KEYTAKEAWAYS

- Polymarket functions as a decentralized information market where prices reflect collective probability, not bookmaker odds.

- The legality of Polymarket depends on jurisdiction, platform version, and timing, with the U.S. and Europe applying very different regulatory frameworks.

- Even where access is permitted, Polymarket users face risks from regulatory changes, geoblocking, account reviews, and market manipulation.

CONTENT

Polymarket is a decentralized prediction market where users trade real-world outcomes. Learn how Polymarket works, where it is legal, and the key regulatory risks to know.

WHAT IS POLYMARKET? IS POLYMARKET LEGAL?

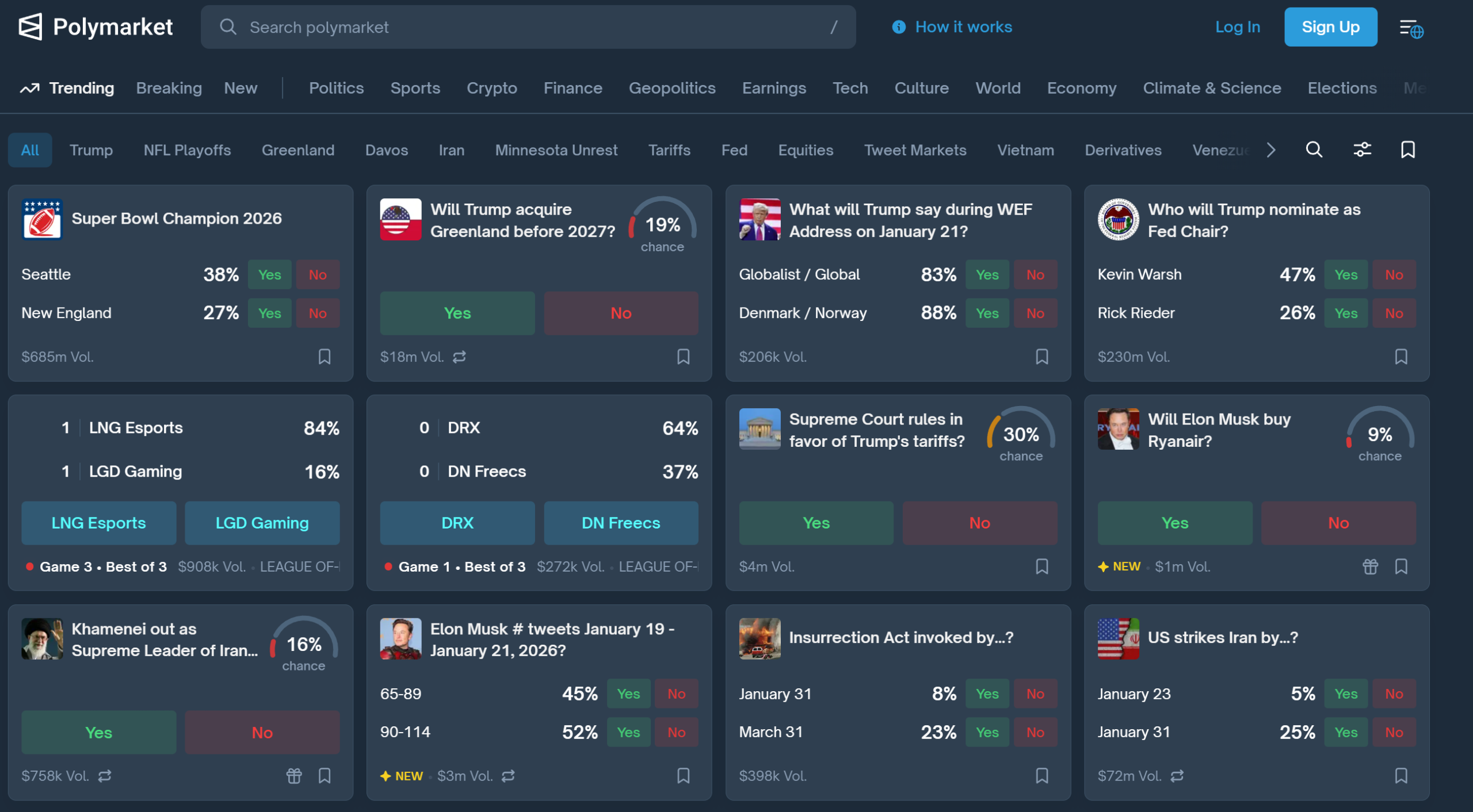

Polymarket is a decentralized prediction market platform that allows users to trade on binary, “Yes or No” outcomes of future events. Each market is created with clearly defined resolution criteria and a transparent outcome source. Once an event is settled, users holding shares of the correct outcome can redeem them for 1 US dollar (USDC).

➤ Official website: polymarket.com

Unlike traditional gambling platforms, Polymarket is designed around market-based truth discovery rather than bookmaker odds. There is no house taking the opposite side of your bet. Instead, participants trade directly with one another, and market prices emerge organically from global user demand and belief.

In this structure, the price of a contract on Polymarket reflects the collective expectation of its participants. Opinions are not weighted equally—confidence is expressed through capital. The more conviction a user has, the more they are willing to stake, allowing the market price to function as a real-time probability signal.

The range of markets available on Polymarket is broad. Users can trade on political events, cryptocurrency price movements, economic indicators, popular culture topics, and even sports-related outcomes, as long as the event can be clearly defined and resolved.

From a technical perspective, Polymarket is built on the Polygon blockchain. All core functions—including fund custody, trade execution, and settlement—are handled through smart contracts. This on-chain architecture ensures transparency, reduces reliance on centralized intermediaries, and makes market rules resistant to arbitrary changes.

Overall, Polymarket positions itself not merely as a betting platform, but as a decentralized information market—one that transforms collective judgment about the future into tradable, quantifiable price signals.

>>> More to read: What is Polymarket? Web3 Prediction Market

IS POLYMARKET LEGAL?

Polymarket is a crypto-enabled prediction market that allows users to take positions on the outcomes of real-world events. Rather than betting against a centralized bookmaker—such as a traditional sports betting operator—users on Polymarket trade directly with one another. This peer-to-peer structure makes the platform resemble a trading market more than a conventional gambling product, although its legal classification remains highly complex.

So, is Polymarket legal? The answer depends on three key factors: the user’s location, the specific version of Polymarket being accessed, and the point in time at which the question is asked. Across jurisdictions, Polymarket may be explicitly permitted, explicitly prohibited, or fall into a regulatory gray area. Even within the United States, legality can vary by state. As a result, users should always verify local laws and regulations before using Polymarket—what is legal today may not remain legal tomorrow.

This regulatory uncertainty stems from how different authorities interpret Polymarket’s core activity. Some regulators view it as a trading or derivatives-like platform, while others classify it as a form of illegal gambling. The use of cryptocurrency further complicates its legal status, adding layers of financial and technological regulation on top of gambling and market-structure rules. To make matters more challenging, these regulatory frameworks continue to evolve.

In 2022, U.S. regulators required Polymarket to restrict access for U.S. users following enforcement action. Since then, its regulatory status in the United States has remained constrained, with access and compliance shaped by ongoing oversight and legal interpretation rather than broad nationwide approval.

Overall, Polymarket sits at the intersection of trading, information markets, and gambling law—an area where definitions are fluid and regulatory clarity is still catching up.

>>> More to read: What is Crypto Prediction Market? A Complete Beginner’s Guide

WHERE IS POLYMARKET LEGAL?

🔍 Is Polymarket Legal in the United States?

In the United States, Polymarket is not freely available in an unrestricted sense. Instead, it operates under a highly regulated framework overseen by the Commodity Futures Trading Commission (CFTC). Following a settlement reached in January 2022, Polymarket shut down access for U.S. users and withdrew from the domestic market.

It was not until late 2025 that Polymarket reintroduced a U.S.-facing product. This relaunch came in the form of a separate, regulated application with a limited scope of services and markets. Even with this return, state-level regulations remain critically important—particularly in areas that intersect with sports-related or betting-adjacent markets, where legal standards can differ significantly across states.

📌Current Status: In July 2025, Polymarket acquired QCEX for $112 million. Prior to the acquisition, QCEX had already obtained exchange and clearing licenses issued by the CFTC. As a result, this transaction created a compliant pathway for Polymarket to re-enter the U.S. market and marked a structural shift away from offshore operations toward a fully regulated market environment.

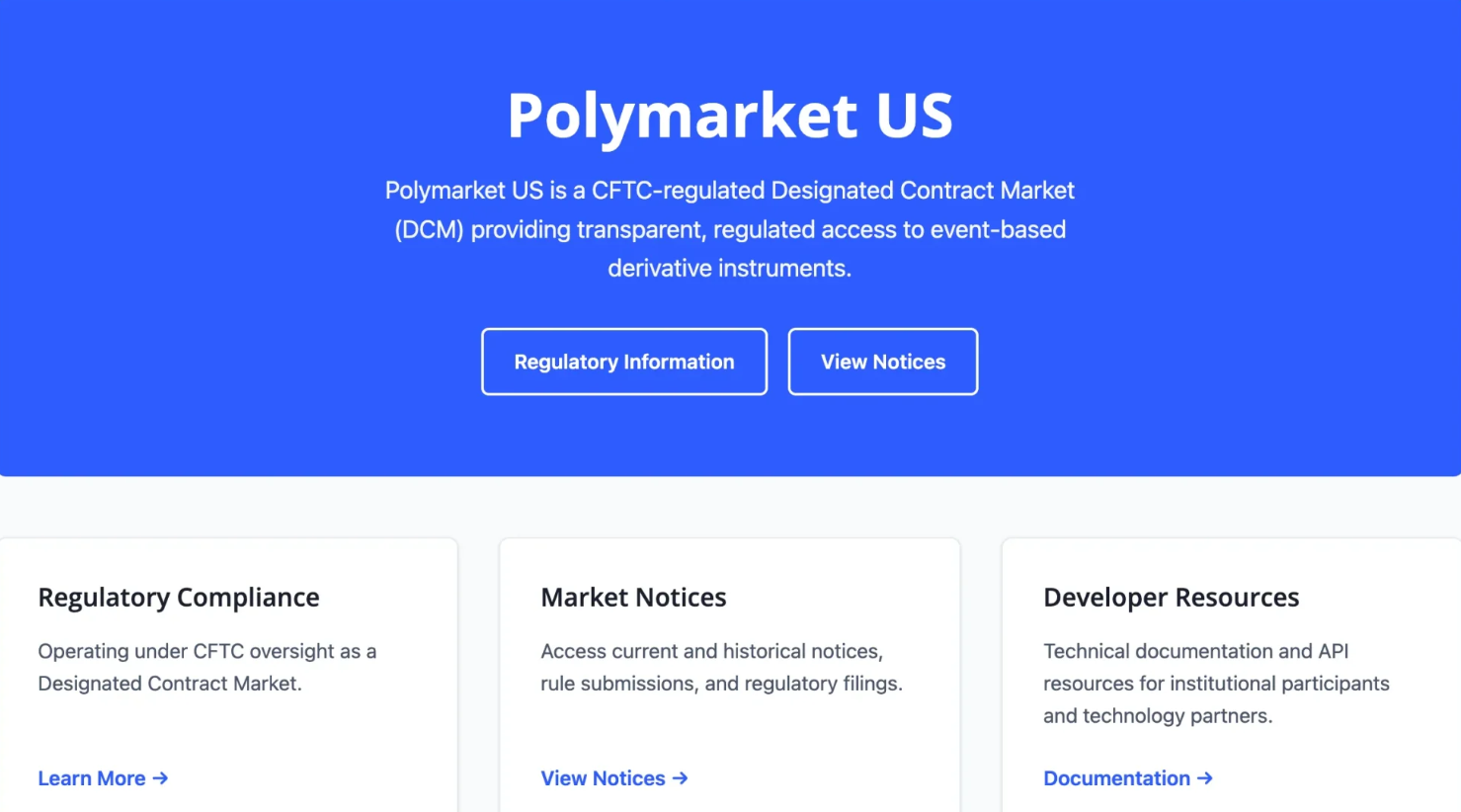

From a regulatory classification perspective, Polymarket was previously identified by the CFTC as a commodity trading venue. By late 2025, this designation was revised to that of a Designated Contract Market (DCM). Under this framework, Polymarket’s event contracts are required to comply with exchange-like rules, including regulated clearing, transaction reporting, and the use of authorized intermediaries.

Following this transition, Polymarket also moved toward a custodial trading model, aligning its operational structure more closely with U.S. regulatory expectations for market infrastructure and investor protection.

✏️ Today, Polymarket has obtained legal recognition from the Commodity Futures Trading Commission (CFTC), although user access and the range of permitted markets continue to vary under ongoing regulatory constraints.

🔍 Is Polymarket Legal in Europe?

Across most of Europe, Polymarket is either illegal or difficult to access. Unlike the United States, Europe does not operate under a single, unified regulatory authority. Instead, the legal environment is shaped by a fragmented mix of national rules, interpretations, and enforcement standards.

In some European countries, prediction markets are classified as gambling activities, while in others they are treated as financial products—often compared to options or derivatives. Regardless of how they are categorized, licensing remains a critical requirement. Without explicit authorization, platforms such as Polymarket are generally considered non-compliant.

Enforcement practices also vary widely across jurisdictions. Following regulatory reviews, French authorities urged Polymarket to implement geoblocking measures. Belgium and Poland have taken steps to block access, while Germany and Italy have appeared on lists of restricted jurisdictions. Although enforcement outcomes differ by country, the overall direction is clear: an increasing number of European regulators are moving toward restriction rather than approval.

➤ Regulatory approaches in Europe typically fall into three broad categories:

✅ Some authorities apply EU-wide and national gambling laws to prediction markets.

✅ Others rely on financial regulations governing derivatives and binary-option–like contracts.

✅ Differences in enforcement intensity mean that access conditions can change rapidly, often with little or no advance notice.

Regulatory resistance toward platforms like Polymarket has intensified for concrete reasons. European regulators emphasize consumer protection, the prevention of underage or unidentified user participation, and the enforcement of anti–money laundering standards. Many also reject the argument that prediction markets are fundamentally distinct from gambling, viewing the “trading versus betting” distinction as largely semantic. When the economic substance resembles gambling, regulators tend to apply gambling-style oversight.

Additional pressure comes from the broader EU stance on retail binary options, which have faced sustained regulatory scrutiny, combined with Europe’s traditionally strict gambling oversight regimes. Polymarket has been blacklisted in Romania due to heavy election-related trading activity and has reportedly been blocked in Switzerland as well. In Europe, legality typically means obtaining permission first—market access usually follows licensing, not the other way around.

>>> More to read: What is Kalshi Prediction Market? How Does It Work

IS POLYMARKET LEGAL? RISKS & LEGAL GRAY AREAS TO UNDERSTAND

To comply with applicable regulations, Polymarket restricts or blocks user access in certain countries. These geographic controls are designed to align with international sanctions and embargoes, local financial regulations, gambling and prediction-market laws, as well as anti–money laundering (AML) and know-your-customer (KYC) requirements. In practice, Polymarket generally chooses to block access rather than operate in potential violation of the law.

Even if Polymarket is currently legal in your jurisdiction, regulatory conditions can change quickly. Laws and enforcement policies may shift with little warning, potentially cutting off access overnight. A user may open an account legally, only to find that nationwide restrictions or new regulatory limitations have been introduced the next day. In such cases, access may be reduced, restricted, or limited to specific versions of the platform.

There is also the risk of account suspension or freezing. Because Polymarket enforces geolocation controls and KYC verification, certain behaviors may trigger account reviews, including:

❗Logging in from locations associated with restricted jurisdictions

❗Using VPNs or frequently changing IP addresses

❗Traveling across borders while maintaining active sessions

During these reviews, user funds may be temporarily frozen until the investigation is completed.

Another structural risk stems from the peer-to-peer nature of prediction markets. Unlike centralized platforms with fixed odds, market prices on Polymarket are shaped by participant behavior. As a result:

- Large traders may influence prices by placing sizable positions

- Market odds can temporarily deviate from fair probabilities

- Smaller participants may face less favorable entry points

For these reasons, anyone using Polymarket must independently assess the associated risks and take responsibility for compliance. Users should always verify their local legal environment, confirm which version of Polymarket they are accessing, and stay informed about current regulatory conditions before participating.

CONCLUSION

Is Polymarket Legal? overall, Polymarket represents a new class of decentralized prediction markets that blends trading, information discovery, and elements traditionally associated with gambling. By allowing users to express beliefs through capital rather than opinion, the platform turns collective judgment into real-time probability signals. At the same time, Polymarket operates in a regulatory environment that remains fragmented and highly jurisdiction-dependent, with markedly different treatment in the United States and Europe.

From a user perspective, participation requires more than understanding how the platform functions. Legal access can change quickly due to regulatory shifts, while practical risks—such as geoblocking, account reviews, custodial restrictions, and price distortion by large traders—remain part of the experience. As global regulators continue to refine their approach to prediction markets, Polymarket stands as both a powerful information market and a reminder that innovation often moves faster than legal clarity.