KEYTAKEAWAYS

- Prediction market activity reached an all-time high in weekly transactions despite a sharp crypto market downturn.

- Polymarket continues to gain momentum across volume, partnerships, and product expansion, while Kalshi’s growth shows signs of divergence over longer periods.

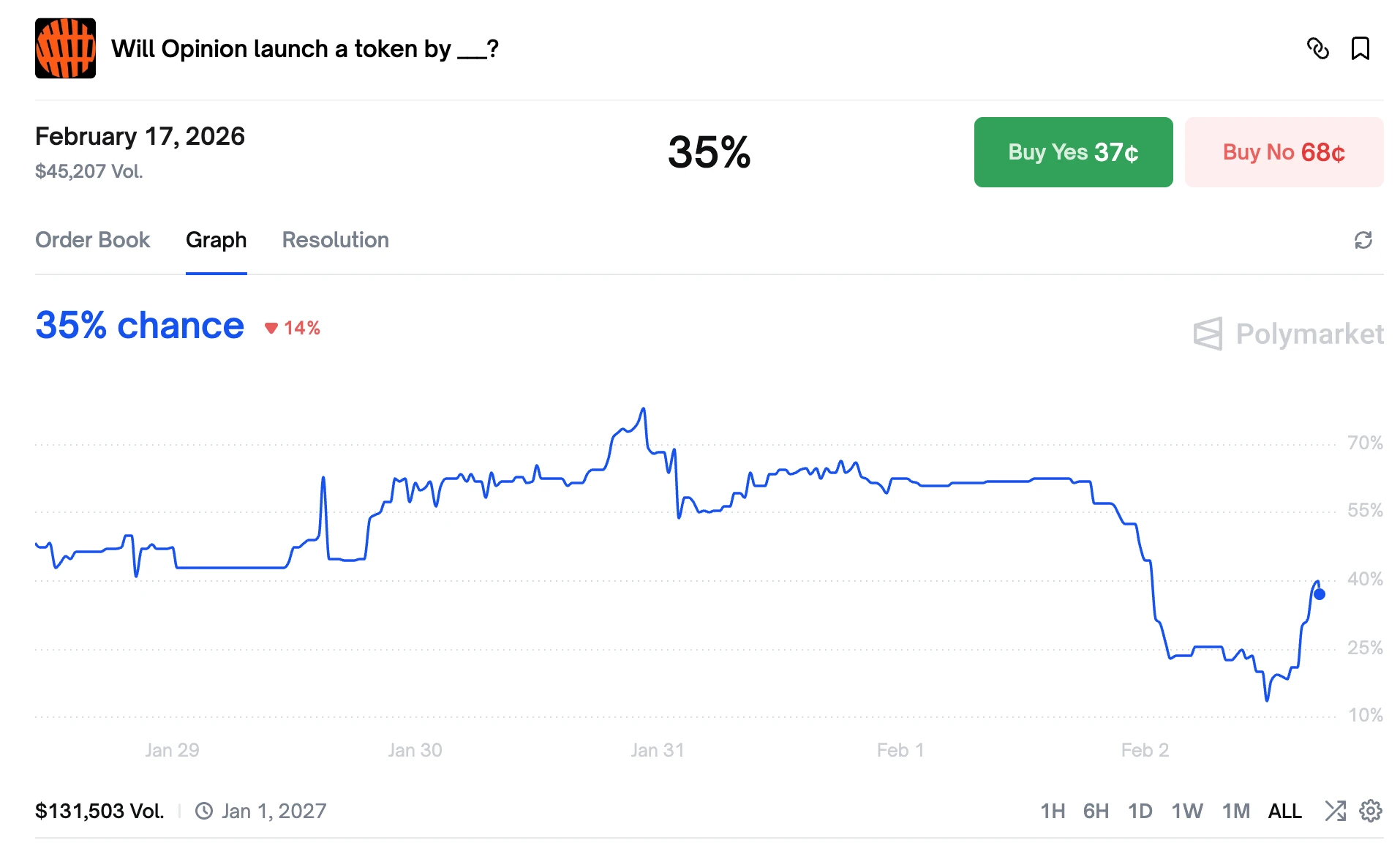

- Opinion’s anticipated TGE faces rising delay expectations, with market-implied probabilities dropping sharply following recent volatility.

CONTENT

Prediction markets hit record activity despite a market sell-off, led by Polymarket and Kalshi, while Opinion’s expected token launch faces growing uncertainty amid volatility.

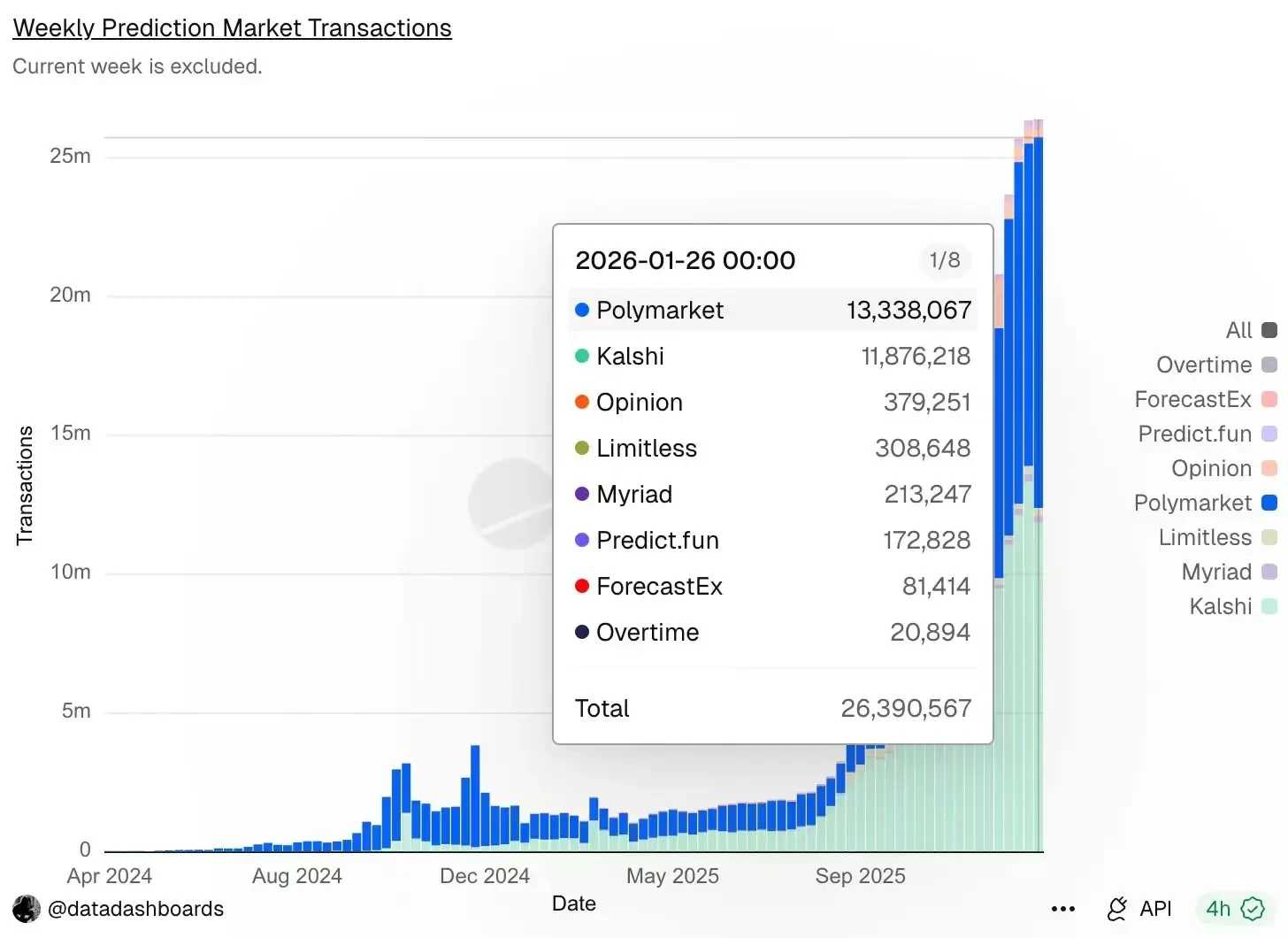

Despite the sharp market sell-off over the weekend, prediction markets posted a record high in weekly transaction volume. According to Dune data, total prediction market transactions reached 26.39 million last week.

Among them, Polymarket led the market with 13.34 million transactions, ranking first. Kalshi followed closely with 11.88 million transactions, taking second place. Opinion ranked third with 379,300 transactions.

2 MARKET LEADERS: POLYMARKET AND KALSHI

Beyond the record-breaking weekly transaction count across prediction markets, the 2 leading platforms—Polymarket and Kalshi—have both maintained elevated trading volumes in recent weeks.

Last week, Polymarket recorded $2.0 billion in trading volume, up 18.4% week over week, ranking first among peers. Kalshi followed with $1.4 billion in volume, a 8.5% weekly increase, placing second.

Looking at a longer time frame, the past 30 days show a clear divergence. Polymarket’s trading volume has continued to trend upward—potentially driven by rising market expectations around a future token launch—while Kalshi’s volume has steadily declined over the same period, indicating a more pronounced pullback.

📌 Key Developments Worth Watching

▶ Polymarket

1) Trading fees on short-term crypto markets

Polymarket has begun charging fees—up to 3% taker fees—on its 15-minute crypto price movement markets. An updated “Trading Fees” page in Polymarket’s official documentation confirms that these short-term markets are now fee-enabled.

2) Launch of real estate prediction markets

On-chain real estate platform Parcl has partnered with Polymarket to introduce housing price prediction markets. Users can trade on monthly, quarterly, or annual movements and threshold outcomes for city-level housing price indices. Each market links to a dedicated Parcl reference page detailing settlement values, historical context, and calculation methodology.

3) Official prediction partner of the Golden Globes

Polymarket has been named the exclusive prediction market partner of the Golden Globes. During the awards season, Polymarket launched on-site Golden Globes prediction dashboards, with both Polymarket and the Golden Globes highlighting the collaboration on X.

4) Integration with Jupiter on Solana

Jupiter announced it will integrate Polymarket, enabling users to access prediction markets directly through the Jupiter app via a built-in “Predictions” feature—positioning Jupiter as a more innovative prediction interface on Solana.

5) Exclusive partnership with Major League Soccer (MLS)

Polymarket signed a multi-year exclusive licensing agreement with Major League Soccer. The partnership covers MLS Cup, conference competitions, and the All-Star Game, and includes new fan experiences such as in-match “second-screen” interactions to deepen viewer engagement.

>>> Learn more: What is Polymarket? Web3 Prediction Market

▶ Kalshi

Because Kalshi requires U.S. KYC verification, participation is limited for many users. As a result, recent developments are primarily macro- and ecosystem-focused.

1) First Prediction Market Conference (March)

Kalshi co-founder and CEO Tarek Mansour announced plans to host the inaugural Prediction Market Conference in March, bringing together researchers, economists, policymakers, and traders to discuss prediction markets and knowledge aggregation.

2) Coinbase prediction markets go live nationwide via Kalshi

Coinbase announced that its Prediction Markets product is now available across all 50 U.S. states through its partnership with Kalshi—marking a full nationwide rollout from a prior limited pilot.

Coinbase noted that all current prediction contracts are provided by Kalshi, a platform regulated by the Commodity Futures Trading Commission. Additional contracts from other platforms may be added in the coming months. Contract prices reflect collective market-implied probabilities, and users can manage these positions alongside crypto assets, stocks, and cash within the Coinbase interface, with a minimum trade size of $1 (USD or USDC).

>>> Learn more: What is Kalshi Prediction Market? How Does It Work

OPINION: TGE MAY BE DELAYED AMID MARKET SELL-OFF

Opinion is the first prediction market platform in the BNB Chain ecosystem. On March 18 this year, Opinion announced the completion of a $5 million seed round, led by YZi Labs, with participation from echo, Animoca Ventures, Manifold, and Amber Group. Opinion was also previously named one of the four top-performing projects in the former Binance Labs MVB program.

According to official information, on January 26 Opinion added an airdrop wallet-binding interface to its website, supporting allocation across up to 5 wallets. This move was widely interpreted as a signal that a token airdrop—and potentially a token launch—was approaching.

In addition, Opinion founder Forrest stated during interactions on the project’s official Discord late last year that the TGE was not expected to be later than February 17 (around the Lunar New Year).

However, following last week’s sharp market downturn, many community members now expect Opinion to delay its TGE. Data from Polymarket shows that the probability of the event “Opinion will officially launch its governance token before February 17” has dropped sharply—from over 70% in late January to a low of below 15%. While the odds have since rebounded, they currently stand at around 35%.