KEYTAKEAWAYS

- Rate cuts + pause in Quantitative Tightening signal liquidity returning, but market still cautious — early easing doesn’t guarantee instant crypto rally.

- Bitcoin is stabilizing after the 10/11 Black Swan flush, but momentum remains weak; market seeks confirmation of trend reversal.

- Some funds rotating into altcoins, but broad altcoin season needs stronger BTC stability + clearer macro tailwinds.

CONTENT

Liquidity is gradually returning as rate cuts and a pause in Quantitative Tightening ease conditions, but market sentiment remains cautious. Bitcoin is stabilizing after the 10/11 shock yet lacks strong momentum. Early rotation into altcoins has begun, but a full alt season still requires stronger BTC stability and clearer macro tailwinds.

OCTOBER 11TH SAW THE MARKET LIQUIDITY WIPED OUT – IS IT STILL A BULL MARKET?

October 11th was undoubtedly the end of the crypto market. Many woke up to find their positions gone. Even more frightening is that the largest number of victims didn’t come from leveraged liquidations of contracts, but from revolving lending. Everyone knows this round was a financial scheme, leading many retail investors to deposit their savings. Consequently, the continuous IPOs and Alpha events by top exchanges and projects spawned a trend of revolving lending, where USDT was used as collateral to borrow more USDT to maximize the value of the tokens. This led many Twitter KOLs to question whether it was a cryptocurrency conspiracy. Many people experienced 80-90% asset losses overnight, starting from scratch.

Read more:When Markets Bleed, Patience and Perspective Decide Who Wins

WHERE DID THE FUNDS GO AFTER OCTOBER 11TH?

From the perspective of three roles (long and short positions), exchanges, and lenders, I will use changes in funds as the main indicator for reference and analysis.

CHANGES IN FUNDS FOR LONG AND SHORT POSITIONS?

First, let’s analyze the changes in funds for long and short positions. For long positions, with the large red candlestick at 5 AM on October 11th retreating nearly 15%, it was essentially a complete liquidation, so they can be considered absolute losers. Conversely, did short positions really profit? This candlestick closed with a nearly 7% lower shadow on the 15-minute chart. Unless there were stop-loss orders or close monitoring, it was basically impossible to profit from this.

CHANGES IN FUNDS AT THE EXCHANGE LEVEL?

Next, let’s analyze the exchanges. My thoughts on this are quite interesting. I simply divide them into top exchanges and non-top exchanges, distinguished by the depth of their order books and whether the market could withstand the panic selling. For second- and third-tier exchanges, this was a catastrophe. Market makers, too, will simply be robbing Peter to pay Paul to prevent a similar collapse like FTX.

Regarding changes in borrower funds?

Thirdly, let’s analyze the role of borrowers. As mentioned earlier, borrowers were the primary targets of liquidation in this black swan event. Based on current understanding, those with initial collateral ratios higher than 85% and lower than 85% are likely to be liquidated. After analysis, who profited? Undoubtedly, the exchanges (more accurately, exchanges with deep liquidity). For exchanges, the revolving loan event did not affect them. Secondly, exchanges have sufficient reserve assets and are not afraid of market panic selling. Thirdly, the liquidation market capitalization that day was the highest ever, and the liquidation costs were absolutely staggering.

Image source: Binance Exchange – BTC Daily Chart

Image source: Binance Exchange – BTC 1-hour chart

DOES A BLACK SWAN EVENT INEVITABLY LEAD TO A BEAR MARKET?

Historically, previous year-end bear market transitions were all preceded by major black swan events, such as the Luna incident, the NFT craze, and the collapse of FTX. These were followed by a gradual decline. Looking back, October 11th was indeed the high point in recent months, and the subsequent price action to this day has shown no significant rebound. Is this a temporary correction or the arrival of a bear market?

RECENT MARKET TRENDS

1.BTC Recent Trends: BTC recently broke below the $100,000 mark, currently trading at $96,200. It has successively broken below the EMA99 and EMA200 moving averages and accelerated its decline. It has not followed the expected rebound after breaking the moving averages, and market liquidity is dry, with funds flowing into stablecoins and gold assets.

Image source: Binance Exchange – BTC Daily Chart

2.Recent ETH Price Movement: ETH is currently trading below the EMA99 and EMA200 moving averages, following the trend of BTC. The current price is $3201, showing stronger performance than BTC, having tested the $3050 level twice. There is potential support around $2900-$2800, which warrants close attention. ETH’s future price movement will determine whether the altcoin season anticipated by retail investors will begin!

Image source: Binance Exchange – ETH Daily Chart

RECENT MAJOR NEWS

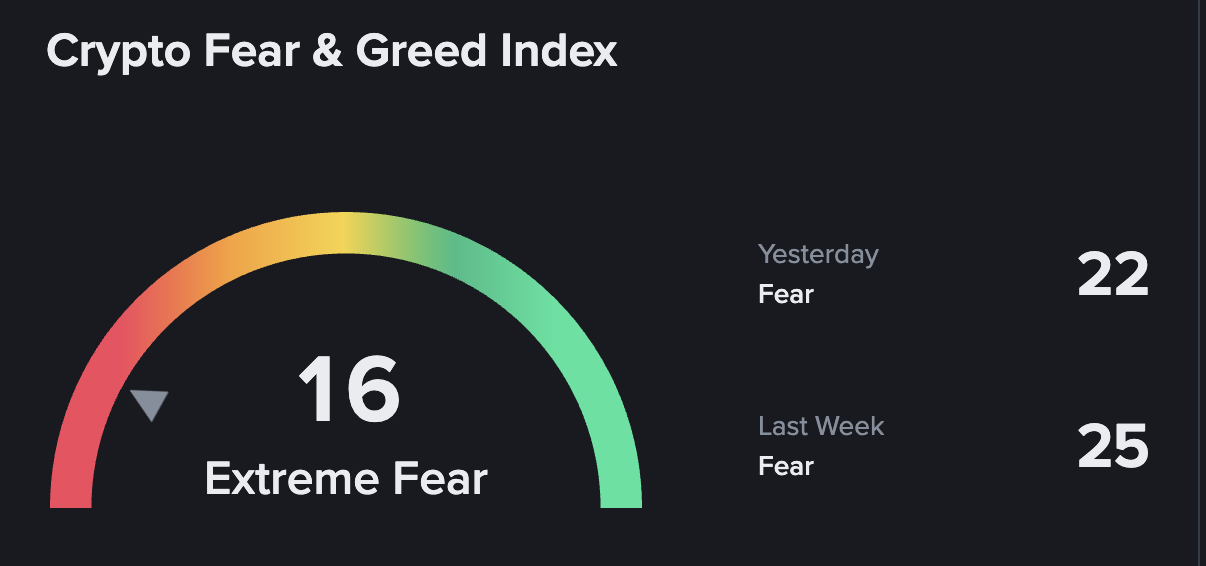

The market’s fear index is currently around 16, similar to March 12th. Let’s look at some recent key news:

1.The US government market shutdown lasted 43 days, a new record. While news of its end was announced last week, this hasn’t yet been reflected in market prices, with most institutions and whales remaining on the sidelines.

2.The Federal Reserve’s December interest rate forecast has been lowered from 90% to 50%, severely impacting cryptocurrency market confidence. Recent upward momentum in US stocks hasn’t been reflected in the cryptocurrency market; in fact, the decline in US stocks has accelerated the cryptocurrency market’s fall, further fueling panic.

3.The recent Lummis Act is noteworthy. This act attempts to clearly define how US law classifies and regulates cryptocurrencies, stablecoins, and exchanges. For years, the division of regulatory responsibilities has been unclear. This act will clearly distinguish between securities and commodities, determining whether assets fall under the jurisdiction of the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

Image source: Binance Exchange – Fear Index

CONCLUSION: DON’T LET MARKET SENTIMENT INFLUENCE YOUR JUDGMENT

The events of October 11th reshaped market psychology, not just prices. Black swan events shake out retail investors effectively. Despite recovering liquidity, macroeconomic signals like interest rate cuts indicate future easing policies. Crypto analysis shows spot trading remains viable. Rational analysis trumps emotional speculation when evaluating BTC and ETH positions.

BEAR MARKET OR CORRECTION? KEY FACTORS DETERMINING ALTCOIN SEASON

Two factors will decide the outcome: Bitcoin stability and macroeconomic clarity. If BTC stays below key moving averages with liquidity trapped in stablecoins, momentum won’t recover. However, if Bitcoin reclaims support levels and macro conditions stabilize, capital may flow back into altcoins, triggering altcoin season. ETH performance will signal broader altcoin market health.

MARKET NEWS: LIQUIDITY WILL DETERMINE THE NEXT MOVE

The market is transitional: damaged but fundamentally solid. Market news shows institutional interest persists despite retail exit. The next move depends on liquidity, not speculation. Watch for capital rotation from stablecoins into BTC, ETH, and altcoins—this will indicate whether altcoin season is imminent or if more recovery time is needed.