KEYTAKEAWAYS

-

The crypto winter started in January 2025, not after peak prices

Structural ETF and treasury buying delayed visible collapse, while retail and non institutional assets entered a full bear market much earlier.

-

Institutional capital changed price behavior but not market reality

Over seventy billion dollars in ETF driven demand supported Bitcoin prices, replacing sharp crashes with prolonged stagnation and time based exhaustion.

-

The next market recovery will be uneven and selective

This cycle represents a shift toward institutional survivability. Assets without compliance pathways or balance sheet relevance may not fully recover.

- KEY TAKEAWAYS

- A MARKET THAT LOOKED STABLE BECAUSE IT WAS BEING HELD UP

- RETAIL WAS ALREADY IN WINTER WHILE THE NARRATIVE LAGGED BEHIND

- THE ETF THOUGHT EXPERIMENT THAT CHANGES EVERYTHING

- WHY POSITIVE DEVELOPMENTS FEEL IRRELEVANT RIGHT NOW

- WHY THIS WINTER MAY END FASTER THAN EXPECTED

- A STRUCTURAL TRANSITION, NOT A SIMPLE CYCLE

- DISCLAIMER

- WRITER’S INTRO

CONTENT

There is a specific feeling that only appears in real bear markets. It is not panic and it is not fear. It is quieter and heavier. Fatigue. Indifference. A slow loss of urgency. When market participants stop refreshing price charts every few minutes and start questioning why they are still paying attention at all, winter is already here. If this describes how the crypto market feels right now, that is not an accident. It is a signal.

This moment does not resemble a normal pullback. It does not behave like a technical correction inside a healthy bull trend. What we are experiencing is the delayed recognition of a structural shift that began far earlier than most people were willing to admit. According to Bitwise Chief Investment Officer Matt Hougan, the crypto winter did not start recently. It started in January 2025. The market simply failed to call it what it was at the time.

The importance of this claim is not its headline value. It is what it explains. Once this premise is accepted, many contradictions of the past year suddenly make sense. Strong adoption narratives alongside falling prices. Institutional optimism paired with retail exhaustion. Regulatory progress that appears disconnected from market performance. These are not inconsistencies. They are the natural characteristics of a market that has already entered winter but has not fully acknowledged it.

A MARKET THAT LOOKED STABLE BECAUSE IT WAS BEING HELD UP

On the surface, the crypto market in 2025 did not resemble the beginning of a deep downturn. Bitcoin pulled back from its highs but avoided a violent collapse. Ethereum weakened but maintained its position as a core asset. At several points, large tokens even staged short lived rebounds. To many investors, these movements suggested a cooling phase rather than the start of a prolonged winter.

This perception, however, was shaped by a narrow view of the market. Hougan’s insight is not focused on price action alone, but on why prices were able to hold at all. The answer lies in structure, not sentiment.

The introduction of spot Bitcoin ETFs and the rise of crypto treasury companies created a form of demand that had never existed in previous cycles. This capital did not arrive chasing narratives or short term momentum. It arrived through allocation mandates, compliance frameworks, and balance sheet strategies. Its goal was not to time the market, but to gain exposure. As long as supply was available, it was absorbed.

This structural bid functioned like a support framework beneath the market. It prevented visible collapse while masking deeper weakness elsewhere. The winter did not disappear. It was simply delayed in its most obvious form.

RETAIL WAS ALREADY IN WINTER WHILE THE NARRATIVE LAGGED BEHIND

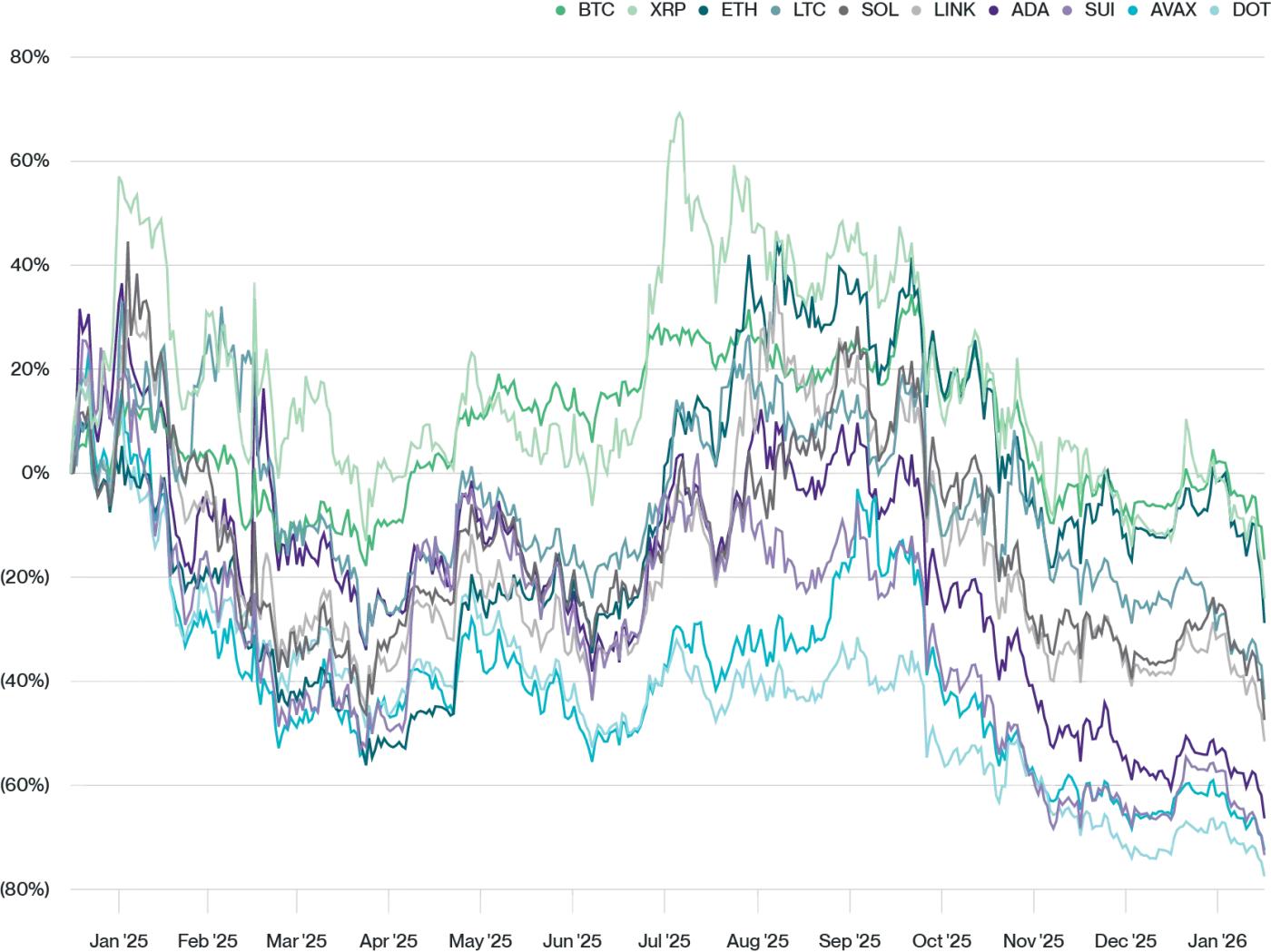

Once attention moves away from Bitcoin and Ethereum, the true condition of the market becomes clear. Across mid tier assets, ecosystem tokens, and projects without institutional access, 2025 was already a full scale bear market. Prices declined not by small percentages, but by fifty, sixty, or even seventy percent. Liquidity dried up. Trading activity collapsed. Narratives that once drove excitement quietly lost relevance.

Hougan divided the market into three layers, and this framework explains far more than any single chart. The first layer consists of assets that institutions can access easily. These assets benefit from ETF channels, treasury demand, and regulatory clarity. They were protected by structural buying. The second layer includes assets that entered institutional consideration later. These tokens experienced real bear markets, but their ecosystems and narratives survived. The third layer includes assets with no institutional gateway or balance sheet demand. This group absorbed the full force of the downturn early and without protection.

This division leads to an uncomfortable conclusion. The retail driven segment of the crypto market entered winter at the start of 2025. The broader industry simply refused to label it as such. As long as Bitcoin appeared stable, the assumption persisted that the cycle had not turned. In reality, the cycle had already fractured.

THE ETF THOUGHT EXPERIMENT THAT CHANGES EVERYTHING

One of Hougan’s most important observations comes from a simple question. What would the market look like without ETFs.

Since early 2025, ETFs and crypto treasury firms accumulated more than seven hundred thousand Bitcoin, representing roughly seventy five billion dollars of demand. This was not speculative capital. It was structural demand that did not exit during drawdowns and did not chase rallies.

Without this demand, price discovery would have followed a very different path. Hougan suggests that Bitcoin could have fallen dramatically further, potentially by another sixty percent. Whether the exact figure is correct is less important than what it reveals. Current prices are not the result of natural market clearing. They are the result of structural intervention.

This explains the unusual stagnation that now defines the market. Prices do not collapse because supply continues to be absorbed. Prices do not recover because sentiment remains exhausted. Time, rather than volatility, has become the dominant force shaping market behavior.

WHY POSITIVE DEVELOPMENTS FEEL IRRELEVANT RIGHT NOW

Every crypto winter produces the same confusion. Adoption continues. Regulation advances. Institutions build infrastructure. Stablecoins expand. Tokenization accelerates. Yet prices remain weak.

The explanation is simple and uncomfortable. In winter, markets are not searching for reasons to rise. They are searching for reasons to stop caring.

Those who lived through 2018 or 2022 recognize this phase. True bottoms do not form when optimism remains. They form after exhaustion. Positive developments do not disappear during this process. They are compressed and stored. When conditions change, that stored progress does not reenter the market gradually. It releases suddenly.

WHY THIS WINTER MAY END FASTER THAN EXPECTED

Hougan’s optimism is not rooted in price targets. It is rooted in time structure. Historically, crypto winters last roughly one year. If measured from peak prices, this cycle appears incomplete. But if winter truly began in January 2025, the market is already well into its later stages.

Several critical processes have already occurred. Excess leverage has been flushed. Retail capitulation has appeared. Only durable narratives remain active. These are not early cycle signals. They are late cycle ones.

When macro conditions stabilize, when policy clarity improves, or when time itself dulls the remaining fear, the market response could be faster and sharper than many expect. Winters end not with excitement, but with indifference. That indifference is now widespread.

A STRUCTURAL TRANSITION, NOT A SIMPLE CYCLE

The most important conclusion goes beyond timing. This cycle is not a simple repeat of past bull and bear rotations. It represents a structural transition.

The crypto market is moving away from pure narrative driven speculation toward institutional survivability. Assets are no longer judged solely by potential upside. They are judged by whether they can be held on balance sheets, accessed through compliant vehicles, and defended under regulatory scrutiny.

Spring will arrive. But it will not lift everything. Some assets already experienced their winter and may never fully recover. Others have barely felt it yet.

If investors continue to apply the logic of the last bull market to the current environment, they may discover that the real winter was not in the market at all, but in their expectations.