KEYTAKEAWAYS

-

Polymarket arbitrage is structural, not opportunistic.

Arbitrage exists because prediction markets must translate complex real-world events into binary settlement outcomes, creating unavoidable gaps between price discovery and final resolution.

-

Most apparent arbitrage is not executable.

Liquidity constraints, non-atomic execution, settlement interpretation, and fees eliminate the majority of visible price discrepancies, leaving only a narrow set of viable opportunities for disciplined traders.

-

Arbitrage functions as a market stabilizer.

Rather than exploiting inefficiency, arbitrage compresses emotional pricing, enforces internal consistency, and anchors prediction markets closer to settlement reality, enabling long-term market credibility.

- KEY TAKEAWAYS

- WHAT POLYMARKET IS REALLY TRADING

- WHY ARBITRAGE IS STRUCTURAL, NOT ACCIDENTAL

- THE DIFFERENCE BETWEEN SEEING ARBITRAGE AND EXECUTING IT

- WHY MOST ARBITRAGEURS LOSE MONEY

- THE ROLE OF ARBITRAGE IN MARKET QUALITY

- WHY ARBITRAGE IS BECOMING MORE COMPLEX

- ARBITRAGE AS THE DISCIPLINE THAT DEFINES PREDICTION MARKETS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

WHAT POLYMARKET IS REALLY TRADING

To understand why arbitrage exists on Polymarket, one must first abandon the most common misconception about prediction markets: that they are primarily places where people trade opinions or express beliefs about the future.

Polymarket does not trade opinions. It trades conditional payout rights tied to a specific resolution mechanism. A YES share is not a statement of confidence. It is a contractual position that pays one dollar if, and only if, an event is officially resolved as true under the platform’s predefined rules. A NO share represents the complementary claim. Nothing more, nothing less.

This distinction matters because it reframes how prices should be interpreted. Market prices on Polymarket are not direct probability estimates in a scientific sense. They are negotiated prices for future settlement outcomes, formed under uncertainty, time delay, fragmented information, and uneven participation. Every market will eventually collapse into a binary settlement where one side pays out fully and the other pays nothing. All price movement before that moment is simply the market attempting to anticipate that final outcome under imperfect conditions.

Arbitrage emerges precisely because this anticipation process is neither instantaneous nor perfectly coordinated. Prediction markets operate in real time, while reality itself often resolves slowly, ambiguously, or through institutional processes that cannot be immediately verified. This gap between real-world resolution and market pricing is not a flaw. It is the structural environment in which prediction markets exist.

WHY ARBITRAGE IS STRUCTURAL, NOT ACCIDENTAL

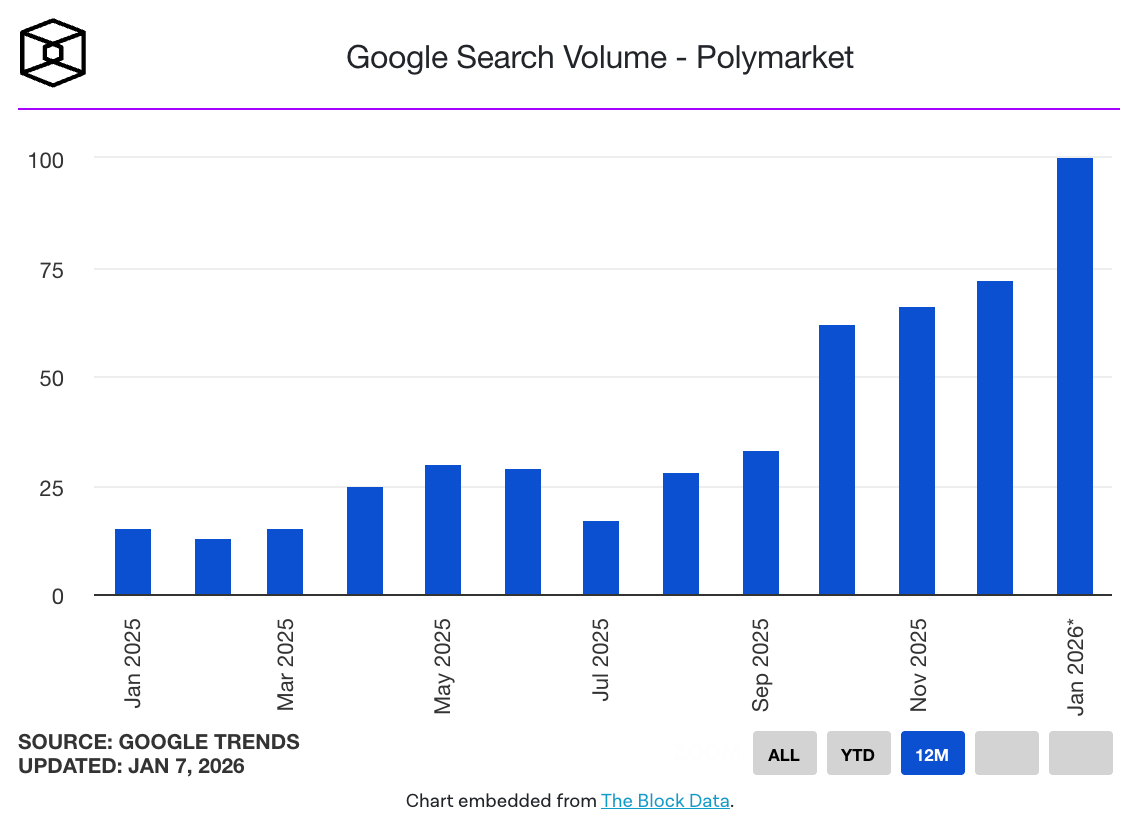

In traditional financial markets, arbitrage is often framed as a temporary inefficiency that disappears as markets mature. In prediction markets, the opposite tends to be true. As the number of markets grows and participation expands, arbitrage opportunities become more frequent, not less.

This is because prediction markets must compress complex, open-ended real-world events into discrete settlement rules. Political outcomes, legal decisions, economic indicators, and sporting events all involve layers of interpretation, timing, and authority. Markets respond to headlines, rumors, partial confirmations, and emotional reactions long before definitive resolution occurs.

At the same time, participation on platforms like Polymarket is highly asymmetric. Retail traders dominate volume during periods of high attention. They tend to trade narratives rather than settlement mechanics. They react quickly to news but slowly to nuance. Liquidity providers and professional traders, by contrast, focus on how prices will converge to settlement, not how they will react to the next headline.

The coexistence of these two groups creates persistent structural tension. Prices reflect excitement, fear, and momentum long before they reflect resolution certainty. Arbitrage is the mechanism by which that tension is gradually resolved.

In this sense, arbitrage is not an exploit. It is a correction process built into the system.

THE DIFFERENCE BETWEEN SEEING ARBITRAGE AND EXECUTING IT

One of the most misleading aspects of Polymarket arbitrage is that opportunities often appear obvious on the surface. Prices may look inconsistent. Complementary outcomes may sum to less than one. Related events may appear logically misaligned. For inexperienced traders, this creates the illusion that arbitrage is easy.

In practice, most apparent arbitrage is not executable.

The first barrier is liquidity. Prediction markets operate on order books, not automated pools. Quoted prices do not represent infinite capacity. The moment a trader attempts to execute size, the effective price moves. What looks like a profitable gap at small scale may disappear entirely once realistic execution costs are considered.

The second barrier is sequencing risk. Arbitrage on Polymarket often requires multiple legs. These legs are not atomic. If one side fills and the other does not, the trader is temporarily exposed to directional risk. In fast-moving markets, this exposure can turn a theoretical arbitrage into a real loss within seconds.

The third barrier is settlement interpretation. Many failed arbitrage attempts stem from misunderstanding how markets are resolved. Two markets that appear identical in theme may differ subtly in wording, timing, or data source. When resolution arrives, those differences matter far more than price relationships.

Professional arbitrageurs spend far more time eliminating these risks than identifying price discrepancies. The visible price gap is usually the least important part of the trade.

WHY MOST ARBITRAGEURS LOSE MONEY

Data from Polymarket consistently shows that a very small percentage of wallets capture the majority of arbitrage profits. This is not because opportunities are rare. It is because the cost of mistakes is high and cumulative.

New participants tend to underestimate friction. Fees, gas costs, partial fills, and capital lock-up all reduce effective returns. A trade that appears profitable on paper may offer no margin for error in practice. When mistakes occur, they often occur during periods of market stress, precisely when prices move fastest.

Another common failure mode is competition with automation. The most obvious arbitrage opportunities are monitored continuously by bots operating with low latency and predefined execution logic. Human traders cannot consistently compete on speed alone. Attempts to do so usually result in poor fills or missed legs.

The final and most dangerous error is psychological. Arbitrage is often described as risk-free. In reality, it is risk-constrained, not riskless. When traders internalize the idea that losses should not occur, they are more likely to hesitate when exiting a broken trade, increasing losses instead of containing them.

THE ROLE OF ARBITRAGE IN MARKET QUALITY

Despite these challenges, arbitrage plays a critical role in improving prediction markets. Without it, prices would drift far from settlement reality, making markets unusable for serious participants.

Arbitrage compresses exaggerated narratives, dampens emotional overreactions, and enforces internal consistency across related markets. It also serves as an informal audit mechanism. When resolution rules are unclear or poorly designed, arbitrageurs are often the first to detect and avoid those markets, signaling structural weaknesses to the broader ecosystem.

As prediction markets mature, this role becomes increasingly important. Institutions considering prediction markets as hedging or forecasting tools require confidence that prices are anchored to resolution outcomes rather than sentiment alone. Arbitrage provides that anchor.

Importantly, arbitrage does not eliminate disagreement. It simply narrows the range of plausible prices as settlement approaches. Markets remain expressive, but they become more disciplined.

WHY ARBITRAGE IS BECOMING MORE COMPLEX

As Polymarket expands, arbitrage is shifting away from simple price gaps toward more subtle structural analysis. The easiest opportunities are quickly consumed. What remains are trades that require understanding event dependencies, resolution pathways, and participant behavior.

This shift favors traders who think less like speculators and more like system analysts. The question is no longer whether a price is wrong, but why it is wrong and how it will be corrected.

In many cases, the most profitable trades are no longer pure arbitrage. They blend arbitrage logic with directional exposure, capturing value as the market moves toward internal consistency. This approach accepts limited risk in exchange for scalability, acknowledging that pure arbitrage capacity is finite.

ARBITRAGE AS THE DISCIPLINE THAT DEFINES PREDICTION MARKETS

Arbitrage on Polymarket is often misunderstood as a shortcut or loophole. In reality, it is a demanding discipline that sits at the core of how prediction markets function.

It requires patience, precision, and a deep respect for market structure. It rewards those who focus on settlement mechanics rather than headlines, execution discipline rather than theoretical pricing, and risk control rather than certainty.

Most importantly, arbitrage reveals what prediction markets truly are. They are not betting platforms. They are evolving financial systems that attempt to price reality before reality fully resolves.

In that process, arbitrage is not an anomaly. It is the mechanism that keeps the system honest.