KEYTAKEAWAYS

-

Boros tokenizes perp funding rates into tradeable units, enabling fixed-vs-floating swaps for hedging, collateral use, and yield stabilization across DeFi protocols.

-

The design supports broader yield tokenization, aligning with projects like Notional Exponent to boost capital efficiency and unify funding rates across exchanges.

-

Launching on Arbitrum with risk controls, Boros aims to dampen funding volatility and expand DeFi’s fixed-income market potential.

CONTENT

In DeFi, a clear trend is emerging: yield streams themselves are becoming modular, composable components. Pendle’s new release, Boros, is a natural extension of this idea — taking the floating funding rates from perpetual futures, one of the most volatile yet essential flows in crypto, and transforming them into tokenized instruments that can be traded, hedged, or even used as collateral in the future.

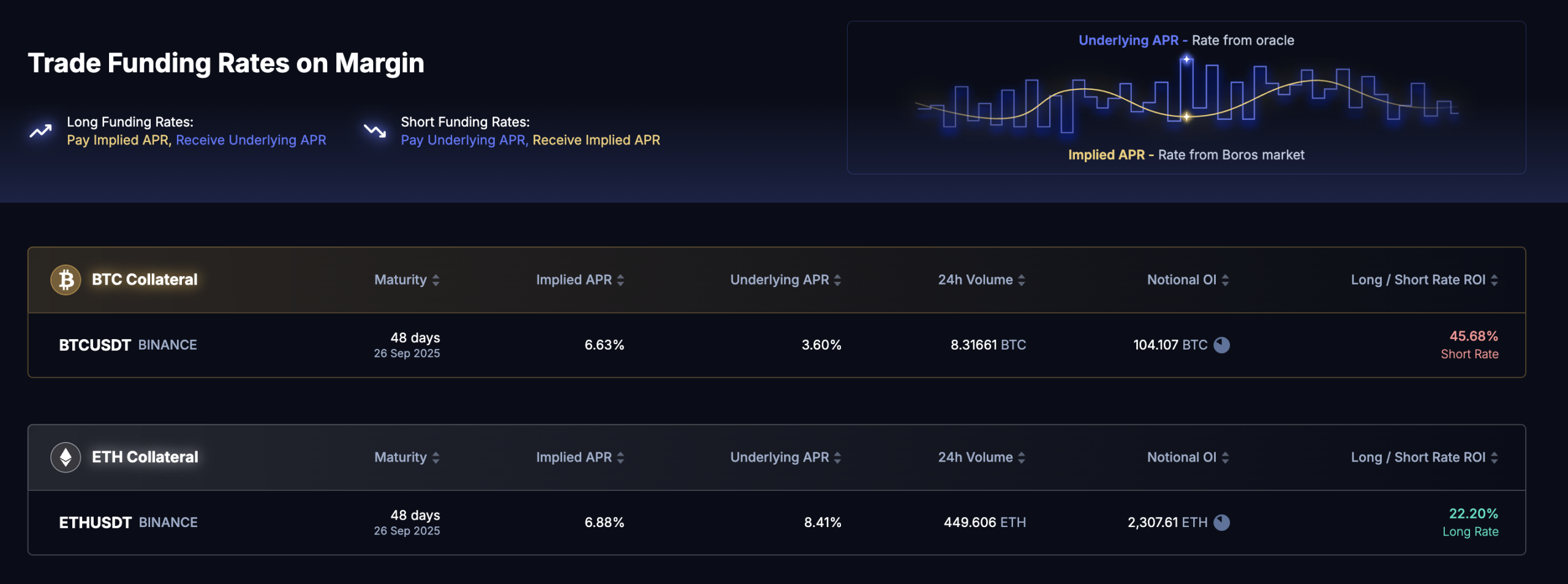

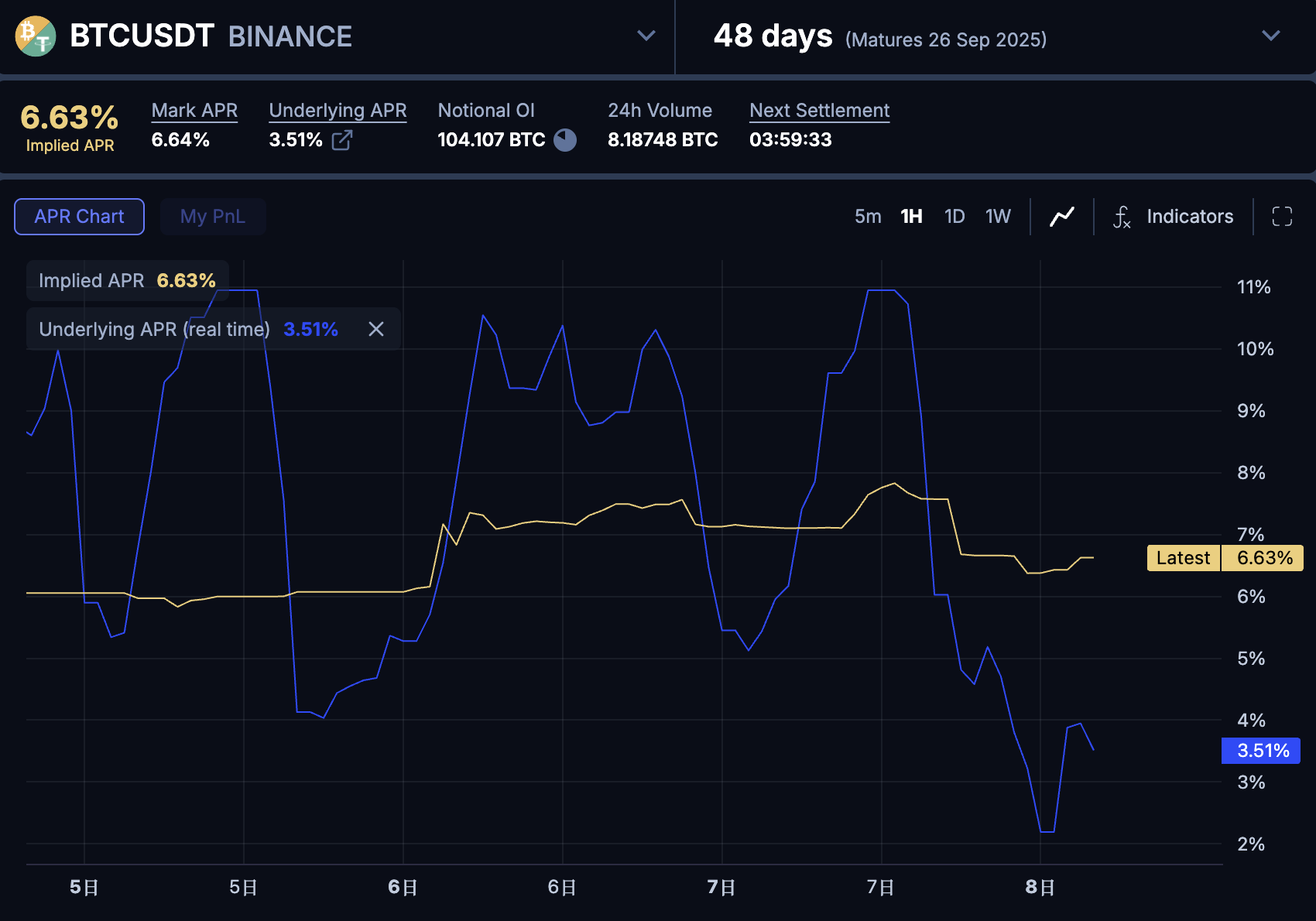

The initial launch supports Binance ETH and BTC perpetuals. In essence, Boros creates an onchain market for fixed-vs-floating funding rate swaps, allowing traders and protocols to directly hedge the funding cost risks that come with directional leverage. Think of it as building a “funding rate derivatives layer” that can plug into the broader DeFi ecosystem.

For example, a trader long ETH perps but worried about higher future funding can buy Yield Units (YU) on Boros, paying a fixed rate in exchange for the floating leg — effectively capping their carry cost. Conversely, a protocol like Ethena, which shorts perpetuals to earn funding, can sell YU to lock in a steady return upfront.

WHY IT MATTERS FOR PROTOCOLS AND THE MARKET

If Boros expands to more exchanges where Ethena hedges spot longs, the benefits become even clearer. By shorting YU, Ethena can convert volatile funding income into a stable coupon, making reserve management easier, reducing tail risks from extreme funding swings, and even pre-announcing yields with confidence.

While YUs don’t redeem like Pendle’s Principal Tokens, they are still well-defined positions in funding rate swaps with a fixed maturity and oracle-based valuation. That makes them potential candidates for collateral in money markets. In that scenario, traders or protocols could post YU as collateral to borrow stablecoins without closing their hedges.

For protocol treasuries, Boros offers the ability to lock in the yield side of a delta-neutral trade, turning volatile PnL into predictable income and attracting more conservative capital. Pendle founder TN Lee believes this could eventually harmonize funding rates across exchanges by enabling efficient cross-platform arbitrage.

Importantly, the model isn’t limited to perp funding rates. Any yield that can be verified via an oracle — staking rewards, real-world credit, CeFi lending rates — could be tokenized in the same way. To support this, Boros plans to launch dedicated liquidity vaults, paying fees and incentives to LPs who take the other side of hedging demand, similar to Pendle V2 pools.

MOVING IN STEP WITH OTHER DESIGNS

Boros isn’t the only project heading in this direction. Notional’s upcoming Exponent upgrade takes a similar approach, wrapping variable yields into tokens usable as collateral. Its standout feature is Smart Redemption — the ability to redeem a staked asset directly without first withdrawing it from a lending protocol, enabling costless exits. This makes yield tokens with long lock-ups or thin secondary liquidity far more acceptable to risk engines.

In essence, Boros and Exponent share the same core design: wrap a variable cash flow into a token that can be priced by onchain oracles and tracked to maturity, giving lending markets a predictable way to haircut and whitelist it as collateral. Even if a YU trends toward zero at expiry, the known payoff schedule and oracle feed make it safe for money markets to manage. The result is greater capital efficiency — users can borrow against income streams that service their debt, while money markets gain collateral that is less correlated to spot volatility.

RISKS AND POTENTIAL IMPACT

On the tokenomics side, Boros does not launch a new token. Instead, 80% of fees go to vePENDLE holders, with PENDLE incentives used to bootstrap vault liquidity. This avoids unnecessary dilution while channeling new revenue into the existing token model.

The team notes, however, that Boros is “starting from zero,” with its own risk engine and vault logic on Arbitrum. Early stages will focus heavily on risk control, especially as the market tests new mechanics. One of Boros’ potential contributions is changing how extreme funding rate spikes ripple through markets — in the past, a sudden surge in funding could force traders to unwind basis trades, triggering cascades. With YUs, they can hedge just the funding leg without touching directional exposure, potentially muting volatility.

That benefit depends on liquidity. To avoid early reflexivity, Boros is capping open interest at 1.2x perp OI. If depth grows, the ability to cheaply hedge funding could smooth the sharpest swings and even reduce price volatility indirectly.

A STEP TOWARD AN ONCHAIN FIXED-INCOME MARKET

Boros doesn’t just tokenize a niche yield stream; it inserts a new interest rate derivatives layer into DeFi architecture. That layer can connect to money markets, structured products, delta-neutral strategies, and even real-world credit. More importantly, it reinforces a broader shift: any predictable, oracle-verifiable yield can become both a tradeable instrument and first-class collateral.

If these building blocks take hold, DeFi moves one step closer to functioning as a full-stack fixed-income market — onchain, composable, and capital-efficient.