KEYTAKEAWAYS

-

Superform reframes DeFi around intent rather than execution.

Instead of asking users to choose chains, bridges, and routes, Superform abstracts these decisions away, allowing users to focus only on outcomes like earning yield.

-

Chain abstraction positions Superform as yield infrastructure, not a yield producer.

By standardizing access through ERC-4626 and routing capital across chains, Superform acts as a distribution layer that connects users to existing yield strategies without competing with them.

-

The protocol bets on usability as the next growth driver for DeFi.

Superform’s design assumes that future adoption will depend less on higher APY and more on hiding complexity, reducing cognitive load, and enabling long-term user participation.

- KEY TAKEAWAYS

- WHEN COMPLEXITY BECAME DEFI’S REAL BOTTLENECK

- CHAINS BELONG IN THE BACKGROUND, NOT THE INTERFACE

- FROM YIELD AGGREGATOR TO USER OWNED NEOBANK

- SUPERVAULTS V2 AND THE MOVE TOWARD INTELLIGENT YIELD

- GAMIFICATION AS A RETENTION MECHANISM, NOT A GIMMICK

- A QUIET BET ON THE FUTURE OF DEFI

- DISCLAIMER

- WRITER’S INTRO

CONTENT

WHEN COMPLEXITY BECAME DEFI’S REAL BOTTLENECK

DeFi did not stall because yields disappeared. It stalled because participation became exhausting.

Over the past few years, the industry solved one problem and created another. Layer 2 networks expanded capacity. Rollups reduced fees. Modular stacks promised flexibility. Yet each improvement pushed more responsibility onto users. Assets spread across chains. Gas tokens multiplied. Bridges introduced new risk. A simple yield action began to look like a checklist.

What failed was not finance. It was product structure.

Most DeFi systems still assume that users should understand execution details. They expect people to choose a chain, manage routes, and accept operational risk in exchange for yield. That assumption may work for power users, but it breaks at scale. The average user does not want to think about chains. They want outcomes.

This is the gap Superform stepped into.

Instead of asking users to learn more, Superform removes what they do not need to see. It treats chains as infrastructure, not as destinations. The result is not a new yield strategy, but a different way to access yield at all.

CHAINS BELONG IN THE BACKGROUND, NOT THE INTERFACE

For most of DeFi’s history, chains were the starting point. You chose Ethereum or another network, then explored what lived inside it. Multi chain DeFi promised more choice, but in practice it fragmented attention and liquidity.

Superform takes the opposite view. The chain should not be the first decision. It should barely be a decision at all.

In Superform’s model, the user expresses intent. Deposit USDC. Earn yield. Everything else happens in the background. Routing, bridging, swapping, and vault interaction are handled by the protocol. What once required many steps becomes a single signature.

This approach mirrors how successful systems evolve outside crypto. Internet users do not manage packets. Mobile users do not care about radio layers. Complexity is hidden so that scale becomes possible.

Chain abstraction is not a marketing phrase here. It is a design choice. By removing chains from the interface, Superform shifts DeFi from an execution driven experience to an intent driven one.

That shift changes who DeFi is built for.

FROM YIELD AGGREGATOR TO USER OWNED NEOBANK

It is easy to describe Superform as a cross chain yield aggregator. That description is incomplete.

Superform behaves more like a user owned neobank. Not a bank that holds funds or offers credit, but a system that organizes access to financial outcomes without custody. Assets remain in user wallets. Yield flows directly back to users. The protocol does not rely on opacity or spread capture.

The core innovation is coordination.

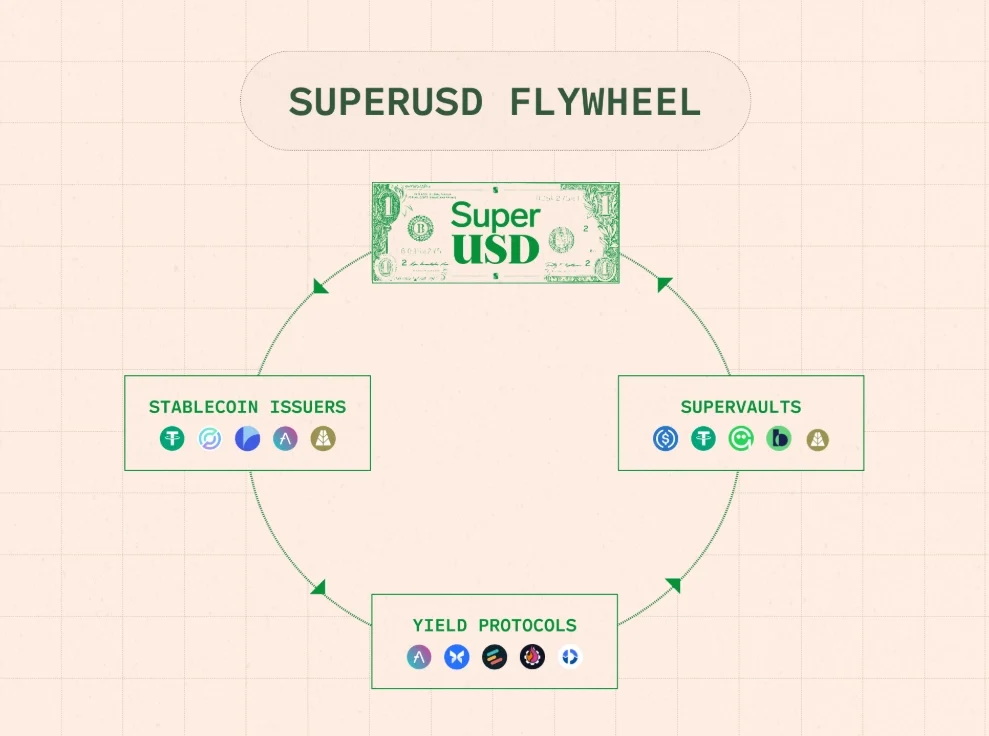

Superform does not compete with yield producers. It depends on them. Protocols such as Yearn, Morpho, and Pendle focus on generating returns. Superform focuses on distribution. It standardizes access through ERC 4626 vaults and routes capital across chains to wherever yield exists.

This separation of roles matters. It allows Superform to scale horizontally without owning risk models. It also allows yield strategies to reach users they could not reach on their own.

In this structure, Superform becomes infrastructure rather than destination. It is the layer that connects users to yield across ecosystems, without forcing users to care where that yield lives.

SUPERVAULTS V2 AND THE MOVE TOWARD INTELLIGENT YIELD

The launch of SuperVaults v2 marked a turning point.

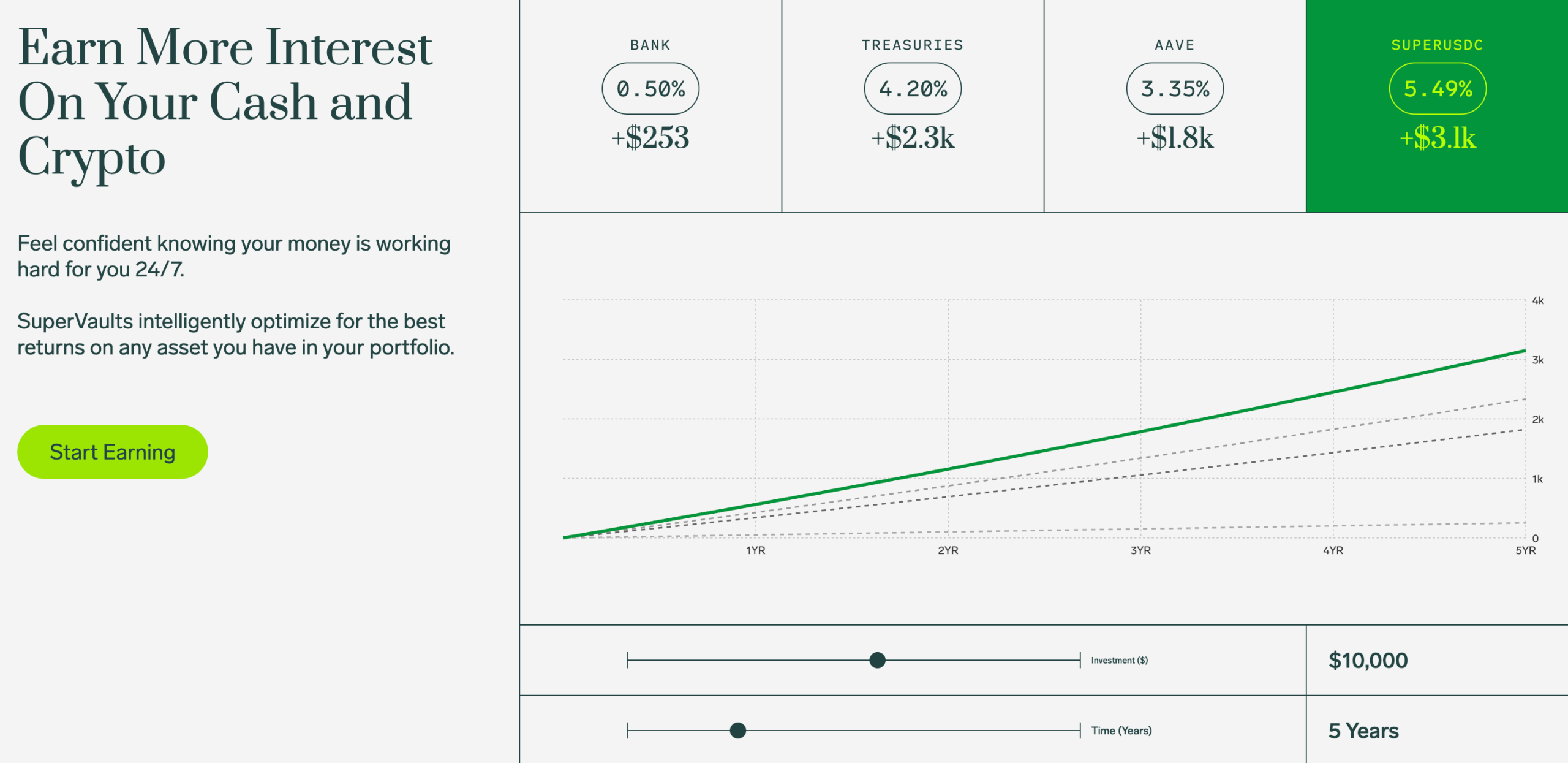

Earlier versions focused on access. Version two began to manage complexity internally. By combining variable lending markets with fixed term yield, SuperVaults v2 introduced adaptive allocation under a single vault interface.

From the user’s perspective, nothing changed. They still deposit one asset and receive yield. Behind the scenes, capital moves between protocols and strategies based on predefined rules and on chain data.

The importance of this shift is not higher returns. It is abstraction of decision making. Strategies that once required constant monitoring are packaged into a system that runs automatically and transparently.

Everything remains on chain. Users can verify where funds are deployed and how positions change. This preserves the core promise of DeFi while removing the cognitive load that has limited its reach.

GAMIFICATION AS A RETENTION MECHANISM, NOT A GIMMICK

Superform’s Safari system is often described as gamification. That word undersells its function.

Safari is not about short term engagement. It is about filtering behavior. Users earn progress by using the protocol across chains, over time, and with consistency. NFTs provide boosts, but only when paired with real activity.

This design rewards commitment rather than opportunism. It distinguishes long term users from transient capital. In doing so, it solves a problem many DeFi protocols struggle with: aligning incentives with actual usage.

Rather than attracting liquidity for a moment, Safari encourages users to stay, explore, and integrate Superform into their routine.

A QUIET BET ON THE FUTURE OF DEFI

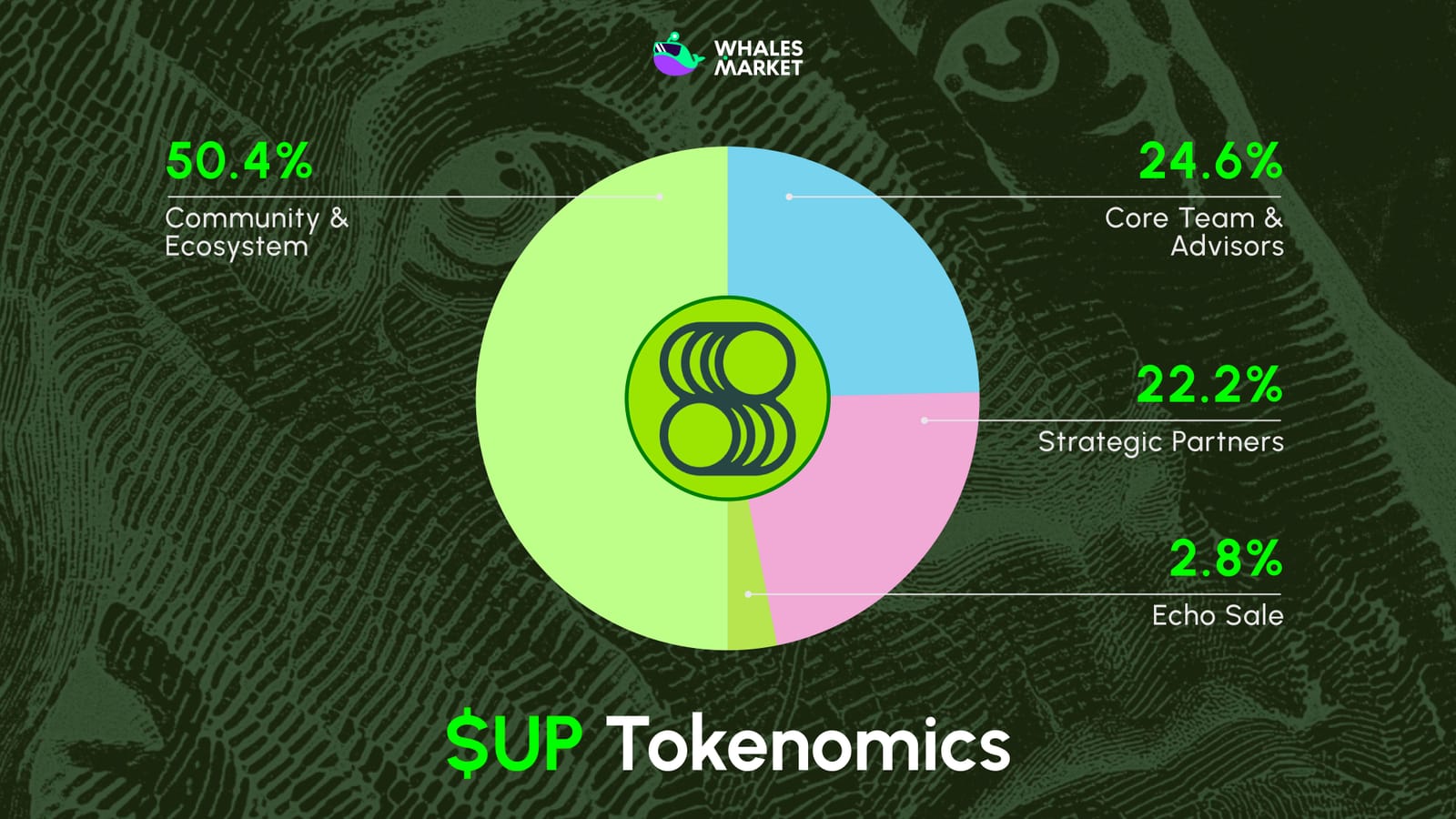

Superform is not without risk. It relies on external bridge infrastructure. It operates in a space that is becoming more competitive. Its token economics still need to prove long term value capture.

Yet its core bet is clear and deliberate.

As DeFi grows, users will not tolerate increasing complexity. They will not learn more chains. They will not manage more tools. They will expect systems to adapt to them, not the other way around.

In that future, the winners will not be the protocols with the most features. They will be the ones that hide complexity best.

Superform is building toward that future quietly, by removing itself from the center of attention. If chain abstraction becomes the norm, it will not be because users asked for it. It will be because they never had to think about it at all.