KEYTAKEAWAYS

-

Linea’s DeFi TVL surpassed $1B, driven by Aave, Etherex, Renzo, and the Ignition incentive program, marking rapid growth in Ethereum’s Layer 2 ecosystem.

-

Ignition launched with 1B LINEA rewards, boosting TVL 18% in one day. Protocol incentives and ZK tech ensure fair, transparent liquidity distribution.

-

Linea’s zkEVM offers lower costs, high throughput, and strong ConsenSys integration, but faces competition from Arbitrum and Optimism and sustainability challenges after incentives.

CONTENT

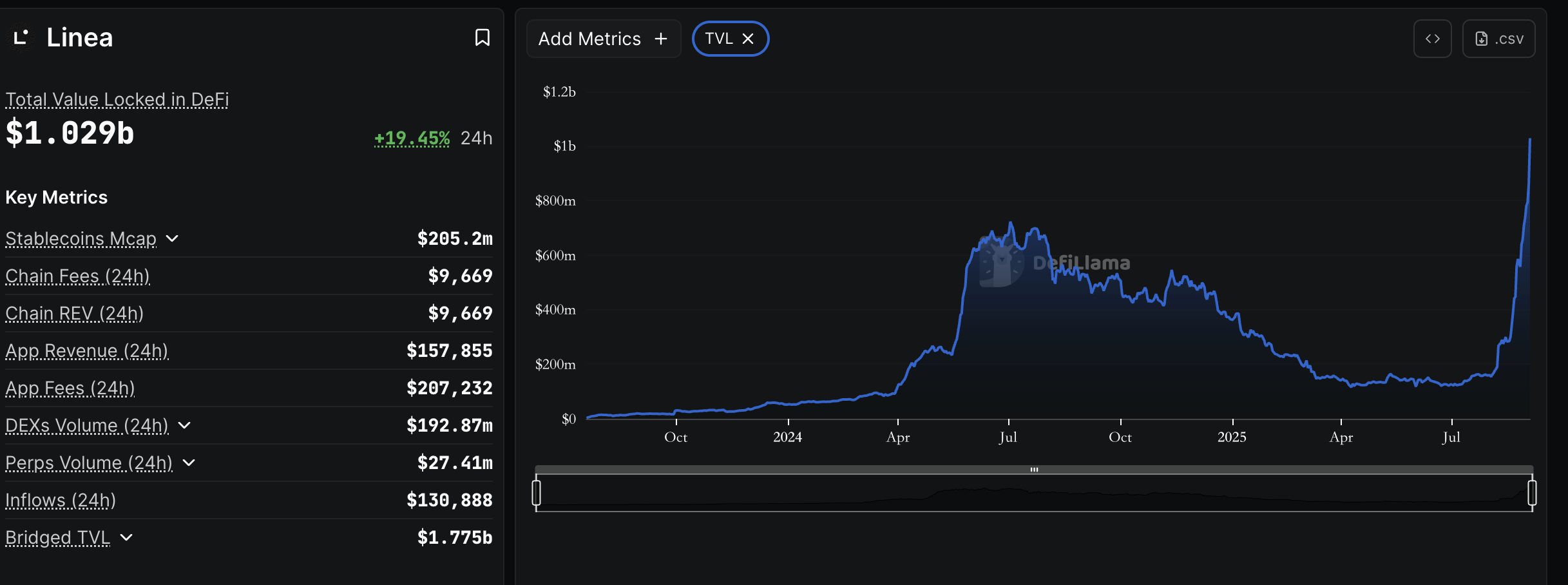

On September 3, 2025, Linea, a Layer 2 network under ConsenSys, reached a major milestone. According to DefiLlama, its decentralized finance (DeFi) total value locked (TVL) passed $1 billion, reaching $1.02 billion. TVL grew by more than 18% in 24 hours, setting an all-time high.

This milestone shows Linea’s fast rise in the Ethereum ecosystem. It also shows its ability to attract users and capital through technical innovation and strategic incentives. Strong performance by leading protocols such as Aave, Etherex, and Renzo, together with the new Linea Ignition liquidity incentive program, drove this growth.

The surge in Linea’s TVL is a snapshot of its rapid ecosystem growth. From less than $500 million at the start of 2025 to more than $1 billion today, Linea has grown at a striking pace in under nine months. It now ranks 12th in blockchain TVL, ahead of some traditional Layer 1 and Layer 2 networks.

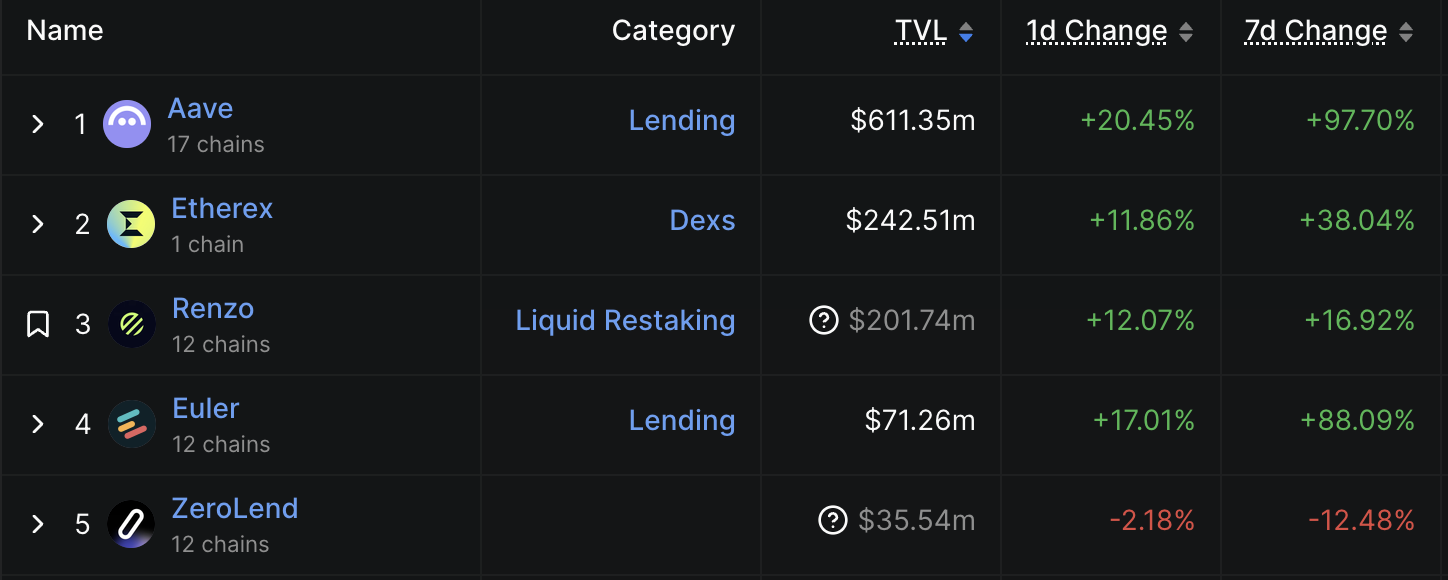

Aave is the pillar of the Linea ecosystem. Its $612 million TVL is almost 60% of the network total. As the world’s largest decentralized lending protocol, Aave’s success on Linea comes from diverse asset pools and efficient liquidity management. It attracts many users who seek lending and yield. Next is Etherex, a DEX with $232 million in TVL. Its metaDEX model and the x(3,3) incentive design give high returns to liquidity providers, which lifts trading volume and user participation. Renzo ranks third with $202 million in TVL.

As a liquid staking project, its growth reflects rising demand for liquid staking derivatives (LSD). Although some TVL may be double-counted due to assets overlapping across protocols, Linea’s overall trend shows clear vitality and appeal. This multi-protocol layout offers lending, trading, and staking, meets different user needs, and builds a solid base for TVL growth.

The fast rise in TVL is closely tied to the new Linea Ignition liquidity incentive program. The program launched on September 2, 2025. It plans to distribute 1 billion LINEA tokens. The goal is to push network TVL above $1 billion and run through October 26. In only one day, Linea’s TVL grew by 18%, showing an immediate impact. Aave, Etherex, and Euler are the first designated partners and play core roles in attracting liquidity.

For example, Etherex rewards are based on trading volume and slippage. It uses an inverted U-shaped incentive function. It favors liquidity during market swings, which reduces pressure and improves stability. Aave and Euler use rewards based on time-weighted average TVL and target TVL. They encourage under-used pools to improve capital allocation. The program also uses Brevis’s zero-knowledge (ZK) technology and Pico ZKVM verification to ensure transparent and fair reward calculations.

This design builds user trust and shows Linea’s technical strength. The unlock is also well planned: 40% of rewards unlock on October 27, 2025, and the remaining 60% vests linearly over the next 45 days. This balances short-term incentives and long-term ecosystem growth. More protocols (such as Turtle Club) will join to expand coverage. With deep integration with leading protocols and an innovative reward design, Ignition not only brings short-term capital inflows, but also lays the groundwork for native yield and long-term growth.

Linea’s success comes from its technical advantages and market position as a zkEVM Layer 2 network. Compared with Ethereum mainnet, Linea’s transaction fees are 15–30 times lower, and throughput is up to 6,200 TPS. This makes it a strong choice for DeFi users and developers. In 2025, as DeFi recovers and Ethereum keeps growing, Layer 2 networks draw capital and users. With low cost and high efficiency, Linea quickly attracts users moving from the mainnet.

As part of the ConsenSys ecosystem, Linea integrates smoothly with tools like MetaMask and Infura. This brings a large user base and developer resources, which increases its appeal. The zkEVM architecture is highly compatible with Ethereum and uses zero-knowledge proofs for efficient verification, which ensures security and scalability. These strengths help Linea attract top protocols such as Aave and Etherex, and give developers a solid platform for complex DeFi apps. Etherex’s token, REX, recently rose 23% to above $0.50, reflecting market optimism about Linea’s growth and the positive effect of the incentive program.

However, Linea also faces strong competition and risks. In the Layer 2 space, Arbitrum and Optimism still lead with higher TVL and more mature ecosystems. Linea must keep improving user experience and expand its protocol set to maintain momentum. Incentive-driven TVL spikes can be short-lived. In past programs (such as Arbitrum Odyssey), TVL fell after incentives ended. Linea needs to build stickiness and a durable ecosystem to keep TVL stable.

Market volatility is another factor. The value of the LINEA token and the effect of incentives may change with the wider crypto market. Also, double counting in TVL data may overstate real locked value. Investors and users should check data sources with care.

Looking ahead, the Ignition program and ecosystem strategy give Linea a solid base for further expansion. As more protocols join and native yield comes online, Linea may lift TVL further in the coming months and even challenge for a top-10 spot.

Its technical innovation, ecosystem synergy, and incentive design give more chances for users and a fertile ground for developers. In a highly competitive Layer 2 landscape, Linea’s rapid rise adds fresh energy to the Ethereum ecosystem, and its future performance is worth close attention.