- Bitcoin long-term holders sold 366,000 BTC in a month, the highest since April 2024, causing market volatility and hinting at a price correction.

- As Bitcoin nears $100,000, profit-taking by long-term holders, halving expectations, and liquidity needs shifted supply-demand dynamics.

- Despite short-term pressure, institutional demand and Bitcoin’s scarcity support long-term growth, requiring investors to balance risks and monitor trends.

TABLE OF CONTENTS

Long-term Bitcoin holders recently sold off a record 366,000 BTC, triggering market volatility as the price nears $100,000. Driven by profit-taking, market sentiment shifts, and halving expectations, this sell-off highlights a dynamic supply-demand balance. Despite short-term pressures, Bitcoin’s scarcity and growing institutional interest suggest strong long-term potential.

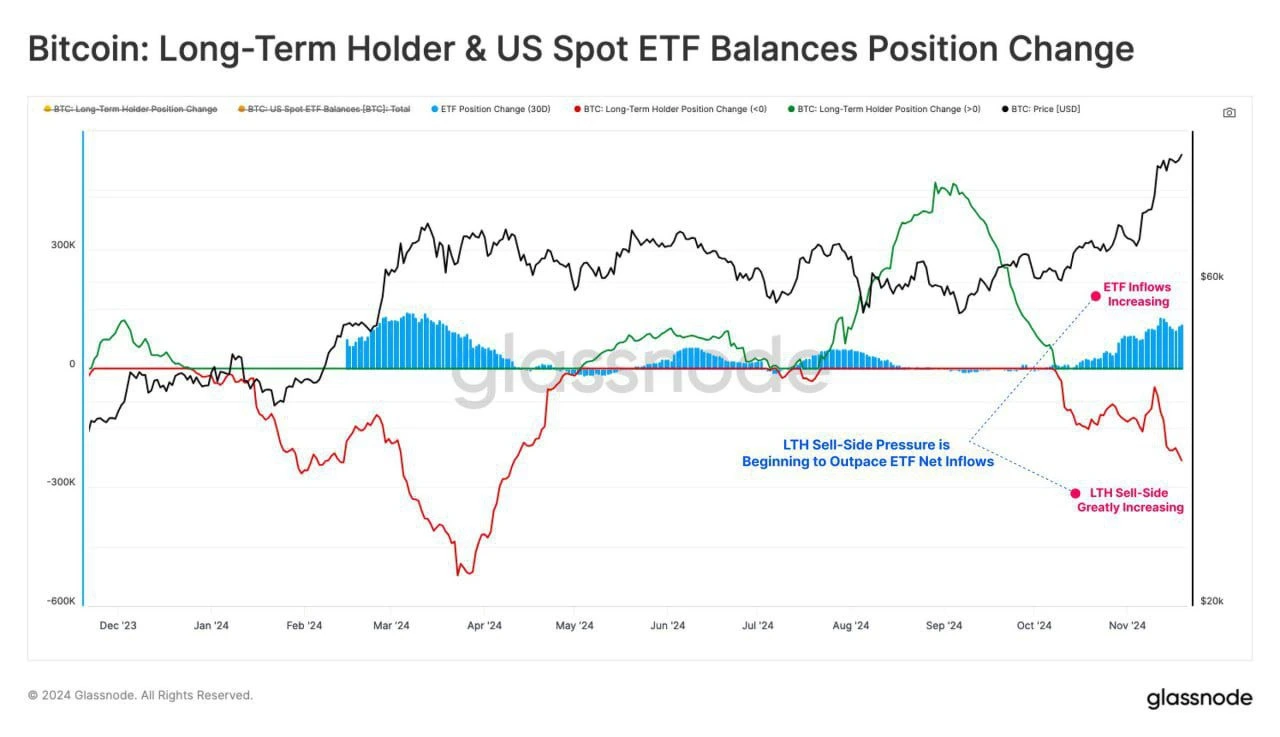

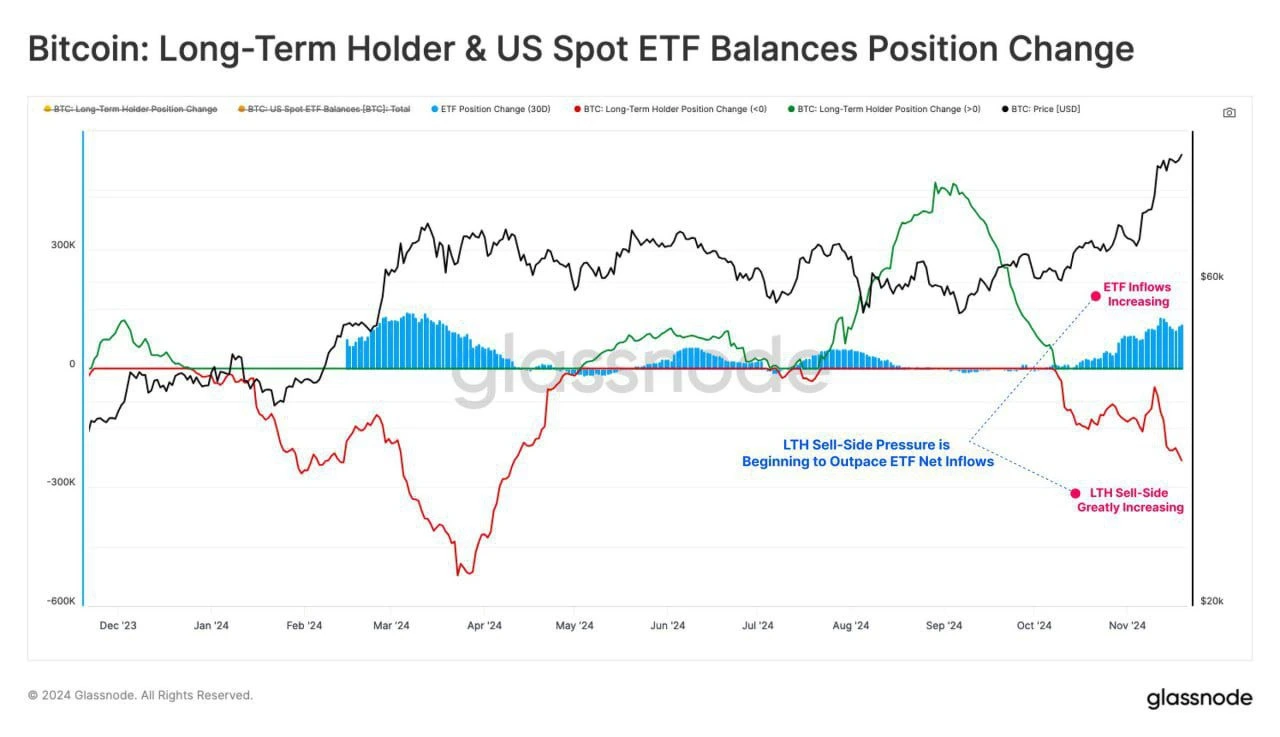

In recent weeks, the Bitcoin market has experienced a noticeable surge in volatility, fueled by a wave of large-scale sell-offs by long-term holders. Data reveals that approximately 366,000 BTC have been sold over the past month—the highest level since April 2024. This significant event highlights shifting market dynamics, reflecting both the evolving sentiment and the complex supply-demand structure of Bitcoin.

(Source:Glassnode)

Bitcoin, as an asset with “Veblen good” characteristics, sees its demand rise in proportion to its price. A market decline of just 1% can deal a significant blow to investor confidence. With news circulating that long-term holders have sold approximately 366,000 Bitcoin over the past month, it is highly likely to trigger significant price volatility. This could further undermine investor confidence, leading to additional sell-offs. Such fragility of confidence is particularly pronounced in the cryptocurrency market, which is inherently driven by emotions and psychological factors.

(Source:Tradingview)

THE SELL-OFF WAVE: CAUSES AND IMPLICATIONS

Long-term Bitcoin holders, often seen as the market’s steadfast “believers,” are typically less swayed by short-term price movements. Their decision to sell en masse at this juncture warrants scrutiny.

Several factors appear to be at play:

1. Profit-Taking at Key Price Levels

As Bitcoin’s price edges closer to the psychological $100,000 milestone, many investors are locking in profits, driving sell-off activity.

2. Shifts in Market Sentiment

Uncertainty about Bitcoin’s ability to sustain further growth or the possibility of a short-term pullback is prompting caution. Macroeconomic factors also contribute to the change in sentiment, encouraging some to reduce their exposure.

3. Preparation for the Halving

With the next Bitcoin halving event approaching, market participants may view the current price surge as a peak, factoring in reduced upside potential in the near term.

4. Liquidity Needs

Some long-term holders may require liquidity for reasons beyond the market, leading them to convert their holdings to cash.

5. Historical Patterns

Similar sell-offs occurred in previous market cycles when dormant Bitcoin supply peaked, typically signaling price corrections.

SUPPLY DYNAMICS: SCARCITY MEETS MARKET PRESSURE

Bitcoin’s total supply is capped at 21 million coins, with production decreasing every 210,000 blocks due to halving events. This ensures scarcity—a core driver of its value.

However, supply-side dynamics have been shifting. Glassnode data indicates that the available market supply has dropped from 5.3 million BTC in 2020 to 4.6 million BTC today. This reduction in tradable Bitcoin heightens price sensitivity to demand fluctuations.

At the same time, institutional demand is surging, fueled by innovations such as spot Bitcoin ETFs. These vehicles channel fresh capital into the market, amplifying the tug-of-war between selling pressure and new inflows.

Additionally, miners play a pivotal role in the ecosystem. While miner wallet balances have remained relatively stable, suggesting limited selling activity from this group, their behavior during the lead-up to halvings often skews toward accumulation.

On the demand side, institutional investors have shown increasing interest in Bitcoin, particularly with the launch of spot Bitcoin ETFs, which have injected new capital into the market. This development has not only elevated the demand baseline for Bitcoin but also attracted more attention to this asset class. However, despite the rise in institutional demand, the large-scale sell-off by long-term holders may exert downward pressure on prices in the short term.

(Source:Sosovalue)

NAVIGATING THE ROAD AHEAD

The current dynamics paint a mixed picture for Bitcoin’s near-term trajectory. On one hand, the large-scale sell-off by long-term holders increases short-term supply, potentially capping price gains. On the other, reduced circulating supply and growing institutional interest provide a counterbalance.

Investors should adopt a strategy tailored to their risk tolerance and investment horizon:

• For Long-Term Investors: Consider holding or gradually reducing exposure without overreacting to short-term noise.

• For Short-Term Traders: Watch for buying opportunities during dips but maintain prudent position sizing.

• For Newcomers: Gain a solid understanding of Bitcoin’s risks and market behavior before making significant commitments.

The sell-off preceding Bitcoin’s $100,000 threshold exemplifies the complexities of a maturing cryptocurrency market. While short-term fluctuations are inevitable, the broader trajectory of Bitcoin remains shaped by its foundational principles of scarcity, growing institutional adoption, and the transformative potential of blockchain technology.

By staying informed and adopting a balanced approach, investors can better navigate the challenges and opportunities of this ever-evolving market.

Read More:

2024 Crypto Asset Industry Regulations Trend Forecasts

Bitcoin ETF Investors Capitalize on Market Dip: Daily Inflows Surge to $295M

CoinRank x Bitget – Sign up & Trade to get $20!