KEYTAKEAWAYS

- Asia’s top exchanges are rejecting DAT firms, citing regulatory and liquidity concerns, marking the end of the corporate crypto-hoarding era in public markets.

- DAT companies evolved from mindless accumulation to strategic treasury management, but poor governance and hype-driven models led to widespread mistrust and regulatory scrutiny.

- The collapse of QMMM exposed the structural weakness of the DAT model, signaling that this bull run’s core growth engine has effectively burned out.

CONTENT

Asia’s major stock exchanges are rejecting crypto-hoarding companies, marking the decline of Digital Asset Treasuries (DATs) and signaling the end of this bull run’s core driver.

On October 21, 2025, Bloomberg reported that three of the Asia-Pacific region’s largest stock exchanges — Hong Kong Exchanges & Clearing (HKEX), Japan Exchange Group (JPX), and Singapore Exchange (SGX) — have begun pushing back against listed companies transforming into so-called Digital Asset Treasury (DAT) firms.

Their message is clear: corporate crypto hoarding is no longer welcome in mainstream capital markets.

THE NEW CRACKDOWN: EXCHANGES DRAW THE LINE

This marks the strongest coordinated stance yet by Asia’s leading exchanges against the trend of public companies turning into digital-asset vaults.

HKEX has reportedly blocked at least five companies from pursuing restructuring plans that would make digital assets their primary business. Officials cited violations of listing rules prohibiting firms from holding large, liquid assets unrelated to their core operations. The exchange now requires detailed disclosures on how cryptocurrencies are acquired, stored, and valued before such pivots can even be considered.

Similarly, the Japan Exchange Group has warned that companies engaging in speculative crypto treasury activities could face tighter reporting requirements, given the difficulty of valuing volatile assets like Bitcoin and Ethereum under Japan’s Financial Instruments and Exchange Act.

Meanwhile, the Singapore Exchange has advised several issuers that any plan to integrate digital-asset reserves into their balance sheets will require heightened transparency and due diligence — exceeding traditional reporting standards.

Together, these actions show that Asia’s top exchanges are drawing a firm line: if a company’s main narrative is “we’re buying crypto as strategy,” it may soon find itself unlistable.

FROM WILD ACCUMULATION TO STRATEGIC MANAGEMENT

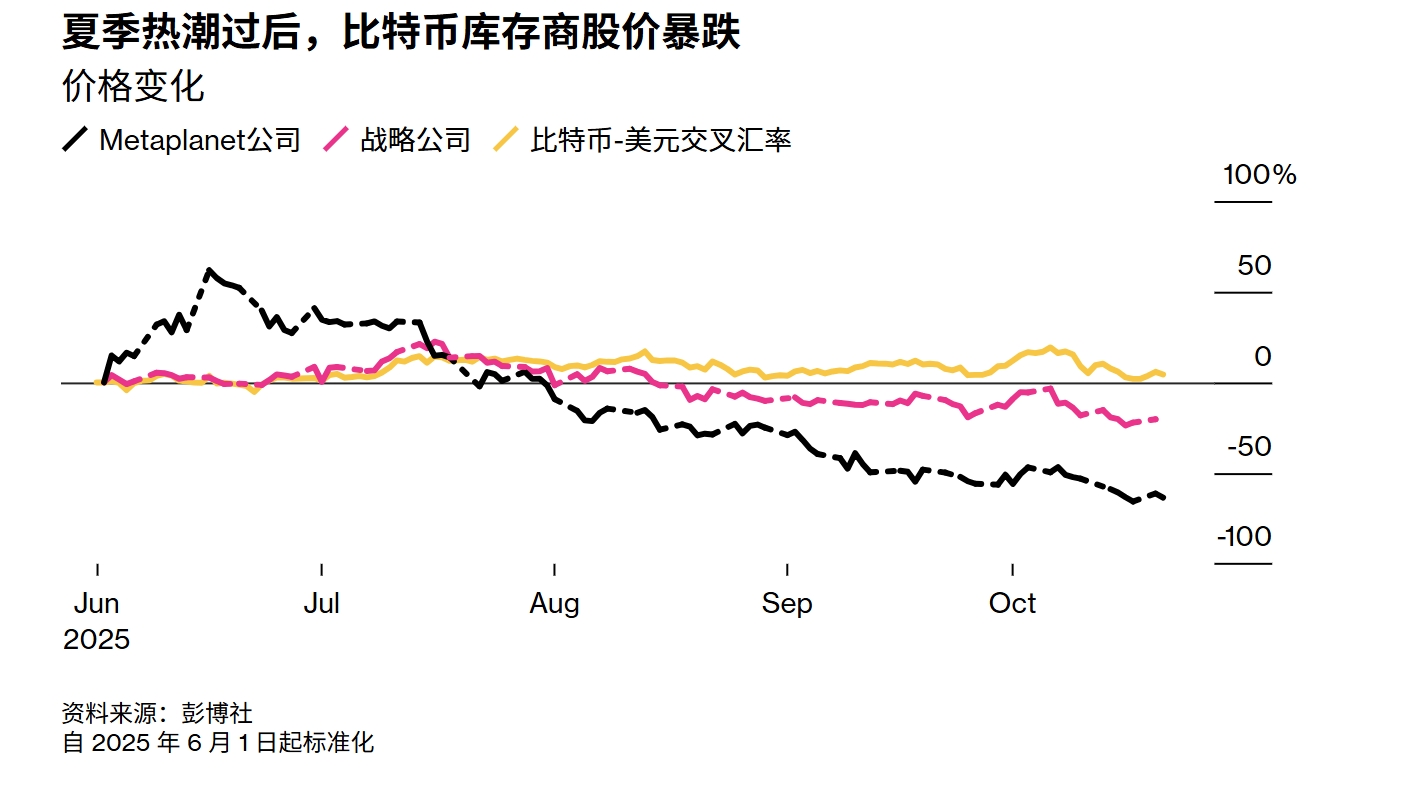

This crackdown did not emerge in a vacuum. The Digital Asset Treasury boom began in late 2023 and gained momentum throughout 2024, as firms across Asia mimicked MicroStrategy’s playbook — accumulating Bitcoin and calling it long-term vision. At the time, simply holding coins seemed visionary; share prices often surged merely on the announcement of a crypto treasury plan.

By early 2025, however, the “buy and hold” mentality began to fade. Analysts noted that a successful DAT model required more than accumulation — it needed governance, diversification, and yield generation. Companies started experimenting with staking, stablecoins, and structured portfolios. The narrative shifted from speculation to strategy, from hype to management.

Yet the shift came too late. Many DATs had already stretched themselves thin, leveraging hype rather than financial discipline.

THE QMMM COLLAPSE: A TURNING POINT

The recent collapse of QMMM Holdings, a Hong Kong-linked DAT company, underscored the risks. After announcing a $100 million crypto allocation plan, its stock skyrocketed nearly 900 percent — only for trading to be suspended amid U.S. SEC scrutiny over alleged market manipulation. Journalists later found its Hong Kong office abandoned, and no verifiable on-chain crypto holdings were ever confirmed.

The scandal sparked calls for mandatory third-party custody and audits for all DATs, led by industry figures like CZ. For regulators and exchanges, QMMM became a cautionary tale — the corporate equivalent of an FTX moment.

WHY THIS MATTERS: THE ENGINE OF THE BULL RUN HAS STALLED

DAT companies were among the most aggressive corporate buyers during this cycle. Their announcements alone fueled market rallies and reinforced the illusion of institutional validation. Now, with regulatory clampdowns and credibility crises mounting, that source of structural demand has vanished almost overnight.

In simple terms, the engine that powered this bull run — corporate accumulation under the DAT model — has sputtered out. Without a new catalyst such as real revenue-driven blockchain adoption or credible tokenization frameworks, the market will likely enter a cooling phase.

THE TAKEAWAY: SIT TIGHT UNTIL A NEW DRIVER EMERGES

This isn’t 2021, when a “we bought Bitcoin” headline sent stocks soaring. Today, institutional tolerance for speculative treasury plays has evaporated. The QMMM scandal was the final straw, and the exchanges’ coordinated resistance confirms it.

Until a new narrative — perhaps RWA tokenization or genuine enterprise blockchain integration — emerges, the prudent move is patience. The DAT boom is over, its momentum spent. For now, investors should stay calm, observe, and wait for the next real driver before jumping back in.

Because when the biggest exchanges in Asia say “no” to crypto hoarding, it’s not just policy — it’s the sound of the market engine winding down.