KEYTAKEAWAYS

- The interest-bearing design introduces explicit time value to retail-level money, redefining the holdable and configurable nature of central bank liabilities.

- The efficiency advantages of tokenized deposits are absorbed within the institutional framework, reducing their reliance on blockchain-based forms.

- The monetary creditor-debtor relationship becomes more explicit, repositioning commercial banks’ intermediary functions and allowing central bank liabilities to enter economic agents’ asset structures directly.

CONTENT

Interest-bearing digital RMB is not merely an upgrade of a payment tool but represents a systemic institutional adjustment by the central bank to its liability structure and tokenized efficiency under digital financial conditions.

CLEARING EFFICIENCY TRANSFORMATION

In traditional financial systems, deposits persistently maintain stability not merely because they provide interest but because they perform clearing, custody, and liquidity adjustment functions. Deposit interest rates essentially compensate for these services.

However, with the digitization of financial infrastructure, especially the significant improvement in clearing and settlement efficiency, the intermediary value of deposits is gradually eroded. Real-time clearing, 24/7 settlement, and low-cost transfers diminish the rationale for keeping funds in bank accounts solely for use. As clearing efficiency approaches zero, the functional advantage of deposits increasingly reduces to interest competition alone.

In this context, if money remains non-interest-bearing for long periods, stability is not preserved; instead, funds naturally flow into various alternative structures—whether quasi-deposit financial products, shadow currency forms, or blockchain-based solutions emphasizing efficiency. This outcome is not the result of aggressive innovation but a natural evolution arising from institutional gaps.

Therefore, interest-bearing features are not an expansionary policy choice but a defensive institutional response: when clearing efficiency is neutralized by technology, the central bank must address the question of how to maintain money’s central position in the system.

TIME VALUE EMERGENCE

From a credit perspective, interest-bearing digital RMB does not introduce new risk structures. It remains a liability of the central bank, without credit expansion or leverage functions typical of financial intermediaries. Thus, it is not a new financial asset and does not possess traditional investment attributes.

The real change lies in the time value of money.

Historically, time value has been largely associated with deposits and bonds, while money was deliberately designed to be “time-neutral.” However, when money can be held long-term, allocated flexibly, and deeply embedded in digital financial activities, stripping time value entirely becomes unnatural. The interest-bearing design addresses this mismatch.

Consequently, a new type of liability emerges: neither commercial bank deposits nor tradable securities, yet holdable, liquid, and with limited yield. Its significance does not lie in the yield level itself but in redefining the existence of money in the temporal dimension.

EFFICIENCY ABSORPTION

Functionally, tokenized deposits primarily aim to enhance system efficiency rather than address credit issues: faster settlement, lower friction, greater programmability, and seamless integration with other digital financial tools.

These goals fundamentally target efficiency, not form.

When such efficiencies can be implemented within the institutional framework, the importance of tokenized deposits as a technological path diminishes. The interest-bearing digital RMB does not replicate blockchain forms but absorbs their efficiency achievements: real-time settlement, centralized credit, low usage costs, and high liquidity are integrated into central bank liabilities.

In this scenario, tokenized deposits no longer compete on equal footing with interest-bearing digital RMB; they may revert to tool-like roles in specific contexts. They no longer serve as “essential financial forms” but become peripheral efficiency supplements. This does not negate the technology itself; rather, when key efficiencies are internalized institutionally, the technological narrative naturally loses its centrality.

EXPLICIT CREDIT RELATIONSHIPS

In traditional systems, although individuals and enterprises use money, their direct creditor relationship often exists at the commercial bank level, with the central bank acting as a behind-the-scenes stabilizer. The ultimate credit of money comes from the central bank, but this relationship is indirect in practical use.

Interest-bearing digital RMB changes this previously overlooked structure. Users can directly and explicitly hold central bank liabilities and configure them to some extent. The creditor-debtor relationship becomes explicit.

This change does not imply the disappearance of financial intermediaries but a redefinition of intermediary functions. Commercial banks no longer rely solely on deposits as a single liability form but must reposition themselves in value-added areas such as payment, credit, and asset management. At the same time, monetary policy transmission becomes clearer due to the direct accessibility of central bank liabilities.

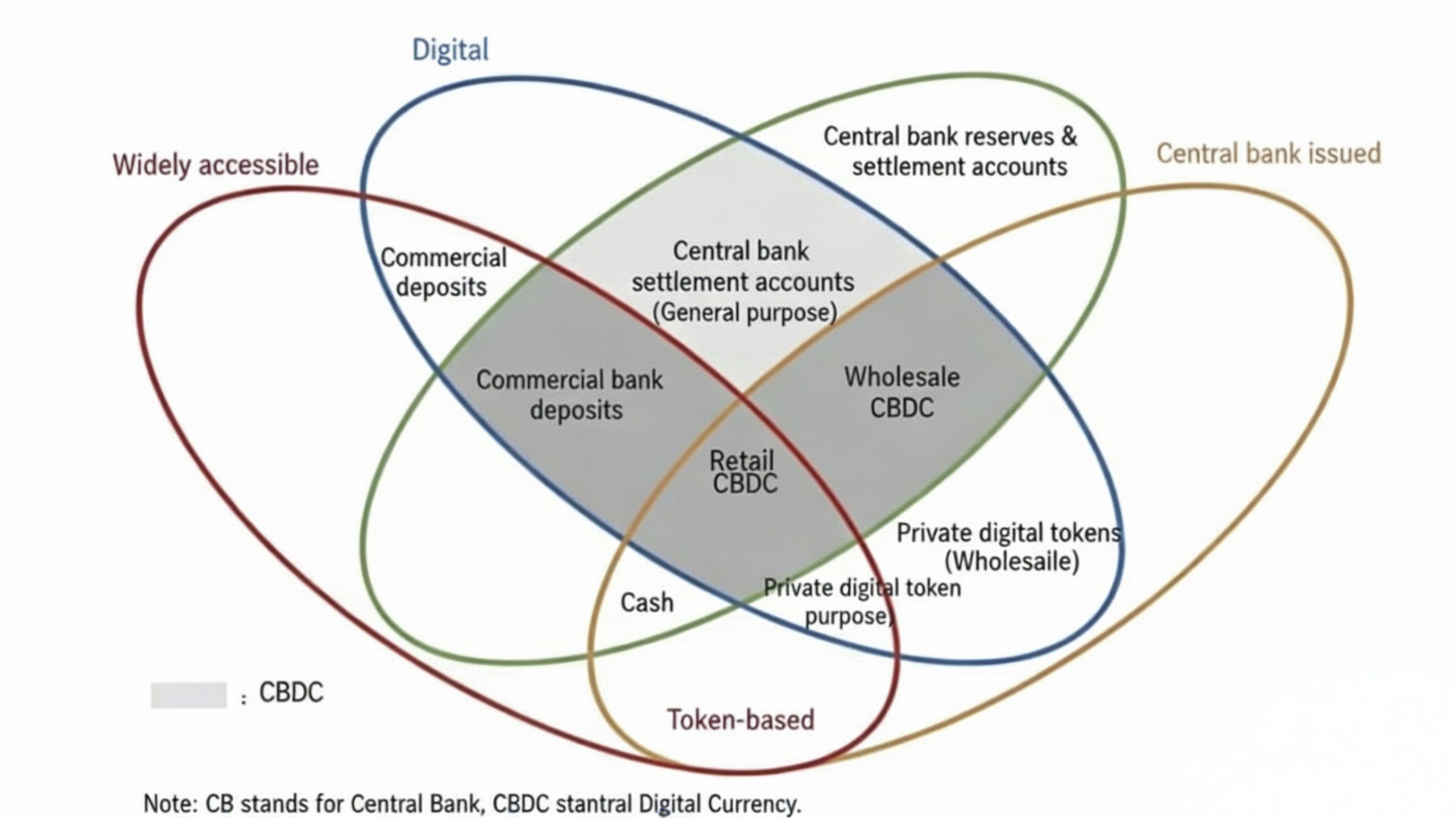

Figure 1: Monetary Classification System Based on Issuing Entities and Technical Forms

CONCLUSION

Overall, interest-bearing digital RMB represents a systemic adjustment to the structure of money liabilities rather than a measure aimed solely at improving payment convenience. By integrating the efficiency advantages previously emphasized by tokenized deposits, it responds within the institutional framework to potential pressures from alternative financial structures.

This adjustment results in a monetary system where money at the retail level possesses explicit time value, central bank liabilities directly enter the asset structures of economic agents with configurability, and the necessity of tokenized finance at the core monetary level is significantly reduced. In this way, interest-bearing digital RMB functions as an institutionally optimal solution under digital conditions, re-establishing the central role of money in modern financial systems through structural recalibration rather than through innovations in form.

Read More:

CRYPTO TAX TRANSPARENCY BECOMES A GLOBAL INFRASTRUCTURE ISSUE