KEYTAKEAWAYS

- KEY TAKEAWAYS

- “I AM FINALLY HERE” BECOMES A MARKET FOCUS: CELEBRITY STATEMENTS ARE AN ENDLESS SOURCE OF MEME COINS

- THE DEBATE AROUND “I AM FINALLY HERE”: A DISGRACE TO CHINESE LANGUAGE OR A NEW MEME CATCHPHRASE?

- FROM MEME COINS TO ECOSYSTEM POSITIONING: BINANCE’S DILEMMA AND ITS INEVITABLE CHOICE

- CONCLUSION: HEAVY LIES THE CROWN—EVERY GAIN COMES AT A COST

- DISCLAIMER

- WRITER’S INTRO

CONTENT

An in-depth analysis of how the “I Am Finally Here” meme coin surged after its Binance Alpha listing, revealing the influence of celebrity narratives, liquidity dynamics, and Binance’s strategic dilemma in the meme-driven crypto market.

Another potential 20× opportunity at the start of 2026—missed once again!

Just yesterday, Binance Alpha listed the Chinese meme “I Am Finally Here.” Originating from a New Year tweet by Binance Co-CEO and co-founder He Yi, this meme coin surged rapidly. In less than half a day, its market cap jumped from around USD 4 million to over USD 16 million, once again demonstrating the wealth-creation effect of “Binance-affiliated memes.”

What pains me even more is that on January 1, when this meme coin’s market cap was still under USD 800,000, I saw a group member forward the contract address—but I didn’t follow up. All I can say is that the market did give an opportunity…

At the same time, opinions in the market quickly polarized. Negative views argue that the meme coin’s listing on Alpha is a product of the Binance listing team’s “Shandong Studies guiding ideology,” an act of “only obeying the top,” pure flattery and therefore disgraceful. Positive views, however, hold that although the meme may be somewhat crude, when combined with the timing of the upcoming Year of the Horse, it has strong meme attributes and is therefore acceptable. So is it another glorious creation of Chinese memes, or a BSC meme shame pillar meant to flatter He Yi? Odaily Planet Daily will analyze this in the article.

“I AM FINALLY HERE” BECOMES A MARKET FOCUS: CELEBRITY STATEMENTS ARE AN ENDLESS SOURCE OF MEME COINS

Like many celebrity meme coins, “I Am Finally Here” had a coincidental yet intriguing beginning.

On January 1, the first day of the new year, Binance Co-CEO and co-founder He Yi posted to celebrate the start of a new year, writing: “2026, a new beginning; 2026, I am finally here.” The accompanying image showed her riding a white horse by the sea, conveying a sense of renewal. The comment section was filled with praise and congratulations.

The meme coin of the same name had actually launched earlier, on December 30 last year, and some commenters were already explicitly sharing the contract address.

In this way, a phrase that sounds slightly crude yet carries a hint of good wishes for the Year of the Horse began spreading and rising in price through the form of memes and meme coins.

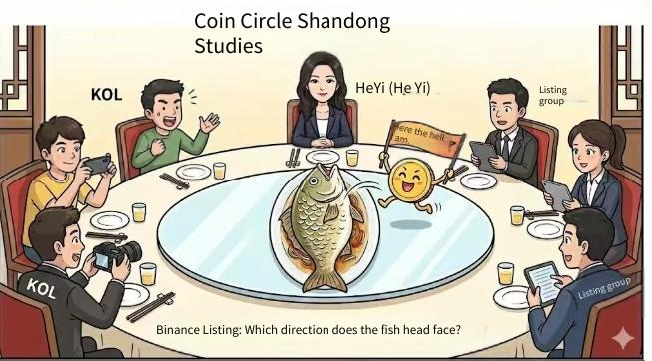

What truly turned “I Am Finally Here” into a hot topic and speculative target, however, was Binance—the so-called “number one exchange in the universe”—officially announcing yesterday that the meme coin would be listed on Alpha. Then came the classic meme image of the day: “Shandong Studies in the Crypto Circle.”

In that image, He Yi appears as the honored guest at a Shandong banquet table, while the listing team and KOLs play the roles of accompanying hosts, all following He Yi’s lead and sharing a slice of the “market liquidity and meme-coin wealth creation” feast.

Some made a fortune, some ate their fill, and naturally some missed the chance and lost the opportunity to get rich. As a result, opinions for and against “I Am Finally Here” going live on Binance Alpha emerged. Here, we select a relatively representative tweet.

THE DEBATE AROUND “I AM FINALLY HERE”: A DISGRACE TO CHINESE LANGUAGE OR A NEW MEME CATCHPHRASE?

Regarding this event, crypto KOL “Diving Observer” posted from the perspective of linguistic purity, saying: “Absurd. In the future, BNB Chain probably won’t even qualify as a state-owned enterprise chain. At least state-owned enterprises have cultural aesthetics—what is this stuff? Pure illiteracy? The depth and beauty of Chinese are gone. Does the Alpha listing team really understand Chinese?”

Someone quickly countered in the comments: “All the shit, balls, X, condoms, cats, and dogs on Solana—did you buy any less of those? When Chinese people play with their own memes, you suddenly get picky?” (profane language omitted). This comment received significant support from “nationalist fans,” who felt it made sense.

Later, Diving Observer clarified that the criticism was not directed at traders, but at those who believe that scatological memes can also represent national confidence.

Another crypto KOL, @0xyukaz, also posted that “this kind of listing strategy by Binance’s listing team will only lead BSC toward decline and seriously undermine genuine Chinese memecoin culture,” directly criticizing the team for being overly obsessed with CZ and He Yi’s meme creation and artificially pushing meme coin launches and pumps. This view was echoed by OKX CEO Star, who commented that compared with “I Am Finally Here,” “I Came Through the Snow” would be more civilized and better.

After this relatively mild debate over whether “I Am Finally Here” is good or bad, what followed in the market was a flood of Chinese memes with strong “Binance leadership-centric” overtones, such as “Mom,” “Dad,” “Son,” “Grandson,” and so on. Leaving aside judgments of right and wrong, let’s move on to a deeper, more fundamental discussion.

FROM MEME COINS TO ECOSYSTEM POSITIONING: BINANCE’S DILEMMA AND ITS INEVITABLE CHOICE

To talk about the present, we must first revisit the past.

In September 2024, in “Neiro and NEIRO Listed on Binance Together: A Turning Point for the Meme Coin Sector?”, we discussed shifts in the meme coin landscape. At that time, Binance simultaneously listed both uppercase and lowercase NEIRO/Neiro meme coins, sparking heated discussion. From then on—or even earlier, from March 2024, when BOME’s “three days to Binance” ignited a meme coin frenzy—the trend became unstoppable.

Faced with such a market environment, regardless of its own preferences, Binance seemed to have many options but in reality only one path: join the meme coin wave to boost trading activity, attract new users, and encourage high-frequency trading. This is dictated by Binance’s position as the largest CEX.

Just as internet platforms rely on three essentials—new users, usage time linked to advertising resources, and conversion rates tied to user spending—CEXs need a constant influx of new users (liquidity), more platform fees from high-frequency trading (their business model), and project supply based on the first two (new token listings). Meme coins, with their sheer quantity, rapid iteration, and strong liquidity, naturally take priority.

The question then becomes: for Binance, should it list meme coins from its own internal ecosystem, or provide a stage—and harvestable liquidity—for meme coins from external ecosystems or even competitors? The answer is self-evident.

Perhaps from that point on, Binance quietly began laying out its own “meme coin territory”—from Binance Wallet to Binance Alpha; from cooperation with the Four.meme platform to last year’s Meme Rush rankings. Through a series of feature updates and ecosystem initiatives, Binance gradually built a complete pipeline of “issuance–listing–Alpha–futures–spot,” injecting new vitality into platform profitability and CEX development.

Therefore, from listing NEIRO/Neiro under the banner of community support, to CZ and He Yi’s frequent statements on meme coins, Binance development, and BNB price, all of this was inevitable.

As the saying goes, “If you don’t occupy the battleground of public opinion, your enemy will.” In a crypto market where liquidity is king, “if you don’t fight for meme coin liquidity, it will naturally flow into your competitors’ pockets.”

Of course, the flip side is that every word and action of CZ and He Yi is magnified by the market and distorted attention. Amid constant praise and noise, it’s hard to avoid a certain enjoyment of being at center stage and holding decisive power.

This differs fundamentally from ecosystems like Solana, Base, or Sui—L1s and L2s more focused on infrastructure—because Binance is not just a CEX. Together with BNB Chain (the BSC ecosystem), the BNB token, and its community, it forms a highly centralized commercial complex that relies on CZ and He Yi’s public voice to achieve “growth only, no stagnation.” The inherently profit-driven nature of a CEX further amplifies their market influence and meme effects.

Compared with Solana’s open, developer-driven ecosystem filled with diverse memes and naturally encouraging meme coin development, Binance and BSC represent a relatively distorted, platform-centric ecosystem where attention and liquidity are highly concentrated. Thus, BSC’s evolution toward a “two-saints-only doctrine” is both accidental and inevitable.

CONCLUSION: HEAVY LIES THE CROWN—EVERY GAIN COMES AT A COST

For Binance and BNB Chain (the BSC ecosystem), having embarked on this “personal-centric” development path, they must naturally bear the accompanying criticism and concentration of pressure. Ultimately, this pressure falls on the listing team and the exchange itself, as this is where liquidity converges. And if one wants more trading fees and more casino players, there’s no need to distance oneself from the outcome.

How to strike a balance between market reputation and commercial interests—so that frequent statements by CZ and He Yi do not negatively affect Binance’s main platform, the relaunch of Binance US, or the healthy development of BSC meme coins and other sectors—will depend on negotiation, communication, and compromise between organizational structures and core figures.

Otherwise, if those who flatter always receive more rewards than those who genuinely work, fragmentation of morale will be inevitable.

And once morale is gone, the team becomes impossible to lead.

Read More:

Binance Co-CEO Yi He’s Account Hack Exposes Critical Security Risks Behind Meme-Coin Manipulation