KEYTAKEAWAYS

- Linea introduces a dual-burn model, burning ETH and LINEA, aligning Layer-2 usage with value creation across both assets while strengthening Ethereum’s overall monetary security.

- With no insider allocations and 85% for ecosystem growth, Linea’s tokenomics focus on community alignment, long-term funding, and reduced risk of heavy sell pressure.

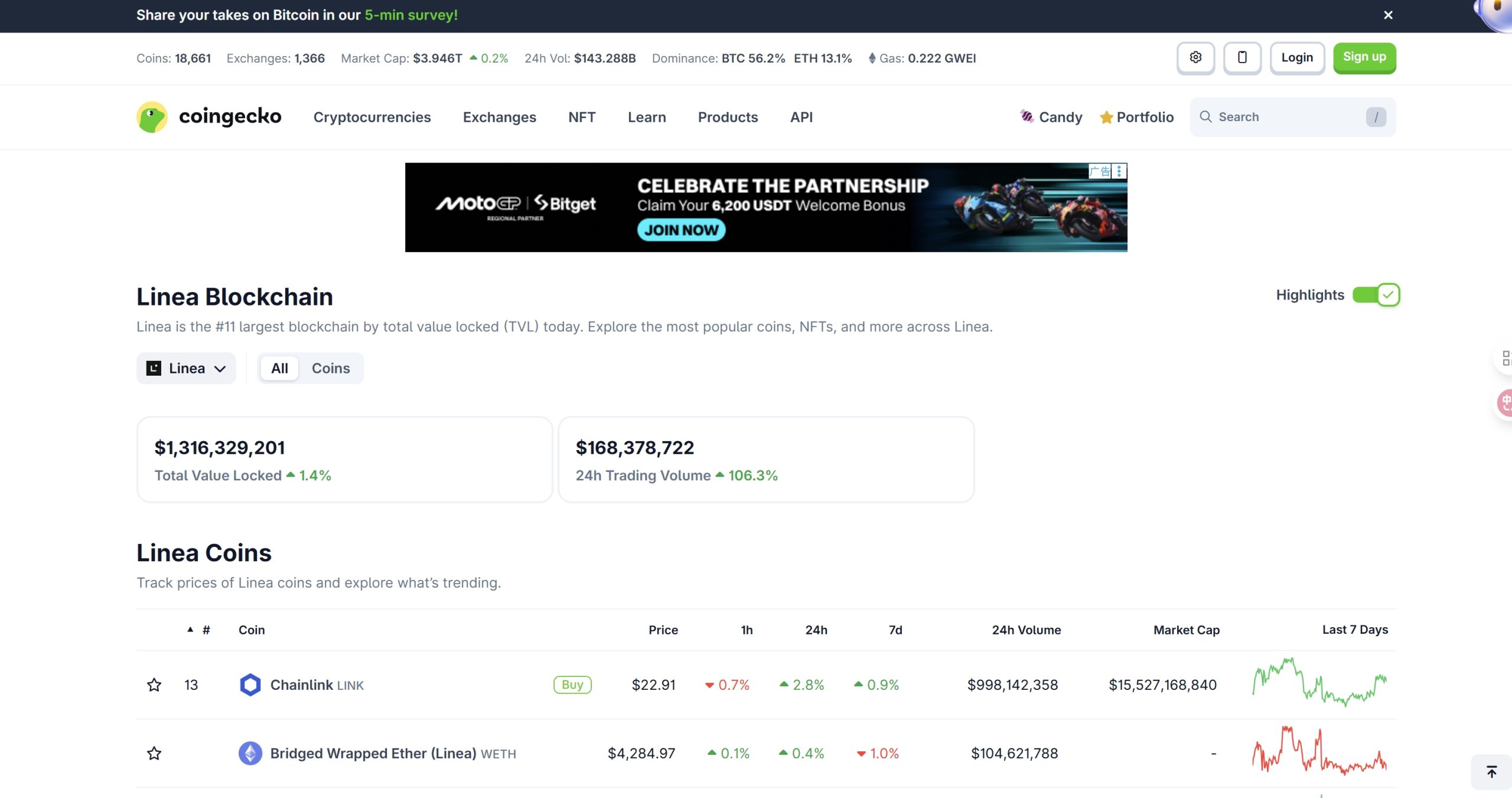

- Rapid TVL growth to $1.3B and listings on Binance, MEXC, and Bybit highlight Linea’s market traction, though long-term success depends on sustained developer adoption.

CONTENT

Linea token launches with a dual-burn model, no insider allocations, and rapid TVL growth. Backed by Consensys, it enters major exchanges as a unique zkEVM Layer-2.

INTRODUCTION

Linea, incubated by Consensys, has emerged as one of the most anticipated zkEVM Layer-2 projects in the Ethereum landscape. Unlike many other L2s that rely on their tokens for gas or governance, LINEA adopts a distinct economic design that emphasizes sustainability and ecosystem alignment. With major exchange listings and strong on-chain traction, Linea is positioning itself as a serious contender in the scaling race.

The above views refer to @web3_batulu

WHAT IS CONSENSYS AND WHY IT MATTERS

Consensys is a blockchain technology company founded in 2014 by Ethereum co-founder Joseph Lubin. Known for products such as MetaMask and Infura, it has played a central role in Ethereum’s global adoption. With Consensys backing, Linea benefits from credibility, developer infrastructure, and institutional reach, setting it apart from other zkEVM competitors.

TOKENOMICS AND DISTRIBUTION

The total supply of LINEA is 72,009,990,000 tokens, with about 22% (15.8 billion) unlocked at the Token Generation Event (TGE).

- Ecosystem (85%): 10% allocated to early contributors (9% airdrop, 1% builder rewards), and 75% dedicated to a 10-year ecosystem fund managed by the Linea Consortium.

- Consensys Treasury (15%): Locked for five years, non-transferable.

- No team or investor allocation: This reduces systemic sell pressure from insiders and signals a strong focus on community-driven distribution.

This allocation structure emphasizes long-term growth and ecosystem funding rather than short-term financial extraction.

ECONOMIC MODEL AND VALUE CAPTURE

Linea uses ETH exclusively as gas, reinforcing Ethereum’s monetary role. Its dual-burn mechanism provides a unique value cycle:

- 20% of net L2 fees are used to burn ETH.

- 80% are used to buy back and burn LINEA.

This model aligns Linea’s growth with Ethereum while ensuring that network usage directly benefits LINEA holders. Governance decisions, including fund allocation and incentive strategies, are managed by the Linea Consortium, prioritizing coordination over token-based governance.

ECOSYSTEM AND ON-CHAIN DATA

Linea’s ecosystem has grown rapidly, supported by incentives and developer activity.

- Total Value Locked (TVL): Currently around $1.3 billion, ranking 11th among all chains.

- TVL growth: Liquidity rose from under $1 billion to over $1.2 billion in the weeks leading up to TGE.

- Applications: A growing base of DeFi, NFT, and infrastructure projects, with more expected as ecosystem funding accelerates adoption.

This rapid liquidity growth demonstrates strong anticipation, though long-term retention will depend on continued developer and user engagement.

DIFFERENTIATION FROM OTHER LAYER-2S

Linea’s design makes it distinct from other L2s in several ways:

- ETH-only gas plus dual-burn ensures both Ethereum and LINEA benefit from network activity.

- No token governance, with decisions handled by the Linea Consortium for strategic stability.

- No insider allocations, reducing supply risks and aligning token distribution with community growth.

These design choices make LINEA more of a coordination asset than a standard gas or governance token.

EXCHANGE LISTINGS AND TIMELINE

Major exchanges are supporting LINEA’s launch with strong liquidity:

- Binance: Deposits open on September 9, 2025 at 14:00 UTC. Trading starts on September 10, 2025 at 16:00 UTC with pairs LINEA/USDT, LINEA/USDC, LINEA/BNB, LINEA/FDUSD, and LINEA/TRY.

- MEXC: Listed in the Innovation Zone with Convert and spot trading expected at TGE.

- Bybit: Spot listing confirmed for September 10, 2025 with LINEA/USDT.

This coordinated rollout ensures accessibility for both institutional and retail participants from day one.

CONCLUSION

The LINEA token launch combines strong credibility, innovative economic design, and rapid ecosystem growth. Its dual-burn model strengthens both ETH and LINEA, while the absence of insider allocations reduces structural risks.

Short-term volatility is likely due to airdrop-driven supply, but the long-term outlook will depend on whether Linea can retain liquidity, grow adoption, and maintain differentiation in the competitive Layer-2 market.