KEYTAKEAWAYS

-

ustin Sun claims JST could become a "100x token" due to JustLend and USDD’s success, driving market excitement, though risks related to algorithmic stablecoins persist.

-

JustLend and USDD, key pillars of Tron’s ecosystem, generate significant profits but face concerns over sustainability and transparency, especially with algorithmic stablecoins.

-

Tron’s high-performance blockchain and strategic partnerships boost its DeFi and content sectors, though governance issues and legal challenges create long-term risks.

CONTENT

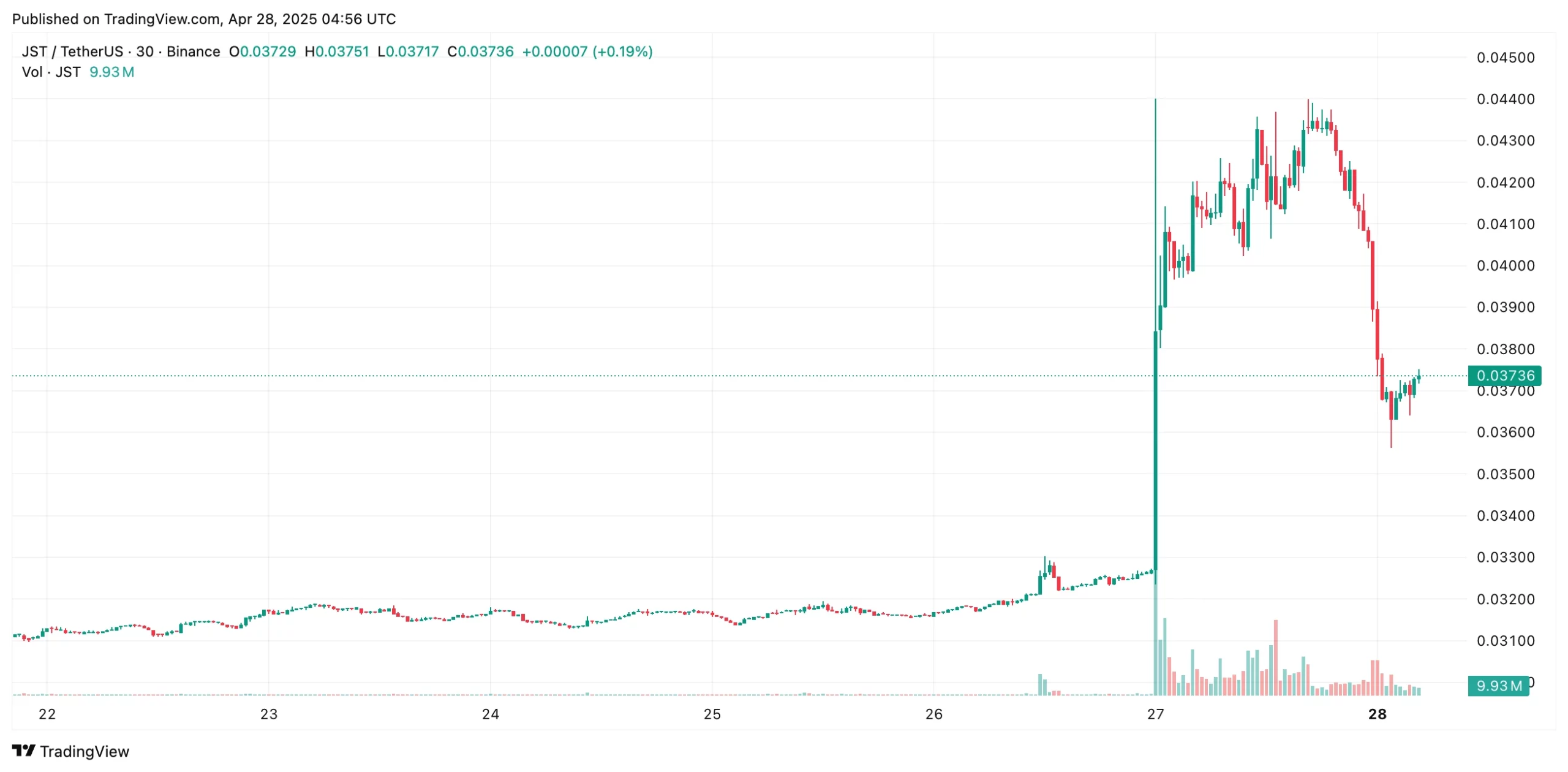

On April 27, 2025, Tron founder Sun Yuchen (Justin Sun) made a bold statement on social platform X. He said that the JUST (JST) token has seen a fundamental reversal and predicted it would become “the next 100x token.”

He highlighted that JustLend, a decentralized lending platform incubated by JST, has become a key pillar of the Tron ecosystem, generating tens of millions of dollars in annual net profit.

Meanwhile, the algorithmic stablecoin USDD has also shown “explosive growth.”

Sun promised to use all profits to buy back and burn JST tokens, aiming to reduce supply and boost value. Following this statement, JST’s price surged by 34% within 24 hours, reaching $0.04310.

JST’S “100X” PROMISE: MARKET EXCITEMENT AND POTENTIAL RISKS

Sun positioned JST as the core of Tron’s DeFi ecosystem, emphasizing that its value comes from the success of JustLend and USDD. He claimed JustLend has grown into one of Tron’s largest lending platforms, with tens of millions of dollars in annual profits.

USDD, after launching USDD 2.0 in January 2025 (offering a 20% APY), also achieved strong growth.

Sun compared JST to a combination of AAVE (lending platform) and MKR (MakerDAO’s governance token), predicting that ecosystem revenue would exceed $100 million by 2026.

He again promised to use all profits to repurchase and burn JST, creating a deflationary effect.

The market responded quickly. Trading volume soared, and the price reflected strong investor optimism. Discussions on X were polarized:

Some users supported the buyback strategy, comparing it to Binance’s BNB model. Others warned of short-term overbought risks, as CRSI indicators showed overheating, suggesting better to buy on dips.

However, risks remain.

USDD’s algorithmic model is similar to Terra’s UST, which collapsed in 2022. USDD itself once lost its peg to $0.97 and has faced questions about reserve transparency.

Both JustLend’s and USDD’s high yields (30% and 20% respectively) rely heavily on subsidies from the Tron DAO, raising doubts about long-term sustainability.

Also, Sun Yuchen faces allegations from the U.S. SEC regarding securities fraud and market manipulation, which affects JST’s credibility.

For JST to truly achieve “100x”, it must overcome both structural risks and reputation challenges.

JUSTLEND AND USDD: THE TWO ENGINES OF JST

The core value of JST comes from the performance of JustLend and USDD, which are the foundation of Tron’s DeFi ecosystem.

JustLend is a decentralized lending platform launched in 2020. It allows users to supply assets to liquidity pools or borrow against collateral.

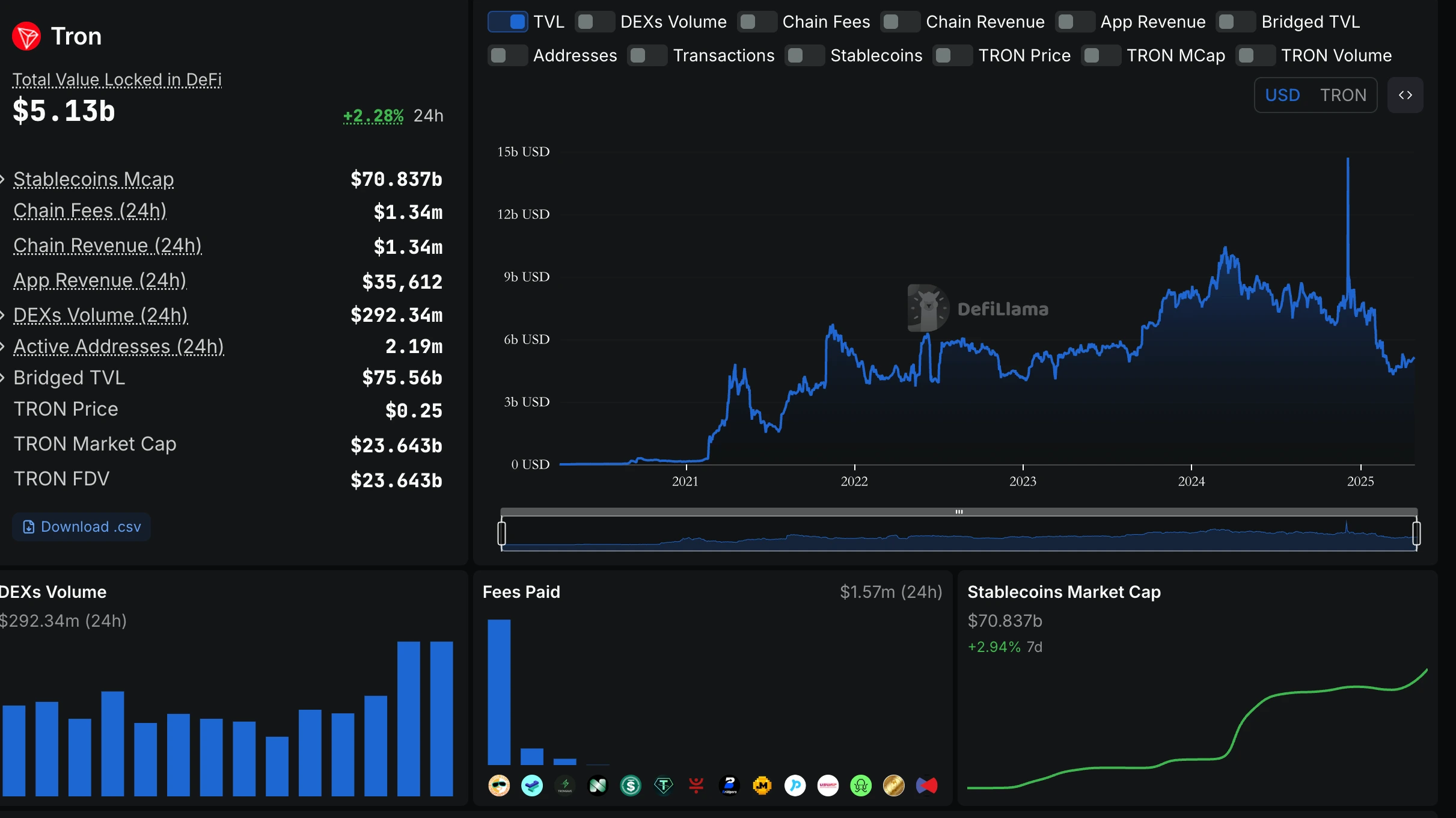

By 2022, JustLend’s Total Value Locked (TVL) had reached $1.9 billion. Thanks to Tron’s low fees and high throughput blockchain, it offered up to 30% APY, attracting many users.

Sun Yuchen claimed that JustLend earns tens of millions of dollars in profit annually, although there is little public data to verify this, and information mainly comes from his statements.

USDD is an algorithmic stablecoin launched by Tron in 2022. It aims to maintain a $1 peg through arbitrage mechanisms and reserve assets like TRX and BTC held by the Tron DAO.

After the launch of USDD 2.0 in 2025, offering 20% APY, it attracted even more users and became a key asset within Tron’s ecosystem.

However, USDD’s design is very similar to Terra’s failed UST, which caused $40 billion in losses.

USDD also temporarily lost its peg in late 2022, and there have been reports questioning the transparency of its stUSDT reserves.

Many USDT reserves were reportedly transferred to platforms controlled by Sun Yuchen, causing centralization concerns.

JST, as the governance token, gives holders voting rights over protocol parameters like interest rates and collateralization levels.

Its value is tightly linked to the success of JustLend and USDD.

While Sun projects that ecosystem revenue could reach $100 million by 2026, the risks from subsidized high yields and lack of audited financials cannot be ignored.

Investors must weigh the potential benefits of JST’s deflation model against the risks from algorithmic stablecoins and transparency issues.

TRON BLOCKCHAIN: A HIGH-PERFORMANCE DECENTRALIZED ENGINE

Tron, founded by Sun Yuchen in 2017, is a Layer-1 blockchain focused on decentralizing digital content and financial services.

It uses a Delegated Proof-of-Stake (DPoS) consensus, handling over 2,000 transactions per second (TPS) — much faster than Bitcoin’s 7 TPS and pre-merge Ethereum’s 15 TPS.

Transaction fees are extremely low, making Tron attractive for DeFi, DApps, and tokenized assets.

TRX, Tron’s native token, is used to pay network fees, execute smart contracts, and for staking rewards.

Transactions are validated by 27 “Super Representatives” elected by TRX holders.

However, critics argue that DPoS can lead to centralization, as many Super Representatives are closely connected to Sun himself.

Despite this, Tron’s strong performance and micro-transaction support make it highly competitive in real-world applications, like micropayments and decentralized content distribution.

Tron’s governance encourages community participation, allowing TRX holders to vote for Super Representatives and protocol upgrades, though transparency about power distribution remains a concern.

TRON’S GLOBAL ECOSYSTEM: DEFI, CONTENT, AND STRATEGIC PARTNERSHIPS

Tron’s ecosystem extends far beyond JST. It covers DeFi, digital content, and global partnerships.

In DeFi, Tron’s total TVL exceeded $8.1 billion in 2023, second only to Ethereum.

Key DeFi products like JustLend, SunSwap (DEX), and JustStable form a complete financial system, offering lending, trading, and stablecoin services.

These projects leverage Tron’s low costs to offer high yields, attracting liquidity providers and retail users. However, the reliance on DAO subsidies means liquidity could face pressure during market downturns.

In the digital content space, Tron acquired BitTorrent in 2021 and launched the BitTorrent File System (BTFS) and BTT token to support decentralized storage and content sharing.

Tron’s NFT marketplace and decentralized streaming platforms have gained popularity, especially in Asia and Latin America.

By 2025, Tron’s content-focused DApps have been widely adopted in these regions due to low transaction fees and high speed.

Strategic partnerships have also boosted Tron’s global reach. Deals with companies like Samsung (TRX integrated into Samsung’s blockchain wallet) and Opera (TRX support in the browser) have strengthened its ecosystem.

Developer tools like the Tron Virtual Machine (TVM) have made building DApps easier, fueling ecosystem expansion.

However, concerns about USDD’s stability, governance transparency, and Sun’s legal issues (facing SEC charges) continue to cast a shadow.

At the same time, strong competition from other high-performance blockchains like Solana and Polygon challenges Tron’s position.

CONCLUSION

Sun Yuchen’s bold prediction that JST could become a “100x token” has sparked strong market interest, highlighting the growth potential of Tron’s DeFi and stablecoin ecosystem.

JustLend and USDD provide fundamental support for JST, while Tron’s high-performance blockchain, diverse applications, and global strategy enhance its competitiveness.

However, risks tied to algorithmic stablecoins, reliance on subsidies, and regulatory pressure remind investors to stay cautious.

If Tron is to realize its vision for decentralized finance and content, it must make solid progress in governance transparency, sustainable economics, and legal compliance.

In the fast-changing crypto world, the story of Tron and JST is full of opportunity but also requires careful evaluation.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!