KEYTAKEAWAYS

- Malu Grape's tokenization bypasses financial regulation using NFTs, stripping tokens of true ownership and liquidity rights.

- The SPV model separates governance and yield—centralizing control while excluding farmers from benefits.

- Blockchain acts merely as a validation tool, not as a means to transform agricultural production relations in China.

CONTENT

The Malu Grape project in Shanghai sparked debate as China’s first agricultural RWA tokenization attempt—but beneath the NFT hype lies a story of compromised decentralization and constrained innovation.

INTRODUCTION

On November 25, 2024, the Malu Grape tokenization project in Shanghai debuted under the banner of “China’s first agricultural RWA (Real World Asset) case.”

The project claimed to turn vineyard data into digital assets via blockchain and simultaneously raised 10 million yuan through equity financing and 200,000 yuan via NFT sales on the Shanghai Data Exchange.

Official narratives hailed it as a benchmark of “technology empowering real-world agriculture,” sparking heated discussion around localized RWA pathways.

However, behind this façade, the project falls far short of true RWA innovation.

Its so-called “tokenization” is essentially a repackaging of traditional financing under compliance-friendly wrappers: NFTs act as consumer presale cards, while SPV-based equity structures retain centralized governance and eliminate real yield tokens.

Born under regulatory pressure, this “de-financialized” survival model fails to empower producers or provide real liquidity, despite its technological presentation.

Using the Malu Grape case as a sample, this article dissects three key contradictions behind the RWA illusion:

- Technological instrumentalization: Blockchain is reduced to a credit-enhancement tool, without altering core production relations.

- Regulatory arbitrage: The SPV structure and NFT definition are crafted to dodge policy red lines on securities issuance.

- Cost of localization: Farmer data rights and financial benefits are stripped away—contradicting RWA’s inclusive ideals.

Through an analysis of asset selection, on-chain mapping, and financing architecture, we argue that the core challenge in digitizing agricultural assets in China lies not in copying technology, but in balancing compliance with real value creation under regulatory constraints.

PROCESS BREAKDOWN

1.Asset Selection and Compliance Ownership

RWA refers to using blockchain to tokenize physical or financial assets, making them tradable and manageable in decentralized networks. Project developers must ensure two things at the outset: the asset must be suitable for tokenization and fully compliant under real-world legal frameworks.

Key Requirements:

- Real and valuable assets

- Stable cash flow or appreciation potential

- Clear, undisputed ownership

Malu Grape is a geographically certified agricultural product with more than 40 years of cultivation history and strong consumer demand. In 2023, its planting area reached 4,051.96 mu (≈267 hectares), yielding 4,437.83 tons with a total output value of 107 million yuan.

It accounts for 12.9% of Shanghai’s grape plantation area and 17.17% of the economic output in the sector.

Its production model is a local industrial consortium: research institutes, enterprises, cooperatives, and farmers each play defined roles—from varietal R&D to branding, standardized production, and farming.

Digitally, Malu Grape boasts more than 50 varietals and a robust traceability system, including IoT sensors and QR-code-based provenance. It stands as a benchmark in digital agriculture, making it suitable for RWA tokenization.

2.Technology Packaging and On-Chain Mapping

A key determinant of RWA success lies in ensuring off-chain data integrity after tokenization.

(1)Data Collection:

IoT devices capture real-time environmental data—temperature, humidity, light, soil pH—as well as operational records like irrigation and fertilization. Economic data includes sales volume, pricing, logistics losses, brand certifications, and consumer sentiment.

(2)Asset Packaging:

Sensor data from 600 mu of vineyards is integrated into a “Data Asset Shell (DAS),” developed by the Shanghai Data Exchange for compliance processing and data standardization. This builds a “truthful” on-chain dataset mutually recognized by stakeholders (farmers, investors, regulators).

SwiftLink anchors the data on-chain, ensuring traceability and immutability, while AMC (Any-Chain Multi-Track) technology mirrors it to the “Pujiang Digital Chain” for multi-chain validation.

(3)Asset Valuation:

- Cost-plus method: accounting for hardware, labor, and data processing

- Market premium method: pricing based on Malu’s brand equity

- Discounted cash flow: estimating future gains from precision agriculture and anti-counterfeiting value

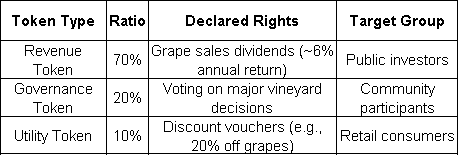

(4)Token Economy Design:

Based on valuation, three classes of tokens were designed:

3.Spv Structure and Financing Design

In October 2023, two Shanghai firms jointly funded a new entity—Zuo’an Xinhui (Shanghai) Data Technology Co., Ltd.—to serve as a project-specific SPV.

The SPV holds all Malu grape data assets and brand rights, isolating them from parent company liabilities. Its full equity is registered with the Shanghai Equity Exchange and recorded on-chain via the “GuYiChain” platform.

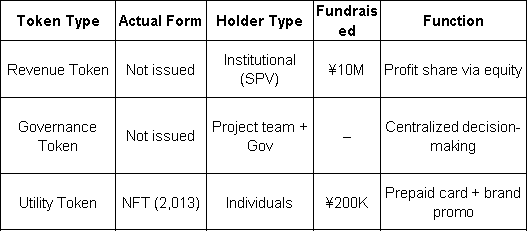

However, due to China’s regulatory prohibitions on token securities (see 2017 ICO ban and 2021 NFT risk guidance), the project abandoned its original token economy in favor of a “de-financialized” route.

Implementation:

- Utility tokens became 2,024 NFTs, marketed as “digital collectibles” to avoid security classification.

- 2,013 NFTs were sold at 99 yuan each, raising 200,000 yuan.

- Governance and revenue tokens were not issued publicly. Instead, yield rights were embedded into the SPV’s equity and offered solely to institutional investors—raising 10 million yuan under the corporate shareholding framework.

4.Liquidity Management

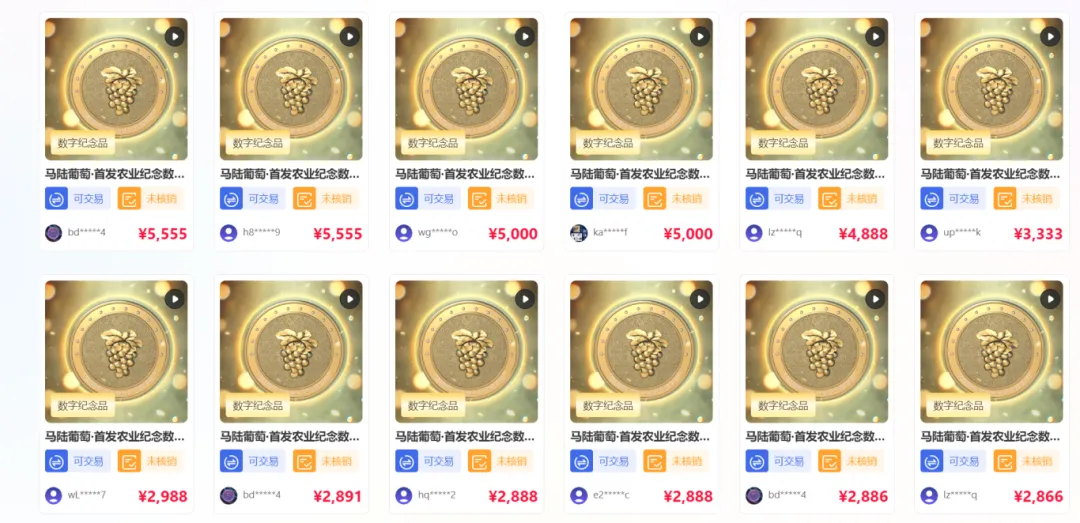

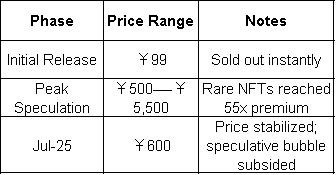

NFTs were issued on November 25, 2024, and sold out quickly. Now only traded in secondary markets.

(1)Each NFT includes:

- Basic Benefits: 2kg grape voucher (“Sunshine Rose” or “Nina Queen”) + optional park tickets

- Add-ons: Access to a virtual vineyard game and loyalty point redemptions

(2)Trading Restrictions:

- Only tradable between Dec 9, 2024 – Dec 8, 2025

- Max 5% ownership per user (~101 NFTs)

- After each sale, 5-day cooldown before next trade

- NFTs are burned upon voucher redemption; no disaster compensation plan disclosed

(3)Market Performance:

Read more: