KEYTAKEAWAYS

- HEMI’s TGE launches with 10.78% of tokens circulating, balancing community, investors, and team allocations, setting a $95M market cap and $977M FDV baseline.

- Core innovations include the hVM integrating Bitcoin nodes, Proof-of-Proof consensus anchoring to Bitcoin, and Tunnels enabling secure cross-chain movement of assets and data.

- Risks remain significant: weak market conditions, airdrop-driven sell pressure, technical execution hurdles, and insider vesting overhang may test long-term adoption and sustainability.

CONTENT

HEMI’s TGE on September 23 introduces a Bitcoin-secured supernetwork with Ethereum programmability, a 10.78% initial float, and potential to reshape Bitcoin’s role in DeFi.

As September 23rd approaches, all eyes are turning toward HEMI, the modular “supernetwork” designed to merge Bitcoin’s security with Ethereum’s programmability. The project’s Token Generation Event (TGE) is not just about launching a new asset; it also represents a broader experiment: can Bitcoin finally step into decentralized applications and DeFi without sacrificing its core strengths?

Some opinions are referenced from @batulu

THE CONTEXT OF THE LAUNCH

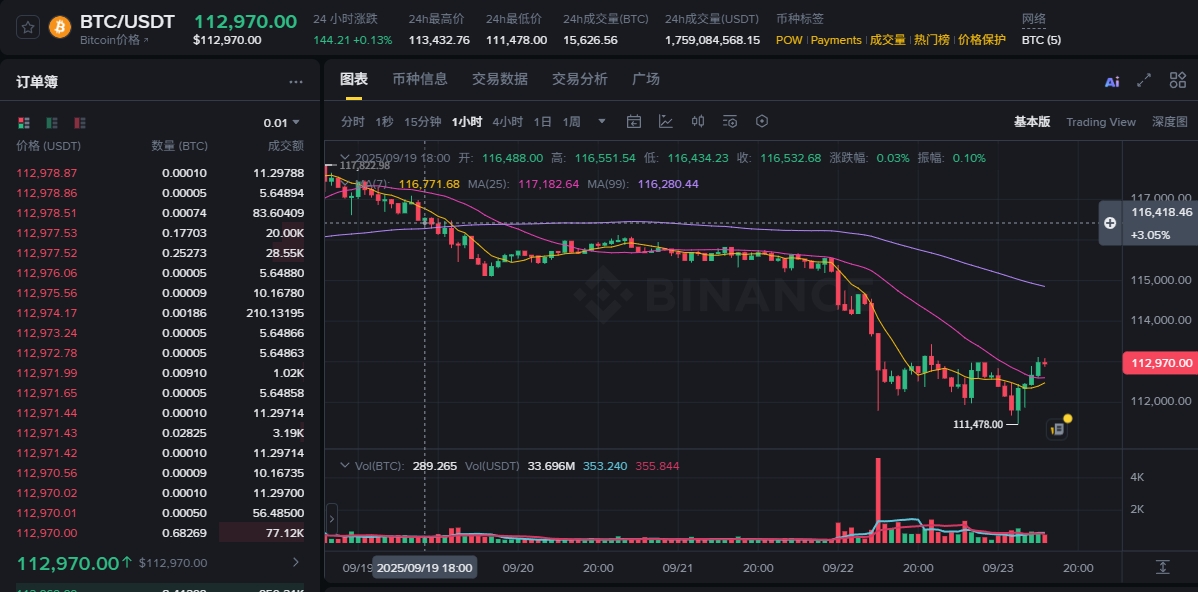

In the weeks leading up to TGE, the crypto market has faced heavy pressure. Bitcoin and Ethereum both retreated sharply, dragging most altcoins lower. Sentiment has been cautious, with many traders preferring stablecoins over speculative bets. Against this backdrop, launching a new token is undeniably risky. Yet it is often in uncertain conditions that projects with true innovation can stand out.

For HEMI, being listed on Binance and other major exchanges provides immediate credibility and visibility. Unlike smaller projects that struggle to attract liquidity, HEMI enters the market with institutional backing, strong exchange support, and a distinctive narrative. This combination gives it a chance to capture attention even when market mood is subdued.

TOKENOMICS AND DISTRIBUTION MODEL

At TGE, HEMI will have a total supply of 10 billion tokens. The initial circulating supply is approximately 977.5 million tokens, around 9.78% of the total. In addition, Binance will distribute 100 million HEMI (1% of supply) through its HODLer airdrop campaign, bringing the effective float at launch to nearly 10.78%.

The allocation model balances community incentives with long-term commitments. About 32% of supply is set aside for community and ecosystem growth, 28% for investors and strategic partners, 25% for the team and contributors, and 15% for the Hemispheres Foundation. Vesting schedules with cliffs and linear unlocks are designed to align stakeholders while avoiding immediate sell pressure, though investors will watch upcoming unlocks carefully.

This structure puts HEMI’s fully diluted valuation (FDV) near $977 million at the Alpha reference price of $0.0977, while its initial market capitalization (MC) stands around $95 million. These figures leave room for appreciation if traction builds, though they also set expectations that the project must meet.

CORE TECHNOLOGY AND POSITIONING

HEMI’s architecture is its real differentiator. The Hemi Virtual Machine (hVM) is Ethereum-compatible but also integrates a full Bitcoin node. This allows smart contracts on HEMI to directly access Bitcoin’s state, something usually dependent on bridges or oracles. By embedding this capability, HEMI reduces reliance on external trust assumptions.

The Proof-of-Proof (PoP) consensus mechanism anchors HEMI’s finality to the Bitcoin blockchain itself. In practice, this means that compromising HEMI would require undermining Bitcoin’s proof-of-work security, which is virtually impossible. If executed correctly, this could inspire strong confidence in HEMI’s security model.

Finally, HEMI introduces Tunnels—trust-minimized cross-chain channels that allow assets and data to move between HEMI, Bitcoin, and Ethereum. Unlike conventional bridges, which depend on centralized validators, Tunnels aim to enhance security. If proven effective, they could become vital infrastructure for Bitcoin-based DeFi.

RISKS AT THE TIME OF TGE

Despite its potential, HEMI faces risks. The most immediate is market pressure. With Bitcoin and Ethereum under selling stress, demand for new tokens could be weak. Airdrop recipients may quickly sell, generating heavy early sell pressure. Volatility is almost certain, and initial trading could be driven more by sentiment than fundamentals.

Another concern is supply overhang from locked allocations. Even with cliffs and vesting, significant supply rests with insiders and partners. If markets anticipate these tokens hitting circulation, enthusiasm could fade.

Technical complexity is also a challenge. HEMI’s promise depends on successfully executing difficult innovations—integrating Bitcoin nodes into an EVM environment, anchoring to Bitcoin’s chain, and running secure cross-chain Tunnels. If any of these falter, trust could erode.

WHY HEMI STILL MATTERS

Yet HEMI matters because it tackles one of crypto’s most persistent questions: how to make Bitcoin more than a passive store of value. For years, Bitcoin has dominated as the ultimate settlement layer but has been largely disconnected from programmable DeFi. Bridging attempts have often been clumsy, insecure, or too centralized.

HEMI’s goal is to create a supernetwork where Bitcoin and Ethereum complement each other. By granting Bitcoin access to smart contracts and giving Ethereum developers Bitcoin-level security, HEMI positions itself as a true connector. If successful, it could expand both Bitcoin’s utility and the design space for decentralized applications.

THE ROAD AHEAD

As TGE unfolds, short-term price action will hinge on liquidity and sentiment. Prices could swing wildly, and traders must be ready for sharp rallies or drops. Longer-term, the key lies in whether developers adopt HEMI, assets flow through its Tunnels, and PoP consensus proves itself.

These answers will not come overnight. Still, the launch signals the industry’s push to broaden Bitcoin’s role. In that sense, HEMI is more than a token—it is a test case for the next wave of blockchain innovation