KEYTAKEAWAYS

- OpenLedger combines blockchain and AI through Proof-of-Attribution, ensuring data contributors receive transparent, fair rewards whenever their datasets are used to train models.

- The OPEN token supports transactions, governance, incentives, and access to AI tools. Its structured tokenomics emphasize long-term sustainability and reduced early sell pressure.

- Binance’s listing and airdrop program provide liquidity and reward early adopters, positioning OpenLedger as a leading AI blockchain ecosystem with global market attention.

CONTENT

OpenLedger (OPEN) launches on Binance September 8, 2025. Positioned as an AI blockchain, it unlocks data liquidity with Proof-of-Attribution, ecosystem rewards, and developer incentives.

PROJECT OVERVIEW

OpenLedger, often referred to by its ticker OPEN, is positioning itself as one of the most anticipated blockchain launches of 2025. Built as an Ethereum-compatible Layer 2 network, OpenLedger leverages the OP Stack and EigenDA to achieve both scalability and security. The project is not just another infrastructure layer—it brands itself as the “AI blockchain”, designed to unlock the liquidity of data, models, and intelligent agents, while ensuring that ownership and attribution remain verifiable on-chain.

The above views refer to @web3_batulu

CORE FEATURES AND INNOVATION

At the heart of OpenLedger lies its Proof-of-Attribution mechanism. This ensures that contributors who provide datasets for AI training receive traceable and fair rewards whenever their data is used. In practice, this means that researchers, developers, and institutions contributing valuable datasets can finally monetize their assets in a transparent, automated way.

Another core innovation is its AI liquidity layer, designed to transform otherwise static resources into composable assets. Data, AI models, and intelligent agents are no longer siloed; instead, they can interact, combine, and be built into new applications. This model opens doors for decentralized innovation—where developers can assemble end-to-end AI solutions directly on-chain.

The OpenCircle SeedLab program further accelerates ecosystem growth by incentivizing developers to build AI-native dApps, tools, and protocols on OpenLedger. Meanwhile, the OpenLoRA initiative, in collaboration with Aethir, utilizes decentralized GPU cloud infrastructure to significantly reduce costs in AI model deployment. This combination of compute efficiency and blockchain-native attribution creates a robust foundation for real-world adoption.

TOKENOMICS AND DISTRIBUTION

The OpenLedger ecosystem is powered by the OPEN token, with a maximum supply of 1 billion tokens. Approximately 21.55% of the supply (215.5 million OPEN) will be in circulation at launch, creating a controlled but significant float for market participants.

Key aspects of the OPEN token design include:

- Utility: OPEN serves as the gas token for transactions on the OpenLedger network. Beyond this, it powers payments for model training, inference, and access to premium datasets.

- Incentives: Data contributors are rewarded in OPEN for their contributions to AI training pipelines.

- Governance: Token holders gain a voice in protocol upgrades, parameter adjustments, and ecosystem funding.

- Access: Developers and enterprises use OPEN to unlock advanced AI tools, models, and infrastructure.

The distribution plan emphasizes long-term alignment:

- Community: 51.7%

- Ecosystem: 10%

- Investors: ~18%

- Team: 15%

- Liquidity: 5%

Community and ecosystem allocations are set for 48-month linear release, while investor and team allocations are subject to a 12-month cliff followed by 36-month vesting. This ensures early stability and reduces immediate sell pressure.

From a design perspective, the $OPEN tokenomics reflect a clear intention to align incentives across the OpenLedger ecosystem.

With more than half of the supply allocated to community rewards and ecosystem growth, the model emphasizes decentralization and ensures that data contributors and developers are the primary beneficiaries. The Proof of Attribution mechanism tightly binds token distribution to measurable data contributions, creating a transparent and fair reward cycle.

Meanwhile, the gradual unlock schedule for investors and the team introduces long-term alignment and helps mitigate short-term selling pressure.

Importantly, $OPEN is not positioned as a passive governance token but as an active utility asset: it fuels transactions, incentivizes data curation, and supports model deployment within the network. This dual role—serving both as a reward mechanism and as the essential medium of exchange—aims to balance inflationary rewards with deflationary sinks, anchoring token value to real usage rather than speculation alone.

BINANCE LISTING AND AIRDROP PROGRAM

OpenLedger’s path to market has been strategically crafted. It was announced as the 36th project on Binance’s HODLer Airdrops program, reflecting strong backing from one of the largest global exchanges. Between August 18 and August 21, 2025 (UTC), Binance users who locked their BNB through Simple Earn or On-Chain Yields were eligible for the OPEN airdrop, totaling 10 million tokens (1% of supply).

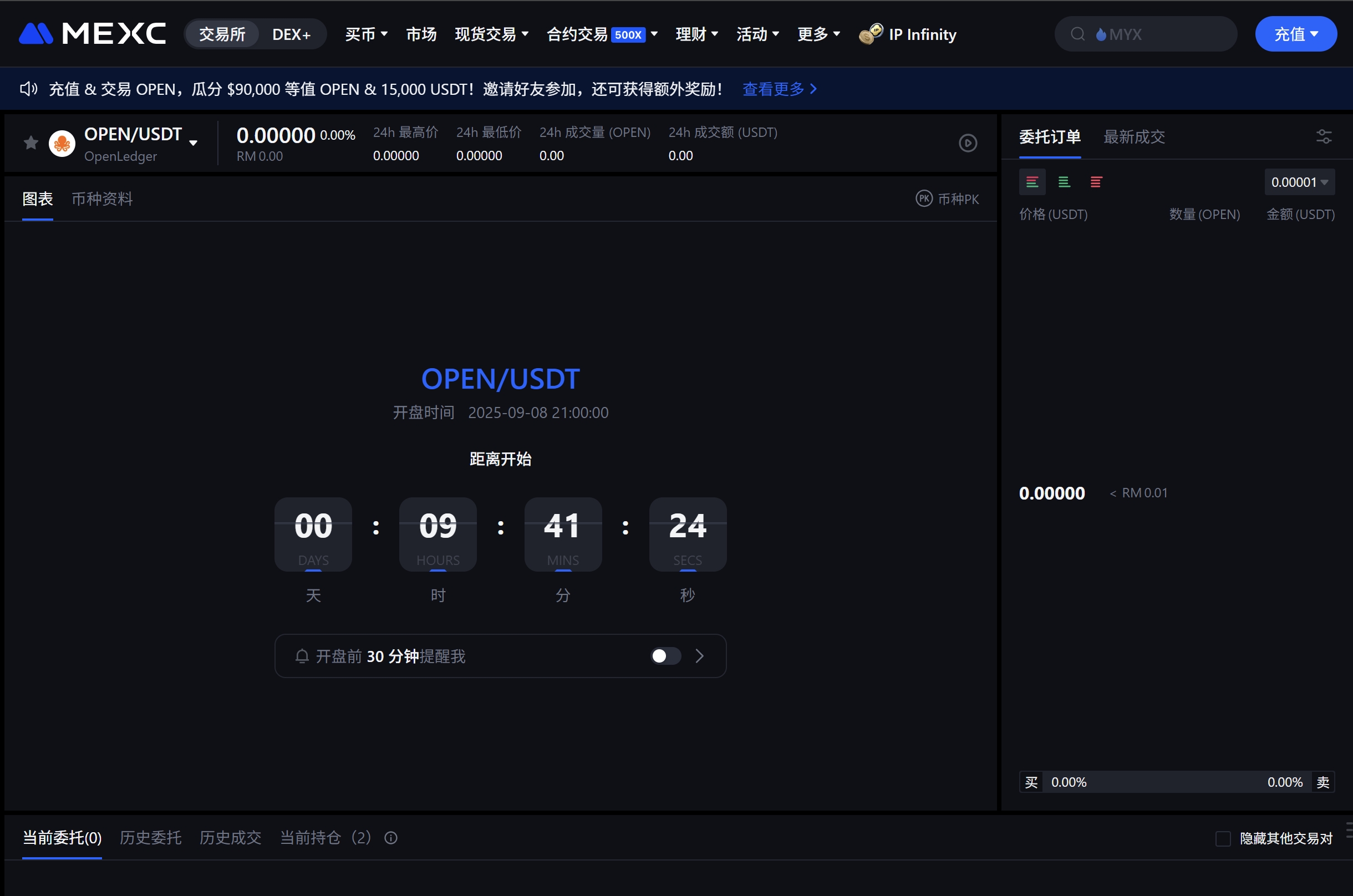

Following the distribution event, Binance enabled deposits on September 5, 2025, ahead of the official trading launch. The token is scheduled to list on September 8, 2025, at 13:00 UTC, with multiple pairs including OPEN/USDT, OPEN/USDC, OPEN/BNB, OPEN/FDUSD, and OPEN/TRY. Initially highlighted under Binance Alpha, OPEN will later transition to standard spot trading.

The structured rollout reflects Binance’s intent to create a strong, fair launch environment while incentivizing long-term holding. For investors, this dual approach of airdrop plus listing provides both early exposure and liquidity from day one.

MARKET OUTLOOK AND EXPECTATIONS

Although pre-market pricing remains unavailable—since OpenLedger has not yet entered active spot trading—the market outlook is bullish. Anticipation is being driven by three factors:

- Narrative Alignment: With AI dominating the global technology agenda, OpenLedger’s positioning as the “AI blockchain” taps into one of the strongest market narratives of 2025.

- Token Design: OPEN’s deflationary structure, multi-utility design, and transparent unlock schedule offer a balance of utility and investor protection.

- Ecosystem Partnerships: Collaborations with Aethir and the growth of the OpenCircle SeedLab point to an expanding developer and enterprise community.

If the launch mirrors previous Binance-backed projects, initial volatility is expected. Early trading often sees sharp price swings as supply from airdrops meets market demand. However, given the strong fundamentals and narrative, long-term performance will hinge on adoption within the AI and data economy space.

CONCLUSION

The launch of OpenLedger represents more than just another token listing. It symbolizes a new chapter in the integration of blockchain and artificial intelligence. By ensuring that data contributors are fairly rewarded and AI assets gain liquidity, OpenLedger is addressing a critical gap in today’s digital economy.

As the project officially debuts on September 8, 2025, it will be closely watched by developers, investors, and enterprises alike. Its ability to execute on the ambitious vision—turning AI infrastructure into a decentralized, transparent, and monetizable ecosystem—will determine whether OpenLedger can establish itself as a true market leader.

For now, the anticipation remains high. The real test will begin as OPEN tokens start trading across global exchanges, where market sentiment, liquidity, and ecosystem traction will converge to shape the project’s trajectory.