KEYTAKEAWAYS

-

HumidiFi transforms Solana’s liquidity landscape by introducing a predictive market making model that behaves closer to an institutional dark pool than a traditional AMM.

-

Its architecture combines off chain price prediction, on chain settlement, dynamic inventory control, and MEV resistant execution enabling CEX level spreads and stable liquidity across market conditions.

-

With a team built from Jump Citadel and other HFT backgrounds and a utility driven token model HumidiFi is positioned to become a core liquidity layer for Solana’s expanding institutional and real world financial ecosystem.

CONTENT

THE NEW FORM OF MARKET STRUCTURE EMERGING ON SOLANA

The story of HumidiFi begins with a question that has followed DeFi for years. Why has the industry struggled to bring market maker grade liquidity on chain Even after several cycles decentralized markets still felt like slow passive pools rather than true financial engines. Solana changed that equation by offering something the industry never had before low latency parallel execution and a network that behaves more like a high speed settlement layer than a typical smart contract system. HumidiFi did not simply build on top of this foundation. It redefined what on chain liquidity is meant to be.

At first glance HumidiFi looks like another DEX inside Solana’s ecosystem. In reality it functions more like a financial institution operating a dark pool predictive pricing engine and real time inventory desk connected to global markets. It does not depend on passive liquidity deposits. It produces liquidity the same way professional market makers do in traditional finance. Prices are not determined by a formula. They are generated by a live prediction engine that reacts to market conditions.

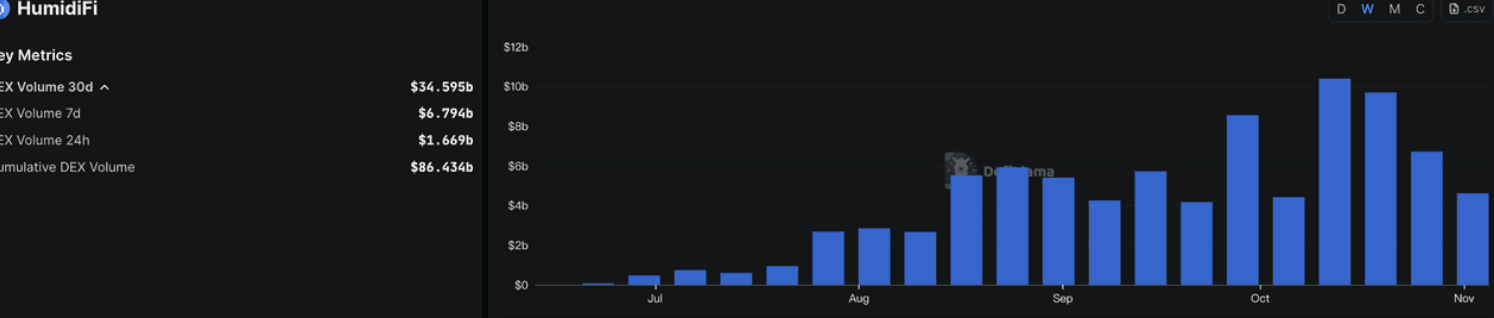

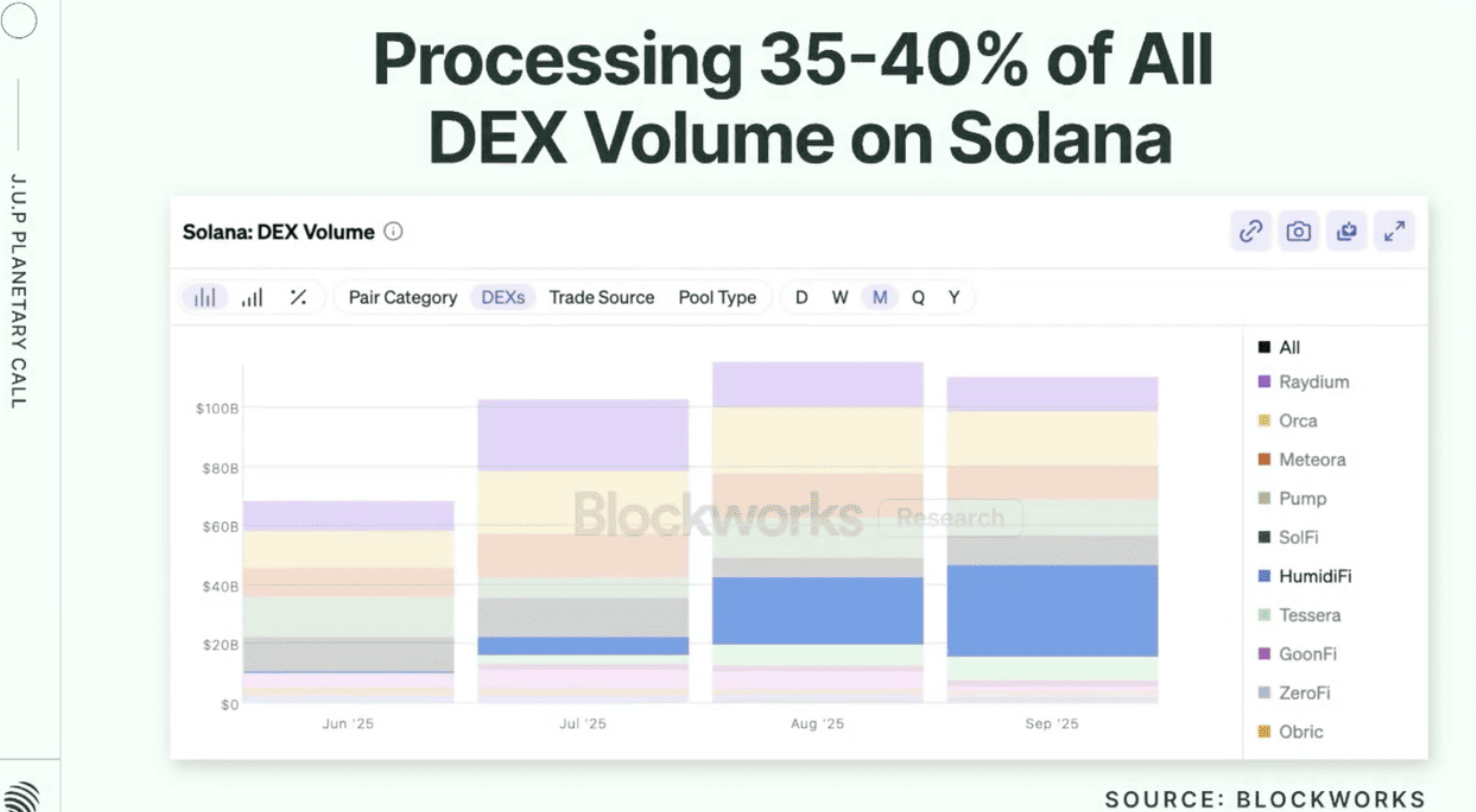

Solana’s rise in 2025 also set the perfect backdrop. Jupiter became the primary aggregator powering nearly every meaningful trade on the chain. Competition shifted away from front end traffic. What mattered was execution quality. This created a market structure where a single liquidity engine could become the hidden center of flow without being visible at the UI layer. HumidiFi stepped directly into this role and quickly became one of Solana’s most influential execution venues.

HOW HUMIDIFI REBUILT THE DEX MODEL FROM THE GROUND UP

HumidiFi’s core is a predictive AMM that behaves nothing like the passive models that defined DeFi’s early years. Earlier designs relied on passive capital and left rebalancing entirely to arbitrage. HumidiFi flips this logic. It anticipates price movements and adjusts its quotes ahead of time. This approach depends on a system that connects off chain computation with rapid on chain settlement.

The first layer is the predictive quoting engine. It pulls data from major exchanges including Binance Coinbase and OKX and combines it with on chain conditions across Solana. A dedicated off chain cluster runs short horizon prediction models in milliseconds. These results are pushed on chain through a custom oracle pipeline. As a result Jupiter surfaces not a pool level view but the best execution available across the market.

Another key component is dynamic inventory management. HumidiFi tracks its asset balances and adjusts quotes whenever inventory drifts from its target range. If it accumulates too much of a volatile asset it posts quotes slightly better than external markets. Arbitrage bots enter and remove the excess inventory. This allows HumidiFi to use external actors as part of its own balancing mechanism. It gives the system resilience in market conditions that would normally drain or destabilize a passive pool.

The architecture also resembles a dark pool. Quotes are visible but no public order book exists. Combined with MEV filtering this protects against toxic flow and front running. For institutions and large traders this protection is essential. It creates a secure environment where size can move without exposing intent to the broader market.

Execution is powered by Nozomi the project’s custom settlement engine. Nozomi connects directly to validator nodes giving HumidiFi priority access and avoiding congestion in the public mempool. For HumidiFi’s model to work quotes must update quickly and trades must settle reliably. Nozomi is built precisely for this use case and delivers CEX like responsiveness in an on chain environment.

THE TEAM BUILDING THE SYSTEM AND THE ECONOMICS DESIGNED TO SUSTAIN IT

HumidiFi is shaped by a team with a background rarely found in DeFi. The project is led by Kevin Pang who spent nine years at Jump Trading one of the world’s leading high frequency trading firms. His experience in algorithmic trading execution design and risk management has directly influenced HumidiFi’s architecture. The broader team includes veterans from Citadel Jump and similar firms where speed and microstructure expertise are core skill sets.

This background explains why the project operates with a level of engineering depth rarely seen in crypto. HumidiFi does not rely on standard frameworks or generic oracle infrastructure. It builds its own block builder logic low level network optimizations and specialized execution pathways. In a competitive environment like Solana these capabilities create a real moat.

The token model is also built for utility not speculation. The WET token enables fee reductions for active traders. For institutions and high volume users fee optimization is not optional. It is a direct operational advantage. This creates a durable form of demand that does not depend on hype cycles or narrative swings.

The distribution structure reinforces this long term alignment. The public sale allocation was fully unlocked at launch while foundation and ecosystem allocations unlock gradually over two years. The team allocation begins at zero unlock at TGE. It signals a project built for long term development not short term extraction. In a market often shaped by fast unlocks and early selling this structure stands out.

The disruption during the first token sale exposed the difficulty of running decentralized launches under high competition. A sophisticated Sybil attack using Jito bundles captured most of the public allocation within seconds. HumidiFi and Jupiter voided the affected round refunded all participants blacklisted attacker wallets and deployed a new contract. The decision restored confidence and resulted in a more resilient launch design for the December 8 sale.

WHAT HUMIDIFI MEANS FOR SOLANA AND THE FUTURE OF DEFI

HumidiFi marks a turning point for Solana showing that on chain markets can reach institutional quality. The combination of predictive pricing inventory control and high speed execution mirrors the structure of traditional electronic liquidity venues. Instead of following Ethereum era AMM design HumidiFi built a liquidity engine closer to a universal market layer that other applications can rely on.

This has strategic implications. As Solana expands into payments RWA structured products and institutional finance every sector will require stable deep liquidity. If HumidiFi continues to scale it could become the default counterparty for these flows. It would no longer resemble a typical DeFi protocol but core infrastructure for the chain.

There are risks. The model depends heavily on off chain computation and custom network pathways. Regulatory attention on dark pool style systems may increase. And after the sale incident the community will expect flawless execution for future launches. But the direction is clear. DeFi is moving toward professionalization and HumidiFi is one of the first clear signs of that shift.

The long term vision is a universal liquidity layer on Solana. A system that lending markets derivative platforms payment rails and institutional products can plug into for execution. If realized Solana would operate like an internet scale capital market with HumidiFi acting as the silent engine that moves liquidity across the network.

The next phase of DeFi will not be driven by new yield incentives or shallow token experiments. It will be driven by rebuilding market structure itself. And this time the builders are people who spent their careers shaping how global markets operate now bringing those systems on chain.