KEYTAKEAWAYS

- Focus on fewer, high-conviction investments rather than spreading too thin across multiple projects.

- Avoid rotating out of winning tokens; let successful investments run their course.

- Understand the difference between pumpamentals and fundamentals, especially in a bull market, and develop a solid investment thesis.

- KEY TAKEAWAYS

- 1. BET LESS, BUT WITH HIGHER CONVICTION

- 2. AVOID ROTATING OUT OF WINNERS

- 3. UNDERSTANDING PUMPAMENTALS VERSUS FUNDAMENTALS IN A BULL MARKET

- 4. DEVELOP A SOLID INVESTMENT THESIS

- 5. REGULAR PORTFOLIO REVIEWS: ESSENTIAL FOR CRYPTO INVESTMENTS

- 6. EMBRACE NEW IDEAS AND PERSPECTIVES

- 7. IMPLEMENT AN EFFECTIVE EXIT STRATEGY

- CONCLUSION : STRATEGY IS KEY

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In my early months of diving into cryptocurrency, I faced a series of challenges that led to poor performance in my portfolio. My initial lack of understanding about the cryptocurrency market’s operation was a key reason for this. Over time, I learned and adapted, eventually turning my investments into profitable ones. However, the mistakes I made in the beginning did cost me a significant amount of money. For those who are just starting out in crypto, it’s crucial to learn from my experience. To help beginners, I’ve put together a list of seven essential tips that could prove beneficial in navigating the next bull cycle in the cryptocurrency market.

1. BET LESS, BUT WITH HIGHER CONVICTION

Investors often get caught up in the concept of diversification. While it’s a solid approach for preserving wealth, it’s not necessarily the most effective for building it. The comfort of having investments spread across 15-20 projects, where the failure of one has minimal impact, is appealing. Yet, this approach rarely leads to significant wealth accumulation.

My advice? Focus on fewer, high-conviction bets. If you’re eyeing 25 projects, narrow down your investments to the top 6-7 that show the most promise. This not only simplifies management but also increases potential returns.

2. AVOID ROTATING OUT OF WINNERS

A common mistake in crypto investing is rotating out of winning tokens. If one of your investments is surging while another lags, resist the urge to sell the high-performer to buy more of the underperformer. Let your successful investments run their course. The next bull market will likely see some dramatic shifts, and there’s nothing more regretful than selling a token after a modest gain, only to watch it skyrocket further.

Profit-taking should be strategic, not reactionary. Set clear sell targets, and consider taking profits only once these are met. A good indicator that it might be time to sell is when people outside the crypto world, like friends who usually don’t invest in crypto, start asking for token recommendations. This could signal a peak in mainstream interest, often a precursor to market corrections.

3. UNDERSTANDING PUMPAMENTALS VERSUS FUNDAMENTALS IN A BULL MARKET

In the realm of cryptocurrency, “pumpamentals” often overshadow fundamentals during a bull run. Pumpamentals refer to factors that can rapidly inflate the price of a token yet are unrelated to its underlying fundamentals. For instance, XRP’s staggering $80 billion market cap in the last bull cycle was significantly influenced by its zealous community, a classic example of solid pumpamentals at play.

Many tokens have reached high valuations primarily due to their pumpamentals. While I believe that fundamentals will ultimately become the key price driver, we’re not quite there yet. It’s essential to recognize what attracts retail investors to a specific token, as their decision-making process often centers around straightforward narratives.

In a bear market, the focus is rightfully on aspects like fundamentals, revenue generation, and product-market fit. However, in a bull market, the dynamics shift, and pumpamentals gain substantial importance. These include factors like charismatic leaders, social media buzz, narrative market fit, and robust marketing strategies.

Previously, I’ve delved deeper into the concept of pumpamentals in a dedicated thread. Understanding these dynamics can be crucial in navigating the cryptocurrency market, especially during its more volatile phases.

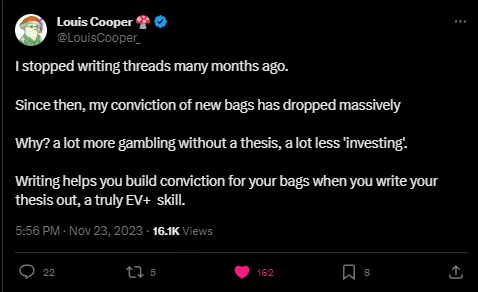

4. DEVELOP A SOLID INVESTMENT THESIS

While it might seem tedious, writing down your investment thesis is crucial. As highlighted by Louis Cooper, writing not only builds conviction in your investments but also enhances understanding and identifies knowledge gaps. This practice helps avoid impulsive decisions driven by FOMO, compelling you to articulate your reasoning before purchasing a token.

5. REGULAR PORTFOLIO REVIEWS: ESSENTIAL FOR CRYPTO INVESTMENTS

In the fast-paced world of cryptocurrency, a “buy-and-forget” strategy, especially for tokens other than BTC or ETH, is not advisable. Many projects lose relevance within two years of launch. Regular portfolio reviews, either bi-monthly or monthly, are key. Factors to evaluate include the team’s progress, on-chain metrics, community strength, and the roadmap. Remember George Soros’s wisdom: success in investing is about maximizing gains when right and minimizing losses when wrong. Cutting losses early when fundamentals change is vital.

6. EMBRACE NEW IDEAS AND PERSPECTIVES

Success in cryptocurrency often involves investing in underrated or misunderstood projects before they become mainstream. Dismissing ideas without research is a costly mistake in a bull market. Be open-minded and willing to adjust your biases with new information. As a true investor, acknowledge mistakes freely, just as the greatest traders do without ego.

7. IMPLEMENT AN EFFECTIVE EXIT STRATEGY

Many regret not taking profits in the previous bull run. To avoid this, create and adhere to an exit strategy. Don’t get swayed by the euphoria and influencer opinions at the peak of a bull run. Your strategy should clearly outline when to take profits and when to cut losses. A well-thought-out exit plan is essential, even though pinpointing the exact market top is challenging.

CONCLUSION : STRATEGY IS KEY

In conclusion, base your investment or trading decisions on a strategy and set of rules derived from your market experience. As the saying goes, a trader without a system is akin to a gambler. Building wealth is challenging, and it’s easy to lose it without a clear strategy. Stay disciplined and informed, and remember that in the dynamic world of cryptocurrency, adaptability and strategic thinking are your greatest assets.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!