KEYTAKEAWAYS

-

Capital Retention: Solana’s growth exhibits "unidirectional inflow" characteristics, marking its evolution from a speculative playground to a long-term sanctuary for high-net-worth capital.

-

Property Mutation: Transaction costs below $0.01 have enabled stablecoins on Solana to shift from "trading chips" to "high-velocity currency," successfully closing the loop on real-world payments.

-

Institutional Game-Changer: Leveraging the compliance certainty brought by Token Extensions, top-tier issuers are increasingly viewing Solana as the optimal settlement path for traditional finance to integrate with Web3.

CONTENT

Solana’s stablecoin market cap surpasses $11B, overtaking BNB Chain and signaling a shift from speculative narratives to global dollar settlement infrastructure driven by capital velocity, ultra-low fees, and institutional adoption.

Scale Leap

In the cryptocurrency market, price acts as the pulse of sentiment, but stablecoin scale serves as the “skeleton” of the ecosystem.

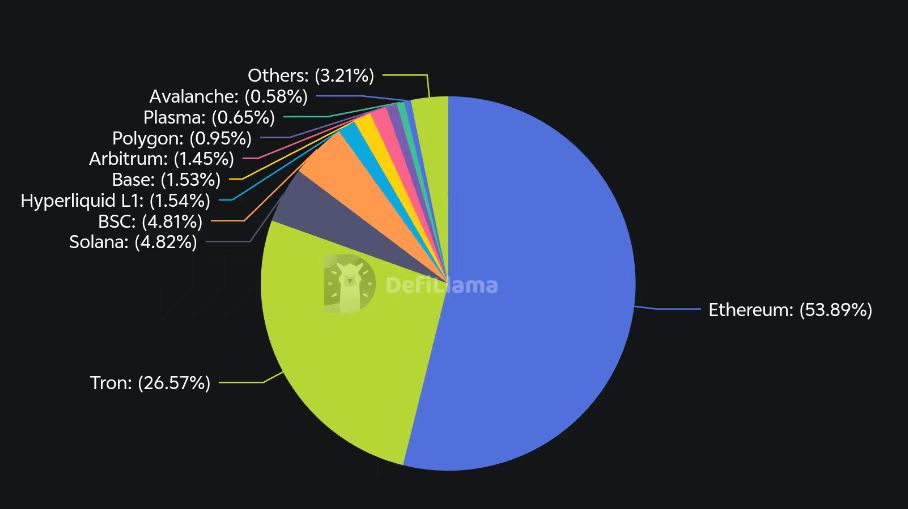

In 2025, while the market remains embroiled in verbal disputes over which public chain possesses superior performance, a “Great Migration” that will truly define the landscape for the next five years has quietly concluded. According to the latest on-chain data, the market capitalization of stablecoins on Solana has officially surpassed the $11 billion threshold. This represents not only a nearly threefold explosive growth within the year but also a critical leapfrogging of BNB Chain, securing Solana’s position as the third-largest stablecoin network globally.

This is more than a mere shuffle in rankings; it is a profound transformation regarding “capital quality” and the “Pareto Principle” (the 80/20 rule). In traditional public chain narratives, stablecoins are often viewed as “trading chips.” When market sentiment is bullish, capital flows in to purchase assets; when the market cools, capital retreats to centralized exchanges. This volatility makes public chains resemble temporary “casinos” rather than financial infrastructure.

However, Solana’s breakthrough at the $11 billion mark exhibits starkly different characteristics. Deep penetration of on-chain capital flows reveals that Solana’s stablecoin growth shows a rare “anti-cyclical” nature. This implies that once capital enters the Solana ecosystem, it no longer seeks immediate conversion into volatile assets but chooses to “reside” long-term in the form of US dollars. This phenomenon uncovers the Pareto Principle of public chain competition: 80% of speculative capital flits between various Layer 2s and sidechains, while 20% of core high-net-worth capital and institutional liquidity is aggregating toward Solana, which possesses global settlement capabilities.

Figure 1: Global Stablecoin Market Share Distribution: Solana Ranks Among the Top Three Public Chains (DefiLlama Data)

WHY SOLANA?

Why Solana, and not the deeply entrenched BNB Chain or the highly compatible Ethereum Layer 2s? The answer lies in the “velocity” of capital.

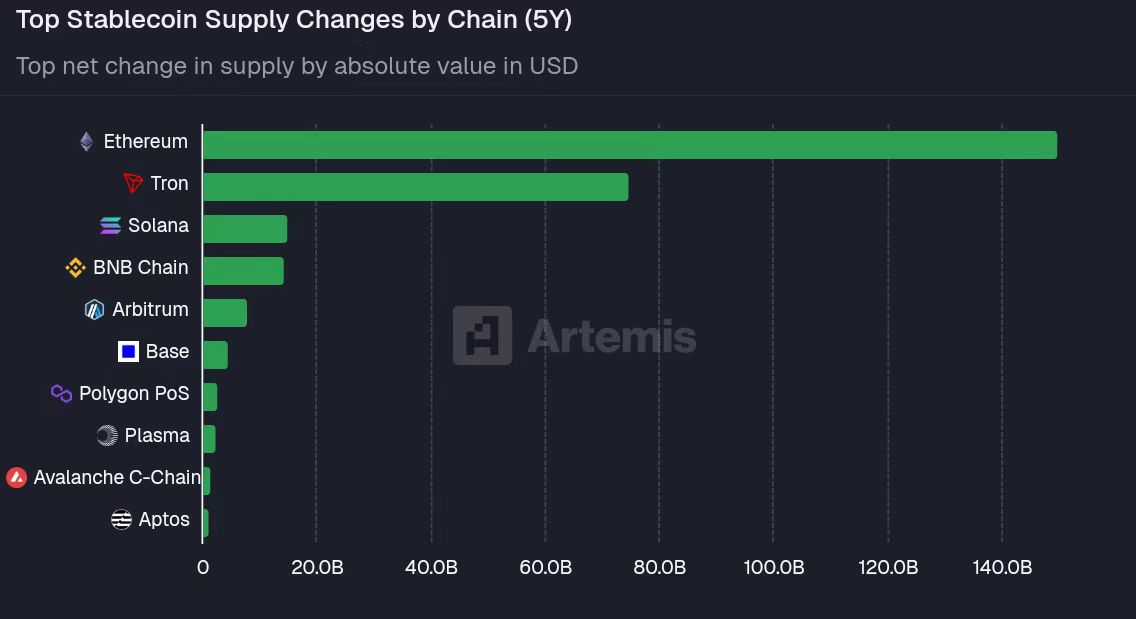

The value of a chain should not be measured solely by how much money it “locks” (Total Value Locked or TVL), but by how much money it “circulates.” Comparing BNB Chain and Solana reveals an enlightening phenomenon: the stablecoins on BNB Chain are, to a large extent, “spillover funds” from the Binance ecosystem. Much of this capital remains static, idling in lending protocols, liquidity pools, or simply serving as a pit stop for exchange withdrawals. They are passive and stationary.

In contrast, stablecoins on Solana exhibit high “nativity.” Whether it is instantaneous swaps on Decentralized Exchanges (DEXs), revenue settlement in Decentralized Physical Infrastructure (DePIN) projects, or actual consumption through mobile payment applications, this money is constantly “at work.”

This is the distinction between “passing through” and “living.” Capital on Solana is not just residing; it is participating in the construction of a closed-loop business ecosystem. When US dollars can seamlessly integrate into payments, credit, and physical incentive scenarios, the chain ceases to be an extension of a centralized exchange and becomes an independent digital economy. This “capital vitality” is the underlying logic that allows Solana to continuously attract high-liquidity assets.

Figure 2: Comparison of Net Growth in Stablecoin Supply Among Major Public Chains Over the Past 5 Years (Artemis Data)

WHEN TRANSACTION COSTS DROP BELOW $0.01

In macroeconomics, there is a core metric called the “Velocity of Money.” The same dollar on Ethereum, due to exorbitant gas fees, can usually only perform large-scale, low-frequency asset movements. On Solana, where transaction costs are stabilized below $0.01, the granularity of finance has been infinitely refined.

The qualitative change brought by this ultra-low cost is significant: stablecoins have finally returned to their essence as “currency.” For the past decade, the crypto industry has struggled to realize the logic of “buying coffee with stablecoins,” consistently hindered by high costs and latency. Today, on Solana, every transaction confirmed in milliseconds at a negligible cost transforms stablecoins from “on-chain chips” into genuine “digital cash.”

This qualitative shift directly triggers a business logic loop. From cross-border micro-remittances to micro-payments for streaming media, and real-time settlement for decentralized ride-hailing software, Solana is carrying business demands that are extremely sensitive to cost and hungry for frequency. When transaction costs are no longer a barrier, stablecoin liquidity irrigates every tiny commercial crevice like a flood. This high turnover rate not only supports a multi-billion dollar market cap but also gives Solana a first-mover advantage in the field of payment settlement.

BEYOND THE SPECULATIVE FRENZY

If the foundation of the $11 billion market cap is built by active retail users, its thickness is reinforced by top-tier institutions. It is an undeniable fact that institutional issuers are collectively casting a “vote of confidence” for Solana.

Observing the composition of this growth, the dominance of USDC and the surge of PayPal’s stablecoin (PYUSD) are the most prominent. At one point, the growth rate of PYUSD on Solana was several times higher than its performance on Ethereum. Why would these traditional financial giants, known for their extreme caution, choose Solana? Beyond performance, the core driver lies in the “Token Extensions” feature provided by Solana.

For a long time, the fear traditional financial institutions held toward on-chain funds was “loss of control.” Token Extensions allow issuers to integrate compliance functions directly into the token’s base layer—such as transfer hooks, confidential transfers, and specific compliance audit logic. This perfectly resolves the ultimate anxiety regarding regulation and compliance that institutions face when embracing decentralized networks. The entry of top issuers serves as a “trust endorsement.” When traditional financial giants believe that Solana’s network architecture is robust enough to carry tens of billions in institutional settlement, this certainty attracts more institutional safe-haven assets, pushing the public chain competition to a new height.

STABLECOINS AS THE WIDEST “MOAT” FOR PUBLIC CHAINS

Finally, we must re-examine the valuation paradigm of public chains. In the past, we were accustomed to defining the success of a chain by its token’s price action. In the future, the ultimate standard for measuring a chain’s vitality will undoubtedly be its “dollar carrying capacity.”

The reason stablecoin scale serves as the widest moat for a public chain is that it represents extremely high “switching costs.” When a user becomes accustomed to using US dollars on Solana to pay bills, earn yields, and build their financial habits, the friction to leave the ecosystem becomes immense. This stickiness, accumulated through real-world application scenarios, cannot be easily shaken by any high-subsidy incentive or airdrop.

Solana’s stablecoin market cap surpassing $11 billion marks an important pivot in the public chain narrative: the era of performance narratives based solely on “speed” is over, and the era of “public chains as global dollar settlement infrastructure” is beginning. In this re-selection of settlement paths, the market has already provided its answer. Solana is paving a road to the future with US dollars, and this road, paved by the accumulation of capital, is the most solid barrier in the competition among public chains.

Read More: