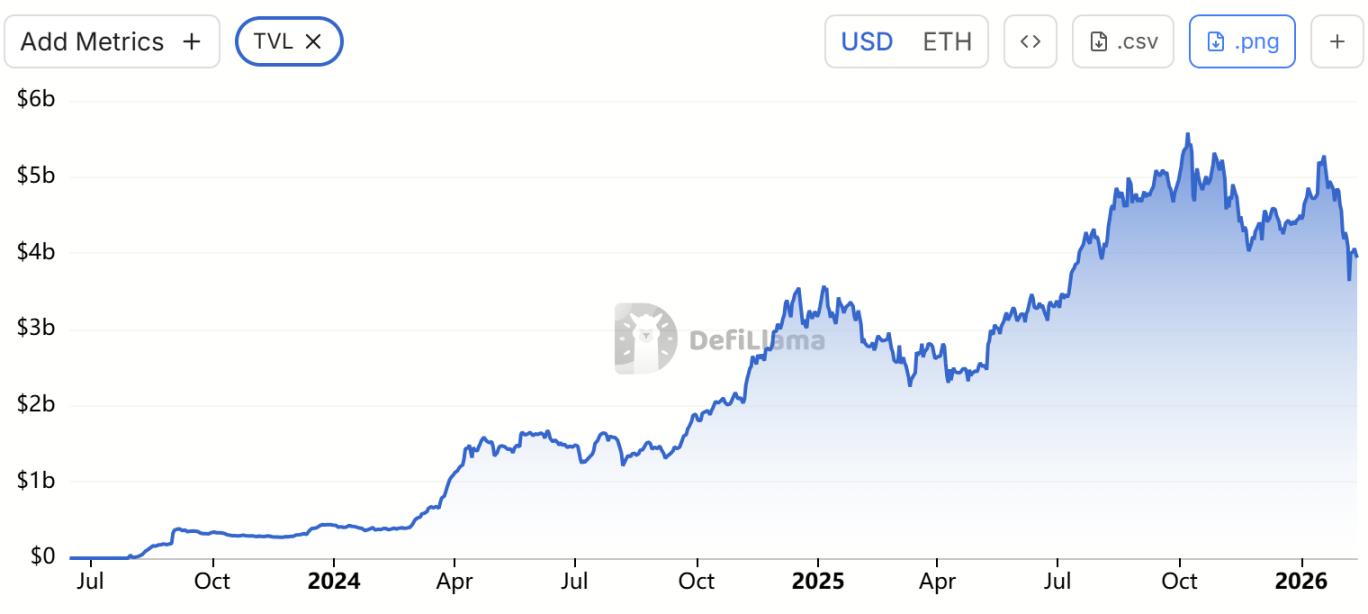

The cooling of Meme activity is not only about lower trading volume. It changed the demand structure of the chain. Many new users came to Solana for short term speculation, not for long term ecosystem participation. When the narrative faded, user stickiness dropped. TVL and active addresses declined together. Incentives and airdrops can create momentum in a bull market, but they are hard to sustain in a risk off environment.

At the same time, the broader public chain narrative is shifting. Between 2025 and 2026, the market moved away from leverage driven excitement toward stronger fundamentals and regulatory clarity. Capital returned to Bitcoin and Ethereum. Solana’s key advantage used to be high throughput and low cost. Now competitors are catching up. Ethereum upgrades expanded data capacity and improved parallel processing. Transaction fees fell and throughput improved. The performance gap between Ethereum and Solana narrowed, while Ethereum still holds a deeper developer base and stronger institutional positioning.

In the tokenization trend, more real world assets are deployed on Ethereum. Ethereum hosts far more RWA value than Solana. RWA emphasizes compliance and stability. That is an area where Ethereum has a clear lead. Solana still holds meaningful scale, but it has not yet built a dominant position in this sector.

WHY DAT BUYING COULD NOT REVERSE THE TREND

In 2025, Digital Asset Treasury companies created extra buying pressure for SOL. Some public companies raised capital and purchased SOL as treasury reserves. During the bull market, this amplified price momentum. But when SOL dropped from above 200 dollars to around 80 dollars, the market value of those companies shrank sharply. Confidence weakened. Locked supply helped reduce circulation, but it could not offset broader market selling pressure. More importantly, new entrants into the treasury strategy slowed significantly.

Bitcoin and Ethereum also experienced heavy corrections in recent months. Risk appetite declined across the market. Solana’s founder once asked the community what the biggest challenge is today. Responses included limited ecosystem perception beyond Meme, weak integration with major exchanges, and the need for stronger product depth. These discussions show that Solana is still searching for its next growth engine.

Public chain competition is no longer just about speed. It is about ecosystem maturity, regulatory positioning, and real demand. Relying only on high frequency speculation is not enough to sustain long term value. For Solana, the current stage looks more like a post bubble revaluation. Whether the cycle premium is truly over depends on whether Solana can build a new narrative instead of following the old one.